(Bloomberg) — Alibaba Group Holding Ltd. reported a 6.6% rise in income after its fundamental e-commerce and cloud companies managed solely modest development.

Most Learn from Bloomberg

Income for the three months ended March rose to 221.9 billion yuan ($30.7 billion), in contrast with analysts’ estimates for 219.8 billion yuan. Internet revenue dived a worse-than-expected 86% after accounting for losses from publicly traded holdings. Its shares slid about 5% in pre-market buying and selling.

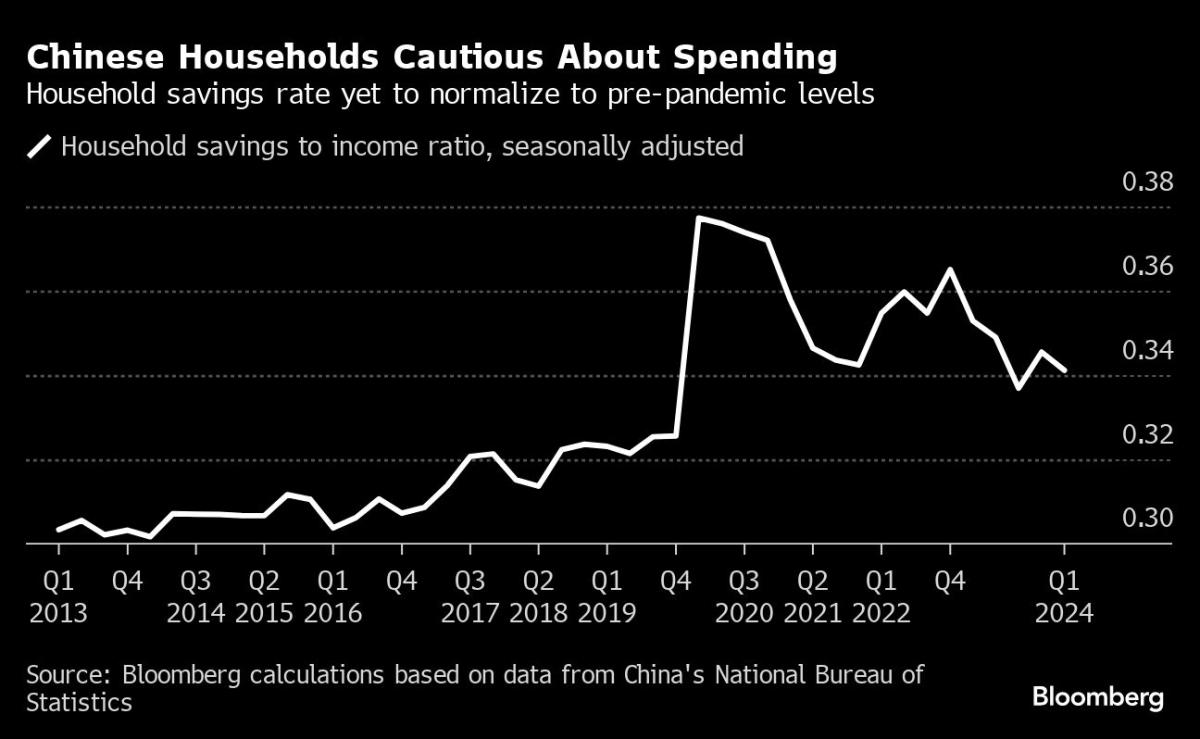

Buyers are intently watching outcomes from Alibaba, a barometer of Chinese language shopper sentiment, amid persistent worries a few lack of enterprise to rivals from PDD Holdings Inc. to ByteDance Ltd. The uneven financial restoration can be roiling the corporate because it tries to revive development after a years-long regulatory crackdown that kneecapped China’s non-public sector.

On Tuesday, the corporate introduced a $4 billion dividend for the fiscal 12 months. Alibaba and Tencent Holdings Ltd. each reported outcomes on Tuesday, providing clues as to whether the Hong Kong fairness rally has legs. Alibaba, which owns slices of public corporations together with SenseTime Group Inc. and Solar Artwork Retail Group Ltd., didn’t disclose which particular losses hammered internet revenue, which got here in nicely under expectations. Its fundamental Chinese language commerce division managed simply 4% income development, whereas the cloud arm grew 3%.

Alibaba Chief Government Officer Eddie Wu and Chairman Joe Tsai, longtime lieutenants of Jack Ma who took the helm from Daniel Zhang in September, are spearheading a turnaround of the e-commerce pioneer. They nixed main initiatives conceived below Zhang together with listings logistics arm Cainiao and the $11 billion cloud unit, then determined to refocus on what they dubbed the shopper expertise and innovation.

Wu took the helm after a interval of unprecedented turmoil at Alibaba, which contended with Covid, Beijing’s web crackdown after which a Chinese language financial downturn in speedy succession.

Ma weighed in on Alibaba’s turbulence final month, with a uncommon memo aimed toward shoring up sagging morale among the many firm’s 200,000-plus staff. He emphasised that development was returning on the firm, regardless of its current flip-flops, whereas acknowledging previous errors.

Wu this 12 months took direct cost of the corporate’s e-commerce and cloud providers arm, each below stress after a collection of mis-steps and regulatory scrutiny. It’s tried to boost customer support, beef up its product lineup and launched options reminiscent of straightforward returns. On the cloud entrance, the once-promising division is slashing costs to regain shoppers from state-backed corporations reminiscent of China Telecom Corp. and the likes of Huawei Applied sciences Co.

Away from the enterprise, it’s hiving off non-core belongings like stakes in streaming platform Bilibili and electric-vehicle maker XPeng Inc. to lift capital. It’s then funneled a few of that money into AI analysis and fast-growing startups like MiniMax.

(Updates with share motion within the second paragraph. A earlier story corrected the size of its internet revenue drop.)

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.