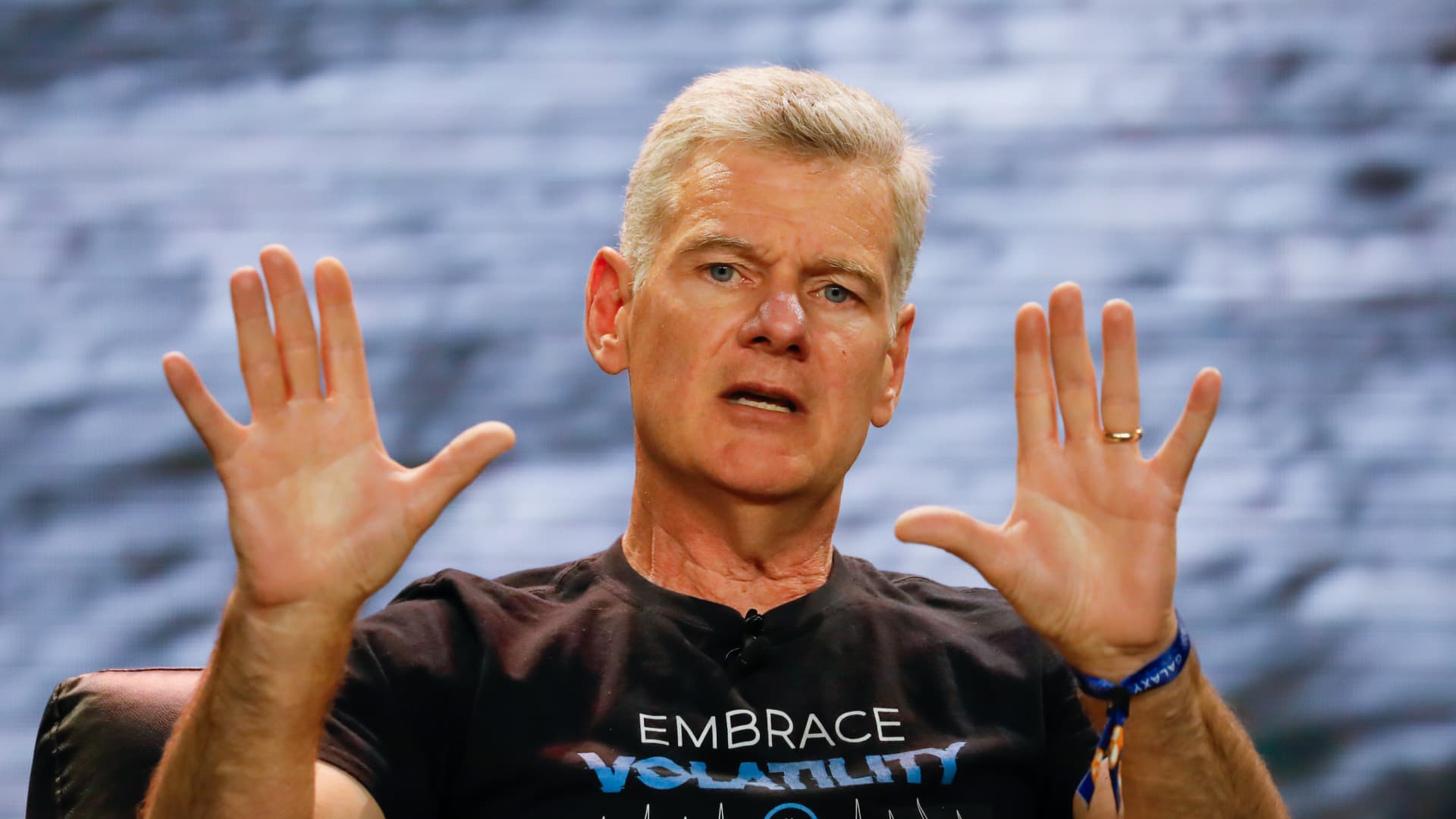

Hedge fund supervisor Mark Yusko is predicting bitcoin will greater than double this 12 months to $150,000.

“Get off zero,” the Morgan Creek Capital Administration CEO and chief funding officer instructed CNBC’s “Quick Cash” this week.

Yusko thinks buyers ought to have at the least 1% to three% allotted to bitcoin of their portfolios. “Bitcoin is the king. It’s the dominant token. It’s a higher type of gold,” he stated.

As of Thursday’s inventory market shut, bitcoin is up about 159% over the previous 12 months. It had surpassed the $73,000 degree earlier in March, however was buying and selling round $70,700 Thursday night.

“The legislation of enormous numbers is available in. I feel it may well go up 10x from right here simply over the subsequent decade,” added Yusko.

He lists bitcoin exchange-traded funds, which had been launched in January, as a significant bullish driver for the cryptocurrency. Yusko expects the bitcoin halving to result in a provide shock leading to one other spherical of main tailwinds for the flagship crypto.

The halving, which cuts the bitcoin mining reward in half to restrict provide, is predicted in late April.

“The massive transfer occurs post-halving,” stated Yusko. “It begins to turn into extra … parabolic towards the top of the 12 months. And, traditionally about 9 months after the halving, so someday towards Thanksgiving, Christmas, we see the height in worth earlier than the subsequent bear market.”

Yusko’s agency additionally has publicity to crypto on-line buying and selling platform Coinbase. “We expect huge issues are in line for Coinbase,” he stated.

Shares of Coinbase are up virtually 321% over the previous 12 months.

Disclosure: Yusko’s corporations personal bitcoin, ethereum, gold, Coinbase and Nvidia.