On this piece, I evaluated two expertise shares: Palantir Applied sciences (PLTR) and Alphabet (GOOGL). A better look suggests a impartial view of Palantir and a bullish view of Alphabet.

Palantir Applied sciences makes a speciality of large information analytics, whereas Alphabet is a holding firm that owns the Google search engine and sells apps and content material on Google Play and YouTube. Alphabet additionally generates income from cloud companies charges, licensing income, and {hardware} merchandise like Chromebooks and different units.

Shares of Palantir have skyrocketed 80% year-to-date and greater than doubled during the last 12 months, rising 111%. In the meantime, Google inventory has jumped 19% year-to-date and 27% during the last 12 months.

With such a dramatic distinction of their year-to-date returns, the sizable hole between their valuations isn’t any shock. We evaluate their price-to-earnings (P/E) ratios to gauge their valuations in opposition to one another and the software program trade.

For comparability, the expertise trade is buying and selling at a P/E of 46.3x versus its three-year common of 39.3x.

Palantir Applied sciences

At a P/E of 182.3x, Palantir Applied sciences appears to be like considerably overvalued relative to its trade. Whereas its ahead P/E of 80.3x appears to be like way more engaging, this inventory is just a bit too scorching to deal with proper now, suggesting a impartial view is perhaps applicable — pending a extra engaging valuation.

Although Palantir Applied sciences is primarily a cloud or software-as-a-service inventory, its valuation has soared this 12 months, pushed by the potential of synthetic intelligence. In early August, the corporate boosted its full-year income outlook because of the power of its AI platform, marking the second time it has achieved so this 12 months.

Palantir is actually the place Alphabet or Google was a number of years in the past. It will possibly do no incorrect, and traders are fortunately pushing its valuation endlessly by means of the roof. Nevertheless, Palantir will not be Alphabet but, so issues must decelerate in some unspecified time in the future, which is why I really feel a wait-and-see strategy is finest proper now.

Actually, traders with a place in Palantir may wish to think about taking some income now, anticipating an inevitable dip. Endurance is the secret with Palantir inventory proper now.

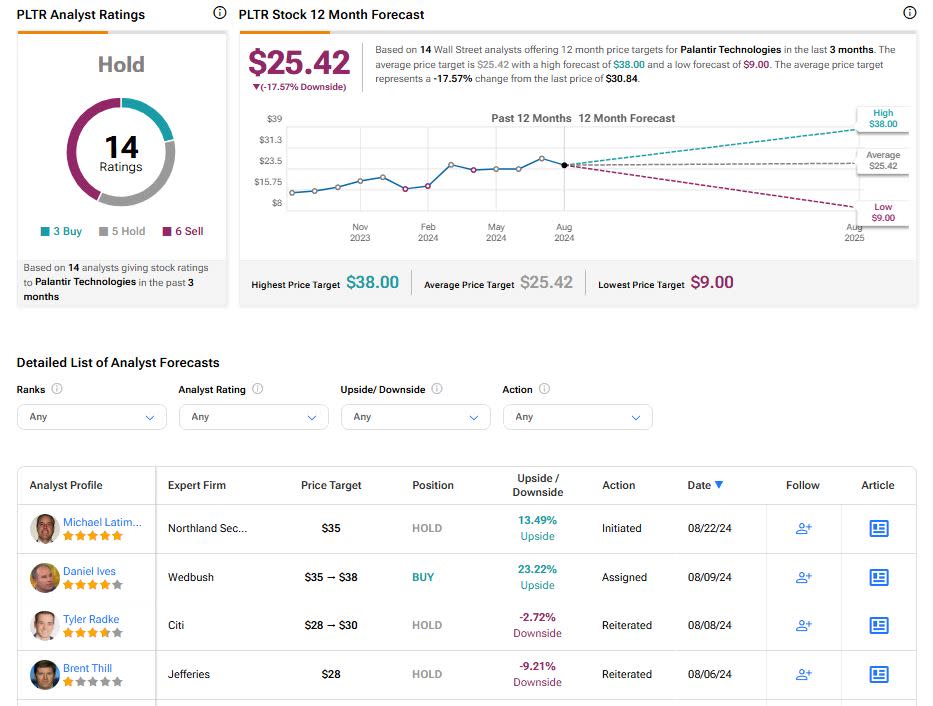

What Is the Value Goal for PLTR Inventory?

Palantir Applied sciences has a Maintain consensus ranking primarily based on three Buys, 5 Holds, and 6 Promote scores assigned during the last three months. At $25.42, the common Palantir inventory value goal implies draw back potential of 17.97%.

Alphabet

At a P/E of 24.2x, Alphabet hasn’t been this low-cost since about March, suggesting this can be a novel buy-the-dip alternative on this stellar inventory. Thus, a bullish view appears applicable, particularly since that is one inventory traders might wish to think about shopping for and holding for the very long run.

Within the newest quarter, Alphabet’s quarterly cloud revenues surpassed $10 billion for the primary time, making up over one-third of its whole income of $84.7 billion. Thus, Alphabet may be very a lot a cloud play, regardless that it gives diversified publicity to a variety of expertise sectors.

Whereas Alphabet hasn’t been this low-cost since March, a assessment of its valuation since October 2019 reveals that it’s buying and selling on the backside of its current peak in July, when it topped out at round 29x. The inventory has additionally been buying and selling in the direction of the underside to center of its P/E vary since October 2019. Alphabet’s P/E has various from about 17x in November 2022 to 39x in April 2021.

Thus, this is a wonderful time to be selecting up some Alphabet shares — or no less than to be including to an already-established place.

A assessment of Alphabet’s long-term share-price features demonstrates why that is one inventory to purchase and maintain for the long run. One might argue that the corporate has earned blue-chip standing, which is why it’s a buy-and-hold place.

Moreover, Alphabet inventory is up 15% during the last three years, which has been difficult for expertise shares usually. The inventory is up 183% during the last 5 years and 463% during the last decade, once more indicating that the overall development for Alphabet is up and to the best, even during times which might be difficult for the tech sector as a complete.

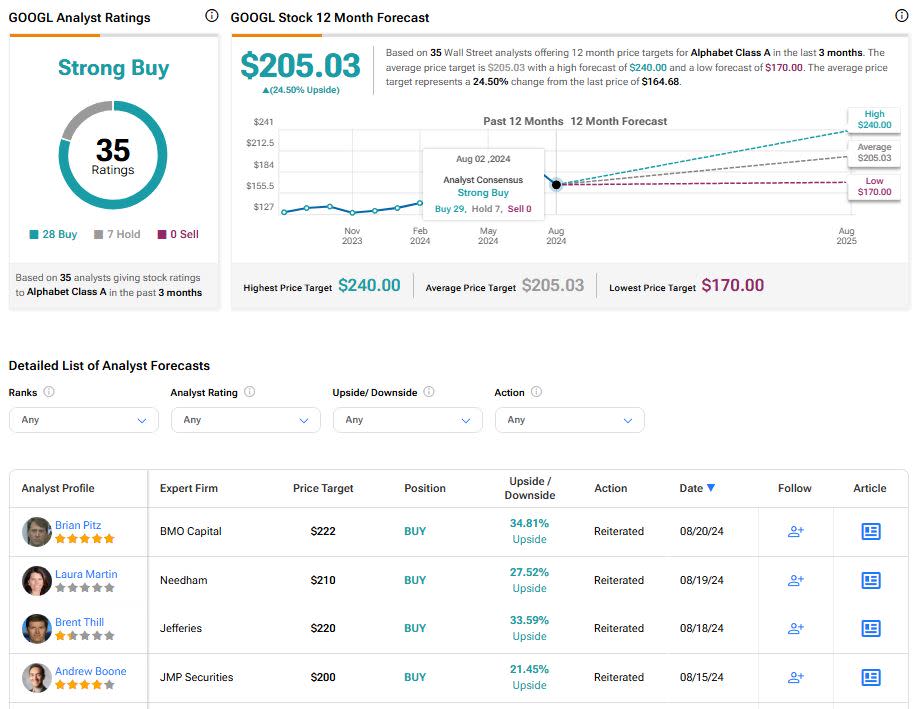

What Is the Value Goal for GOOGL Inventory?

Alphabet has a Sturdy Purchase consensus ranking primarily based on 28 Buys, seven Holds, and nil Promote scores assigned during the last three months. At $205.03, the common Alphabet inventory value goal implies upside potential of 24.50%.

See extra GOOGL analyst scores

Conclusion: Impartial on PLTR, Bullish on GOOGL

Whereas Palantir might turn into a inventory price shopping for and holding over the long run, its present valuation has merely gotten forward of itself. Like Alphabet, Palantir has put up spectacular three- and five-year features, however when the inventory final surpassed $30 per share in February 2021, a correction quickly adopted. Thus, traders ought to concentrate on volatility across the nook.

Importantly, Palantir Applied sciences is being valued like a progress inventory, whereas Alphabet inventory has transitioned into worth inventory or blue-chip territory. Nevertheless, Alphabet is simply too low-cost to disregard proper now, particularly attributable to its blue-chip standing. Thus, a assessment of their valuations reveals that Alphabet is the clear winner of this pairing.