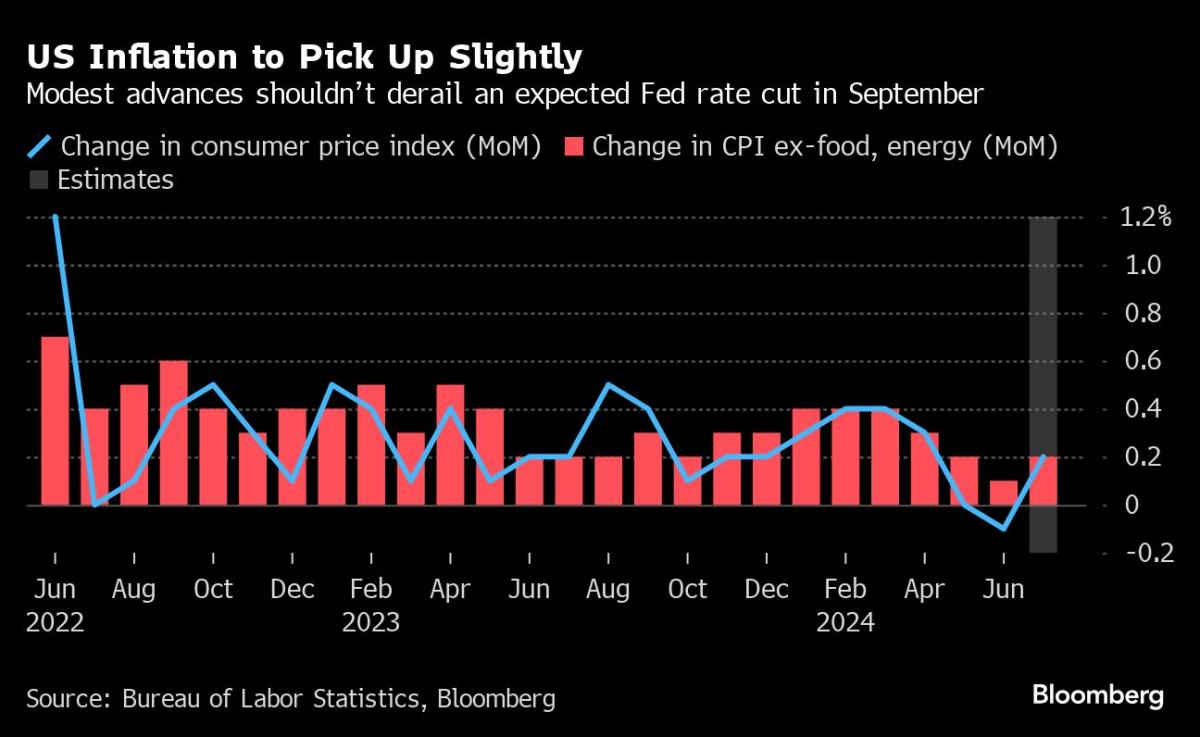

(Bloomberg) — Shares rallied and bond yields fell after the newest US inflation studying bolstered hypothesis the Federal Reserve will have the ability to deploy its broadly anticipated interest-rate minimize in September.

Most Learn from Bloomberg

Simply 24 hours forward of the patron inflation report, knowledge confirmed the producer worth index rose lower than forecast. Classes within the PPI report used to calculate the Fed’s most well-liked inflation measure — the private consumption expenditures worth index — had been typically tame. The S&P 500 climbed 1.7%, led by beneficial properties on the planet’s largest know-how firms. Treasuries rose throughout the curve, with the transfer pushed by shorter maturities. The greenback fell.

“Markets looking for stability received extra proof of cooling inflation,” stated Chris Larkin at E*Commerce from Morgan Stanley. “The lower-than-expected studying will most likely be welcomed by a inventory market trying to bounce from its largest pullback of the yr.”

The easing of worth pressures has bolstered confidence US officers can begin decreasing borrowing prices whereas refocusing on the labor market, which is exhibiting better indicators of slowing. Fed Financial institution of Atlanta President Raphael Bostic stated he’s on the lookout for “a bit extra knowledge” earlier than supporting a discount in charges, whereas reiterating he’ll doubtless be prepared to chop “by the tip of the yr.”

To Ian Lyngen at BMO Capital Markets, there isn’t something in Tuesday’s knowledge suggesting the Fed may have any hesitation reducing charges subsequent month.

“That stated, tomorrow’s client inflation replace is way extra related to near-term coverage expectations,” he famous.

A survey performed by 22V Analysis confirmed 52% of buyers anticipate the response to Wednesday’s client worth index to be “risk-on.” Nevertheless, the proportion of respondents anticipating a “recession” has stayed elevated.

The S&P 500 noticed its largest four-day rally this yr. The Nasdaq 100 climbed 2.5%. The Russell 2000 rose 1.6%. Starbucks Corp. surged 25% after ousting its chief and selecting Chipotle Mexican Grill Inc.’s Brian Niccol as its subsequent chief. In late hours, Bloomberg Information reported {that a} bid to interrupt up Alphabet Inc.’s Google is among the choices being thought-about by the Justice Division.

Wall Avenue’s favourite volatility gauge — the VIX — tumbled to round 18. Treasury 10-year yields fell six foundation factors to three.85%. Swap merchants priced in an about 40 basis-point Fed minimize in September and a complete price discount of over 105 foundation factors for 2024. The greenback hit the bottom since April. Oil sank.

“Disinflationary knowledge is being celebrated by buyers — not for its signaling of a slowing financial system right here within the US — however to solidify enhancing liquidity situations forward by way of the a lot anticipated price cuts beginning presumably in September,” based on Dan Wantrobski at Janney Montgomery Scott.

Apparently sufficient, the disinflationary knowledge that triggered the “nice rotation” final month will not be having the identical impact after the newest PPI. Large tech outperformed small caps on Tuesday as evidenced by the exchange-traded funds monitoring the Nasdaq 100 (QQQ) and the Russell 2000 (IWN).

Whereas situations stay “oversold sufficient” to capitalize on a positive CPI print on Wednesday, Wantrobski says he hasn’t seen any alerts that negate or cancel the “correction cycle” which started in earnest round Aug. 1.

“Proceed to anticipate a really bumpy trip over the quick run, in our opinion,” he concluded.

The volatility in international monetary markets hasn’t derailed investor optimism round US know-how behemoths or expectations of a gentle financial touchdown, based on a worldwide survey by Financial institution of America Corp.

Whereas the ballot, performed from Aug. 2 to Aug. 8 and overlaying the peak of final week’s turmoil, confirmed a defensive rotation into bonds and money and out of equities, lengthy bets on the “Magnificent Seven” megacaps remained probably the most crowded commerce — albeit much less so after the selloff.

“Core optimism on gentle touchdown and US massive cap development shares is unbowed,” strategist Michael Hartnett wrote. It’s “simply that buyers now assume the Fed wants to chop more durable to ensure no recession.”

Tech shares had been on the forefront of the latest rout in international monetary markets amid worries about excessive valuations at a time when the US financial system has proven some indicators of cooling.

At Citigroup Inc., Chris Montagu stated US know-how shares stay below “important strain” as investor positioning continues prolonged on the bullish aspect regardless of the previous month’s selloff.

“On any destructive financial knowledge, there might be important strain on these lengthy positions,” Montagu wrote. “That, in flip, may amplify any down strikes from right here within the close to time period.”

BofA shoppers had been internet consumers of US equities for the primary time in additional than a month final week, snapping up shares throughout the rout and subsequent restoration. Institutional buyers led internet purchases of $5.8 billion in US shares as hedge funds and retail buyers offloaded shares, Jill Carey Corridor stated.

At a sector degree, know-how and communications providers recorded the most important inflows for the week and on cumulative year-to-date foundation, she stated.

“Our consumer flows have tended to weaken within the fall months,” Carey Corridor famous, including she expects continued fairness volatility heading into the US election.

Probabilities of a full-fledged inventory market rout are low, though poor seasonality and a murky development outlook are prone to restrict US fairness beneficial properties by means of the remainder of the quarter, based on Morgan Stanley’s Mike Wilson.

“I discover it arduous to consider we’re going to interrupt out again towards the highs,” he stated Tuesday in an interview with Bloomberg Tv. “I additionally don’t assume we’re going to fully break down in a approach that might argue that we’re getting into a brand new bear market.”

“Whereas shares appear to have stabilized, I do consider there’s nervousness within the air, which is prone to result in greater volatility and the potential for outsized reactions to knowledge and developments,” stated Kristina Hooper at Invesco.

To Chris Zaccarelli at Impartial Advisor Alliance, this can be a “pivotal week” for knowledge following on the heels of the “mini-panic” to start with of August.

“If tomorrow’s CPI report is available in decrease than anticipated, like this morning’s PPI report did, then the Fed actually has a inexperienced mild to chop charges by 50 foundation factors at their subsequent assembly in the event that they deem it essential to shortly get again to impartial within the face of a looming slowdown within the financial system, he famous.

Within the wake the market maelstrom that briefly sparked concern throughout Wall Avenue final week, monetary markets are flashing a better chance of an oncoming recession.

It nonetheless stays an out of doors likelihood. However fashions from Goldman Sachs Group Inc. and JPMorgan Chase & Co. present that the market-implied odds of an financial downturn has risen materially, judging by alerts within the US bond market and to a lesser extent the efficiency of shares which can be acutely delicate to the ebbs and flows of the enterprise cycle.

The producer worth index for last demand elevated 0.1% from a month earlier. The median forecast in a Bloomberg survey of economists referred to as for a 0.2% achieve. In contrast with a yr in the past, the PPI rose 2.2%. Excluding the unstable meals and power classes, it was unchanged in July from the prior month — the tamest studying in 4 months.

“The runway is obvious for the Fed to chop charges in September,” stated Jamie Cox at Harris Monetary Group. “If knowledge like this persists, the Fed may have loads of room to chop charges additional this yr.”

At Evercore, Krishna Guha stated there’s “nothing threatening” within the newest PPI knowledge.

“The bigger level right here is that we’re previous the purpose at which a couple of foundation factors right here or there on month-over-month inflation may have any materials bearing on Fed coverage and the speed outlook, which at this juncture might be pushed overwhelmingly by the labor market knowledge,” Guha stated.

David Russell at TradeStation says PPI knowledge gave offers additional proof that the tide has turned on inflation, particularly in providers.

“This course of may proceed or speed up in coming months as weak spot in China weighs on commodity costs. Jerome Powell has quite a bit to be ok with going into Jackson Gap,” he stated.

The Fed Financial institution of Kansas Metropolis’s Financial Coverage Symposium in Jackson Gap, Wyoming might be held Aug. 22-24.

Company Highlights:

-

Residence Depot Inc. lowered its forecast of a key gross sales metric for the yr on expectations that customers will proceed to carry again spending within the coming months.

-

Boeing Co.’s business plane deliveries are exhibiting indicators of stabilizing, with deliveries in July mirroring these in the identical month a yr earlier.

-

Paramount International started shedding workers Tuesday after the leisure firm stated final week it deliberate to slash 15% of its US-based workforce, amounting to roughly 2,000 positions.

-

Common Motors Co. has been shedding workers in China and can quickly meet with native associate SAIC to plan a bigger structural overhaul of its operations there, a recognition the Detroit automaker is unlikely to see its gross sales return to 2017 peak ranges.

-

Baxter Worldwide Inc. stated it’s going to promote its kidney-care unit to the Carlyle Group personal fairness agency for $3.8 billion, a part of the well being care firm’s efforts to streamline and pay down debt.

-

Avon Merchandise Inc., proprietor of the wonder model identified for its door-to-door saleswomen, filed for chapter after going through a wave of lawsuits alleging talc in its merchandise prompted most cancers.

-

Illumina Inc.’s plan to extend gross sales by means of simpler DNA sequencing and improved knowledge evaluation did not excite buyers, with targets in need of earlier development charges.

-

Kroger Co. and Albertsons Cos. have spent greater than $800 million on charges to legal professionals, bankers and advisers for his or her proposed merger, underscoring the excessive prices of attempting to finish the most important ever tie-up between two US grocery chains.

Key occasions this week:

-

Eurozone GDP, industrial manufacturing, Wednesday

-

US CPI, Wednesday

-

China dwelling costs, retail gross sales, industrial manufacturing, Thursday

-

US preliminary jobless claims, retail gross sales, industrial manufacturing, Thursday

-

Fed’s Alberto Musalem and Patrick Harker communicate, Thursday

-

US housing begins, College of Michigan client sentiment, Friday

-

Fed’s Austan Goolsbee speaks, Friday

A few of the most important strikes in markets:

Shares

-

The S&P 500 rose 1.7% as of 4 p.m. New York time

-

The Nasdaq 100 rose 2.5%

-

The Dow Jones Industrial Common rose 1%

-

The MSCI World Index rose 1.7%

-

Bloomberg Magnificent 7 Whole Return Index rose 3.1%

-

The Russell 2000 Index rose 1.6%

Currencies

-

The Bloomberg Greenback Spot Index fell 0.4%

-

The euro rose 0.6% to $1.0996

-

The British pound rose 0.8% to $1.2866

-

The Japanese yen rose 0.2% to 146.85 per greenback

Cryptocurrencies

-

Bitcoin rose 3.4% to $60,850.63

-

Ether rose 1.2% to $2,712.82

Bonds

-

The yield on 10-year Treasuries declined six foundation factors to three.85%

-

Germany’s 10-year yield declined 4 foundation factors to 2.19%

-

Britain’s 10-year yield declined three foundation factors to three.89%

Commodities

-

West Texas Intermediate crude fell 1.9% to $78.51 a barrel

-

Spot gold fell 0.2% to $2,467.08 an oz.

This story was produced with the help of Bloomberg Automation.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.