The capital markets received off to a roaring begin in 2024. Nonetheless, the S&P 500 and Nasdaq Composite have given again a few of their good points over the past month or in order equities have skilled some pronounced promoting exercise. As of the time of this text, shares of synthetic intelligence (AI) darling Nvidia (NASDAQ: NVDA) have fallen practically 14% within the final month.

Whereas among the decline could be attributed to sell-offs within the broader market, Nvidia just lately hit buyers with some disappointing information. Ought to buyers be bothered by this dilemma, or is that this a uncommon probability to purchase the dip in AI’s hottest inventory?

What is going on on with Nvidia inventory?

There are plenty of components influencing Nvidia inventory’s latest worth motion.

For starters, the unemployment fee unexpectedly rose to 4.3% in July — its highest degree in over two years. Furthermore, latest commentary from the Federal Reserve continues to have economists questioning whether or not or not a reduce to rates of interest is on the horizon or not.

All issues thought-about, the cloudy macroeconomic image coupled with some typical election-driven volatility has certainly induced some buyers to begin promoting inventory and hoard money amid a pool of uncertainty. Sadly, this is just one facet of the equation for Nvidia buyers. Maybe most regarding of all is that Nvidia’s extremely anticipated Blackwell graphics processing unit (GPU) is dealing with delays on account of design flaws, in accordance with a number of media shops.

Contemplating corporations of all sizes and each trade are doubling down on generative AI investments, Nvidia’s Blackwell delay would not precisely encourage confidence. However, I do not suppose that is essentially a cause for buyers to hit the panic button simply but.

Why the Blackwell delay is not a giant deal

Whereas estimates differ, public analysis means that Nvidia owns at the very least 80% of the AI chip market. So, whereas a delay to the Blackwell launch could also be a lowlight, it is terribly unlikely that Nvidia will lose vital market share on account of this design blunder.

Chief Funding Officer of Harvest Portfolio Administration Paul Meeks just lately expressed the same sentiment throughout an interview on CNBC. He makes an awesome level in that demand for Nvidia’s GPUs is so excessive that the corporate may have no actual drawback promoting the Blackwell chips as soon as they really come to market — whatever the delay.

“I simply must see these shares stabilize for a few periods at some form of trough degree.”

Harvest Portfolio Administration Co-CIO Paul Meeks is carefully watching the technicals as he discusses why he is not shopping for the dip in tech simply but: pic.twitter.com/XqsOM9qABO

— Cash Movers (@moneymoverscnbc) August 5, 2024

Moreover, every of the “Magnificent Seven” corporations has reported earnings this season besides Nvidia. One of many frequent threads stitching mega-caps collectively is that spending on AI-powered services has steadily risen over the past 12 months. Specifically, capital expenditures (capex) have been on the rise amongst mega-cap tech as demand for cloud computing infrastructure, information middle companies, and semiconductor chips will increase.

Contemplating that the majority of Nvidia’s income development at present stems from {hardware} operations in chips and information facilities, I feel the rising funding in capex amongst large tech corporations represents a compelling secular narrative round Nvidia’s shiny future.

Purchase the dip like there is no tomorrow

When buyers are hit with some distressing information, it is at all times necessary to zoom out and think about all of the variables.

Again in 1997, Apple practically filed for chapter. At present, Apple is the biggest firm on the earth by market cap. Even one of the best corporations hit street bumps sometimes. What’s extra necessary is how administration navigates these challenges within the second.

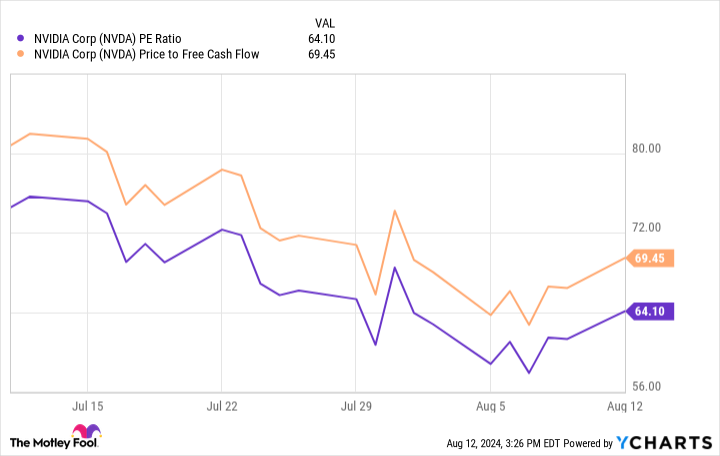

The chart under illustrates Nvidia’s price-to-earnings (P/E) ratio and price-to-free money circulation (P/FCF) a number of over the past month. Whereas a 14% drop in Nvidia inventory might not look like so much within the grand scheme of issues, the compression this decline has made on valuation multiples in such a brief timeframe should not be ignored.

Outdoors of its GPUs, the corporate is quietly constructing a software program platform to enrich the core chip enterprise. Moreover, the corporate has made a variety of strategic investments in areas reminiscent of robotics to additional diversify its AI ecosystem.

I do not see any of those initiatives as priced into Nvidia inventory in the meanwhile. Actually, I feel a lot of what Nvidia is doing exterior of GPUs is just not but totally understood. For these causes, I feel the response to the Blackwell delay is overblown and look at the latest sell-off as a no brainer alternative to purchase Nvidia inventory proper now as additional good points look to be in retailer over the long term.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Nvidia wasn’t one in every of them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $763,374!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 12, 2024

Adam Spatacco has positions in Apple and Nvidia. The Motley Idiot has positions in and recommends Apple and Nvidia. The Motley Idiot has a disclosure coverage.

Amid a 14% Promote-Off, Nvidia Simply Hit Buyers With a Impolite Awakening. What Ought to Buyers Do? was initially revealed by The Motley Idiot