(Bloomberg) — Asian shares broadly strengthened on Monday forward of key central financial institution choices within the area this week and the annual assembly at Jackson Gap.

Most Learn from Bloomberg

A gauge for the area’s shares edged increased, extending Friday’s positive aspects. Fairness markets in Japan fluctuated, whereas these in Australia edged decrease. US futures contracts have been up in early Asian buying and selling after the S&P 500 rose 0.2% on Friday. The greenback was little modified, whereas Treasury yields superior.

The calm begin to the week comes forward of US jobless claims and financial exercise information, whereas Jerome Powell is predicted to verify Federal Reserve interest-rate cuts are on the playing cards when he speaks in Wyoming. The assembly caps a risky interval for international shares, partially pushed by concern the Fed wouldn’t scale back borrowing prices quick sufficient to stop a deeper US slowdown.

“Monetary markets shall be delicate to his each phrase,” Commonwealth Financial institution of Australia strategists led by Joseph Capurso wrote in a be aware. “We count on Powell to inexperienced gentle a lower on 19 September, however we count on Powell to retain optionality for delayed cuts or bigger cuts topic to the subsequent CPI and payrolls.”

Goldman Sachs on the weekend trimmed the chance of a US recession within the subsequent 12 months to twenty% from 25%, citing final week’s retail gross sales and jobless claims information. If the August jobs report set for launch on Sept. 6 “appears fairly good, we might in all probability lower our recession chance again to fifteen%,” Goldman economists led by Jan Hatzius wrote in a report back to purchasers on Saturday.

In Asia this week, traders shall be trying to central financial institution conferences in Indonesia and South Korea for indicators of coverage easing, whereas the Thailand resolution shall be essential following experiences the nation’s new prime minister could abandon a key stimulus bundle.

Financial institution of Japan Governor Kazuo Ueda is scheduled to attend a particular session at Japan’s parliament this week to possible talk about the July 31 fee hike, which roiled international markets. In the meantime, hedge funds have turned bullish on Japan’s forex for the primary time since 2021, marking a pointy turnaround from the extraordinarily unfavourable sentiment seen amongst these merchants as not too long ago as early July.

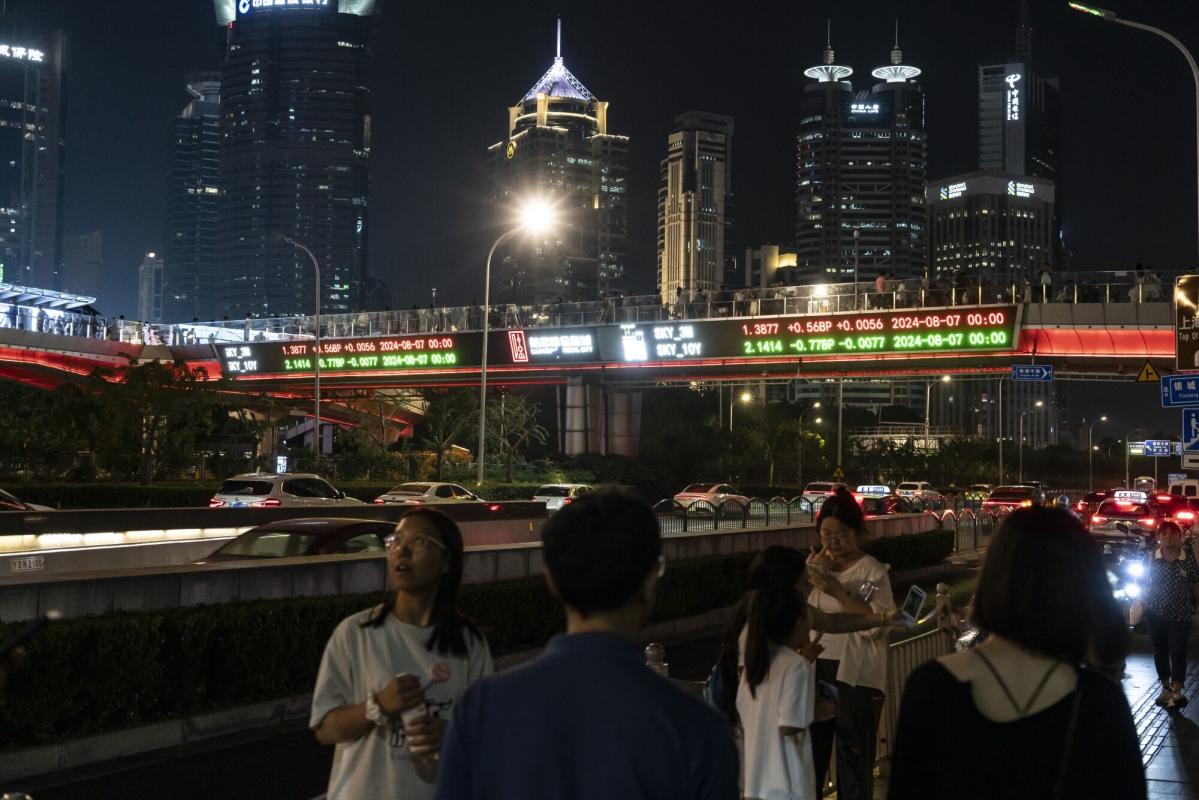

In China, authorities are anticipated to maintain the 1- and 5-year mortgage prime charges regular after the Individuals’s Financial institution of China final week pledged additional steps to assist financial restoration, whereas cautioning that it gained’t be adopting “drastic” measures.

In commodities, oil declined for the fourth time in 5 periods as merchants tracked US-led efforts to safe a cease-fire within the 10-month previous Center East, whereas the Russia-Ukraine conflict is escalating. Gold topped $2,500 on hopes the Fed is edging nearer to chopping charges. Elsewhere, iron-ore had it worst week since early June on concern {that a} steel-industry disaster rippling throughout China will sap demand, whereas provides from miners stay strong.

“How markets commerce the inventory markets round one other “quiet” week for information, crammed with extra central financial institution choices and steerage shall be essential in organising the tone for a extra hectic month finish,” stated Bob Savage, head of markets technique and insights at BNY. “Additional, count on the week forward to be dominated by the unknowns of politics and geopolitics.”

Right here’s what’s arising:

-

US Democratic Nationwide Conference takes place Aug. 22, Monday

-

Begin of annual US-South Korea joint army train, Monday

-

China mortgage prime charges, Canada and euro space CPI, Tuesday

-

Sweden and Turkey rate of interest choices, Tuesday

-

Indonesia and Thailand rate of interest choices, Wednesday

-

US FOMC minutes of of July 30-31 coverage assembly, BLS preliminary annual payrolls revision, Wednesday

-

European Central Financial institution Governing Council member Fabio Panetta speaks in Rimini, Wednesday

-

South Korea central financial institution fee resolution, Thursday

-

US Vice President Kamala Harris delivers acceptance speech on the ultimate night time of Democratic Nationwide Conference, Thursday

-

Mexico’s central financial institution, Nationwide Financial institution of Poland points financial coverage minutes

-

Malaysia CPI information, whereas Mexico and Norway publish GDP information

-

Japan CPI information due, and Financial institution of Japan Governor Kazuo Ueda to attend particular session at Japan’s parliament to debate July 31 fee hike, Friday

-

Federal Reserve Chair Jerome Powell and Financial institution of England Governor Andrew Bailey converse at Kansas Metropolis Fed’s annual Jackson Gap symposium, Friday

A few of the most important strikes in markets:

Shares

-

S&P 500 futures rose 0.2% as of 9:34 a.m. Tokyo time

-

Cling Seng futures rose 0.9%

-

Nikkei 225 futures (OSE) have been little modified

-

Japan’s Topix was little modified

-

Australia’s S&P/ASX 200 was little modified

-

Euro Stoxx 50 futures rose 0.2%

Currencies

-

The Bloomberg Greenback Spot Index was little modified

-

The euro was little modified at $1.1026

-

The Japanese yen fell 0.2% to 147.93 per greenback

-

The offshore yuan was little modified at 7.1634 per greenback

-

The Australian greenback rose 0.2% to $0.6684

Cryptocurrencies

-

Bitcoin fell 2.3% to $58,437.63

-

Ether fell 1.9% to $2,615.24

Bonds

-

The yield on 10-year Treasuries superior two foundation factors to three.90%

-

Japan’s 10-year yield superior two foundation factors to 0.890%

-

Australia’s 10-year yield superior two foundation factors to three.95%

Commodities

-

West Texas Intermediate crude fell 0.1% to $76.56 a barrel

-

Spot gold fell 0.2% to $2,501.96 an oz

This story was produced with the help of Bloomberg Automation.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.