After a slight market sell-off, loads of firms appear like nice offers. A lot of the information inflicting this decline will likely be irrelevant in three to 5 years, so there isn’t any motive to panic.

On the prime of my procuring listing at present are Taiwan Semiconductor Manufacturing (NYSE: TSM), Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), and Amazon (NASDAQ: AMZN). All three firms have improbable long-term tailwinds and appear like sturdy buys proper now.

Taiwan Semiconductor

Taiwan Semi might be essentially the most vital firm on the planet. With out its manufacturing capabilities, firms like Apple, Nvidia, and nearly each different firm that will depend on high-tech units can be out of luck. Its best-in-class semiconductor manufacturing capabilities enable it to provide cutting-edge chips within the 3nm advertising class.

These specialised manufacturing methods require unbelievable information and ability to be applied at a big scale, so unseating TSMC is almost unattainable, though there are nonetheless worthy opponents on the market.

Proper now, the inventory is about 10% off its 2024 highs, but it surely’s nonetheless value a purchase despite the fact that traders have missed the true backside. At 26 occasions ahead earnings, it nonetheless is not costly for the expansion it is placing up.

Within the second quarter, income grew 33% in U.S. {dollars} whereas offering strong steering for the third quarter (32% income progress). Taiwan Semi is well-positioned to learn from the regular improve of know-how in our lives. If traders have the possibility to purchase the inventory on sale, they need to take the chance.

Alphabet

Even with out the sell-off, Alphabet seemed like a main shopping for alternative. Regardless of being one of many largest firms on the planet, Alphabet would not earn a premium valuation like its friends. The mum or dad firm of Google, YouTube, and the Android working system solely carries a price ticket of twenty-two occasions earnings.

Contemplating that its friends have valuations of 30 occasions ahead earnings or higher, Alphabet seems like one of many least expensive large tech shares. And its cheapness is not related to its enterprise efficiency, as a result of Alphabet has been crushing it.

In Q2, Alphabet’s income rose 14% 12 months over 12 months and elevated its working margin by three proportion factors. Google Cloud, specifically, had an excellent quarter, with income rising 29%. This can be a vital division, and robust outcomes present that it’s nonetheless a prime decide within the cloud computing area.

Alphabet is a dominant firm that does not have the premium that its friends carry. This is a wonderful alternative to scoop up shares for a improbable worth.

Amazon

In some traders’ eyes, Amazon could also be doing the worst out of those three. In Q2, gross sales solely rose 10% to $148 billion, however traders needed extra. The corporate additionally issued steering for 8% to 11% income progress for Q3, which additionally did not please the gang.

Nevertheless, that is the mistaken determine to be taking a look at. Amazon is not going to supply lightning-fast progress because of its sheer measurement. As an alternative, I might level traders to how worthwhile Amazon is turning into. Amazon affords working earnings steering, which is projected to come back in between $11.5 billion and $15 billion within the subsequent quarter, in comparison with $11.2 billion within the year-ago interval.

Until working earnings is available in on the very backside finish of administration’s steering, that may present wonderful earnings progress, which is vital in bringing down Amazon’s valuation.

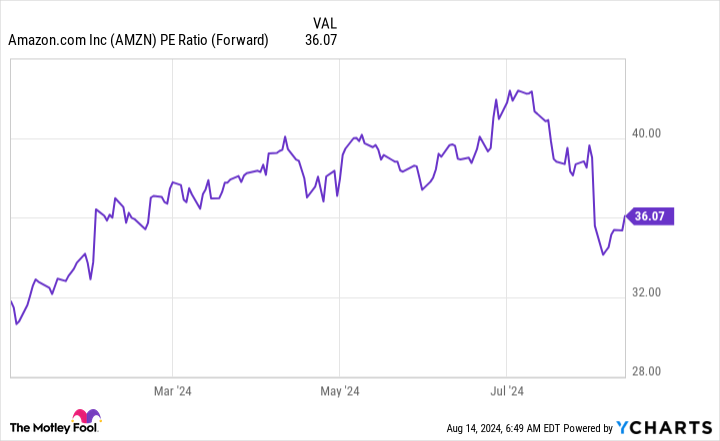

36 occasions ahead earnings is not essentially low-cost, however getting Amazon to most profitability in a single 12 months additionally is not a practical expectation. Amazon’s long-term trajectory is to develop its earnings a lot sooner than income as it really works to extend profitability throughout the board.

That is my main funding thesis in Amazon, and it’ll take years to play out. If traders concentrate on income progress and are promoting off the inventory because of this, then that gives a less expensive shopping for worth for me.

Must you make investments $1,000 in Taiwan Semiconductor Manufacturing proper now?

Before you purchase inventory in Taiwan Semiconductor Manufacturing, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Taiwan Semiconductor Manufacturing wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $763,374!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 12, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Keithen Drury has positions in Alphabet, Amazon, and Taiwan Semiconductor Manufacturing. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot has a disclosure coverage.

Inventory Market Promote-Off: 3 Shares to Purchase Now Earlier than It Recovers was initially printed by The Motley Idiot