Nvidia (NASDAQ: NVDA) has been one of many hottest synthetic intelligence (AI) shares available on the market, and for good cause. It has put up unimaginable progress numbers quarter after quarter these days, and every time, the inventory has popped following these stories. With Nvidia’s second-quarter FY 2025 outcomes being introduced on Aug. 28 after the markets shut, traders could need to contemplate shopping for Nvidia inventory earlier than that date.

Nevertheless, these outcomes could differ from a few of its earlier bulletins, as year-over-year comparisons have gotten tougher.

The expansion will not be as sturdy as in earlier quarters

Nvidia’s rise is tied to its main product: graphics processing models (GPUs). GPUs have been developed by Nvidia again within the ’90s as units that would course of gaming graphics extra effectively than a CPU. Whereas GPUs excelled on this area, different makes use of have been shortly developed for them.

As a result of a GPU can course of a number of calculations in parallel, it’s helpful for calculation-intensive duties like engineering simulations, drug discovery, and AI mannequin coaching. The latter has triggered its enterprise to blow up, and we’ll get a checkup on demand subsequent week when the corporate releases its most up-to-date quarterly outcomes.

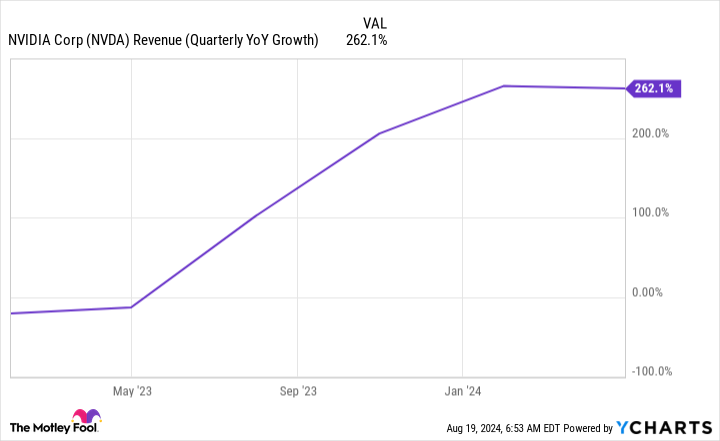

For Q2, administration instructed traders to count on $28 billion in income. In comparison with final 12 months’s Q2 gross sales of $13.5 billion, that represents 107% 12 months over 12 months progress. That might be a formidable soar, however would symbolize a progress charge slowdown in comparison with earlier quarters.

This slowdown is happening as a result of we’re overlapping the interval when AI demand actually began to take off. Nonetheless, I would not contemplate a doubling of income a disappointment. Moreover, do not be shocked if Nvidia beats that concentrate on. It has constantly outperformed its steerage over the previous 12 months, and Wall Road analysts are beginning to catch on to this development. From a median of 40 analysts, they collectively assume Nviida’s Q2 income will likely be $28.5 billion.

Whereas year-over-year income progress is a crucial stat, there are others that I feel are extra essential to contemplate, with margin on the high of that record.

Nvidia’s margin will likely be essential to look at

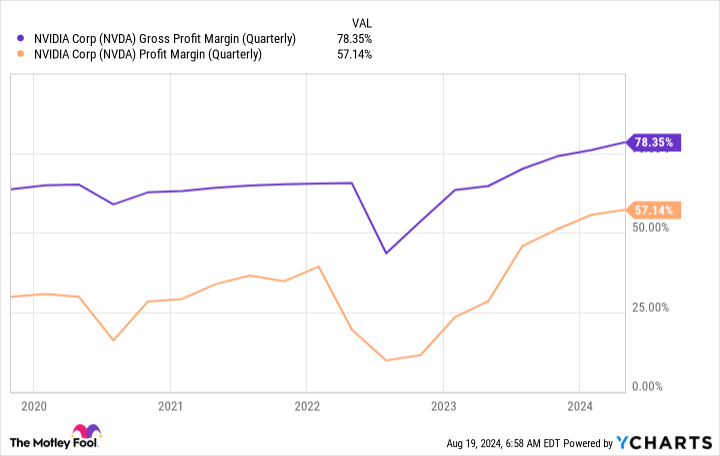

Nvidia’s income progress has been nothing wanting unimaginable, however its margin growth has been much more spectacular. With a gross margin close to 80% and a revenue margin approaching 60%, Nvidia has change into probably the most worthwhile corporations ever to commerce on the general public markets.

When the Q2 report comes out, I will be trying to see if the corporate has maintained or expanded these elevated ranges. If traders see weak spot in these margins, it is a signal that Nvidia is going through elevated competitors and wanted to regulate the worth of its GPUs to remain aggressive out there.

I do not count on a margin drop, but when one does happen, do not be shocked if the inventory will get slammed instantly after the discharge of data.

Is the inventory a purchase now?

With Nvidia anticipated to report one other sturdy quarter, many traders could marvel if they need to make investments now, earlier than the report. Traders ought to first contemplate that investing success infrequently comes from making an attempt to time the market and soar out and in at simply the suitable time.

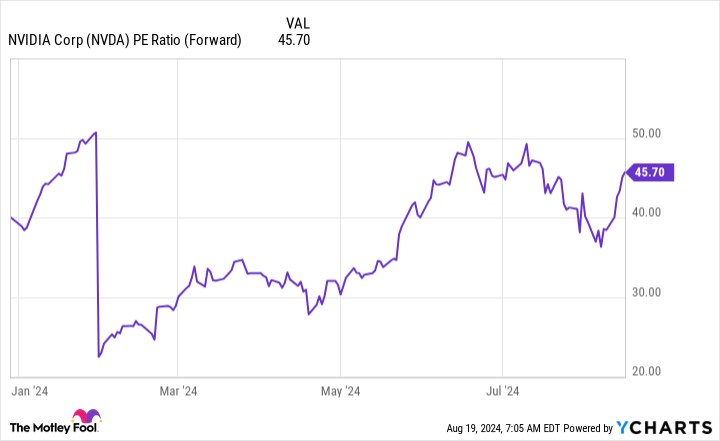

They need to additionally contemplate how costly the inventory is, buying and selling at practically 46 occasions ahead earnings estimates.

The inventory has plenty of progress baked into it, and Nvidia might want to report a robust Q2 and provides spectacular Q3 steerage to justify the optimism.

For a lot of traders (together with myself), the worth is just too excessive. However for others, it could nonetheless symbolize a shopping for alternative. At this valuation, Nvidia must report one other 12 months or two of flawless quarters; in any other case, it could possibly be knocked from its perch. If you happen to imagine it will probably try this, Nvidia’s inventory might nonetheless be fascinating right here. However with its historical past of reporting sturdy earnings, and being rewarded by traders for doing so, when you’re able to be a purchaser, you may need to purchase earlier than Aug. 28.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $779,735!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 12, 2024

Keithen Drury has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.

Aug. 28 Might Be a Large Day for Nvidia Inventory. Is It a Purchase Proper Now? was initially printed by The Motley Idiot