AI market darling Nvidia (NASDAQ: NVDA) has cooled off, dropping roughly 15% since peaking at a $3.3 trillion market cap only a few weeks in the past. Regardless of the current stumble, the inventory has gained over 100% over the previous yr. Volatility is regular for any inventory that rises a lot in a brief period of time.

However Nvidia’s present dip is not an computerized shopping for alternative. Query marks are beginning to pile up as the corporate prepares to announce second-quarter earnings in a number of weeks.

Listed here are the dangers traders ought to contemplate earlier than shopping for the inventory in the present day.

Is Nvidia’s market share underneath assault?

The synthetic intelligence (AI) race started in early 2023 with the viral arrival of ChatGPT. Nvidia’s GPUs, which may optimize for AI purposes utilizing proprietary software program, shortly established a dominant market share. Trade estimates have pegged Nvidia’s AI market share as excessive as 70% to 95%. Analysis from TechInsights estimates Nvidia accounted for 98% of whole information middle GPU income in 2023.

Nvidia’s financials again that up; income development accelerated to almost 300%. Know-how CEOs like Elon Musk brazenly pleaded they could not get Nvidia’s chips quick sufficient. Such excessive demand has finished wonders for Nvidia’s pricing energy, too. Gross revenue margins have expanded considerably to over 75%:

However it’s laborious staying on high when everyone seems to be coming on your crown, and lots of of those large chip spenders might not get pleasure from being at Nvidia’s mercy. It is recognized that opponents like Intel and AMD are pushing options, and massive know-how corporations like Amazon, Alphabet, and Meta Platforms are constructing customized AI chips.

Alphabet might have struck the primary recognized blow to Nvidia’s dominance. Apple (NASDAQ: AAPL) not too long ago disclosed that it used 2,048 of Alphabet’s TPU v5p chips to construct the AI that may run on iOS units. For its server AI mannequin, Apple deployed 8,192 TPU v4 processors. These tensor processing items (TPUs) are purpose-built to coach AI fashions. Apple did not say it did not use Nvidia chips, however omitted Nvidia when describing its {hardware} and software program construct.

Heading into earnings with sky-high expectations

Apple’s tie-up with Alphabet is important for a number of causes.

First, Apple’s AI mission is critically vital, and the corporate selected Alphabet’s chips regardless of the notion that Nvidia was the de facto business chief and go-to chip vendor. It is only one occasion, nevertheless it’s now truthful to query whether or not Nvidia’s AI moat is as extensive as initially thought.

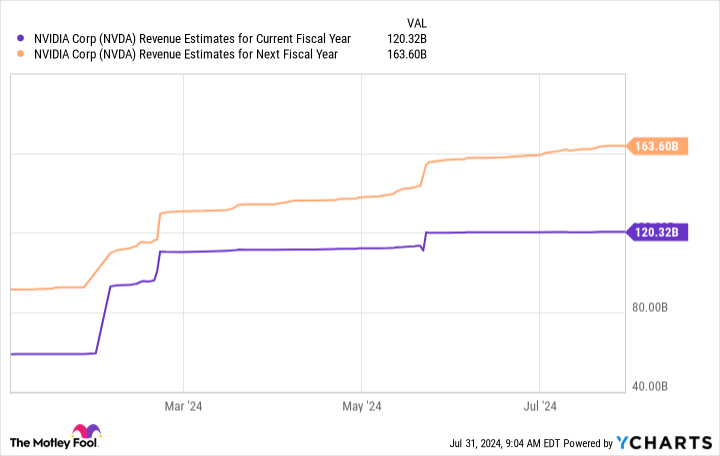

Second, analysts’ income estimates stay very optimistic regardless of potential aggressive strain. You’ll be able to see that estimates for 2024 and 2025 are as excessive as ever:

Third, real aggressive pressures would probably threaten Nvidia’s gross revenue margins, which (as you noticed within the first chart) have expanded past 75%. Over the previous 5 years, Nvidia’s gross margins have averaged 63%. Even when Nvidia retains the lion’s share of the AI chip market, it could not accomplish that at any worth. Costs might have to come back right down to compete.

How ought to traders strategy Nvidia in the present day?

The potential draw back in each income and gross margins ought to concern traders. I am not saying that Nvidia cannot or will not stay the main AI chip firm. However it’s changing into more and more believable that deep-pocketed opponents can win enterprise. Many of those large know-how corporations constructing customized AI chips are at the moment Nvidia’s largest prospects!

Possibly the broader demand for AI chips can be so nice that Nvidia can develop whereas ceding a few of its market share. The danger is that it will possibly’t, that Nvidia’s AI income might peak after which average and even decline as different AI chips flood the market. Q2 earnings might simply be one other blowout quarter. Buyers will wish to pay shut consideration to administration’s full-year steering, which ought to reveal future gross sales momentum.

Nvidia might show risky as Wall Road chews on these questions. Buyers might wish to contemplate ready to see how Q2 earnings look earlier than aggressively shopping for shares. On the very least, contemplate dollar-cost averaging your Nvidia investments. That is a sensible solution to handle unsure markets or falling inventory costs. By investing a hard and fast quantity at common intervals, you may decrease your common value per share over time. This methodology helps you purchase extra when costs are low, providing a strategic benefit in risky markets.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Nvidia wasn’t one in every of them. The ten shares that made the minimize might produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $657,306!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 29, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units, Alphabet, Apple, and Nvidia. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and quick August 2024 $35 calls on Intel. The Motley Idiot has a disclosure coverage.

Is Nvidia Inventory a Purchase Now? was initially revealed by The Motley Idiot