The mammoth integration of failed financial institution Credit score Suisse into its former rival UBS will act as a “case examine,” UBS CEO Sergio Ermotti stated Friday, one that may present that massive financial institution mergers must be allowed.

“It’ll be a case examine to be evaluated globally, but in addition significantly in Europe, the place finally the need of making stronger banks, and stronger and extra aggressive banks from a world standpoint of view, is in my viewpoint a necessity,” Ermotti informed CNBC’s Steve Sedgwick at an occasion on the Ambrosetti Spring Discussion board in Italy.

“In fact, we will not simply depend on a disaster to create or facilitate the merger of banks,” Ermotti stated.

“It is good to have robust gamers that may be a part of the answer, like UBS was within the Credit score Suisse case. … However it can’t be simply that half. So in that sense, I believe that the actual problem is, there needs to be a political need to facilitate one thing like that. So it is not the fact of at the moment,” he added.

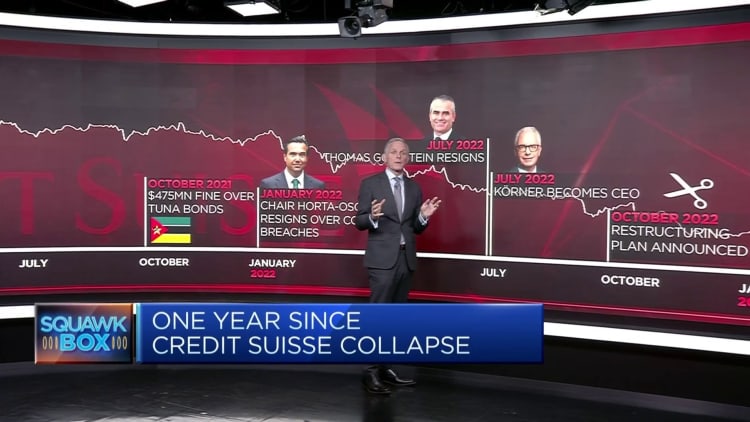

Credit score Suisse collapsed in March 2023 after years of underperformance, scandals and danger administration crises. UBS in June accomplished its takeover of the 167-year-old financial institution in a deal controversially brokered by Swiss authorities.

The Swiss Nationwide Financial institution has stated the scale of the brand new entity flags potential competitors points that may should be monitored.

Ermotti stated Friday, “The excellent news is that, in my opinion, in lots of nations, there’s a recognition that they need to shield their banks or monetary establishments as nationwide champions, which is an implied or specific recognition of their worth for his or her economies.”

“However the unhealthy information is that they do not notice that as a way to actually be significant, and go to the subsequent degree of their contribution of their economies, they may should be additionally extra aggressive globally. However and not using a banking union, and not using a capital markets union, it is going to be very, very troublesome for Europe to compete with U.S. massive banks.”

Not like within the U.S., European economies proceed to depend on the banking sector for enterprise financing; and Europe has a “utterly completely different enjoying area and a scarcity of crucial mass,” Ermotti stated.

“So I hope, I am not so satisfied it is going to occur quickly, however I hope finally at some point these sorts of mergers between massive banks shall be allowed and we will contribute to that by displaying that it is attainable. Within the meantime, I believe that in lots of nations, crucial mass and synergies may be created by additional rounds of native mergers,” he stated.