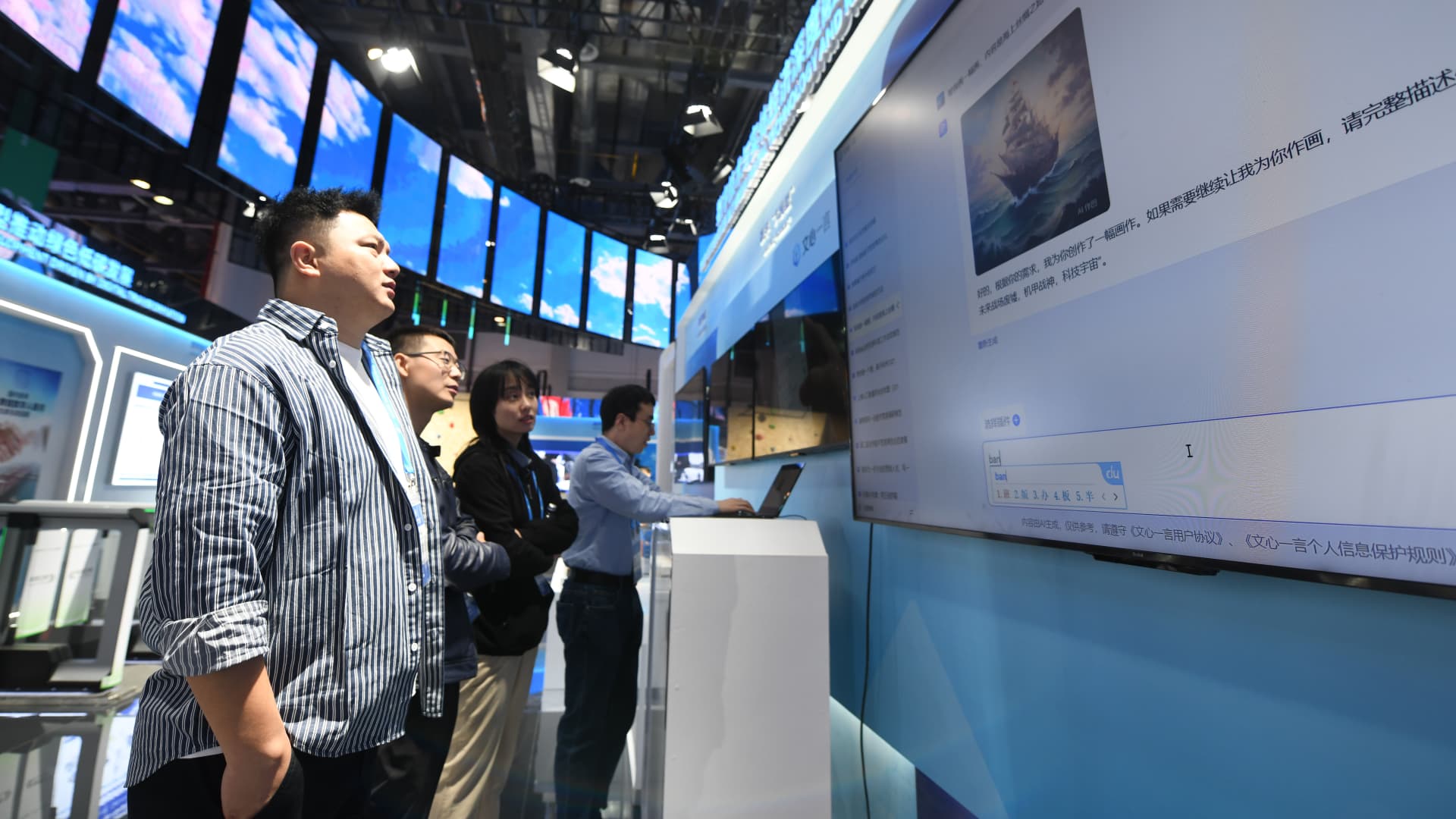

Folks study Baidu’s synthetic intelligence chatbot service Ernie Bot throughout the 2nd International Digital Commerce Expo at Hangzhou Worldwide Expo Middle on November 23, 2023 in Hangzhou, Zhejiang Province of China.

China Information Service | China Information Service | Getty Pictures

Nvidia’s rocket-ship journey within the inventory market underscores the extent to which chip high quality and availability will dictate the winners within the generative AI period. However there’s one other side to measuring early leads within the house. In China, which is angling to supply its personal chips or get extra from Nvidia, no dominant gen AI contender to OpenAI has emerged but amongst dozens of Chinese language tech titans and startups.

Late to the sport, China is looking for to catch the lead of OpenAI in a wider U.S. AI market formed by tech titans Microsoft, Alphabet’s Google and Amazon, and well-financed startups together with Anthropic, which this week obtained a $2.7 billion infusion of money from Amazon.

Within the fast-moving discipline, the hole between the U.S. and its tech rival China is seen as vast. “The main Chinese language firms are benchmarking towards ChatGPT, which signifies how far behind they’re,” stated Paul Triolo, senior vice chairman for China and know-how coverage lead at Dentons International Advisors in Washington, D.C.

“Not too many firms can help their very own giant language mannequin. It takes lots of capital. Silicon Valley is unquestionably effectively forward of the sport,” stated Jenny Xiao, a accomplice at AI VC agency Leonis Capital in San Francisco.

The U.S. stays the largest funding market. Final 12 months, funding of gen AI upstarts accounted for almost half of $42.5 billion invested globally in synthetic intelligence firms, in line with CB Insights. Within the U.S., VCs and company traders drove AI funding to $31 billion throughout 1,151 offers, led by giant outlays in OpenAI, Anthropic and Inflection. This compares with $2 billion in 68 offers in China, which marked a big drop from 2022’s $5.5 billion in 377 offers. The autumn-off is partly attributable to restrictions on of U.S. enterprise funding into China.

“China is at an enormous drawback in constructing the inspiration fashions for Gen AI,” stated Rui Ma, an AI investor and co-founder of funding syndicate and podcast TechBuzz China.

However the place China lags in foundational fashions, that are dominated by OpenAI and Google’s Gemini, it is closing the hole through the use of Meta’s open supply, giant language mannequin Llama 1, and Triolo stated the Chinese language contenders, if behind, are bettering on the U.S. mannequin.

“Most of the China fashions are successfully forks of Llama, and the consensus is that these forks are one to 2 years behind the main U.S firms OpenAI and its video-to-text mannequin Sora,” Ma stated.

China does have the tech expertise to make a distinction within the AI rivalry within the years forward.

A brand new examine by assume tank Marco Polo, run by the Paulson Institute, reveals that the U.S. is house to 60% of high AI establishments, and the U.S. stays by far the main vacation spot for elite AI expertise at 57% of the full, in contrast with China at 12%. However the analysis finds that China leads the U.S. by a couple of different measures, together with being forward of the U.S. in producing top-tier AI researchers, primarily based on undergraduate levels, with China at 47% and the U.S. lagging with 18%. Moreover, amongst top-tier AI researchers working at U.S. establishments, 38% have China as their nation of origin, in contrast with 37% from the U.S.

New Chinese language gen AI market entries also can attain mass adoption shortly. Baidu’s ChatGPT competitor, Ernie Bot, launched in August 2023, reached 100 million customers by the tip of the 12 months. Samsung is planning to combine Baidu’s Ernie AI into its new Galaxy S smartphones whereas in one other high-profile growth that speaks to U.S.-China relations, Apple is in talks with Baidu about supplying the iPhone 16 with the Chinese language firm’s gen AI know-how.

Inside its present slate of AI contenders, Baidu’s Ernie Bot fashions are thought-about among the many most superior, in line with Leong.

A number of different Chinese language firms are forging forward, funded by main gamers in its personal know-how market. Giant cloud firms similar to similar to Baidu and Alibaba, social media gamers ByteDance and Tencent, and tech firms SenseTime, iFlyTek, Megvii and Horizon Robotics, in addition to analysis institutes, are all aiding the hassle.

Moonshot AI, funded by China’s e-commerce large Alibaba and VC agency Hongshan (beforehand Sequoia China), is constructing giant language fashions that may deal with lengthy content material inputs. In the meantime, former Google China president Kai-Fu Lee has developed an open supply gen AI mannequin, 01.AI, funded by Alibaba and his agency Sinovation Ventures.

Whereas China has accelerated growth of its homegrown chip business and superior AI, its AI growth has been restricted partly by U.S. restrictions on exporting high-end AI chips, a market cornered by Nvidia, as a part of a new battleground for tech supremacy between the U.S. and China.

“Regardless of efforts to develop indigenous options, Chinese language AI builders nonetheless largely depend on international {hardware}, notably from U.S. firms, which is a vulnerability within the present geopolitical local weather,” stated Bernard Leong, founder and CEO of tech advisory Analyse Asia in Singapore.

The continued tensions between the U.S. and China over know-how innovation and nationwide safety points is resulting in a break up in gen AI growth, following the sample of different impactful applied sciences caught up in superpower tech arms races. Given rules and bans over delicate, cutting-edge applied sciences, the doubtless consequence is 2 parallel ecosystems for gen AI, one within the U.S. and one in China. ChatGPT is blocked in China whereas Baidu’s Ernie Bot can solely be accessed within the U.S. with a mainland Chinese language cellular phone quantity. “U.S. firms cannot go into China and Chinese language firms cannot go into the U.S.,” Xiao stated.

U.S. Secretary of Commerce Gina Raimondo has acknowledged {that a} purpose of U.S. curbs on AI chip exports is to stop China from buying or producing superior chips. As mainland China focuses on homegrown capabilities, Chinese language firms SMIC or Huawei may very well be an alternative choice to Nvidia. However the future for alternates is probably going unsure if export controls minimize off these firms from essentially the most superior designs for manufacturing. Triolo famous that Huawei not too long ago developed a collection of AI chips as a rival to Nvidia.

China is getting forward in making use of AI to sure classes, similar to laptop imaginative and prescient. “The chip scarcity is essential for coaching foundational fashions the place you want sure chips, however for purposes, you do not want that,” Ma stated.

The “actual killer app” for gen AI, in line with Triolo, might be in firms which can be prepared to pay cash to harness the know-how as a part of their enterprise operations. Alibaba is specializing in integrating AI into its e-commerce ecosystem. Huawei, whereas competing extra efficiently towards Apple’s iPhone within the client market up to now 12 months, additionally has broader ambitions, creating AI for particular industries together with mining, utilizing its in-house {hardware}, Leong stated.

Boston Consulting Group analysis suggests it could be some time earlier than this wider gen AI market ramps exterior of tech. Sixty % of 1,400 executives surveyed are ready to see how gen AI rules develop, whereas solely 6 % of firms have educated their staff on gen AI instruments.

AI and tech points are entrance and heart for China’s management, with the nation’s launch of guardrails on AI in 2023 after ChatGPT’s breakthrough, after which modifications of some measures.

The open supply gen AI know-how many Chinese language builders use can encourage collaboration amongst globally and result in shared insights as AI advances, however Leong stated open supply additionally results in points associated to making sure high quality and safety of the fashions, in addition to managing bias and potential misuse of AI.

“China desires to verify content material is just not spewing out. In addition they need their firms to steer and are prepared to reign in draconian measures,” Triolo stated.

Moral and social considerations hinder gen AI advances in China in addition to different areas, together with the U.S., as see within the battle for management over OpenAI’s mission. Inside China, there’s one other issue that might sluggish AI acceleration, in line with Leong: sustaining management of gen AI purposes, particularly in areas delicate to state pursuits.