Day-after-day, tens of hundreds of market merchants deal in hundreds of shares, conducting a number of thousands and thousands of transactions – and producing an unlimited flood of uncooked knowledge. That knowledge incorporates every part the typical investor must find out about any inventory available in the market – however discovering it’s the drawback. The sheer quantity of inventory market info is by itself a barrier to profitable investing.

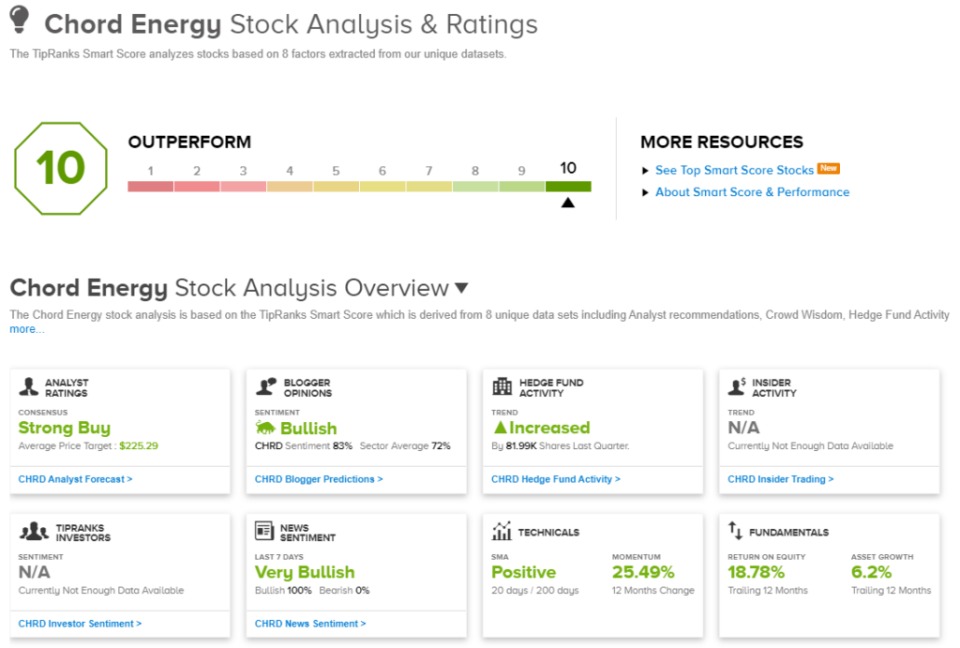

That is the issue that the TipRanks Sensible Rating was designed to unravel. The Sensible Rating is a complicated knowledge crunching algorithm, utilizing AI and pure language processing to pan the stream of market knowledge and extract the dear nuggets. The algorithms scan each inventory on the market, and evaluate them to a set of things which are recognized to foretell future outperformance – after which every inventory is given a rating, a easy score on a scale of 1 to 10, to point out traders how a given inventory is more likely to carry out within the close to future. A ‘Excellent 10’ signifies shares which are primed for features.

On a sensible aspect, we will dip into the Sensible Rating device to search out shares that boast that Excellent 10 rating – and which have latest stable rankings from the Avenue’s analysts. Right here is the lowdown on two of them.

Flutter Leisure (FLUT)

We’ll begin with one of many world’s largest iGaming and sports activities betting operators, Flutter Leisure. This firm reported a world whole of 12.3 million common month-to-month gamers final 12 months, throughout all of its betting and gaming manufacturers. Flutter operates as a dad or mum firm, and its 15 manufacturers embrace main names within the trade, resembling Paddy Energy, PokerStars, and Betfair.

The corporate’s excessive participant depend final 12 months translated into important earnings. The corporate’s 2023 income whole got here to $11.8 billion, and Flutter was in a position to make investments $100 million into secure playing initiatives through the 12 months. The earnings stream got here from Flutter’s 4 geographical divisions – US, UKI, Australia, and Worldwide – with the English-language divisions making up 76% of the overall international footprint. The corporate’s US division generated 38% of the 2023 income whole. As of 4Q23, Flutter claimed to have a 53% market share within the sportsbook section, and a 26% market share within the iGaming section.

In its most up-to-date quarterly report, masking 1Q24, Flutter reported quarterly income of $3.4 billion, a determine that was up greater than 16% year-over-year however got here in barely beneath the forecast, lacking by $160 million. Flutter’s money place improved year-over-year, and the corporate reported a robust improve in adjusted free money circulate, which received out of the unfavorable and rose $207 million to succeed in $157 million.

This inventory’s stable place in its trade leads Oppenheimer analyst Jed Kelly to provoke his protection of the shares with an upbeat outlook, noting the corporate’s potential for progress within the US.

“We count on Flutter’s FanDuel (FD) model to keep up its main US market share from FLUT’s international OSB/iGaming platforms offering gamers a fascinating/localized expertise at trade main win margins to accumulate and retain extra prospects at greater incremental gross revenue {dollars} versus opponents. We imagine FLUT is greatest positioned to navigate states doubtlessly growing on-line wagering taxes based mostly on its Worldwide scale, operational expertise, and better unit economics,” Kelly opined.

Kelly goes on to elucidate simply why he believes the shares are primed to carry returns going ahead, including, “We see latest pullback creating a horny setup for traders, and count on a number of growth (at the moment 13.6x ’25E EBITDA) from US EBITDA rising 52% ‘24E-‘26E CAGR and validating FD moat thesis.”

These feedback assist Kelly’s Outperform (i.e. Purchase) score on FLUT shares, and his worth goal of $240 implies a one-year potential achieve of 25%. (To look at Kelly’s monitor report, click on right here)

It’s clear from the Sensible Rating and the analyst consensus that the upbeat Oppenheimer take shouldn’t be an outlier; the shares have 17 latest analyst critiques that break down to fifteen Buys and a couple of Holds, for a Sturdy Purchase consensus score. The ‘Excellent 10’ inventory is at the moment priced at $191.70 and its $260.07 common worth goal is much more bullish than Kelly’s, suggesting a ~36% upside on the one-year horizon. (See FLUT inventory evaluation)

Chord Power (CHRD)

The second ‘Excellent 10’ inventory we’ll take a look at is Chord Power, one of many foremost operators within the Williston Basin of the northern Nice Plains. Particularly, Chord operates primarily within the Bakken Shale, the oil-rich shale formation that spreads throughout northern North Dakota and Montana and into Canada. The corporate has over 126,000 web acres on this area, with 6 working rigs its holdings. Of the corporate’s reserves, roughly 57% are petroleum.

Throughout the first quarter of this 12 months, Chord achieved 99 MBopd in crude oil manufacturing, 34.4 MBblpd of pure gasoline liquid manufacturing, and 209.8 MMcfpd of pure gasoline output. The corporate’s whole manufacturing determine was listed as 168.4 MBoepd, with 58.8% of that whole being crude oil. The corporate’s whole hydrocarbon revenues – from crude oil, pure gasoline, and pure gasoline liquids – got here to $748.3 million, down 2.3% from the prior 12 months.

The entire prime line for the quarter, together with bought oil and gasoline gross sales, got here to $1.09 billion, up greater than 21% year-over-year and greater than $323 million forward of the forecast. The corporate’s quarterly EPS, of $4.65, was in-line with expectations.

Furthermore, Chord made headlines with its strategic acquisition of Enerplus, a significant Canadian impartial oil and gasoline producer, valued at $4 billion. This transaction, executed in each money and inventory, was finalized on Could 31. The mixed firm boasts a complete of 1.3 million web acres within the Bakken formation, and mixed This autumn 2023 manufacturing of 287 MBoepd. Chord’s Q2 2024 report would be the first to incorporate post-merger outcomes.

The Enerplus acquisition, and the potential it will probably unlock, are key factors right here, in line with BMO analyst Phillip Jungwirth. The analyst says of Chord, “We like the corporate’s sturdy FCF yield and low leverage, which allow sturdy capital returns… Chord closed its ~$4bn acquisition of Enerplus, leading to a ~$12bn enterprise worth, together with over a million acres within the Bakken, 10 years of stock, and ~270MBoe/d of manufacturing. Whereas integration shall be a spotlight close to time period, we imagine Chord has good runway to persevering with to develop its Bakken footprint. This could enhance relative valuation with the shares solely buying and selling close to SMID E&P friends, and a ~0.5-1.0x low cost to large-cap E&Ps.”

Wanting forward, Jungwirth places an Outperform (i.e. Purchase) score on CHRD, and offers the inventory a $230 worth goal that factors towards a 33% share worth improve over the following 12 months. (To look at Jungwirth’s monitor report, click on right here)

Jungwirth’s colleagues additionally assume CHRD is well-positioned to ship. The inventory has a Sturdy Purchase consensus score, based mostly on a unanimous 7 Purchase suggestions. The forecast is for one-year features of ~30%, given the typical worth goal at the moment stands at $225.29. (See Chord’s inventory forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Finest Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely necessary to do your individual evaluation earlier than making any funding.