(Bloomberg) — US inflation figures within the coming week will reinforce that long-awaited interest-rate cuts are coming quickly, whereas a studying on shopper spending is seen indicating that the central financial institution has been profitable at retaining the enlargement intact.

Most Learn from Bloomberg

Economists see the private consumption expenditures worth index excluding meals and vitality — the Fed’s most popular measure of underlying inflation — rising 0.2% in July for a second month. That might pull the three-month annualized charge of so-called core inflation right down to 2.1%, a smidgen above the central financial institution’s 2% aim.

Economists within the Bloomberg survey additionally anticipate shopper outlays, unadjusted for worth modifications, to climb 0.5% — the strongest advance in 4 months — in Friday’s report.

Talking on the Jackson Gap symposium, Fed Chair Jerome Powell acknowledged latest progress on inflation, saying he’s gained confidence it’s on a path again to 2% and that “the time has come for coverage to regulate.”

Friday’s remark marked a key turning level within the Fed’s two-year battle in opposition to worth pressures and underscored how the main target has shifted towards dangers within the labor market — the opposite a part of the central financial institution’s twin mandate. Employment progress has helped preserve shoppers spending — a key to making sure enlargement of the economic system.

On Thursday, the federal government will difficulty its first revision of second-quarter gross home product. Economists’ median projection requires a 2.8% annualized charge of progress, unchanged from the prior studying.

Different US information within the coming week embrace July sturdy items orders on Monday and separate indexes of shopper confidence on Tuesday and Friday.

What Bloomberg Economics Says:

“Powell’s very dovish deal with at Jackson Gap was music to market gamers’ ears. He pledged the Fed would do ‘all the things’ it might probably to help a robust labor market, offering a flooring for the economic system. We predict a little bit of a actuality verify is so as.”

— Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou. For full evaluation, click on right here.

Additional north, Canadian second-quarter GDP information would be the closing main financial launch earlier than the central financial institution is anticipated to decrease charges for a 3rd straight assembly on Sept. 4.

Preliminary information instructed 2.2% annualized quarterly progress — greater than the central financial institution’s forecast of 1.5% — bolstering its efforts to engineer a delicate touchdown whereas persevering with to decrease borrowing prices.

Traders shall be additionally looking ahead to the newest developments to resolve a Canadian railway dispute that has snarled North American provide chains.

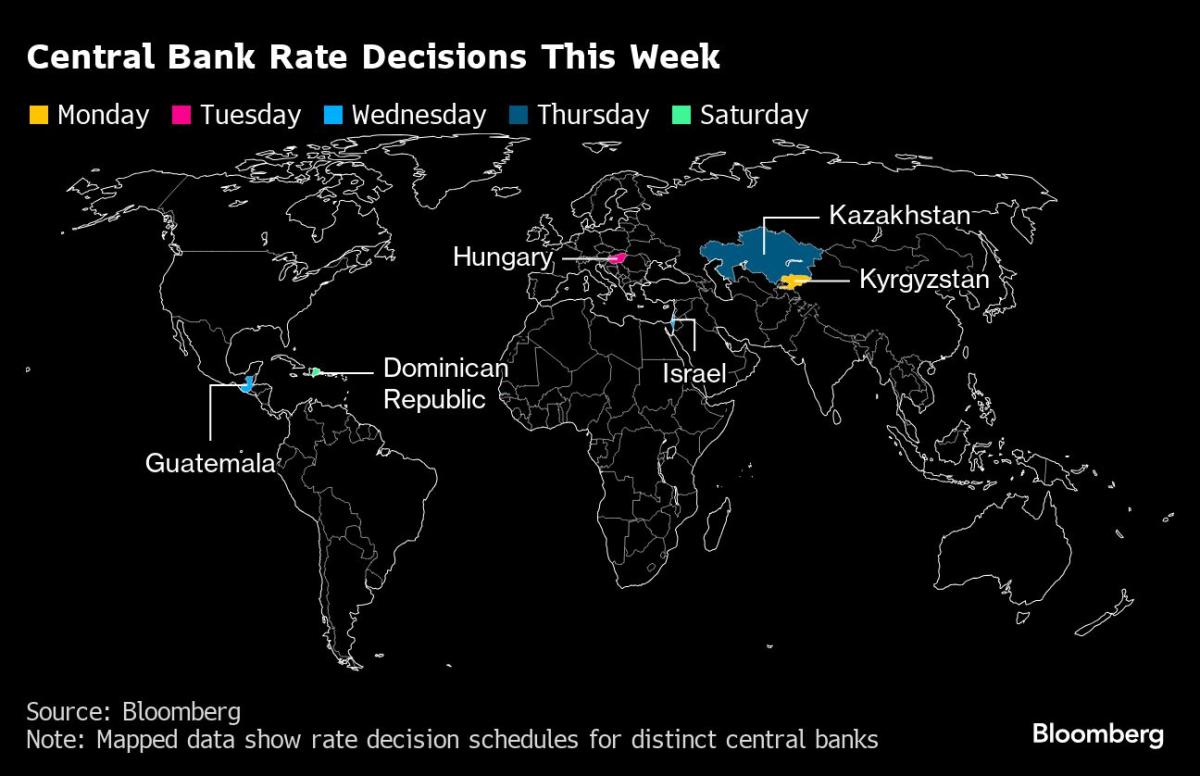

Elsewhere, the euro zone will report inflation for August lower than two weeks earlier than the European Central Financial institution subsequent decides on financial coverage, whereas China’s central financial institution will set the speed on its one-year coverage loans. Charge choices embrace Hungary and Israel.

Click on right here for what occurred previously week, and under is our wrap of what’s developing within the international economic system.

Asia

The week begins with a renewed concentrate on China’s new financial framework, because the Individuals’s Financial institution of China units the speed on its one-year coverage loans. After a shock lower in July, authorities are anticipated to carry the speed regular at 2.3%.

Monday’s resolution comes after the PBOC signaled this month that it’s de-emphasizing the medium-term lending facility’s position as a coverage software, whereas elevating the seven-day reverse repurchase charge to higher prominence.

A day later, China will get industrial revenue figures which will spur requires extra coverage steps to spice up the economic system, and Beijing sees official PMI numbers on Saturday.

Elsewhere, costs shall be a theme.

Australia’s trimmed imply inflation gauge for July will give its central financial institution recent proof to weigh because it considers whether or not or to not retain its hawkish rhetoric.

Japan additionally will get a shopper inflation replace for the capital, a number one indicator for nationwide tendencies. Information on Friday could present India’s year-on-year financial progress slowed a tad within the second quarter, and commerce figures are due throughout the week from Thailand, Sri Lanka and Hong Kong. Kazakhstan’s central financial institution meets Thursday to resolve whether or not to chop its key charge for a 3rd consecutive assembly.

Europe, Center East, Africa

Inflation information shall be in focus for Europe as effectively, with August numbers due from the area’s massive economies — Germany, France, Italy and Spain — together with a studying for the 20-nation euro zone as a complete.

A slowdown is anticipated for the bloc from July’s 2.6%, paving the best way for the ECB to decrease rates of interest for the second time this cycle when it meets in September.

Such expectations have been strengthened by the continent’s financial predicament. Whereas August’s Buying Managers’ Index received an surprising increase from the Paris Olympics, underlying weak point is more likely to persist past that non permanent carry. The beginning of the week will see updates on output and sentiment in Germany — the area’s present weak spot.

Audio system more likely to touch upon financial coverage and the newest shifts within the economic system embrace ECB Governing Council members Joachim Nagel and Klaas Knot, in addition to Government Board member Isabel Schnabel.

In Jap Europe, Hungary is anticipated to maintain rates of interest on maintain at 6.75%. It’s an identical story within the Center East, the place Israel’s central financial institution is seen retaining benchmark borrowing prices at 4.5%.

In Africa, there’ll be August inflation readings from Kenya and Uganda, together with second-quarter GDP figures from Nigeria.

Latin America

Brazil’s central financial institution on Monday posts its weekly survey of economists. Financial institution President Roberto Campos Neto this month stated inflation expectations are unmoored and that officers are able to tighten financial coverage if wanted.

Brazil’s mid-month inflation information on Tuesday could present a slight easing from July’s 4.45%, nonetheless effectively above the three% goal. Analysts are marking up their interest-rate forecasts whereas merchants are pricing in a hike as quickly as subsequent month.

Fiscal slippage has put Brazil’s funds information — the July figures are slated for publication within the coming week — within the highlight. Economists surveyed by the central financial institution don’t see an annual nominal or major funds surplus to the 2027 forecast horizon.

The primary occasion in Mexico would be the central financial institution’s quarterly inflation report. New forecasts are unlikely so quickly after revisions made within the financial institution’s Aug. 8 post-decision communique, however policymakers could re-examine GDP estimates.

Chile’s June retail gross sales figures will seemingly present a seventh consecutive constructive year-on-year print after almost two years of declines.

–With help from Robert Jameson, Laura Dhillon Kane, Zoe Schneeweiss, Paul Richardson and Brian Fowler.

(Updates with Canada rail dispute in tenth paragraph)

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.