(Bloomberg) — Nvidia Corp. did not stay as much as investor hopes with its newest outcomes on Wednesday, delivering an underwhelming forecast and information of manufacturing snags with its much-ballyhooed Blackwell chips.

Most Learn from Bloomberg

Comply with information and evaluation of Nvidia’s earnings report in our stay weblog.

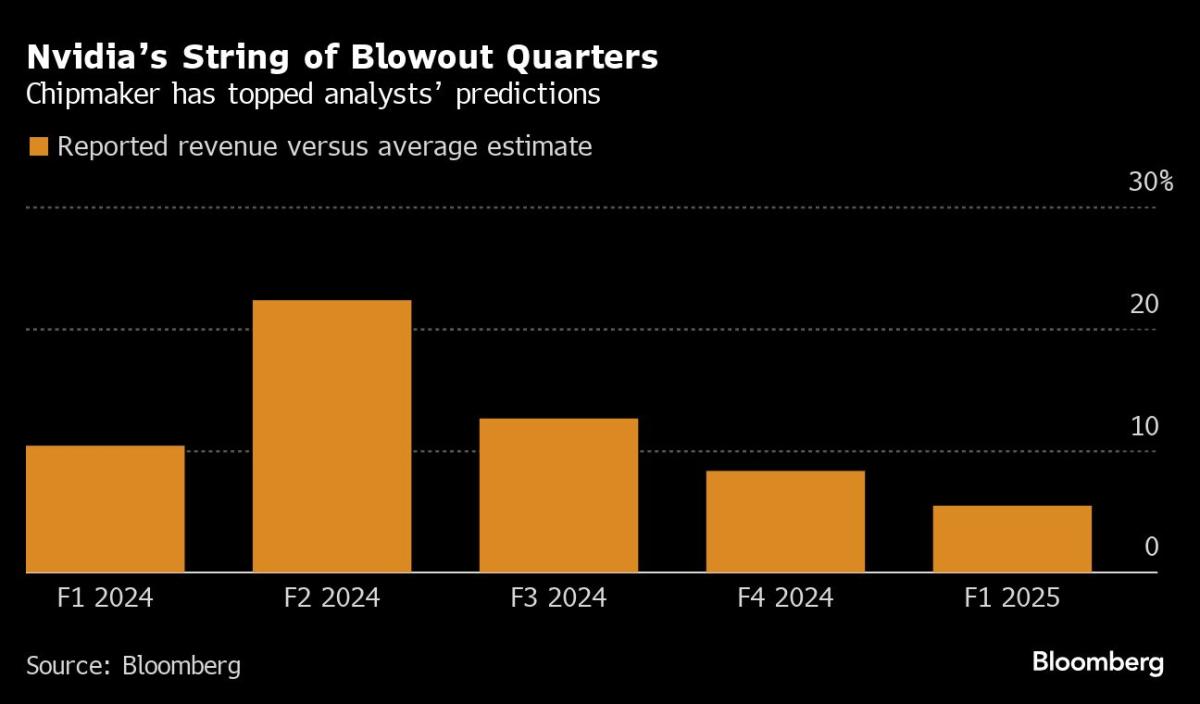

The corporate’s quarterly report — probably the most anticipated a part of the tech business’s earnings season — met or beat analysts’ estimates on practically each measure. However Nvidia traders have grown accustomed to blowout quarters, and the most recent numbers didn’t qualify.

Furthermore, Nvidia’s subsequent large money cow — the brand new Blackwell processor lineup — has confirmed more difficult to fabricate than anticipated. That information contributed to a inventory decline of as a lot as 8.4% in late buying and selling after the outcomes had been launched. The shares had greater than doubled this 12 months by way of Wednesday’s shut, following a achieve of 239% in 2023.

“It was up towards lofty and unsustainable expectations,” Bloomberg Intelligence analysts Kunjan Sobhani and Oscar Hernandez Tejada stated in a observe.

Third-quarter income will probably be about $32.5 billion, the corporate stated. Although analysts had predicted $31.9 billion on common, estimates ranged as excessive as $37.9 billion.

The disappointing outlook threatens to tamp down an AI frenzy that has reworked Nvidia into the world’s second-most-valuable firm. The chipmaker is the important thing beneficiary of a race to improve information facilities to deal with AI software program, and its gross sales forecasts have turn out to be a barometer for that spending increase.

Heading into the announcement, there was concern that Nvidia was having issues with its new Blackwell design. The corporate acknowledged that there have been points with manufacturing, saying that it was making modifications to enhance its manufacturing yield — the variety of functioning chips that come out of factories. On the identical time, the corporate stated it expects to herald “a number of billion {dollars}” of income within the fourth quarter from the product.

“The anticipation for Blackwell is unimaginable,” Chief Govt Officer Jensen Huang stated in an announcement.

Nvidia is coming off a string of quarters that shattered Wall Avenue expectations — at the same time as analysts continued to boost estimates. However the quantity of upside has been trending down.

Most of Nvidia’s progress additionally has come from a small group of consumers. About 40% of Nvidia’s income stems from massive data-center operators — corporations like Alphabet Inc.’s Google and Meta Platforms Inc. — that are pouring tens of billions of {dollars} into AI infrastructure.

Although Meta and others have elevated their capital expenditure budgets this earnings season, there’s been concern that the quantity of infrastructure being put in place exceeds present necessities. That might result in a bubble. However Nvidia’s Huang has maintained that that is solely the start of a brand new period for expertise and the economic system.

Expectations had been lofty. Nvidia has been one of the best performing inventory within the S&P 500 Index this 12 months, eclipsing beneficial properties by all different semiconductor corporations. At a market worth of greater than $3 trillion, Nvidia is value roughly the identical quantity as the subsequent 10 largest chip corporations mixed.

Nvidia made its identify by promoting video-game playing cards, however is now greatest recognized for so-called AI accelerators. These chips, derived from its graphics processors, are used to develop synthetic intelligence software program by bombarding it with info.

The method, referred to as coaching, makes AI fashions higher at recognizing and responding to real-world inputs. Nvidia’s elements are additionally utilized in techniques that then run the software program, a stage referred to as inference, and assist energy companies reminiscent of OpenAI’s ChatGPT.

Final quarter’s outcomes topped Wall Avenue projections, and the Santa Clara, California-based firm’s board authorised an extra $50 billion in inventory buybacks.

Nvidia’s income greater than doubled to $30 billion within the fiscal second quarter, which ended July 28. Excluding sure gadgets, revenue was 68 cents a share. Analysts had predicted gross sales of about $28.9 billion and earnings of 64 cents a share.

Nvidia acquired a bounce on different chipmakers as a result of its expertise was well-suited to the wants of AI. However rivals are attempting to catch up. Superior Micro Units Inc. is now its closest competitor, with Intel Corp. — as soon as the world’s largest chipmaker — trailing additional behind. Their mixed income from the market is simply about 5% of Nvidia’s whole.

Nvidia’s data-center division — now by far its largest supply of gross sales — generated $26.3 billion of income final quarter. Gaming chips offered $2.9 billion. Analysts had given targets of $25.1 billion for the data-center unit and $2.79 billion for gaming.

Blackwell is anticipated to generate a recent wave of progress when it rolls out within the coming months. Analysts have downplayed issues about delays, noting that the corporate nonetheless enjoys enormous demand for its present era of merchandise. That might assist Nvidia address any delays with no large monetary hit.

In describing its challenges with Blackwell, Nvidia stated it needed to change a masks manufacturing step to enhance its yield. A masks is the template used to burn the circuit sample into supplies deposited on a disk of silicon.

Manufacturing of Blackwell is ready to ramp up within the fourth quarter and proceed into the subsequent fiscal 12 months, Nvidia stated.

Throughout a post-results convention name, analysts sought extra particulars on the quantity of income that the brand new Blackwell chips would ship and when. Huang and Chief Monetary Officer Colette Kress caught to their promise of billions of {dollars} within the fourth quarter, refusing to elaborate additional.

The inventory prolonged its declines as the decision went on and solutions weren’t offered.

In his typical trend, Huang made high-level predictions on the way forward for the computing business, arguing {that a} trillion {dollars} of apparatus will probably be wanted to interchange outmoded gear on this planet’s information facilities. That alternative course of is simply starting, he stated.

AI is taking on pc search, serving to corporations velocity up their enterprise processes, and wanted by international locations to safe information, he stated.

“It’s affecting how each layer of computing is completed,” Huang stated.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.