After a gangbusters runup final 12 months, the inventory markets are nonetheless on an upward trajectory. The tech-heavy NASDAQ is up virtually 25% year-to-date, and the broader S&P 500 index has gained 17%. These strong outcomes are underpinned by a number of units of optimistic financial information launched lately – resilient jobs numbers, a slowing tempo of inflation, and better-than-expected Q1 earnings.

Based on John Stoltzfus, chief funding strategist from Oppenheimer, this background means that the present bullish pattern nonetheless has some wind left, and potential to run greater. He backs that opinion with an upward revision to Oppenheimer’s year-end S&P goal, to five,900, or almost 6% from present ranges.

Stoltzfus lays out his case for a powerful year-end in clear prose: “That is our third worth goal for 12 months 2024, which started with a 5,200 worth goal for this 12 months which we initiated final December 11. S&P 500 earnings outcomes over the latest three quarterly reporting seasons (Q3 ‘23, This fall ‘23, and Q1 ‘24) and financial information that has supplied proof of resilience underpinned by the Fed’s mandate-sensitive financial coverage stays on the core of our bullish outlook for shares.”

Oppenheimer analyst Brian Schwartz, rated by TipRanks within the high 2% of Wall Avenue inventory specialists, is taking the subsequent step, and following the bullish outlook for the S&P with some strong suggestions, selecting out two shares to purchase on this atmosphere. Based on the most recent information from TipRanks, each shares are Purchase-rated; let’s take a more in-depth look and discover out why this 5-star analyst sees them as such compelling decisions.

Braze (BRZE)

The primary Oppenheimer choose we’ll take a look at right here is Braze, a New York-based cloud software program firm providing its customers a buyer engagement platform. Braze payments its platform as a full-service, data-based device for entrepreneurs to boost the shopper engagement course of. The corporate works with enterprise clients, giant and small, together with such names as Canva, Burger King, and Intuit. Entrepreneurs can use the platform to gather and collect information, take a variety of actions on that information, and develop inventive engagements with their clients in actual time. Braze makes use of AI know-how to energy the platform, permitting for better personalization, higher buyer outreach, and improved outcomes.

Some numbers will present that Braze has a strong basis and upbeat prospects. The corporate claims greater than 2,100 clients as of April 30 this 12 months, coping with 6.5 billion lively customers over the platform. Within the calendar 12 months 2023, there have been greater than 2.6 trillion messaging and different canvas actions taken on the Braze platform. All of this exercise generates a sound income stream for Braze.

In its fiscal first quarter (ended on April 30), the corporate realized a 33% year-over-year enhance in income as the highest line determine landed at $135.5 million, additionally beating the forecast by $3.81 million. On the backside line, the corporate runs a internet quarterly loss – however the 5-cent non-GAAP EPS loss was a nickel higher than had been anticipated.

Nonetheless, regardless of the sturdy outcomes, Braze inventory is down 28% year-to-date, though analyst Brian Schwartz thinks there’s a particular purpose for that and notes that its underlying power bodes nicely for the long run. “Whereas BRZE shares have been underneath stress YTD as traders have averted buyer engagement software program suppliers due to a tricky working atmosphere, we stay optimistic on the long-term enterprise trajectory,” he mentioned. “We anticipate Braze to proceed leveraging its differentiated subsequent era information streaming structure and platform time to worth to win enterprise clients and help development… In our view, Braze is well-positioned to profit from growing buyer channel adoption, momentum touchdown bigger enterprise offers, and rising AI product providing. The corporate’s rising worldwide gross sales capability, platform innovation and extensibility, and robust management group are laying a basis for sturdy development and improved profitability.”

Together with this outlook, Schwartz provides BRZE shares an Outperform (Purchase) score, with a $60 worth goal to point his confidence in a 58% achieve on the 12-month horizon. (To observe Schwartz’s observe document, click on right here.)

Total, Braze has a Sturdy Purchase consensus score from the Avenue, primarily based on 17 latest analyst critiques that embody 16 Buys to simply 1 Maintain. The shares are priced at $37.92 and their common worth goal, of $61.40, implies a 62% achieve within the 12 months forward, barely extra bullish than the Oppenheimer view. (See Braze’s inventory forecast.)

Clearwater Analytics Holdings (CWAN)

Subsequent up on our Oppenheimer-backed record is a fintech firm, Clearwater Analytics. This agency operates on the favored software-as-a-service (SaaS) mannequin, providing its clients quite a lot of instruments for information analytics. The corporate’s options embody automated aggregation of funding information; accounting, compliance, efficiency, and threat reporting; and information reconciliation. The corporate’s merchandise report on greater than $7.3 trillion in consumer property on daily basis, and are utilized by insurers, asset managers, pension plans, authorities companies, and nonprofits. Clearwater is trusted by funding professionals worldwide to ship correct and well timed data-driven outcomes.

Knowledge evaluation is a service in excessive demand, particularly amongst fintech professionals, and Clearwater has leveraged that demand to beat the forecasts on its income and earnings in latest quarters. In the latest quarter reported, 1Q24, the corporate’s high line got here to $102.7 million, an organization quarterly document that was additionally up 21% year-over-year and was $2.16 million higher than had been anticipated. Clearwater’s quarterly earnings got here to 10 cents per share in non-GAAP measures, beating the forecast by a penny per share.

The corporate completed Q1 with a sound stability sheet, that includes $296.5 million in money and different liquid property readily available – greater than offsetting the $47.9 million in whole debt. The corporate had a free money circulation in Q1 of $8.6 million, a rise of 38.3% from the prior-year interval.

In his protection of Clearwater for Oppenheimer, analyst Schwartz has had a rethink lately, the results of which has been an improve for the inventory from Carry out (Impartial) to Outperform (Purchase). Explaining his new stance, Schwartz writes, “Our battle with Clearwater over the previous 18 months has largely been tied to valuation which already projected a lot of the long run success into the inventory. Throughout this time, investor sentiment has materially shifted away from expectations of excessive income development charges for the foreseeable future, and expectations have grow to be extra affordable. Backside Line: CWAN has a sturdy development story and a defensible moat within the AI period as a system of data and Verticals chief. We additionally see the enterprise in place to reaccelerate development subsequent 12 months from expansions power and ship upside to estimates. This stuff look underappreciated and may catalyze a number of growth when extra obvious.”

Schwartz enhances his improve on this inventory with a $25 worth goal that means a one-year upside potential of 33%.

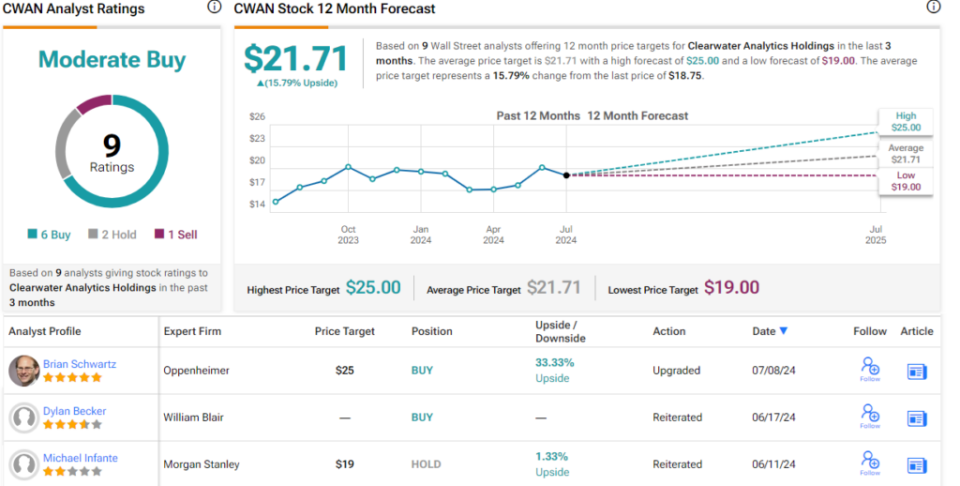

Clearwater has picked up 9 latest analyst critiques, with a breakdown of 6 Buys, 2 Holds, and 1 Promote giving the shares a Reasonable Purchase consensus score. The inventory’s $18.75 worth and $21.71 common worth goal collectively indicate an upside of 16% over the approaching months. (See Clearwater’s inventory forecast.)

To search out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally necessary to do your personal evaluation earlier than making any funding.