(Bloomberg) — Upcoming readouts on the US labor market, together with the month-to-month payrolls report, will give Federal Reserve policymakers perception into the necessity for additional interest-rate reductions after an all-but-certain minimize in a bit greater than two weeks.

Most Learn from Bloomberg

With inflation slowing — though nonetheless working sooner than the Fed’s purpose — Chair Jerome Powell has telegraphed a September fee minimize and mentioned that officers “don’t search or welcome” additional cooling within the labor market. Weeks earlier, authorities figures confirmed lower-than-expected July job progress and the very best unemployment fee in almost three years.

This coming Friday, the August jobs report is anticipated to indicate payrolls on the earth’s largest economic system elevated by about 165,000, primarily based on the median estimate in a Bloomberg survey of economists.

Whereas above the modest 114,000 achieve in July, common payrolls progress over the latest three months would ease to a bit greater than 150,000 — the smallest because the begin of 2021. The jobless fee most likely edged down in August, to 4.2% from 4.3%.

Two days earlier than Friday’s report, the federal government will concern figures on July job vacancies. The variety of open positions, a measure of labor demand, is seen easing to a three-month low of 8.1 million — simply above a greater than three-year low.

The variety of vacancies per unemployed employee, a ratio the Fed watches intently, at present stands at 1.2, just like pre-pandemic ranges and an indication labor demand is roughly according to provide. At its peak in 2022, the ratio was 2 to 1.

Additionally included within the job openings report are information on lay-offs and discharges. Any massive enhance might add to Fed officers’ considerations a couple of weakening labor market.

Different labor-related reviews within the upcoming holiday-shortened week embrace weekly jobless claims and ADP Analysis Institute’s August snapshot of personal payrolls. As well as, the Fed will concern its Beige Ebook of regional financial circumstances, whereas the Institute for Provide Administration reviews buying managers indexes for manufacturing and providers.

What Bloomberg Economics Says:

“Non-farm payrolls will possible enhance from July’s disappointing studying – however the 818k downward revision within the BLS’s early estimate for the March 2024 benchmark interval most likely leaves Fed officers much less prepared to take the preliminary prints at face worth.”

— Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou and Chris G. Collins, economists. For full evaluation, click on right here

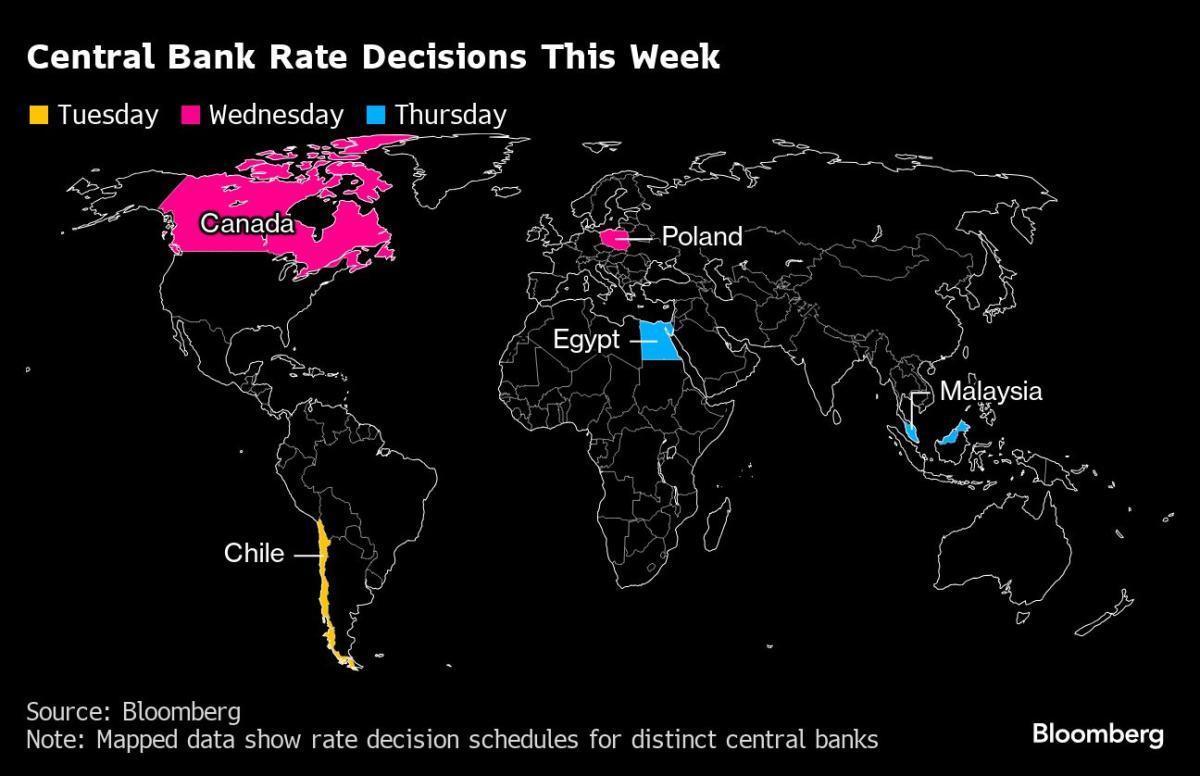

Elsewhere, the Financial institution of Canada is broadly anticipated to ship a 3rd straight fee minimize, as inflation that’s been inside its goal vary all yr permits officers to shift focus to weak spot within the job market.

Buying supervisor indexes from round Asia, German industrial numbers and gross home product from Brazil are amongst different highlights.

Click on right here for what occurred prior to now week, and beneath is our wrap of what’s developing within the international economic system.

Asia

Asia begins the week with a wave of August manufacturing PMI information – together with from Indonesia, South Korea, Malaysia, Thailand, Taiwan and the Philippines – following on from China’s official figures on the weekend.

China’s Caixin manufacturing PMI can be out on Monday, and is anticipated to indicate a return to growth after a dip beneath 50 in July.

Japan on Monday will get a report on company efficiency within the second quarter. Capital funding could recuperate a tad after slipping within the three months by means of March, information that may feed into revised financial progress figures the next week.

In Australia, consideration falls on present account figures that will even possible have an effect on gross home product information. These figures, due Wednesday, are anticipated to indicate that financial progress accelerated barely from the prior quarter.

South Korea revises its second-quarter GDP the next day, and the area additionally will get a flurry of inflation updates. Commerce information for August — printed Sunday — confirmed that export progress returned to a double-digit clip, an consequence that bodes effectively for the financial outlook and displays the resilience of world demand for know-how merchandise.

Vietnam’s shopper worth positive factors could gradual beneath 4% for the primary time since March, whereas consumer-price information are additionally due from South Korea, Thailand, Taiwan, Indonesia and the Philippines. Commerce statistics shall be printed in Australia, Vietnam and Pakistan.

Amongst central banks, Malaysia units its in a single day coverage fee on Thursday and Reserve Financial institution of Australia Governor Michele Bullock delivers a speech the identical day.

Europe, Center East, Africa

Euro-zone policymakers have till the shut of play on Wednesday to make feedback earlier than a blackout interval kicks in forward of their Sept. 12 resolution.

With inflation now at a three-year low, a second fee minimize for the newly-minted easing cycle appears to be like more and more possible. Central financial institution chiefs from Germany and France are amongst these scheduled for appearances.

The calendar for information is comparatively gentle, with Germany more likely to be a spotlight. Manufacturing facility orders on Wednesday and industrial manufacturing the next day will reveal the state of the nation’s struggling producers in the beginning of the third quarter.

Amongst regional reviews on the agenda, a second studying of the euro-zone’s GDP measurement for the three months by means of June shall be launched.

The UK is more likely to be equally quiet, with remaining takes on August buying supervisor indexes for manufacturing and providers scheduled for Monday and Wednesday respectively.

Client-price information in Switzerland could draw eyeballs upfront of the Swiss Nationwide Financial institution’s fee resolution later this month. Inflation could stick at 1.3% for a 3rd month, comfortably beneath the two% ceiling for policymakers.

Turning east, in Poland — the place information on Aug. 30 confirmed the quickest inflation up to now this yr — the central financial institution is broadly anticipated to maintain its key fee unchanged at 5.75% on Wednesday. Governor Adam Glapinski will converse at a information convention the next day.

Information from South Africa on Tuesday will possible present that the continent’s most industrialized economic system skirted recession. Analysts count on the economic system to have grown 0.5% within the second quarter after contracting 0.1% within the prior three months, helped by improved energy provides.

In Turkey, information is anticipated to indicate the inflation fee dropped by about 10 proportion factors in August, to 52% from 62%. The central financial institution is hoping it declines to about 40% by year-end.

From Wednesday to Friday, African heads of and Chinese language President Xi Jinping will collect in Beijing for the Discussion board on China–Africa Cooperation, the place they’re anticipated to debate new funding alternatives.

On Thursday, Egypt’s central financial institution is broadly anticipated to carry its essential fee at 27.5%. Some analysts, although, suppose it could decide to begin the easing course of now given the regular retreat in worth pressures over the previous yr.

Latin America

Brazil on Tuesday will report second-quarter financial progress figures more likely to reinforce that demand is shaking off the consequences of tight financial coverage.

GDP is anticipated to have risen 0.9% quarter-on-quarter, greater than throughout the first three months of the yr, as a good labor market and robust consumption propel exercise.

The discharge will possible enhance leftist President Luiz Inacio Lula da Silva, who’s raised public spending whereas pledging to enhance residing requirements for strange residents in Latin America’s largest economic system. It might additional strain the central financial institution for rate of interest will increase as quickly as in September.

The approaching week shall be essential for financial information releases in Chile. On Tuesday, the nation’s central financial institution is more likely to minimize its key fee by a quarter-point, to five.5%, after having paused the easing cycle at its prior assembly.

The following day, Chilean central bankers will publish their quarterly financial coverage report, with up to date estimates on financial progress, inflation, and the long run path for borrowing prices.

On Friday, the federal government will report August shopper worth information, which is anticipated to indicate inflation accelerating additional above the three% goal as a result of a sequence of electrical energy tariff hikes.

–With help from Matthew Malinowski, Piotr Skolimowski, Laura Dhillon Kane, Brian Fowler and Monique Vanek.

(Updates with South Korea commerce in Asia part)

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.