-

The bond market is flashing a warning signal for shares for the primary time since 1999, in response to BofA.

-

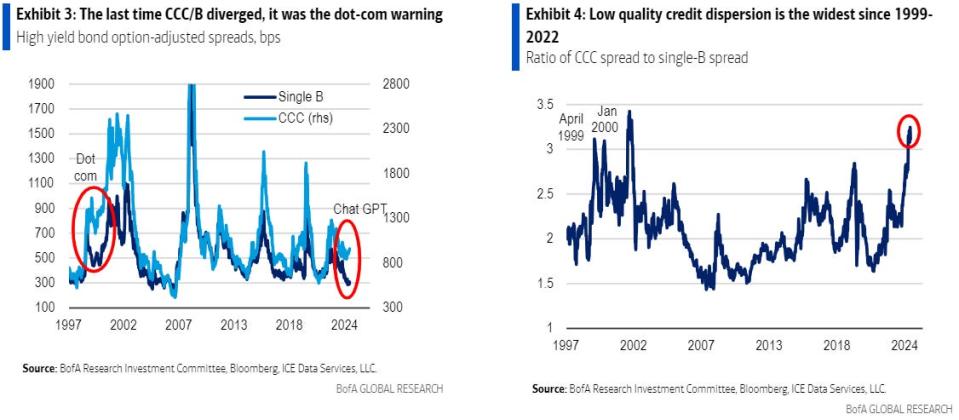

The financial institution highlighted widening credit score spreads in CCC-rated bonds.

-

BofA recommends traders enhance their bond credit score high quality and favor worth shares over mega-cap tech.

A dependable indicator within the bond market is sending a warning sign to shares for the primary time since 1999, in response to Financial institution of America.

The financial institution highlighted in a Tuesday notice that value motion in dangerous high-yield bonds is just not confirming the document rally within the inventory market.

“Excessive yield bonds marched with US shares lately, however these days the lowest-quality firms are lagging, even whereas fairness benchmarks depend on a handful of heavy hitters,” Financial institution of America stated.

For the reason that begin of the yr, the S&P 500 has surged practically 19%, whereas the iShares Excessive Yield Company Bond ETF is up 4%.

However what’s much more worrying, in response to the financial institution, is that within the depths of the bond market, ultra-risky bonds are diverging from their less-risky counterparts.

Financial institution of America stated that the bottom high quality CCC-rated company debt is displaying the widest divergence from safer B-rated bonds in 25 years.

“Junk bond spreads are warning prefer it’s 1999,” the financial institution stated. “In 1999, the ratio of CCC to B spreads rose above 3x nearly precisely one yr earlier than the dot-com market peaked.”

The dot-com bubble peak in March 2000 was adopted by a 30-month-long bear market decline that led to a 78% drop within the Nasdaq 100.

The warning signal from the bond market, mixed with the continued uncertainty over when firms may expertise a revenue increase from AI, leads Financial institution of America to have a cautious view on investing.

The financial institution stated traders ought to shore up their threat within the bond market by “transferring up in credit score high quality” and favor worth shares over mega-cap tech names.

“We anticipate US households to take income on megacap tech in H2’24. Credit score markets are usually not confirming the fairness rally and traders are getting impatient with AI,” Financial institution of America stated.

Learn the unique article on Enterprise Insider