Over the past 30 years, no next-big-thing pattern or innovation has come near rivaling the arrival of the web. Nevertheless, synthetic intelligence (AI) has the potential to do for companies on this era what the web did for company America three many years in the past.

By the flip of the last decade, analysts at PwC foresee AI, which depends on software program and techniques rather than human oversight, growing international gross home product by $15.7 trillion. No firm has extra straight benefited from the AI revolution than semiconductor inventory Nvidia (NASDAQ: NVDA).

Nvidia’s inventory could also be in a bubble

Over the span of 15 months, Nvidia’s valuation has soared by $1.9 trillion to $2.26 trillion, which ranks behind solely Microsoft and Apple amongst publicly traded corporations within the U.S.

Nvidia’s outperformance is a mirrored image of the overwhelming demand for its high-powered A100 and H100 graphics processing items (GPUs). Some analysts imagine Nvidia’s top-tier chips might account for greater than 90% of the GPUs deployed in AI-accelerated information facilities this 12 months. The early stage shortage related to these chips has afforded Nvidia distinctive pricing energy.

However there are additionally loads of causes to imagine Nvidia is in a bubble.

For instance, each next-big-thing pattern and innovation over the past three many years has labored its approach by means of an early stage bubble. Traders have a behavior of overestimating the adoption of recent expertise, and I do not anticipate AI being the exception.

Nvidia can be prone to see its pricing energy wane within the quarters to return as new opponents enter the area and the corporate’s personal manufacturing reduces the shortage of AI-GPUs. The majority of Nvidia’s 217% data-center gross sales progress in fiscal 2024 (ended Jan. 28, 2024) may be traced to its pricing energy.

The chief concern would possibly simply be that its high 4 prospects, that are “Magnificent Seven” constituents and comprise roughly 40% of its gross sales, are all creating in-house AI chips for his or her information facilities. A method or one other, Nvidia’s orders from its high prospects are liable to taper off within the quarters to return.

If historical past rhymes, as soon as extra, and the AI bubble bursts, Nvidia’s market cap might crater (in context to the place it’s now) and permit different corporations to leapfrog it.

Listed below are 5 corporations — not together with Microsoft and Apple, that are already forward of Nvidia — which have the instruments and intangibles to be value greater than Nvidia three years from now.

1. Alphabet: $1.88 trillion present market cap (Class A shares, GOOGL)

The primary trade titan that should have no bother surpassing Nvidia’s market cap over the approaching three years is Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG), the guardian firm of web search engine Google, streaming platform YouTube, and autonomous-driving firm Waymo, amongst different ventures.

The explanation Alphabet would maintain up considerably higher than Nvidia if the AI bubble bursts is as a result of it is a veritable monopoly in web search. In March, Google accounted for greater than 91% of worldwide web search share. Wanting again by means of 9 years of month-to-month information from GlobalStats, Google hasn’t ceded greater than 10% of worldwide web search share to all different corporations, mixed. It is the clear-and-obvious alternative for advertisers trying to get their message in entrance of customers, and it is going to profit immensely from lengthy durations of home and worldwide progress.

Google Cloud also can thrive if Nvidia stumbles. Enterprise cloud spending remains to be in its early innings, and Google Cloud has wolfed up a ten% share of worldwide cloud infrastructure service share, as of September 2023. Since cloud margins are historically juicier than promoting margins, Alphabet’s money circulate progress might speed up within the latter-half of the last decade.

2. Amazon: $1.87 trillion present market cap

Like Alphabet, e-commerce juggernaut Amazon (NASDAQ: AMZN) can leap again forward of Nvidia in some unspecified time in the future over the following three years if the AI bubble deflates.

Most individuals are accustomed to Amazon due to its world-leading on-line market. In 2023, an estimated 38% of on-line retail spending within the U.S. was traced to its e-commerce web site. However the true profit of getting greater than 2 billion folks go to Amazon’s web site every month is the promoting income it may possibly generate, and the subscription income introduced in through Prime. Amazon topped 200 million Prime customers in April 2021, and has virtually actually added to this determine since turning into the unique streaming companion of Thursday Night time Soccer.

Nevertheless, Amazon’s premier money circulate driver is its cloud infrastructure service platform. Regardless of accounting for a sixth of the corporate’s internet gross sales, Amazon Internet Providers (AWS) persistently generates 50% to 100% of Amazon’s working revenue. AWS is the world’s high cloud infrastructure service platform by spend, per Canalys.

3. Meta Platforms: $1.24 trillion present market cap

Though social media firm Meta Platforms (NASDAQ: META) is betting on a future fueled by AI and augmented/digital actuality, the corporate’s core operations ought to maintain double-digit earnings progress and assist elevate its valuation effectively previous Nvidia come 2027.

Meta’s “secret sauce” is not any secret in any respect. Regardless of its metaverse ambitions and large spending at Actuality Labs, the corporate’s bread-and-butter continues to be its social media empire. It is the guardian of the most-visited social web site on the planet (Fb), and collectively attracted simply shy of 4 billion month-to-month energetic customers through the December-ended quarter with its household of apps. Simply as advertisers willingly pay a premium to Alphabet’s Google due to its dominance in web search, Meta’s ad-pricing energy tends to be superior in most financial climates.

The opposite motive Meta can shine and fully shut the roughly $1 trillion valuation hole between it and Nvidia over the approaching three years is its stability sheet. Meta is a cash-flow machine. It generated greater than $71 billion in internet money from operations final 12 months and closed out 2023 with $65.4 billion in money, money equivalents, and marketable securities. Not solely does this money present a buffer to the draw back, nevertheless it affords Meta the posh of taking possibilities that few different corporations can match.

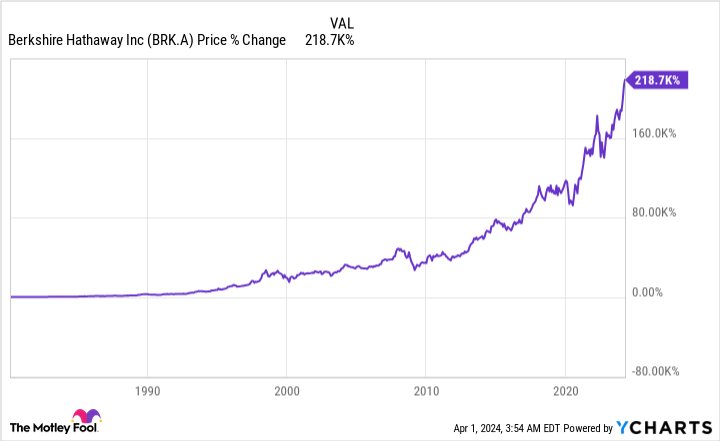

4. Berkshire Hathaway: $908 billion present market cap (Class A shares, BRK.A)

A fourth firm that may surpass AI inventory Nvidia’s market cap over the course of the following three years is conglomerate Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B). Since Warren Buffett took the reins at Berkshire Hathaway within the mid-Sixties, he is overseen an annualized common return on his firm’s Class A shares that is approaching 20%!

One of many major causes Berkshire Hathaway has been such a moneymaker for traders is the “Oracle of Omaha’s” love of dividend shares. Berkshire is on observe to gather within the neighborhood of $6 billion in payouts this 12 months, with simply 5 core holdings accounting for nearly $4.4 billion in combination dividend revenue. Since dividend-paying corporations are sometimes worthwhile on a recurring foundation and time-tested, they’re simply the kind of companies we might count on to develop in lockstep with the U.S. economic system over lengthy durations.

Warren Buffett and his funding group additionally gravitate to brand-name companies with trusted administration groups. As an example, the $155 billion invested in Apple provides as much as virtually 42% of Berkshire Hathaway’s invested belongings. Apple is without doubt one of the world’s most-valuable manufacturers, and CEO Tim Prepare dinner has executed a masterful job of main ongoing bodily product innovation whereas additionally pivoting the corporate to a subscription services-driven future.

5. Visa: $573 billion present market cap

The fifth inventory that’ll be value greater than synthetic intelligence inventory Nvidia three years from now could be payment-processing behemoth Visa (NYSE: V). As issues stand now, Visa must shut a virtually $1.7 trillion valuation hole. But when the AI bubble pops and Visa retains doing what it has been doing for many years, it may possibly occur.

What makes Visa tick is the corporate’s lengthy runway of alternative. It is the undisputed market share chief in bank card community buy quantity within the U.S. (the biggest marketplace for consumption globally), and has a multidecade alternative to organically or acquisitively push its fee infrastructure into underbanked areas, such because the Center East, Africa, and Southeastern Asia. Visa ought to be capable of maintain a double-digit earnings progress fee all through the rest of the last decade, if not effectively past.

Visa’s different supply of success is its comparatively conservative administration group. Though it could most likely be wildly profitable as a lender, its leaders have chosen to maintain the corporate solely targeted on fee facilitation. The benefit of this strategy is that Visa would not need to put aside capital to cowl mortgage losses throughout financial downturns since it is not a lender. The result’s a revenue margin that is persistently hovered at or above 50%!

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of April 1, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Sean Williams has positions in Alphabet, Amazon, Meta Platforms, and Visa. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, and Visa. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Prediction: 5 Shares That’ll Be Value Extra Than Synthetic Intelligence (AI) Inventory Nvidia 3 Years From Now was initially printed by The Motley Idiot