(Bloomberg) — Chinese language shares rose by probably the most in a month on contemporary indicators of an financial restoration, forming a vibrant spot in Asia. Gold hit a report.

Most Learn from Bloomberg

Benchmarks gained in China and South Korea, whereas Japanese equities fell after a report confirmed confidence among the many nation’s giant producers weakened barely for the primary time in 4 quarters. US futures edged larger in Asia, with markets in Australia and Hong Kong shut for a vacation.

China’s CSI 300 Index jumped as a lot as 1.7%, probably the most since Feb. 29, as a rebound in manufacturing exercise strengthened hopes that the nation’s financial restoration could also be beginning to acquire traction.

“Rising optimism about China is actual,” mentioned Vishnu Varathan, chief economist for Asia ex-Japan at Mizuho Financial institution in Singapore. It could acquire traction given “corresponding optimism elsewhere in Asia that dovetails with an upturn in world manufacturing,” he mentioned.

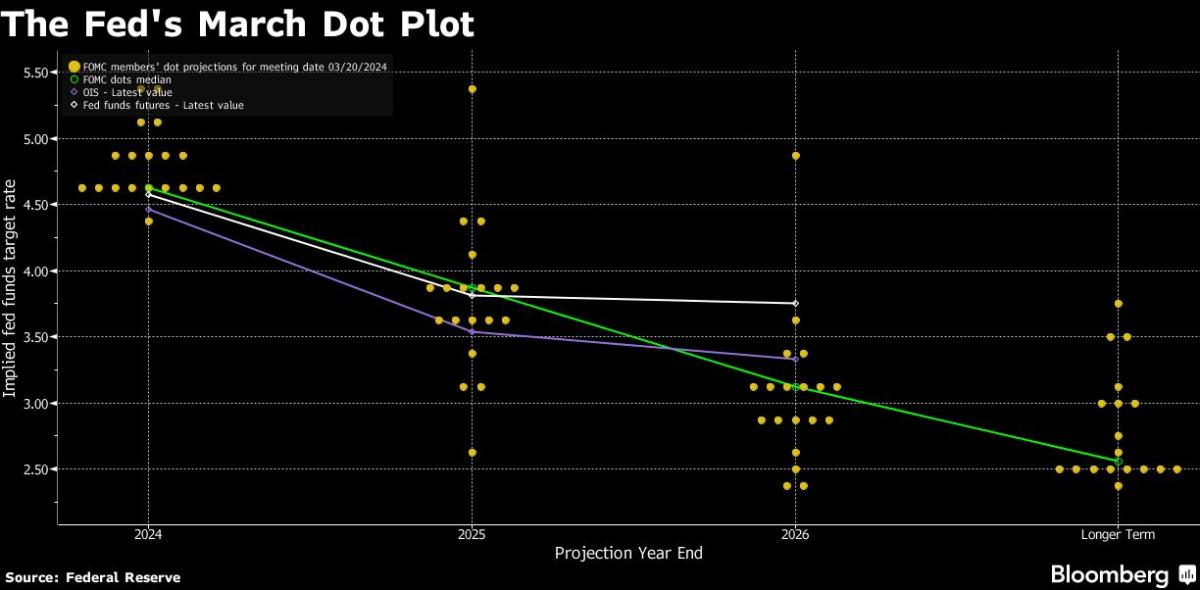

Treasury yields have been largely regular in Asia after Federal Reserve Chair Jerome Powell mentioned Friday the central financial institution’s most well-liked gauge of inflation was “just about consistent with our expectations.” Powell added that it wouldn’t be acceptable to decrease charges till officers are certain inflation is in test. Buyers are betting the US central financial institution will make that first reduce in June.

The core private consumption expenditures value index — which excludes unstable meals and vitality prices — rose 0.3% in February after climbing within the earlier month, marking its greatest back-to-back acquire in a yr. The measure is up 2.8% from a yr earlier, nonetheless above the Fed’s 2% goal.

The greenback was regular.

“You’ve a Fed that in the meanwhile is extremely knowledge dependent,” mentioned Matthew Luzzetti, chief US economist at Deutsche Financial institution. “Till we get both affirmation or a distinct view on what the info are going to be, it’s sort of arduous to gauge precisely the place we find yourself from a Fed coverage perspective.”

In commodities, iron ore fell to the bottom in 10 months as China’s years-long property disaster continued to strain costs. Gold prolonged a rally that’s been pushed by the Federal Reserve transferring nearer to charge cuts and deepening geopolitical tensions.

Elsewhere, Bitcoin was regular after buying and selling above $71,000. The biggest digital foreign money has jumped virtually 70% this yr amid persistent demand for US exchange-traded funds holding the token.

Key occasions this week:

-

Indonesia CPI, manufacturing PMI, Monday

-

Pakistan commerce, CPI, Monday

-

US development spending, ISM Manufacturing, Monday

-

Financial institution of Canada points enterprise outlook and survey of shopper expectations, Monday

-

Eurozone S&P International Manufacturing PMI, Tuesday

-

France S&P International Manufacturing PMI, Tuesday

-

Germany S&P International / BME Manufacturing PMI, CPI, Tuesday

-

India HSBC/S&P International Manufacturing PMI, Tuesday

-

Mexico worldwide reserves, Tuesday

-

South Korea CPI, Tuesday

-

Spain unemployment, Tuesday

-

UK S&P International / CIPS Manufacturing PMI, Tuesday

-

US manufacturing unit orders, gentle car gross sales, JOLTS job openings, Tuesday

-

Brazil industrial manufacturing, Wednesday

-

Eurozone CPI, unemployment, Wednesday

-

Hong Kong retail gross sales, Wednesday

-

US ISM Companies, Wednesday

-

Eurozone S&P International Companies PMI, PPI, Thursday

-

India companies PMI, Thursday

-

US preliminary jobless claims, commerce, Thursday

-

Eurozone retail gross sales, Friday

-

France industrial manufacturing, Friday

-

Germany manufacturing unit orders, Friday

-

Hong Kong PMI, Friday

-

India charge choice, Friday

-

Japan family spending, Friday

-

Philippines CPI, Friday

-

Russia GDP, Friday

-

Singapore retail gross sales, Friday

-

South Korea present account stability, Friday

-

US unemployment, nonfarm payrolls, Friday

A few of the essential strikes in markets:

Shares

-

S&P 500 futures rose 0.3% as of 11:35 a.m. Tokyo time

-

Nasdaq 100 futures fell rose 0.5%

-

Japan’s Topix fell 1.9%

-

The Shanghai Composite rose 1.2%

Currencies

-

The Bloomberg Greenback Spot Index was little modified

-

The euro was little modified at $1.0788

-

The Japanese yen was little modified at 151.30 per greenback

-

The offshore yuan was little modified at 7.2523 per greenback

Cryptocurrencies

-

Bitcoin was little modified at $70,819.51

-

Ether fell 0.6% to $3,609.75

Bonds

Commodities

-

West Texas Intermediate crude rose 0.3% to $83.44 a barrel

-

Spot gold rose 1.2% to $2,255.77 an oz.

This story was produced with the help of Bloomberg Automation.

–With help from John Cheng.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.