Even with a short drop this week, the markets are exhibiting energy this 12 months, with the S&P 500 climbing 8%. Nonetheless, there’s an enormous query on buyers’ minds: Can this momentum sustain?

David Kostin, Goldman’s chief US fairness strategist, has given 4 eventualities for investor consideration: “(1) in a ‘catch up,’ the S&P 500 would finish the 12 months at 5800 (+12% from in the present day), (2) in a ‘catch-down,’ the S&P 500 would fall to 4500 (-14%), (3) continued mega-cap exceptionalism would carry the index to 6000 (+15%), and (4) recession fears would push the index all the way down to 4500 (-14%).”

It stays to be seen which state of affairs will play out. Nonetheless, Goldman Sachs analyst Richard Legislation has made two particular inventory suggestions, foreseeing substantial upside potential of over 120%. Legislation’s bullish outlook is shared by others available in the market; based on the TipRanks database, each shares carry a Sturdy Purchase consensus score from analysts. Let’s take a more in-depth look.

Olema Prescription drugs (OLMA)

The primary Goldman choose we’ll take a look at is Olema Pharma, a medical analysis agency working on the medical stage with a give attention to the invention, improvement, and commercialization of latest therapies particularly focused at girls’s cancers. Olema has a analysis pipeline constructed round a number one drug candidate, OP-1250 (additionally referred to as palazestrant), which is beneath investigation in six separate analysis tracks. Of those, 5 are on the medical trial stage.

These 5 medical tracks contain testing OP-1250 as a monotherapy and as a combo remedy along side a number of different anti-cancer medicine within the remedy of ER+/HER2 metastatic breast most cancers. Essentially the most superior observe, learning the drug as a monotherapy, is fully beneath Olema’s course; a number of of the opposite tracks contain partnership packages with bigger drug firms.

The corporate’s most superior is the Part 3 pivotal monotherapy trial of OP-1250. This research was initiated throughout 4Q23, and top-line outcomes are anticipated throughout 2026.

Within the meantime, there are a number of milestones anticipated for this 12 months. In Might, the corporate will current interim outcomes from the Part 2 medical trial of OP-1250 in combo with ribociclib on the ESMO Breast Most cancers Annual Congress in Berlin. Subsequent, throughout Q3, the corporate is predicted to provoke a Part 1b/2 research of its main candidate in combo with everolimus. And at last, late this 12 months, Olema expects to file the Investigational New Drug utility for its candidate OP-3136 with the FDA

In all, this biopharma has a full plate, and that has caught the eye of Goldman Sachs’ Richard Legislation.

“OLMA’s Ph. 2 late line mono information confirmed spectacular efficacy even within the elusive ESR1-WT inhabitants. Whereas the mESR1 information look in-line with rivals, the ESR1-WT information are arguably the best-in-class. Making use of statistical changes on Ph. 2 outcomes utilizing EMERALD learnings for Ph. 3 OPERA-1 in 2-3L confirmed palazestrant may obtain approval in each mESR1 and ESR1-WT, though we’re much less assured on why it’s ready to achieve ESR1-WT whereas others with related MOA couldn’t. Our Purchase score is pushed by pala’s best-in-class potential in a big ER+/HER2- breast most cancers market and the opportunity of OLMA securing a biopharma partnership deal (OLMA introduced as precedence in 2024) that might deliver extra worth to the inventory,” Legislation opined.

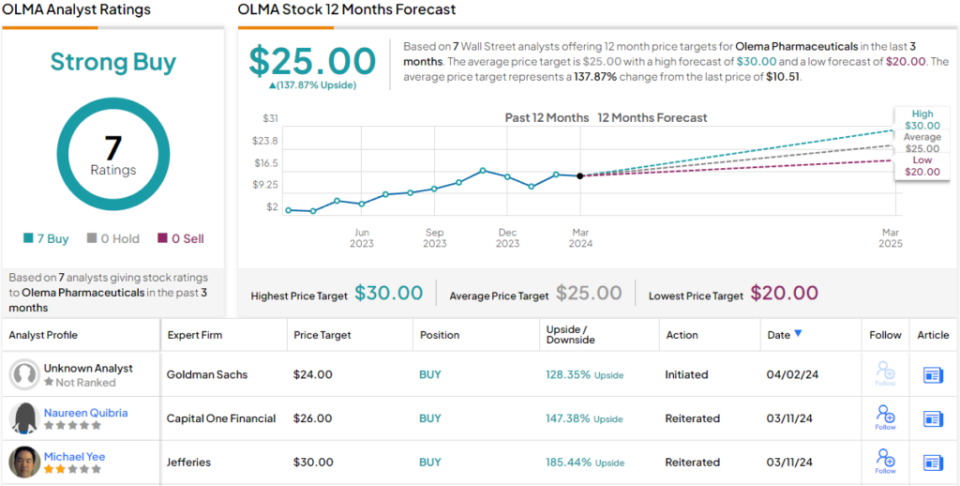

Legislation’s Purchase score on OLMA comes with a $24 value goal, implying the inventory will acquire 128% on the one-year horizon. (To observe Legislation’s observe document, click on right here)

Total, it’s clear, from the unanimous Sturdy Purchase consensus score, that Wall Avenue agrees with the bullish take; this inventory has 7 current optimistic suggestions. The shares are priced at $10.51 and their $25 common value goal recommend a one-year upside potential of ~138%. (See OLMA inventory forecast)

Mineralys Therapeutics (MLYS)

The second Goldman choose is Mineralys, one other clinical-stage biopharmaceutical firm. Mineralys is laser-focused on addressing the implications of elevated ranges of aldosterone, a hormone that, at elevated ranges, may cause critical hypertension. Aldosterone is a part of the pure management for potassium and salt ranges within the bloodstream; when these get out of whack, hypertension, or hypertension, is the same old end result. Roughly 25% of sufferers with hypertension even have elevated aldosterone.

This factors towards a big potential marketplace for Mineralys to deal with. Amongst People age 20 and up, there are some 122 million who’ve hypertension, with or with out remedy. The prevalence of uncontrolled hypertension, and its impact on the organs reminiscent of the center and kidney, has an enormous greenback influence on the financial system, within the type of preventable well being care spending and time missed from work. Mineralys has developed a brand new drug candidate, lorundrostat, to deal with this medical want, and has superior the drug effectively into medical trials.

The corporate lately launched a pivotal Part 3 trial of lorundrostat, the Launch-HTN research. That is the second ongoing pivotal of the drug, on sufferers with uHTN or rHTN. The research, which was initiated throughout 4Q23, seems to be on the drug when added to the sufferers’ current blood stress remedy routine.

The primary of the 2 pivotal trials, Advance-HTN, additionally continues apace. Mineralys is utilizing this trial to look at the protection and efficacy of lorundrostat used as an add-on remedy ‘to an AHA guidelines-based standardized background remedy routine of both two or three antihypertensive medicines.’

Mineralys expects to have topline information from the Advance-HTN trial prepared for launch throughout 4Q24, in addition to to have topline information from Launch-HTN throughout 2H25.

Checking in once more with analyst Richard Legislation, we discover him upbeat on this firm, primarily based on the earlier successes in its Part 2 trials and the greenback potential of the addressable market in hypertension remedies.

“Regardless of spironolactone turning into the SOC in resistant HTN, there’s nonetheless an unmet want attributable to its gynecomastia and hyperkalemia results. Lorundrostat’s Ph. 2 already confirmed ~10 mmHg placebo-adjusted SBP discount. Sufferers with weight problems confirmed a fair better ~17 mmHg discount. We consider this degree of efficacy can obtain best-in-class and MLYS’s focused method for obesity-related HTN within the 3/4L settings may nonetheless deal with 7-8M targetable sufferers within the US alone. We mannequin lorundrostat reaching ~$2.8B WW non-risk-adjusted, or ~$1.1B risk-adjusted, peak gross sales in 2040. Our Purchase score is pushed by MLYS doubtlessly exhibiting best-in-class efficacy in a big obesity-related HTN market,” Legislation opined.

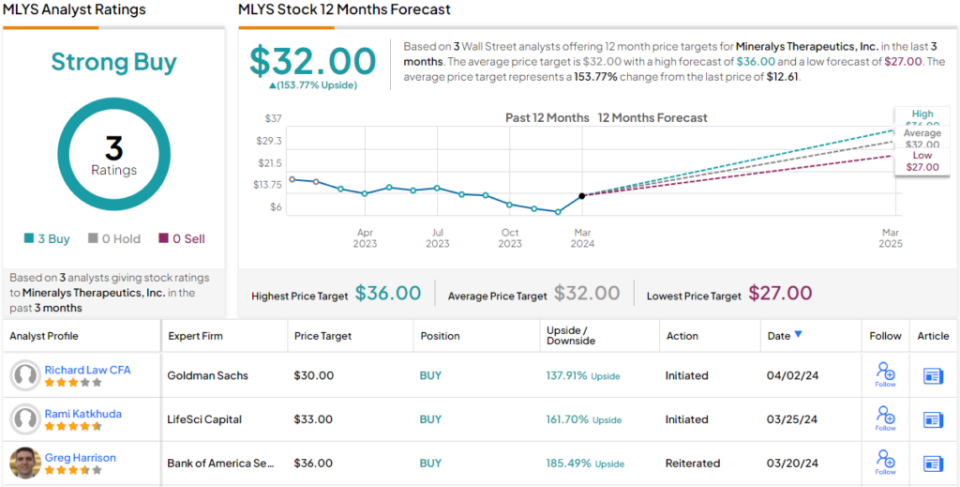

Legislation’s Purchase score on MLYS is backed by a $30 value goal, indicating a 138% upside over the one-year horizon.

All in all, there are 3 current analyst critiques of this inventory, and they’re all optimistic, for a unanimous Sturdy Purchase consensus score. Mineralys shares are buying and selling for $12.61 and their common value goal of $32 is considerably extra bullish than the Goldman view, suggesting a strong 154% acquire within the coming 12 months. (See MLYS inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is rather necessary to do your personal evaluation earlier than making any funding.