When examined over lengthy stretches, the inventory market cannot be beat. Whereas different asset lessons have produced stable nominal features for buyers, together with gold, oil, housing, and Treasury bonds, none have come near matching the annualized common returns that shares have dropped at the desk over the past century.

However when the lens is narrowed to only a few years or an excellent shorter timeline, predicting the directional strikes of the ageless Dow Jones Industrial Common (DJINDICES: ^DJI), benchmark S&P 500 (SNPINDEX: ^GSPC), and growth-powered Nasdaq Composite (NASDAQINDEX: ^IXIC) with any sustained accuracy turns into virtually unattainable.

Nevertheless, this does not cease buyers from attempting to do the unattainable. Although there isn’t any financial knowledge level or indicator that may concretely predict which path the Dow, S&P 500, and Nasdaq Composite will head subsequent, there are a very choose group of metrics and forecasting instruments which have strongly correlated with strikes greater and decrease within the main inventory indexes all through historical past.

One among these metrics, which seems to be foreshadowing a large transfer in shares, is U.S. cash provide.

U.S. cash provide hasn’t completed this in 9 many years

Among the many 5 measures of cash provide, M1 and M2 are likely to garner many of the focus from economists and the investing group. M1 is a measure of money and cash in circulation, in addition to demand deposits in a checking account. It is cash you could have quick access to that may be spent instantly.

Alternatively, M2 cash provide accounts for the whole lot in M1 and likewise provides in financial savings accounts, cash market accounts, and certificates of deposit (CDs) under $100,000. That is nonetheless cash you’ll be able to entry, however you may should work a bit tougher to get to it. That is additionally the cash provide metric that is elevating eyebrows proper now for all of the unsuitable causes.

Most economists and buyers are likely to pay little or no consideration to M2 cash provide as a result of it is grown with such consistency over time. For the reason that U.S. financial system expands over lengthy durations, it is solely pure that more money and cash are wanted to finish transactions.

However in these extraordinarily uncommon cases the place a notable contraction in M2 cash provide has been noticed, bother has traditionally adopted for the U.S. financial system and inventory market.

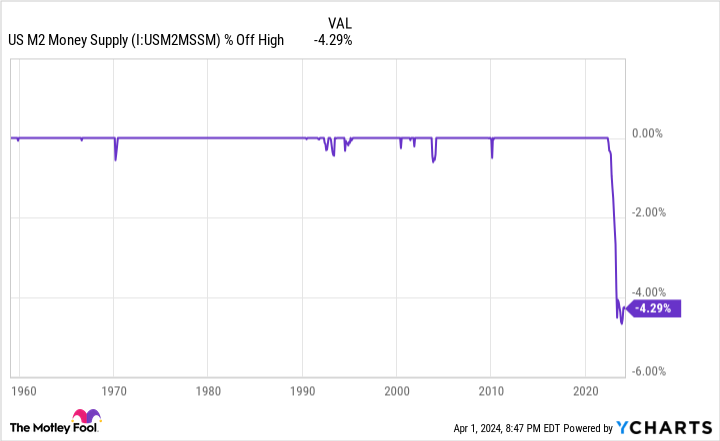

Two years in the past, in March 2022, M2 cash provide reached roughly $21.71 trillion. Based mostly on the most recent month-to-month knowledge launch from the Board of Governors of the Federal Reserve System, M2 clocked in at $20.78 trillion in February 2024. As you’ll be able to see within the chart above, this represents a comparatively minor 0.5% year-over-year decline, however a extra pronounced 4.29% drop-off since March 2022. It is also the primary significant transfer decrease anybody has witnessed in M2 for the reason that Nice Despair.

In a single respect, this 4.29% retracement in U.S. cash provide might merely be a reversion to the imply after M2 expanded by a historic 26% on a year-over-year foundation in the course of the top of the COVID-19 pandemic. A number of rounds of fiscal stimulus flooded the U.S. financial system with money and shoppers who have been greater than keen to spend it.

Alternatively, greater than 150 years’ value of historical past has been fairly clear about what occurs when M2 cash provide retraces by greater than 2% from a file excessive.

Final yr, Reventure Consulting CEO Nick Gerli shared the submit you see under on X (the platform previously often called Twitter). Gerli leaned on knowledge from the U.S. Census Bureau and Federal Reserve to trace M2 actions since 1870.

WARNING: the Cash Provide is formally contracting. 📉

This has solely occurred 4 earlier occasions in final 150 years.

Every time a Despair with double-digit unemployment charges adopted. 😬 pic.twitter.com/j3FE532oac

— Nick Gerli (@nickgerli1) March 8, 2023

Gerli famous 5 cases the place M2 cash provide declined by at the least 2% on a year-over-year foundation, together with the numerous year-over-year transfer decrease noticed in 2023. The earlier 4 cases the place M2 fell by at the least 2% — 1878, 1893, 1921, and 1931-1933 — have been related to durations of despair and excessive unemployment for the U.S. financial system.

To guage this knowledge agnostically, it should be famous that the nation’s central financial institution did not exist in 1878 or 1893. Additional, financial and financial coverage have come a good distance for the reason that Nice Despair. The chance of a despair occurring as we speak given the wealth of fiscal and financial instruments accessible is low.

However this knowledge set is fairly clear: If the amount of money accessible to shoppers is declining, and the prevailing/core price of inflation is at or above historic norms, there is a good probability shoppers will pare again discretionary purchases. Briefly, it is a historic blueprint for a U.S. recession.

Despite the fact that shares do not transfer in lockstep with the well being of the U.S. financial system, a recession can be anticipated to adversely influence company earnings. Historical past reveals that the lion’s share of drawdowns within the S&P 500 have occurred after an official recession has been declared.

Endurance and perspective are money-in-the-bank attributes for buyers

Contemplating how resilient the U.S. financial system has been within the face of quickly rising rates of interest, the prospect of the Dow Jones, S&P 500, and Nasdaq Composite being knocked off of their respective pedestals will not be one thing you need to hear or discuss. Fortunately, historical past is a two-way avenue that very a lot favors buyers who can take a step again and recognize the facility of perspective.

For example, let’s take a more in-depth have a look at the course most financial cycles have taken. Though recessions are completely regular and inevitable, they’ve traditionally come and gone within the blink of an eye fixed. For the reason that finish of World Conflict II in September 1945, solely three of 12 U.S. recessions lasted at the least 12 months. Additional, not one of the remaining three surpassed 18 months.

With few exceptions, expansions have endured a number of years. In truth, two durations of progress for the reason that mid-Nineteen Forties hurdled the 10-year mark. Whereas recessions could also be unwelcome within the brief run, they’ve given technique to long-lasting durations of financial and company progress.

It is a lot the identical story with regards to Wall Avenue. Information from market analysis firm Yardeni Analysis reveals there have been 40 separate double-digit share declines within the S&P 500 for the reason that begin of 1950. Despite the fact that we’re by no means going to exactly know forward of time when these downturns will begin, how lengthy they will final, or how steep the decline will likely be, historical past reveals that the S&P 500, Dow, and Nasdaq Composite ultimately recoup their losses and push to new highs.

In June 2023, market insights firm Bespoke Funding Group took issues one step additional and printed knowledge on simply how disproportionate bull markets have been, relative to bear markets, within the S&P 500.

The researchers at Bespoke examined almost 94 years’ value of bear and bull markets within the S&P 500, starting with the beginning of the Nice Despair in September 1929. Whereas the 27 bear markets have been famous as lasting a median of 286 calendar days (about 9.5 months), the 27 bull markets within the S&P 500 caught round for a median of 1,011 calendar days (roughly two years and 9 months), or 3.5 occasions as lengthy.

So as to add to the above, the longest bear market within the S&P 500’s historical past was simply 630 calendar days (Jan. 11, 1973 – Oct. 3, 1974), by Bespoke’s measure. Comparatively, 13 of the 27 S&P 500 bull markets have been longer than the lengthiest bear market.

Regardless of how unpredictable issues could appear within the brief time period, or how dire an image traditionally correct money-based metrics might paint, time is the undisputed ally of buyers. When you have a long-term funding horizon and belief within the simple growth of the U.S. financial system over time, even a historic transfer decrease in M2 cash provide is nothing to fret about.

The place to speculate $1,000 proper now

When our analyst crew has a inventory tip, it might probably pay to pay attention. In any case, the publication they have run for over a decade, Motley Idiot Inventory Advisor, has almost tripled the market.*

They simply revealed what they consider are the 10 finest shares for buyers to purchase proper now…

*Inventory Advisor returns as of April 4, 2024

Sean Williams has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.

U.S. Cash Provide Is Doing One thing No One Has Witnessed For the reason that Nice Despair, and It Foreshadows a Massive Transfer to Are available in Shares was initially printed by The Motley Idiot