A satellite tv for pc surveillance firm with hyperlinks to U.S. intelligence, former Trump administration officers, U.S. authorities debt barons and the stablecoin Tether (USDT) introduced plans earlier this 12 months to construct the “Web for Forests” within the Amazon rainforest. The satellite tv for pc firm, referred to as Satellogic, plans to affix an initiative to rig up one of many world’s oldest and most necessary forests with sensors and “machine intelligence infrastructure” led by a bunch referred to as O.N.E. Amazon. O.N.E. Amazon, in flip, seeks to show the Amazon rainforest right into a digital asset safety to be chopped up, tokenized and offered off to traders world wide as a novel type of digital credit score. O.N.E. Amazon’s companions on this endeavor, reminiscent of Aecom, even have necessary U.S. intelligence connections.

O.N.E. Amazon is chaired by Peter Knez, who oversaw the creation of ETFs (change traded funds) and iShares, which is now owned by BlackRock. Knez, who additionally served for a few years as BlackRock’s International Chief Funding Officer, additionally chairs the Venom Basis, which is growing a proprietary blockchain and token to facilitate the “growth and implementation of central financial institution digital foreign money (CBDC) and conventional finance merchandise by governments and companies” world wide. On condition that O.N.E. Amazon describes its rainforest tokenization initiative as “crypto with a goal” and that it is usually chaired by Knez, it appears probably that the Amazon-focused initiative might contain Venom in some capability. Given Satellogic’s ties to previous efforts to impose a Bitcoin blockchain-powered carbon market on Latin America, it is usually potential that Bitcoin or one other distinguished blockchain might be used, particularly contemplating the involvement of Jalak Jobanputra, a significant investor within the digital foreign money house and significantly in necessary Bitcoin-related corporations, in allegedly co-founding O.N.E. Amazon.

As we beforehand reported earlier this 12 months in a bit entitled Tokenized Inc., BlackRock and different titans of finance try to tokenize and financialize the pure world. Contemplating that the architect of iShares now stands on the helm of O.N.E. Amazon, you will need to replicate on BlackRock’s Larry Fink’s phrases shortly after the approval of the iShares Bitcoin ETF earlier this 12 months. Fink said that “We consider ETFs are a expertise no completely different than Bitcoin was a expertise for asset storage.” In different phrases, blockchain and ETFs, per Fink, merely function a technological means to retailer centralized indexes, funds and tokenized belongings, in direct distinction to the founding aspirations of Bitcoin as a peer-to-peer digital foreign money. Now, the very man who developed BlackRock’s ETF machine is searching for to tokenize the Amazon rainforest and rework it right into a digital asset of finite provide – basically turning a significant and essential ecosystem right into a “digital gold” or bitcoin analogue.

For years, titans of Wall Road like BlackRock have helped saddle South American international locations with unprecedented debt ranges, robbing them of their financial sovereignty by means of dollarization or establishments just like the IMF and World Financial institution. Now, they’re searching for to show the continent’s most vital assets right into a type of “digital gold” that might be enforced by a satellite-sensor system tied to people deeply invested in efforts to globalize dollar-denominated debt and in addition to American intelligence. Whereas the purpose is framed as “conservation” of the Amazon, the Satellogic-O.N.E. Amazon proposal seeks as an alternative to allow the exploitation of a protected useful resource like by no means earlier than whereas additionally constructing a cybernetic surveillance grid into considered one of nature’s best monuments – not to make sure the forest’s “well being” – however to make sure the “integrity” of the digital asset safety it’s now poised to uphold.

What’s O.N.E. Amazon?

O.N.E. Amazon goals to create “sustainable affect for the surroundings and traders by utilizing next-generation expertise to deliver innovation to conservation.” It was formally launched at COP28 in December 2023 however seems to have begun operations someday round 2021, if not earlier. The “innovation” O.N.E. Amazon provides is associated to its issuance of an upcoming,“regulated O.N.E. Amazon Digital Asset Safety.” Per O.N.E. Amazon’s chairman Peter Knez, “every safety will symbolize the perceived worth of 1 hectare of biome within the Amazon rainforest, backed by a 30-year preservation settlement over that land.” The quantity of securities to be issued might be capped at 750 million, “comparable to the hectarage of the rainforest.” In different phrases, every safety issued represents one hectare of the Amazon. Knez said in an interview with TradeArabia that the group has already secured “a formidable long-term land preservation settlement for 50 million hectares of rainforest, an space bigger than Spain.” The corporate asserts that “traders will profit from the potential capital appreciation of the safety” largely attributable to “the finite measurement” of the rainforest it’s tokenizing.

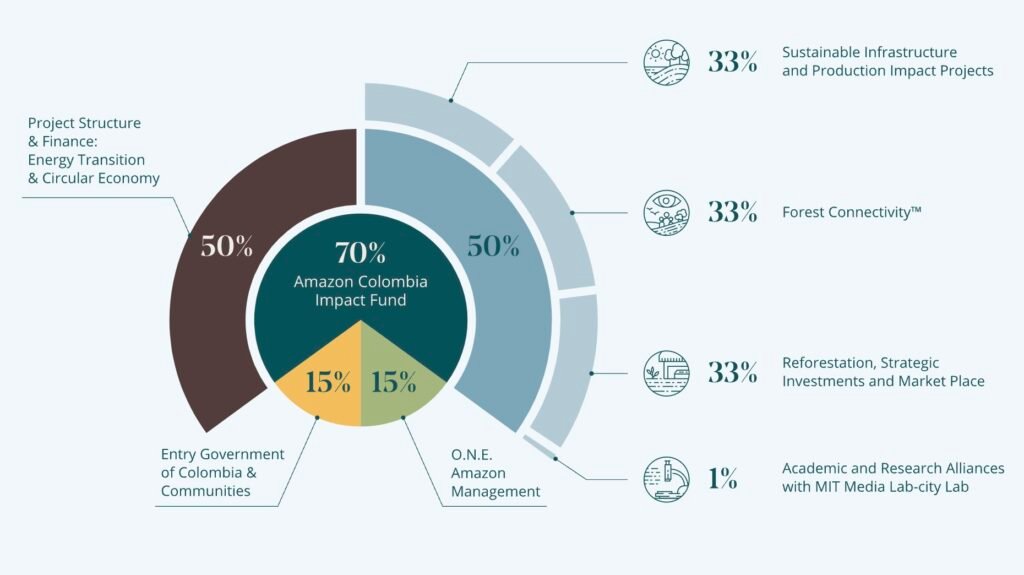

Proceeds from purchases of this safety will go to the O.N.E. Amazon Impression Discovered (OAIF), which is headquartered Abu Dhabi, UAE and “will create jobs for the native Amazonian communities and speed up the power transition of the international locations by means of which the Amazon rainforest extends.” At its COP28 launch, O.N.E. Amazon, together with the OAIF, was described as “the world’s first trillion-dollar nature-based asset platform.” Goldman Sachs is the “structuring associate” for the fund. The corporate has additionally said that this fund “will put money into power transition and round economic system initiatives, together with infrastructure and clear power technology initiatives, along with extra localised neighborhood land preservation initiatives within the Amazon.” It additionally purports to “higher the lives” of the thousands and thousands who inhabit the area.

Nonetheless, as we will quickly see, O.N.E. Amazon’s efforts to-date within the Amazon present that the group, regardless of claiming to champion ecosystem preservation and indigenous well-being, have acted predatorily with respect to indigenous Amazonian tribes. They’re additionally backing main industrial initiatives within the international locations it operates that don’t profit the native individuals or surroundings, arguably the other.

As a way to assist underwrite their digital asset safety linked to every hectare of the Amazon rainforest, O.N.E. Amazon plans to construct the “world’s first Web of Forest (IoF)” in partnership with MIT Media Lab and the aforementioned satellite tv for pc surveillance firm, Satellogic. A proportion of the OAIF will go towards constructing out the IoF and different investments in Amazon “knowledge enablement.” MIT Media Lab is particularly serving to O.N.E. Amazon create “a framework to watch each hectare that’s tokenized in opposition to a Digital Asset Safety” that may even “present a data-driven, real-time understanding of what’s occurring the Amazon biome.” On its web site, O.N.E. Amazon states that the IoF will “monitor and analyze the well being” of the rainforest whereas additionally “digitally join[ing] each hectare of land.” In line with O.N.E. Amazon co-founder and CEO Rodrigo Veloso, a former board member of Trump Media & Know-how Group:

“The Web of Forests is meant to make sure dependable measurements of key environmental and social metrics; function world – class knowledge assortment and storage infrastructure for scientific evaluation of forest environments; and allow native communities to higher perceive how their conduct and the conduct of establishments affect the pure surroundings throughout the rainforest.”

Chris Lang, contributing editor of the REDD-Monitor substack, revealed in a 2023 report that O.N.E. Amazon has sought to trademark the “Web of Forests” idea since 2021 and that the trademark is meant to cowl the next:

“Software as a service; digital knowledge storage; database growth; knowledge evaluation and processing; info / knowledge processing; analysis on agroforestry and agroecological methods; analysis actions, together with the usage of equipment and devices for actions associated to the operation of monitoring and measuring forestry and lands; scanning; recommendation and consultancy in finishing up exams and measurements for high quality management; measurement and verification of carbon dioxide emissions and different greenhouse gases; aero photogrammetry; photogrammetry; land surveying; topographic surveys; geological surveys; environmental management of air and noise air pollution; analysis within the subject of environmental safety; geological analysis; organic analysis; offering scientific info, recommendation and consultancy referring to carbon offsetting; growth of technical initiatives on agroforestry and agroecological methods.”

Given the mentions of carbon dioxide emissions and carbon offsetting, it appears clear that the O.N.E. Amazon safety and the “Web of Forests” underwriting it intends to combine into the broader efforts to impose carbon markets globally. As famous in earlier reporting, Latin America has been a significant focus for “inexperienced” bankers and financiers on this regard and O.N.E. Amazon, like teams like GREEN+, are utilizing deeply inequitable contractual agreements made on the native degree to implement their plans. The O.N.E. Amazon contracts might be mentioned in later element shortly.

As well as, in a analysis paper printed earlier this 12 months in April, O.N.E. Amazon co-founders Peter Knez and Rodrigo Veloso joined O.N.E. Amazon associate Veea and Mysten Labs to develop an strategy the place blockchain expertise might be built-in into “biodiversity conservation, providing a novel perspective on how digital resilience may be constructed inside ecological contexts.” The paper, entitled “Preserving Nature’s Ledger: Blockchains in Biodiversity Conservation,” promotes a framework that focuses on “tokenization methods for biodiversity species and for IoT options, reminiscent of sensors, drones, and satellites to watch and document knowledge associated to species and ecosystems.”

The paper notes that the biodiversity knowledge obtained beneath this framework might be used to develop new inexperienced bonds and derivatives that might be traded on a blockchain. To perform this, they suggest the “datafication of biodiversity,” which they outline as “the method of making digital representations of assorted species within the ecosystem. Additionally they suggest “knowledge repurposing cascades,” which refers to “the method of reusing collected biodiversity knowledge for numerous functions […] that aren’t essentially and instantly linked to conservation efforts,” i.e. commercializing the biodiversity knowledge they get hold of. One instance given in a while pertains to how “all collected knowledge can be utilized to create AI coaching units aimed toward figuring out and resolving threats to biodiversity.” That instance claims that the information might be used to coach an AI that deploys “swarm intelligence drones which can be in touch with sensor on the bottom” to “handle threats and shocks to biodiversity.”

The paper fails to determine how these “improvements” will truly promote and shield biodiversity. The paper merely says in its conclusion that “the outcomes of leveraging [biodiversity] knowledge will hopefully assist in biodiversity preservation by way of sustainable digital expertise investments” (emphasis added). It appears probably that these expertise investments allude to the growth of the sensor community and the Web of Forests, which seems to be way more about surveilling the pure world and turning it right into a monetary asset than truly selling biodiversity, in addition to the the aforementioned use of “swarm intelligence drones” to “handle” biodiversity.

Notably, Mysten Labs, which co-authored the paper with O.N.E. Amazon’s co-founders, is deeply tied to the Peter Thiel and DARPA-linked social media community Fb and its efforts to make its personal digital foreign money. Mysten Labs was based in September 2021 by 4 former members of Meta/Fb’s stablecoin undertaking Libra, often known as Diem and Novi Monetary. Evan Cheng, co-founder and CEO was beforehand the top of Analysis and Growth at Novi Monetary, whereas Sam Blackshear, one other co-founder and the CTO of Mysten Labs, was beforehand the Chief Engineer at Novi, having contributed considerably to the creation of the MOVE programming language utilized by Libra/Diem whereas at Meta. The founding crew additionally contains Adeniyi Abiodun and George Danezis, key contributors to Diem’s stablecoin and the aforementioned MOVE programming language –– the language now employed by Mysten Lab’s blockchain, Sui.

O.N.E. Amazon’s Companions

Although previous efforts of O.N.E. Amazon have concerned collaborations with teams just like the aforementioned Mysten Labs, the one “official” companions it lists on its web site embrace MIT Media Lab, Satellogic, Aecom and Veea. The latter three have important connections to the U.S. authorities, specifically the U.S. navy and intelligence neighborhood.

MIT Media Lab was beforehand the pressure behind the creation of the Digital Forex Initiative, which partnered with the U.S. Federal Reserve on assessing the feasibility of a U.S. greenback CBDC (that effort is called Mission Hamilton). It’s also recognized for its prior but very deep monetary relationship with intercourse trafficker of minors, foreign money speculator and monetary legal Jeffrey Epstein, who not solely funded MIT Media Lab and cultivated a detailed relationship with its former head Joi Ito, but additionally introduced in different main donors like Invoice Gates and Leon Black. Epstein was extraordinarily desirous about cryptocurrency and beforehand invited crypto pioneer Brock Pierce to his island to talk on cryptocurrency. Pierce would later create the greenback stablecoin Tether (USDT) together with William Quigley, a long-time enterprise associate of Invoice Elkus, a former trustee of the J. Epstein Basis and founding associate of Idealab, the primary institutional investor in PayPal. MIT Media Lab seems to not have publicly commented on its partnership with O.N.E. Amazon.

The opposite associate of O.N.E. Amazon in its IoF undertaking is Satellogic. Satellogic was just lately the recipient of $30 million funding from Tether (USDT) and Howard Lutnick, the long-time CEO of Cantor Fitzgerald – the custodian of a lot of Tether’s U.S. Treasuries, sits on the board. Lutnick and Cantor each maintain 23.9% every of Satellogic shares, for a mixed 47.8%. Lutnick was just lately named co-chair of Donald Trump’s transition crew, the place he’ll assist Trump select cupboard and different govt appointments if Trump’s 2024 election bid is profitable. Satellogic’s board can be chaired by Steve Mnuchin, Trump’s former Treasury Secretary who helped implement BlackRock’s “Going Direct” plan months earlier than and all through the Covid-19 disaster. “Going Direct” put the majority of cash printed for financial aid supposed to mitigate the results of lockdown insurance policies on common Individuals into the fingers of Wall Road giants like BlackRock. BlackRock, whose head Larry Fink was tapped by Trump to develop the federal government’s fiscal response to the disaster, used a lot of that cash to purchase shares in their very own ETFs. The previous Joint Chiefs of Workers of the U.S. navy beneath Trump, Joseph Dunford, can be on the board of Satellogic.

Apart from its board, Satellogic’s co-founders, Emiliano Kargieman and Gerardo Richarte, have been long-time contractors for DARPA, the NSA and different U.S. intelligence businesses previous to founding Satellogic. Kargieman just lately said that the corporate’s funding from Tether would assist Satellogic advance extra simply into the U.S. “Nationwide Safety market,” i.e. intelligence contracts. Tether itself onboarded the FBI, the U.S.’ home intelligence company, and Secret Service onto its platform final 12 months, permitting them to surveil and seize Tether from wallets deemed unfriendly by the U.S. authorities.

As well as, Satellogic, as we reported in Debt From Above, was additionally a key associate in an effort referred to as GREEN+, which seeks to make use of satellite tv for pc surveillance to show Latin America’s protected areas into tokenized carbon credit to be traded on the Bitcoin side-chain Rootstock (RSK) and to finance industrial initiatives that may assemble an inter-continental “good grid” digitally linking the Americas.

Debt From Above: The Carbon Credit score Coup

Latin America is quietly being compelled right into a carbon market scheme by means of regional contractual obligations – enforced by the satellites of a US intelligence-linked agency – which seeks to create an inter-continental “good grid,” erode nationwide and native sovereignty, and hyperlink carbon-based life to the debt-based financial system by way of a Bitcoin sidechain.

Satellogic isn’t the one regarding agency partnered with O.N.E. Amazon. One other associate, Aecom, is the successor to the CIA-linked Ashland Oil and at present contracts extensively with USAID, broadly believed to be a CIA entrance group. Within the Nineteen Seventies, Ashland Oil pled responsible to a number of counts of constructing unlawful home marketing campaign contributions, which later grew to become a part of the Watergate scandal, and of bribing authorities officers in a number of international locations. Throughout this similar interval, Ashland was revealed to be a recipient of enormous quantities of CIA funds for “undisclosed functions,” roughly half of which have been paid in money. Ashland, the CIA and the SEC all refused to touch upon the character of those funds. The Washington Publish additionally reported within the late Nineteen Seventies that the CIA had used Ashland Oil as “a canopy for an agent working overseas.” As well as, all through the Nineteen Seventies and Nineteen Eighties, Ashland Oil performed a central position in plenty of scandals that concerned CIA veterans working in Oman and Libya. These veterans labored on behalf of what was often called the “non-public CIA” created throughout the Carter administration by Ted Shackley, the CIA’s “blonde ghost,” and former CIA covert operations officer Thomas Clines. As famous in One Nation Beneath Blackmail, the “non-public CIA” cabal initiated what would turn out to be often called the Iran-Contra scandal and its members, together with Clines, would turn out to be its fundamental conspirators. The identical group would later assist give rise to Jeffrey Epstein and the networks that enabled his sexual and monetary misdeeds.

The subsidiary of Ashland that may turn out to be Aecom, Ashland Know-how, was fashioned in 1985, when Ashland was nonetheless steeped in clandestine intelligence ties. It was formally spun off in 1990, forming Aecom. Aecom, which now describes itself as an infrastructure agency serving governments, companies and organizations, acquired long-time USAID, World Financial institution and Ford Basis contractor PADCO (Planning and Growth Collaborative Worldwide). It subsequently acquired a PADCO competitor, The Companies Group, and launched Aecom Worldwide Growth, making the corporate a significant contractor to USAID. The Ford Basis has long-standing connections to the CIA and USAID itself is broadly believed to itself be a CIA entrance (see right here, right here, right here and right here). One in all Aecom’s companions on USAID contracts, the Nature Conservancy, is deeply linked to the efforts to financialize nature and use “debt-for-nature” or “debt-for-climate” swaps to pressure nationwide governments within the International South to implement sure insurance policies favored by Nature Conservancy stakeholders, reminiscent of J.P. Morgan. Notably, a doc supplied by O.N.E. Amazon associate Veea to the SEC, claims that USAID is instantly concerned in O.N.E. Amazon’s efforts together with unspecified “UN businesses.”

Veea is a significant developer of “good metropolis” expertise that’s pioneering the creep of these applied sciences into rural areas and farms. They’re additionally a significant supplier of 5G expertise. They’ve a deep relationship with U.S. navy contractor Qualcomm, which describes itself as “the driving pressure behind the event, launch and growth of 5G.” Veea is considered one of Qualcomm’s fundamental companions in that endeavor. For example, Veea is a part of Qualcomm’s Rural Cloud Initiative, which seeks to make use of 5G connectivity to “digitally rework” rural areas and agriculture by means of growing its AI-powered “FarmGrid answer.” Veea can be a part of Qualcomm’s Good Cities Accelerator Program. Veea can be a significant supplier of expertise aimed toward deploying the “metaverse” and augmented actuality wearables. For instance, final 12 months, they introduced a merger with augmented actuality {hardware} producer Ostendo Applied sciences. As might be famous later, Peter Knez’s enterprise earlier than O.N.E. Amazon, the Venom Basis, was additionally pushing into the metaverse. Ostendo is backed by the U.S. navy’s DARPA and Peter Thiel, who co-founded the deeply CIA-linked data-mining agency Palantir. Thiel is intimately linked to Trump’s vice presidential decide J.D. Vance and beforehand performed a major position in Trump’s transition crew throughout his first time period along with being a significant donor to Trump within the 2016 election. Ostendo has additionally labored as a contractor for the U.S. intelligence neighborhood’s DARPA-equivalent IARPA.

Veea offers the {hardware} that hyperlinks collectively the Web of Forests (IoF) sensors, which have been developed by MIT media Lab and “others.” It states that constructing the IoF will happen in 5 phases, starting with knowledge infrastructure, adopted by satellite tv for pc and drone-provided imagery. The following phases contain “environmental sensing,” “socio-environmental sensing” which seems to discuss with surveilling the actions of locals dwelling within the surveilled areas, and at last “bio-sensing” that may present “molecule-level insights.”

Veea frames the IoF undertaking as finally main towards an “AI-driven neural community for our planet.” The hassle to develop that neural community, framed as being based on the “precept that each one species and ecosystems on this planet are a part of a single system,” are already underway. Known as “Enterprise Neurosystem,” the purpose is to “hyperlink all of the related local weather networks and knowledge sources” for “local weather initiatives” world wide into “a single open AI framework” and “conduct the next order evaluation throughout all factors of reference in actual time.” This “AI neurosystem” would span your complete planet and its companions embrace not solely Veea, however Microsoft, Google, Meta/Fb, IBM, Intel and Yahoo!, amongst others. In different phrases, the IoF of O.N.E. Amazon is meant to ultimately span each forest, in all places, with main implications for nature and society.

O.N.E. Amazon’s Doubtful Observe Report and Future Plans

In September 2022, O.N.E. Amazon signed an settlement with the indigenous group FICSH, which represents the Shuar individuals of the Ecuadorian Amazon. FICSH, after studying the settlement extra rigorously, voted to cancel the settlement with O.N.E. Amazon only a few months later in early February 2023. Regional activist teams like Acción Ecológica have famous that the contract signed dramatically favored the pursuits of O.N.E. Amazon and put the Shuar at a significant drawback.

For instance, the surveillance methods positioned within the forest as a part of the settlement, i.e. methods just like the Web of Forests, could be beneath the unique management of O.N.E. Amazon, and the corporate may use any sort of surveillance gadget in Shuar territory and move that knowledge alongside to anybody they select with out oversight. As well as, any growth or conservation undertaking in Shuar territory associated to the settlement are to even be beneath the unique management of O.N.E. Amazon and the corporate additionally possesses ultimate authority over what non-public companies or NGOs can enter Shuar territory to execute these initiatives.

The Shuar are additionally anticipated to assist facilitate the surveillance of its territories by each the sensor community and by satellite tv for pc, i.e. Satellogic, and people who finally buy the O.N.E. Amazon digital asset safety are additionally enabled to “observe” the Shuar’s land by way of satellite tv for pc per the contract. The proceeds from the sale from the safety derived from Shuar land are additionally to be beneath the unique management of O.N.E. Amazon, with the Shuar solely entitled to fifteen% of the income that O.N.E. Amazon and its OAIF custody. The contract says the Shuar would obtain half of their cash inside 30 days after the sale concludes and the remaining half could be disbursed yearly over the remaining 30 12 months period of the contract.

As well as, solely O.N.E. Amazon can unilaterally cancel the settlement, that means that the Shuar’s speedy change of opinion within the contractual settlement may see them nonetheless wait a long time earlier than they’re truly freed from its phrases. It additionally opens up the likelihood that O.N.E. Amazon may cancel the contracts after promoting its securities however earlier than the 30 days they must pay the Shuar their half of their meager share of the gross sales. Finally, as REDD-Monitor’s Chris Lang famous, O.N.E. Amazon’s contract with the Shuar “would lead to a panopticon-level of surveillance over” their territory, give O.N.E. Amazon management over the monetization of that knowledge, permit O.N.E. Amazon to decide on what companies can enter into and act upon Shuar territory with out Shuar consent, and permit O.N.E. Amazon to make virtually the entire cash. O.N.E. Amazon appears to have secured the signing of this deeply inequitable contract by paying Shuar management $10,000 adopted by $90,000 as soon as the contract was signed. But, given what the Shuar have misplaced and stand to lose – and what O.N.E. Amazon stands to realize – $100,00 is subsequent to nothing.

Along with their previous contracts with the Shuar, there’s additionally the partnership between the Colombian authorities and O.N.E. Amazon to contemplate. O.N.E. Amazon, which not publicly discusses its previous controversy with the Shuar, as an alternative highlights their partnership with the federal government of Colombia and the way the OAIF might be investing in “power transition and round economic system initiatives” which is able to ostensibly profit each the native surroundings and native inhabitants.

For example, the proposed OAIF-funded undertaking in Ciénaga includes a “clear power” port and industrial park in addition to two offshore wind initiatives to be positioned off the coast of the Ciénaga port. The offshore wind initiatives might be solely owned by BlueFloat, a Spanish offshore wind firm. BlueFloat is a portfolio firm of 547 power, which itself is a part of the Houston-based Quantum Vitality Companions (now Quantum Capital). Quantum, historically centered on the oil and gasoline sector, has – since 2021 – been investing very closely in carbon seize and carbon market infrastructure corporations and it was reported in June 2024 that Quantum has been trying to promote its stake in BlueFloat for €500 million.

In line with O.N.E. Amazon, the Environmental Impression Assessments for the offshore wind initiatives might be carried out by USAID contractor and O.N.E. Amazon associate Aecom. The majority of the ability generated by this plant won’t go towards powering native communities however as an alternative will primarily energy the Ciénaga industrial park together with the Ciénaga desalination and “inexperienced” hydrogen manufacturing plant in addition to the proposed Ciénaga “inexperienced” mineral processing zone, which is able to course of uncooked minerals from Chile and Argentina (probably lithium) and different South American international locations. The world of Ciénaga, per O.N.E. Amazon, has 2000 hectares of business “growth potential.”

As well as, as famous by O.N.E. Amazon, the “stakeholders” they’ve engaged with respect to the offshore wind undertaking doesn’t embrace native inhabitants, indigenous teams or environmental activists. As an alternative, it contains “authorities in key [Colombian government] establishments concerned within the undertaking” in addition to the British and Spanish embassies, which O.N.E. Amazon says are “carefully collaborat[ing]” on the initiatives. It additionally states that there have been “discussions” with the Worldwide Finance Company and the World Financial institution, outlined by the U.S. navy as “monetary weapons” of U.S. authorities energy, about “potential help schemes” for the initiatives.

In line with O.N.E. Amazon, locals who will profit from these initiatives will merely be these employed as “staff, upkeep personnel and [other employed] presumably in associated actions reminiscent of transportation and logistics.” The proposed initiatives at Ciénaga will “profit” indigenous tribes by “conserving” the “black line” (línea negra) that separates indigenous territory from non-indigenous territory.

Along with Ciénaga, O.N.E. Amazon is backing the manufacturing of biocrude from agricultural biomass. The tip results of the biocrude produced might be for the aviation business, as it’s supposed to provide sustainable aviation gas (SAF). The crops might be run and operated (and presumably owned) by two international corporations – the Dutch firm BTG Bioliquids and Alder Fuels (now Alder Renewables). BTG and Alder are companions.

Alder was based by Bryan Sherbacrow, who embezzled $5.9 million from Alder and was sentenced to three years in jail this previous June. In January 2023, shortly earlier than Sherbacrow was faraway from his position as CEO, Alder acquired thousands and thousands from the U.S. Division of Vitality to develop its SAF manufacturing course of, which has additionally been examined on the DoE’s Nationwide Renewable Vitality Laboratory “with help from the U.S. Protection and Logistics Company,” a part of the U.S. navy. Alder can be searching for to make use of “blockchain expertise instruments to account for all of the emissions claims from the usage of the SAF” so as to “generate the required data and transparency for compliance with regulatory frameworks, ESG requirements and different sustainability commitments.” It will instantly allow the performance of carbon markets because it pertains to air journey.

In abstract, the O.N.E. Amazon’s OAIF-funded initiatives in Colombia profiled above are industrial initiatives that may drastically profit international corporations and are being carefully developed with international governments (just like the UK and Spain) in addition to entities which can be funded by or are contractors for the U.S. authorities. Their “environmental” advantages are doubtful and, whereas it could create industrial hubs that would theoretically generate financial progress for the inhabitants, the majority of the infrastructure might be owned by international corporations, which additionally obtain the overwhelming majority of the income that consequence from these initiatives.

Starlight Ventures and Jalak Jobanputra

O.N.E. Amazons’s sole recognized funder is Starlight Ventures, which funds corporations that produce “transformative applied sciences to repair the world.” Its different investments focus primarily on biotechnology, lab-grown meat, carbon market infrastructure, autonomous mining autos and space-related applied sciences, particularly satellite tv for pc surveillance corporations. The agency was co-founded by Patricia Wexler, a Venezuelan-American businesswoman who beforehand labored with high Disney executives after which Elevation Companions, a major investor in Fb, Uber and different distinguished tech corporations.

Starlight Ventures additionally has ties to the Endeavor Community, which is deeply embedded in Latin America – significantly its cryptocurrency infrastructure – and is closely funded by the controversial Bronfman household and Pierre Omidyar, the founding father of eBay and proprietor of PayPal from 2002 to 2015. For example, considered one of its three enterprise companions is Santiago Bilinkis, one of many earliest fixtures within the Endeavor Community who – amongst different issues – first linked Wences Casares, the founding father of Xapo Financial institution, with Endeavor’s Linda Rottenberg. Bilinkis later co-founded Wanako Video games with Casares and has served on Endeavor’s board of administrators. Bilinkis is nonetheless concerned with Endeavor’s Argentina department, serving on its Council of Founders alongside Argentine oligarchs like Eduardo Elzstain, host of the Bilderberg-style Llao Llao Discussion board in Bariloche, Argentina. Starlight additionally invests in some Endeavor-backed corporations, like Satellogic, which can be significantly linked to Endeavor’s Argentina department.

The Chain of Custody: The “Mafia” Holding The Elite’s Bitcoin

The businesses poised to dominate the digital monetary infrastructure of Latin America have arisen courtesy of the self-described “mafia” multiplier, Endeavor. Flush with funds from billionaires linked to the US intelligence and arranged crime, Endeavor’s affect over the CEOs it has championed guarantees that, with the ushering in of a brand new monetary system, a wave of covert dollarization will shortly observe.

In line with an older profile written by Starlight Ventures about O.N.E. Amazon and cited by Acción Ecologica, an investor named Jalak Jobanputra is known as the third co-founder of O.N.E. Amazon. Jobanputra, earlier than founding her VC agency Future Excellent Ventures, was the director of Rising Market Cell Investments for Pierre Omidyar’s the Omidyar Community and in addition beforehand labored for Intel and Lehman Brothers. Whereas on the Omidyar Community, Jobanputra closed “Omidyar’s largest for revenue funding ($5M) so far in Latin America, a wi-fi firm that created credit score profiles on unbanked center earnings shoppers utilizing cellular knowledge.”

It was reportedly throughout her time on the Omidyar Community that Jobanputra grew to become desirous about bitcoin and cryptocurrency. Extra particularly, it was her “time spent in Africa analyzing the expansion of the cellular cash providers platform M-Pesa,” which led her to consider that crypto and bitcoin adoption have been extra probably to achieve rising markets. Nonetheless, Jobanputra hyperlinks adoption of those applied sciences to having a digital ID “that you just [can] have completely different belongings related to and might transact with.” Notably, the Omidyar Community is a long-time funder of applied sciences that allow CBDC issuance in addition to Digital ID. As well as, by means of Endeavor, the Omidyar Community backs the largest corporations in Latin America’s fintech house, successfully dominating the cost rails for crypto and bitcoin and subsequently centralizing management over them and neutering the supposed “decentralizing” results of cryptocurrency and bitcoin adoption.

In Jobanputra’s case, her present VC agency has invested in quite a lot of crypto corporations together with BitGo, Blockstream and Celo. BitGo was based by Mike Belshe, a massive supporter of Trump VP decide JD Vance, alongside Ben Davenport and has beforehand custodied the U.S. authorities’s bitcoin. Blockstream is essentially linked to Bitcoin Core and, thus, has performed an outsized position in many of the previous main updates made on the Bitcoin community, making them so necessary to that community that Endeavor’s Reid Hoffman as soon as advised they’d be the Microsoft or Google of blockchain (Hoffman is a key member of the Endeavor community and “PayPal Mafia,” and was beforehand a Blockstream board member and can be a significant Blockstream investor). Celo is a “cellular first,” “carbon impartial” blockchain with a significant concentrate on “scaling voluntary carbon markets” and stablecoins. Its traders embrace Reid Hoffman, Jack Dorsey and Coinbase Ventures. Celo has a significantly necessary relationship with Circle’s greenback stablecoin USDC, which Coinbase’s Brian Armstrong as soon as advised would turn out to be the U.S.’ de facto CBDC. Circle and USDC are deeply linked to BlackRock, with BlackRock holding a minority stake in Circle, Circle’s USDC getting used to transform shares of BlackRock’s first tokenized fund BUIDL into digital {dollars}, and the Circle Reserve Fund being managed by BlackRock.

Peter Knez and the Venom Basis

O.N.E. Amazon co-founder Peter Knez started his profession at Goldman Sachs as a Quantitive Analysis Affiliate, earlier than becoming a member of Barclays’ BGI as their Chief Funding Officer. Whereas employed at Barclays, Knez personally oversaw the creation of their iShares model, a necessary pillar within the proliferation of the now-dominant ETF market. In a dialog with Nasdaq, Knez claimed that “ETFs actually solely began with iShares at BGI.” In line with Knez, “there was a easy motive for growing it: we have been the most important institutional asset supervisor with out a mutual fund product and needed to increase into retail.” The iShares ETFs “allowed us to enter the retail market and compete with Mutual Funds” by “replicating present indexes with a product that traded on exchanges, whereas disclosing their holding each day and delivering liquidity and transparency in a tax environment friendly format.”

As a result of international collateral injury throughout the 2008 monetary disaster, BGI was ultimately acquired by BlackRock in 2009, who took the iShares model to new heights, together with the quickest rising ETF in historical past, the IBIT spot Bitcoin ETF. When requested about BlackRock’s Bitcoin ETF, Knez implied “we’re within the early innings of the ‘institutional’ regime in cryptocurrencies and blockchain because the Wild West regime ends,” and later described this institutional regime as “characterised by elevated participation of establishments like BlackRock and by governments” whereas noting incoming “laws offering a regulatory framework for digital belongings” inside america. Knez additional claims that “BlackRock needs to take part on this regulatory momentum” and said his consider that “BlackRock will finally succeed” attributable to their “wonderful monitor document” whereas articulating suspicions that CEO Larry Fink “wouldn’t have gone public if it was not pre-approved.”

Knez, nevertheless, has said that Bitcoin as a speculative asset is much less necessary than the underlying blockchain expertise:

“My view is Bitcoin is to blockchain very like search or pornography was to the web. It drove early adoption, however the underlying expertise is way more necessary. Applied sciences that take away necessary frictions and enhance profit for society, these are those that persist. Blockchain, for my part, is such a expertise, and the establishments consider it, too. I’ve talked to BlackRock, I had lunch immediately with very senior individuals at Morgan Stanley, they consider it too. And so they’re getting ready for it. They’re getting ready for it as a result of they comprehend it’s a quantum leap they usually know they must be on this sport they can not stand on the sidelines.”

In a dialog with CertiK, Knez famous that this imminent transformation was why he “couldn’t resist getting concerned.” He later made reference to his former Goldman Sachs boss, Fischer Black, finest often called one of many authors of the Black–Scholes equation, who “began possibility pricing” and “created the entire notion of artificial replication.” In line with Knez, “tokenization of actual world belongings is as massive, or greater than that” and can “dramatically change the best way belongings are managed”:

“When you tokenize it, you may commerce it. As soon as you may commerce, it you may index it. When you index, it you may write synthetics on it. That’s transformative in a means that’s by no means been remodeled ever…The rationale you see guys like Larry Fink pushing tokenization now could be, for one, that Aladdin’s about to have the performance he needs for his purchasers. [And] quantity two, there’s not a whole lot of alternate options to go scale the enterprise. This can be a means for the massive establishments, whether or not it’s Morgan Stanley or BlackRock or the opposite asset managers, it is a means for them to scale their enterprise. And in order that’s why I believe it’s inevitable.”

In keeping with these beliefs, Knez participated within the launch of a brand new layer one blockchain, Venom, and alongside it based the Venom Basis in 2020. Different Venom Basis members embrace Mustafa Kheriba, the Govt Chairman of Iceberg Capital; Dr. Kai-Uwe Steck, supervisor of Pontinova Circle Funding Group; Osman Sultan, the previous CEO of DU Telecom and Founding father of Fikratech; and Shahal M. Khan, Founding father of Burkhan World, Trinity Hospitality Holdings and the CEO of Burtech. In August 2023, the Venom Basis signed a Memorandum of Understanding (MOU) with the United Arab Emirates Authorities to “develop and implement the Nationwide Carbon Credit score System” in preparation of the nation internet hosting COP28 that November. “Venom Basis has supplied an unparalleled answer, performing as a key infrastructure for a worldwide ecosystem for Web3 purposes, with superfast transaction speeds and limitless scalability to fulfill governments’ wants.” Knez defined that the inspiration is “the primary firm within the UAE to develop and licence its blockchain expertise and form the way forward for nationwide decentralised methods and digitise operations in company and authorities enterprises.” The MOU additional covers “inexperienced funding,” “adaptation to local weather change,” “lowering carbon emissions,” “getting ready and implementing a local weather neutrality technique,” whereas “enhancing partnership alternatives with the non-public sector.”

Knez expressed his pleasure upon the signing of the MOU, commenting that the inspiration is “honored and excited to affix fingers with the UAE Authorities to construct the Nationwide Carbon Credit score System.” The press launch claims that this was “a revolutionary collaboration” which demonstrates “the UAE’s unwavering dedication to bolstering transparency, reliability, and effectivity in carbon emission administration” by way of “the following technology blockchain expertise of Venom” which boasts being “carbon impartial.” Knez, the chair of the inspiration, had beforehand informed Nasdaqthat Venom was “centered on three major initiatives: stablecoins, carbon credit, and commodities” and furthered that “with respect to stablecoins” the inspiration was “concerned with governments and business banks in international locations each in Africa and Asia.” Knez believes the “mixture of blockchain and good contracts” will “profoundly rework monetary providers” within the ensuing decade. “They are going to be unrecognizable, as virtually each core perform in monetary providers might be remodeled.”

As a way to advance this transformation, the Venom Basis partnered with Iceberg Capital, led by Venom basis member Mustafa Kheriba, in January 2023 to kind the Venom Ventures Fund (VVF). The purpose of the VVF was to create “a ten-figure battle chest” with $1 billion devoted to “accelerating the adoption of blockchain, DeFi, and web3 in MENA and past.” Knez was chosen to chair the enterprise, whereas readying “strategic investments” to “rework digital asset administration” by way of the “superb platform for us to realize this purpose,” the Venom blockchain. Curiously, each the Venom Basis and Iceberg Capital at present function throughout the Abu Dhabi International Market (ADGM), a “fast-growing monetary heart located within the coronary heart of the UAE’s capital.” It was based a decade in the past to “promote entrepreneurship all through the United Arab Emirates and the broader MENA area.” Venom had beforehand been granted “a proper license to subject utility tokens by ADGM” and in keeping with Forbes, grew to become “the primary blockchain to come back beneath authorities company management” and to be “monitored by a regulatory physique.”

In line with reporting from The Block, on the time of its announcement, the fund stated it had led a $20 million funding in Nümi Metaverse and the following January introduced a $5 million funding in Layer 1 blockchain Everscale, whereas “no offers have been introduced since.” In a December 2023 tweet, the Venom Basis introduced they may “not proceed working in ADGM and in accordance with part 40 of the laws, the Basis has initiated the dissolution course of.”

Whereas there’s little to indicate for the $1 billion fund launched in 2023, simply final week, Venom introduced a “historic settlement with the federal government of the Republic of the Philippines” so as to “digitize billions of accountable kinds utilizing its superior blockchain expertise” in “what may find yourself because the world’s largest blockchain use case,” in keeping with reporting from Gulf Information.

Christopher Louis Tsu, the CEO of Venom Basis, referred to as Venom’s choice by the Republic of the Philippines a “testomony to our platform’s capabilities and the belief positioned in our expertise.” He furthered famous that “by digitizing checks utilizing Venom blockchain, we’re not solely lowering printing and processing prices but additionally considerably enhancing transparency and effectivity in monetary operations” demonstrating “the large utilization of the Venom blockchain within the type of tons of of thousands and thousands of Venom tokens yearly” whereas showcasing their “dedication to delivering scalable, safe, and modern options for national-level purposes.”

These aspirations for additional institutional and nation-state adoption of blockchain was seemingly echoed by Knez in a dialogue with CoinTelegraph in March 2023:

“It’s the early innings of the institutionalization of Web3. It’s early innings, nevertheless it’s going to occur… If you wish to appeal to institutional cash, you’re going to have to hunt regulation… The period of the Wild West is ending, which I believe is sweet for everyone. So I counsel them to to embrace the institutionalization, as that’s what time it’s.”

Now, with O.N.E. Amazon, it seems clear that Knez is searching for to once more associate with main governments to tokenize actual world belongings, on this case the pure world, and to allow the development of a worldwide carbon market/carbon offset economic system.

Rodrigo Veloso’s “O.N.E” Empire

The opposite co-founder and present CEO of O.N.E. Amazon is Rodrigo Veloso, a Brazilian entrepreneur who developed the O.N.E. Coconut Water model, later offered to PepsiCo in 2012. That very same 12 months he co-founded Brazil’s first on-line insurance coverage firm, Segurar.com, although it seems to not have launched till 2013. Round this time, in 2013, Veloso started working at Unik Capital, which operates in each the U.S. and Brazil, and he claims to nonetheless work there despite the fact that he isn’t talked about on the corporate web site. He has additionally claimed to be the founding father of Unik Capital and that he used his funds from promoting O.N.E. Coconut Water to Pepsi to take action. Nonetheless, solely CEO Sylvie Proia is listed as the founder on the corporate’s web site.

A 12 months after becoming a member of Unik Capital, in 2014, Veloso tried to accumulate a decommissioned naval base in Puerto Rico and switch it right into a “mixture of Disney World and Las Vegas,” a “inexperienced metropolis with a concentrate on leisure,” marking his first foray into “inexperienced” enterprise ventures that may later culminate together with his position in co-creating O.N.E. Amazon. Along with O.N.E. Amazon, Veloso additionally created one other firm referred to as O.N.E. Pure Vitality that focuses on producing syngas, which may be produced from “a variety of carbon-containing substances” and is used to generate electrical energy or “as a constructing block for a variety of fascinating commodities, from methanol to gasoline.” O.N.E. Pure Vitality at present operates in Brazil.

A couple of years earlier than creating O.N.E. Amazon, Veloso performed an attention-grabbing position within the efforts to take Trump Media & Know-how Group (TMTG), the dad or mum firm of the Trump-centric social community Reality Social, public. Starting in 2021, TMTG deliberate to merge with Digital World, a particular goal acquisition firm or SPAC. The merger finally occurred in March of this 12 months. The merger was controversial and fraught with scandals for Digital World. As a consequence of the insider buying and selling allegations and fines from the SEC, former CEO of Digital World Patrick Orlando was fired from that position in March 2023 because of the scandals, although Orlando has sued the brand new CEO, Eric Swider, alleging Swider had deliberate a “coup d’etat” of Digital World to depose him.

Rodrigo Veloso is a detailed pal of Orlando’s and was a Digital World board member from July 2021 till December 2022. Veloso was additionally current on a pre-merger name with Trump, whereas nonetheless a board member at Digital World, which later grew to become a key focus of the SEC investigation into Digital World that ended with the SEC suing Orlando (the go well with was filed after Orlando was fired from Digital World). The New York Instances reported that Veloso was performing as an adviser to Orlando on the decision. Along with the SEC expenses in opposition to Orlando, Digital World was fined $18 million by the SEC. There have been no allegations of TMTG itself partaking in improper trades or different actions associated to expenses in opposition to Digital World and its previous executives. Finally, the SPAC merger between TMTG and Digital World added billions to Trump’s internet price and allegedly supplied a “monetary lifeline” to the previous president. Veloso, along with his ties to Orlando and Digital World, was additionally a board member/director of TMTG itself from September 2021 till December 2022, the identical time he resigned from Digital World when the then-Orlando-led firm was the topic of a number of investigations. Notably, throughout this similar time frame (2021-2022), Veloso was laying the groundwork for the formal launch of O.N.E. Amazon, together with efforts to trademark the Web of Forests idea and signing the controversial settlement between O.N.E. Amazon and the Shuar in 2022.

Carbon Sink or Debt Sink?

In inspecting the efforts of O.N.E. Amazon and their just lately introduced partnership with Satellogic, it’s price dwelling on why an organization like Satellogic, which is deeply tied to the stablecoin Tether and the U.S. Treasuries market by means of its board member Howard Lutnick, would possibly want to be concerned with such an endeavor.

Very like a company, america authorities itself has a finances it should finance, partly by means of taxation of residents and firms, however principally by way of the issuance of recent debt offered within the type of authorities bonds often called Treasuries. These securities are instantly issued by the U.S. Treasury with the yield, or charge of the return, successfully set by the U.S. Federal Reserve and its governors by way of the Federal Funding Price, generally known as an rate of interest. Sometimes, these bonds yield the next charge of return the longer the period for which they’re issued. For instance, a 30 12 months Treasury would yield the next coupon than a 3 month Treasury to incentivize patrons to carry U.S. debt for higher durations of time, giving the federal government an extended runway to service their debt obligations. On March 15, 2020, the Federal Reserve Committee lower the focused federal funding charge to 0% attributable to “the results of the coronavirus” weighing “on financial exercise within the close to time period” and thus “dangers to the financial outlook.”

“The coronavirus outbreak has harmed communities and disrupted financial exercise in lots of international locations, together with america,” the Fed assertion stated. “International monetary situations have additionally been considerably affected.” Regardless of the following lockdowns and widespread worry of the virus, President Trump praised the Fed that week, saying in a briefing on the White Home that the speed lower “makes me very completely happy.” On reflection, the mix of government-mandated lockdowns and the Fed’s aggressive charge lower, with unprecedented monetary stimulus being distributed (with heavy income) with collaboration from non-public sector stalwarts like BlackRock, systemically modified the monetary system not only for the U.S., however the world at massive. The truth is, the Fed “struck a deal” with 5 different central banks together with the Financial institution of Canada, the Financial institution of England, the Financial institution of Japan, the European Central Financial institution and the Swiss Nationwide Financial institution, to “decrease their charges” to “hold the monetary markets functioning usually.”

By printing trillions of {dollars} of newly issued debt at successfully 0% rates of interest whereas concurrently shuttering financial velocity and demand alongside the companies compelled to shut by their reactionary laws, Trump’s Treasury, led by present Satellogic board Chair Steve Mnuchin, massively elevated the financial provide and the U.S. authorities’s debt obligations whereas minimizing the quick inflationary results of such stimulus. This unprecedented mixture of Fed, Treasury and home insurance policies allowed large income for the best wealth bands within the nation, with these closest to the cash spigot capable of gobble up commodities with freshly printed {dollars}. Arguably, no firm benefited greater than BlackRock, having been a chief architect of the “Going Direct” plan, which allowed them to make use of these supposed pandemic aid funds to buy massive swaths of belongings together with from their very own iShares ETF division, having acquired the Knez-led iShares from Barclay’s throughout the 2008 disaster after the financial institution denied a authorities bail out of their very own.

The identical March 2020 week as the speed cuts, Bitcoin crashed to just about $3000, oil futures went adverse, and actual property and inventory markets world wide collapsed, providing an unprecedented shopping for alternative to these with the capital to take benefit –– specifically the just lately “stimulated” BlackRock. However the U.S. authorities nonetheless wanted a purchaser of Treasuries and whereas discovering a brand new place to sink this freshly issued debt, the Fed itself started “buying huge quantities of debt securities,” a way utilized throughout the 2008 disaster often called Quantitive Easing, or QE. As Brookings notes, the Fed aimed to “restore easy functioning” to the “Treasury and mortgage-backed securities (MBS) markets” which “play a crucial position within the stream of credit score to the broader economic system.”

On March 15, 2020, the Fed “shifted the target” of QE to supporting the economic system, agreeing to buy “not less than $500 billion in Treasury securities” and “$200 billion in government-guaranteed mortgage-backed securities” over “the approaching months.” Per week later, on March 23, 2020, the Fed agreed to make the purchases open-ended, saying it could purchase securities “within the quantities wanted to help easy market functioning and efficient transmission of financial coverage to broader monetary situations,” and thus “increasing the said goal of the bond shopping for to incorporate bolstering the economic system.” By June 2020, the Fed lowered the speed of purchases to “not less than $80 billion a month in Treasuries” and “$40 billion in residential and business mortgage-backed securities” in the interim. The Fed once more up to date its coverage in December 2020 to sluggish these purchases when the economic system made “substantial additional progress” towards the Fed’s mandate of most employment and worth stability, and in November 2021, the Fed started tapering the tempo of securities purchases.

By October 2021, Bitcoin had rocketed to just about $70,000, and alongside it arose a brand new insatiable purchaser of U.S. debt by way of government-issued securities –– greenback stablecoin issuers, led by Tether and Lutnick’s Cantor Fitzgerald. As beforehand reported by Limitless Hangout:

“Within the previous 18 months, a brand new excessive quantity internet purchaser of this debt has appeared within the cryptocurrency business: stablecoin issuers. Stablecoin issuers reminiscent of Tether or Circle have bought over $150 billion of U.S. debt –– within the type of securities issued by the Treasury –– so as to “again” the issuance of their dollar-pegged tokens with a dollar-denominated asset. For some perspective on the completely astounding quantity of quantity these comparatively younger and comparatively small companies have devoured up of U.S. debt, China and Japan, traditionally the U.S.’ largest collectors, maintain slightly below and simply over $1 trillion, respectively, in these similar debt devices. Regardless of solely present for a decade, and regardless of solely surpassing a $10 billion market cap in 2020, this leaves Tether alone at over 10% the Treasuries held by both of the U.S.’ largest nation-state collectors.”

Whereas the likes of Tether’s USDT, alongside BlackRock-affiliated Circle’s USDC and PayPal’s PYUSD issued by Paxos, the U.S. has discovered companions for servicing the $35 trillion of already-issued debt alongside any future authorities finances in addition to the trendy evolution of the public-private partnership of capital creation whereas sustaining greenback hegemony throughout the globe by way of surveillable, programmable and seizable non-public financial institution currencies. Tether’s CEO Paolo Ardoino beforehand claimed that Tether froze round $435 million in USDT for the U.S. Division of Justice, the Federal Bureau of Investigation and the Secret Service on its path to changing into a “world class associate” to the U.S. to “increase greenback hegemony globally.”

Lutnick’s Cantor Fitzgerald, which holds Tether’s T-Payments, is “among the many best-known bond buying and selling homes on Wall Road” and “considered one of 25 major sellers for U.S. Treasuries” which permits “direct commerce with the Federal Reserve.” A report from September 2023 said that Tether held $86.4 billion of belongings in reserves with a later attestation report exhibiting that USDT is usually backed by U.S. Treasuries. By July 2023, the Federal Reserve raised its key rate of interest to five.5%, the “highest degree in 22 years,” in hopes of constructing “borrowing and investing dearer.” With charges having risen sooner than ever in U.S. historical past from the 0% goal reached in March 2020, corporations reminiscent of Cantor Fitzgerald –– internet patrons of brief period securities often called T-Payments – are set to obtain excessive yields with little or no danger. In Tether’s Q1 2023 Assurance Report, the stablecoin issuer held $81.8 billion with “nearly all of its reserves” having been “invested in U.S. Treasury Payments” with “all new issuance of tokens” having “been invested in U.S. Treasury payments or positioned in in a single day Repo.”

On this similar report, the corporate introduced they’d “commonly allocate as much as 15% of its internet realized working income in direction of buying Bitcoin (BTC)” by way of “using realized income from its funding technique,” which relied predominantly on brief period Treasuries. In Q1 2023, Tether held roughly $1.5 billion in bitcoin. By April 2024, the agency held roughly 75,354 bitcoin, price practically $4.5 billion immediately.

In Ardoino’s assertion concerning “the choice to put money into Bitcoin”, the present CEO of Tether famous “its restricted provide” as a motive for why the asset has “emerged as a long-term retailer of worth” full with “substantial progress potential.” Whereas the U.S. authorities by way of the Treasury can frequently subject these securities with no restrict by way of a capped provide, bitcoin the asset has a predetermined issuance schedule, and an eventual complete provide of slightly below 21 million bitcoin. The shortage innate to bitcoin permits a debt-based monetary system just like the U.S. greenback system to proceed to inflate into the demand inelastic, deflationary financial coverage of bitcoin. Now that the U.S. en masse has emerged, in no small half because of BlackRock’s iShares IBIT spot Bitcoin ETF, because the world’s largest recognized holder of bitcoin, full with regulatory blessing from the likes of the DOJ and SEC, the Treasury has discovered prepared market companions of their quest to service their money owed and additional dollarize the planet.

However it’s maybe throughout the planet itself {that a} new methodology for retaining U.S. greenback hegemony has emerged – the dollar-denominated, restricted provide carbon market proposed by O.N.E. Amazon. Removed from an unsubstantiated idea, Knez himself states exactly that the Amazon rainforest “needs to be valued within the trillions” and that his firm is “enabling the market to worth it as such” by “turning it into a sophisticated digital asset safety.” In a dialogue with Gulf Information, Knez took this one step additional in explaining why the tangible parameters of the Amazon’s measurement led to the creation of a restricted provide of securities, offering the required mechanism to create a dollar-denominated debt sink out of the rainforest upon the safety’s appreciation:

“At O.N.E. Amazon, we’re harnessing the ability of the market – the identical pressure that has pushed exploitation – to rework it right into a software for conservation. We goal to show that the Amazon is extra helpful alive than lifeless.

We’re not simply environmentalists; we’re innovators, economists, technologists, and neighborhood leaders. Collectively, we’re growing a digital safety asset – that represents the intrinsic worth of the world’s largest rainforest’s biome. This isn’t only a monetary instrument; it’s a press release, a dedication to the assumption that the Amazon is effective and must be priced. By way of monetary returns, traders will profit from the potential capital appreciation of the digital safety because the market values the optimistic environmental and social advantages of the rainforest’s biome.

Given the finite measurement of the Amazon rainforest, the overall variety of securities might be restricted to 750 million, comparable to the hectarage of the rainforest. This creates a restricted provide of digital securities.” [emphasis added]

As a result of restricted provide of digital securities, O.N.E. Amazon has created an axiom for huge capital appreciation of the asset itself, permitting an extra growth of dollar-denominated liabilities and thus additional eventual demand for the greenback’s underlying asset: U.S. Treasuries. Knez implies the Amazon needs to be valued within the trillions, and, very like he did in his position spearheading the iShares ETF model, has created yet one more progress marketplace for the U.S. capital markets to “quantitively ease” into. Curiously, such a authorities debt growth was theorized by RFK Jr.’s former operating mate, Nicole Shanahan, in a undertaking she led at Stanford titled “An Evaluation of Carbon Credit score Markets as Validation for Local weather Supportive Quantitative Easing Utilizing the Blockchain” described under:

“This undertaking will present a white paper for a carbon coin that works in tandem with the prevailing carbon credit score (offset) markets. As an energetic enterprise investor in carbon credit score markets reminiscent of Pachama and Joro Applied sciences, and a significant buyer of those offsets with my husband Sergey Brin, I might be leveraging the present entrepreneurial ecosystem to determine the financial, coverage, and technological necessities to scale a carbon credit score coin…Whereas authors and futurists reminiscent of Kim Stanley Robinson (creator of Ministry of the Future), have centered on the feasibility of governments issuing carbon cash in change for carbon sequestration, my argument is {that a} non-public market can first be located to confirm the accuracy of the carbon sequestration initiatives funded by the coin. The federal government can in flip, have proof primarily based outcomes by which to promote authorities treasuries into the carbon coin community.”

These “proof primarily based outcomes” of which Shanahan theorized, because it pertains to the O.N.E. Amazon scheme, would presumably be the information supplied by their satellite tv for pc associate, Satellogic. As a result of Satellogic’s board being Chaired by former Treasury Secretary Mnuchin, Cantor Fitzgerald’s Lutnick massive stake of shares and board place, and their funding by main dollar-denominated stablecoin issuer Tether, the personnel and wherewithal to create such a debt sink at a time of dire want has been assembled.

Because the U.S.’ ballooning debt calls for additional areas to position their newly-issued debt, Knez and O.N.E. Amazon have all however instantly proposed making the 750 million hectares of Amazon rainforest precisely that place.

Datafication & Debt – The New “Conservation”

O.N.E. Amazon’s said causes for its enterprise mannequin – ostensibly “preserving” and “conserving” the Amazon – replicate a broader effort to border efforts to centralize management over the worldwide commons and construct out a surveillance grid for each individuals and the planet as the one “possible” technique of rescuing the planet from disaster. Nonetheless, as this text has endeavored to indicate, O.N.E. Amazon’s curiosity just isn’t in serving to locals or indigenous teams and even in serving to truly preserve the rainforest in the best way most would think about. As an alternative, the purpose is to show the Amazon rainforest into an exploitative farm – a farm for knowledge that itself may be monetized and tokenized, similar to the hectarage of the Amazon itself.

Because the architects of Wall Road’s new web3 economic system seek for new methods to retailer the wealth they’ve pilfered from the general public by means of organized wealth transfers, extra types of “digital gold” will turn out to be a necessity. Whereas bitcoin represents one digital retailer of worth, the race is on to tokenize actual world belongings, particularly the pure world and pure assets, so as to perpetuate the debt-based financial system that has enabled the theft of standard individuals’s wealth for hundreds of years. Framed in altruistic phrases of “serving to” the surroundings and the have-nots, we’re as an alternative witnessing the “datafication” of all life each for revenue and so that each one life – together with human beings and the pure world – may be surveilled, ultimately right down to the molecular degree, after which “managed” by clever machines. Such a paradigm doesn’t symbolize “conservation” or “preservation,” however moderately the onboarding of our best pure treasures onto a system of hi-tech management, with each flutter of a butterfly wing and each department swaying within the breeze being transformed into bits and bytes that predatory bankers can commerce and speculate on for revenue.

O.N.E. Amazon is greater than an organization, it represents a mannequin that others are following which seeks to borgify the pure world, and us together with it, claiming to “harness the market” to save lots of us all from a obscure but impending doom. Nonetheless, we and the forests usually are not being saved, we’re being put in chains – compelled into a jail with out partitions the place the sensors to be positioned on and within the timber and on and in our our bodies will join us to the bankers’ blockchain of selection and permit us to be traded or offered, our organic indicators and processes monetized for his or her profit, and the lots of individuals, crops and animals on this planet to be “managed” by AI-powered machines that they program and management.