The rise of Nvidia (NASDAQ: NVDA) has been nothing in need of unbelievable. No firm has grown as rapidly as Nvidia on the scale that it’s. However that is all previously; buyers wish to know what’s in retailer for Nvidia inventory sooner or later.

The issue is that Nvidia’s future is extraordinarily cloudy. Whereas it might proceed its fast progress, it might face challenges with its major merchandise.

Nvidia’s GPU progress has been phenomenal

Nvidia’s major merchandise are graphics processing items (GPUs). These {hardware} items had been initially supposed to course of gaming graphics rapidly, however their use case has expanded past that. GPUs can run engineering simulations, analysis medication, mine cryptocurrency, and, most significantly, prepare synthetic intelligence (AI) fashions. The latter has contributed considerably to Nvidia’s rise in the course of the previous yr and a half.

GPUs are a high decide for working huge workloads as a result of they’ll break up a calculation into a number of elements and compute in parallel. Moreover, GPUs may be mixed in a server to multiply this impact. Actually, the first limitation to constructing one in all these highly effective servers to run AI fashions on is an organization’s checkbook measurement.

The explosive progress AI has supplied may be seen in Nvidia’s information middle income, which rose 427% yr over yr to $22.6 billion within the fiscal first quarter (ended April 28). Maybe extra spectacular is that it rose 23% quarter over quarter, which exhibits demand remains to be quickly rising. All issues being equal, if an organization will increase its quarter-over-quarter income by 25%, the quarterly income would have greater than doubled by the top of the yr. Nvidia is true at that mark, and the quarter-over-quarter income is without doubt one of the greatest indicators to look at and see if demand for its GPUs remains to be there.

Moreover, the biggest tech firms have indicated to buyers that they plan to proceed rising their spending to construct up computing energy for AI demand. This bodes properly for Nvidia as a result of it wants its shoppers to proceed spending to remain afloat.

However there could also be extra to the story.

Nvidia’s revenue margin is at a document degree

There’s an previous saying: “Your margins are my alternative.” And this might grow to be a problem for Nvidia.

Nvidia’s gross and revenue margins have widened to document ranges, which is improbable for buyers. However they might be unsustainably excessive. A few of its largest shoppers have already developed their very own chips in-house to switch GPUs for his or her AI computing infrastructure. That is possible in response to the excessive costs they have to pay for GPUs.

Take Alphabet‘s tensor processing unit (TPU), for instance. When an AI workload is correctly configured, the TPU can obtain a lot increased efficiency than a GPU. With every main cloud computing firm having its personal product, it might grow to be a problem for Nvidia.

Nonetheless, GPUs are improbable at working AI fashions and can proceed for use closely, however buyers ought to be cautious as a result of Nvidia’s margins could quickly come underneath stress.

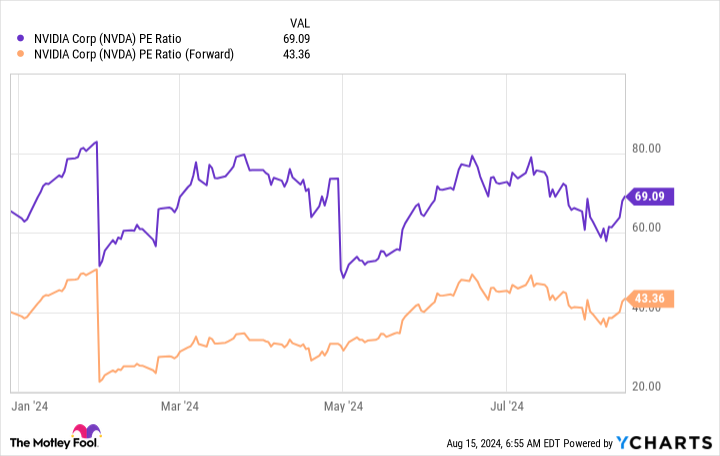

If Nvidia’s revenue margin returns to its earlier excessive peak of about 40%, it is going to take about 42% extra income simply to generate the identical income it will possibly generate now at its 57% revenue margin. That is regarding as a result of Nvidia is already priced at a premium.

So, what would possibly Nvidia’s inventory appear to be in three years? I might say the corporate will nonetheless be a stalwart, producing an unbelievable variety of GPUs to fulfill the demand for AI. Nevertheless, I would not be shocked to see the inventory across the identical ranges as a result of margin compression.

That is an underrated consideration when investing in Nvidia. I feel buyers want to contemplate the chance that even when its income continues to extend quickly, its revenue margin should keep elevated for the inventory to make sense.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Nvidia wasn’t one in all them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our advice, you’d have $779,735!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 12, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Keithen Drury has positions in Alphabet. The Motley Idiot has positions in and recommends Alphabet and Nvidia. The Motley Idiot has a disclosure coverage.

The place Will Nvidia Inventory Be in 3 Years? was initially revealed by The Motley Idiot