On the Shady Lane Residences within the suburbs east of San Diego the carpet may very well be worn, the home equipment previous. However with a few of the cheaper rents round, the complicated was a comparatively reasonably priced dwelling for an more and more priced-out working class.

Then, in 2021, the nonprofit that owned the 112-unit property bought it. In slightly below three years, the brand new homeowners raised hire for vacant models 21 share factors greater than landlords in close by neighborhoods, in keeping with information from an actual property analysis agency. On common, accessible properties on the complicated went from inexpensive than the encompassing space to dearer.

Present tenants noticed change too. Rubin Flournoy, a supervisor at a metropolis water therapy plant, mentioned he’s seen his hire climb roughly twice as a lot yearly for the reason that sale. What he didn’t know was that the brand new homeowners had a stunning funding supply: individuals like himself.

Rubin Flournoy, 48, mentioned his hire has elevated roughly twice as a lot yearly since Blackstone took over the Shady Lane Residences in El Cajon.

(Gina Ferazzi / Los Angeles Instances)

The El Cajon complicated had been bought, in keeping with analysis agency CoStar and industrial mortgage reviews, to a large actual property funding fund managed by the personal fairness agency Blackstone. Buyers within the fund embody the California State Lecturers’ Retirement System and different public pension programs throughout the nation.

“I didn’t know that [public pensions] did most of these investments,” mentioned Flournoy, a member of the San Diego Metropolis Workers’ Retirement System. “I imply, I’m being affected as a result of someone else’s pension is doing it. So I’m fairly certain that my pension is doing the identical factor to someone else.”

Throughout the nation, public pension programs are pouring billions of {dollars} into larger danger actual property funding funds which can be managed by personal corporations and goal outsize returns. Funding specialists say the pattern is pushed by quite a lot of elements, together with a long-running purpose of portfolio diversification and a extra urgent want by underfunded public pension programs to spice up returns to pay members what they’ve promised.

Such pension funding in multifamily housing elevated practically sevenfold between 2011 and 2023, in keeping with one measure tracked by consultancy Ferguson Companions.

However whereas the investments are aimed to beef up pension plans that lecturers and different public workers depend on once they retire, critics of those larger danger actual property funds say their very design encourages gentrification. Interviews with tenants and an L.A. Instances evaluation of business hire information present the funds typically sharply hike rents, squeezing a few of the identical middle-class staff that pension programs are supposed to profit.

Flournoy’s retirement system, for instance, dedicated $30 million to a fund managed by actual property agency Waterton that in 2021 bought the Vue high-rise residence tower in San Pedro, in keeping with CoStar. Waterton then raised the common asking hire practically 19% — in contrast with a ten.4% enhance within the surrounding space.

In line with CoStar, a Blackstone fund that acquired public pension cash bought 66 residence complexes in San Diego County, together with this one in Imperial Seaside.

(Gina Ferazzi / Los Angeles Instances)

“The price of dwelling is ridiculous,” mentioned Erich Tran, who alongside together with his companion Tyler Bahr skilled an almost 6% hire enhance final yr that introduced the associated fee for his or her one-bedroom in San Pedro to almost $2,500.

A yr earlier, hire had risen practically 8%.

Since 2011, larger danger actual property funds have bought greater than 1.4 million flats throughout the US, in keeping with CoStar.

The information service doesn’t monitor what number of of these funds acquired cash from pension programs, however does have information on hire in particular person properties.

Utilizing CoStar and a separate database that tracks pension commitments to funding funds — PitchBook — The Instances analyzed rental tendencies at 133 properties in California that have been acquired by larger danger funding automobiles that acquired commitments from California pensions over an eight-year interval ending in 2022. These embody the statewide megafund for public college lecturers, CalSTRS, together with native retirement programs for presidency workers in Los Angeles, Orange County and San Diego.

General, common hire rose 7.7 share factors extra on the pension-linked buildings than the encompassing neighborhoods, in keeping with a Instances evaluation of information from actual property agency CoStar. Almost 40% of properties noticed hire rise a minimum of 10 share factors extra.

In an announcement, CalSTRS mentioned it “acknowledges the challenges surrounding reasonably priced housing” and that “our method to investing in actual property displays our mission to make sure a safe retirement for California’s public educators. “

Protesters chant outdoors the college chancellor’s workplace throughout a protest calling for the UC Retirement Plan to divest from Blackstone at UCLA in February.

(Michael Blackshire / Los Angeles Instances)

CalSTRS pointed to investments it has made in each income-restricted reasonably priced housing and new development, which expands provide. However the retirement system declined to reply particular questions on its investments in riskier funds which have acquired current, non-income-restricted residence buildings.

The San Diego Metropolis Workers’ Retirement System — which invested within the fund that CoStar exhibits bought Tran’s residence constructing — declined to remark.

Blackstone and Waterton declined to say if particular person California public pensions have earned or will earn a return off the buildings CoStar and different sources present the funds acquired. Generally, business specialists mentioned that if pensions or different traders commit cash to such funds, they obtain a return primarily based off all properties the funds purchase.

Michael Reher, an assistant professor of finance at UC San Diego’s Rady College of Administration, has studied pension housing investments and reviewed The Instances’ findings. It “definitely looks as if this is able to be exacerbating the affordability disaster,” he mentioned.

The information tracked by The Instances covers hire for accessible models and thus present a rise in housing prices for individuals searching for a brand new place to reside. A number of tenants additionally informed The Instances their hire climbed sooner as soon as the pension-linked funds in The Instances’ evaluation took over.

On the Vue in San Pedro, Bahr mentioned the couple’s final two hire will increase, at $139 and $172, have been greater than 3 times what he recalled was widespread underneath the earlier proprietor.

The escalating hire had an impression. Bahr stopped placing cash into financial savings and the couple determined to name California quits all collectively.

Aerial view of The Vue, a 16-story rental group in San Pedro in July.

(Allen J. Schaben / Los Angeles Instances)

This month, they gave up their $2,465 one-bedroom and moved to Texas.

“It’s been on my thoughts for a couple of years,” Bahr mentioned. “I would like to have the ability to afford to have a roof over my head.”

In the event that they selected to remain one other yr on the Vue, Waterton was set to boost their hire once more, this time practically 7%, to $2,633, in keeping with a renewal letter.

As of Tuesday, Waterton was promoting the unit, accessible in September, at slightly below $2,900 a month for a one-year lease.

‘Mercenary’ funding methods

Over the previous decade and a half, capital of all types has flooded actual property, at instances serving to to ship costs larger.

In a seek for larger returns, institutional traders equivalent to pensions and insurance coverage corporations pumped cash into huge funds run by personal fairness and different corporations that turned ever-larger landlords.

The businesses supply funds tailored to a particular danger technique. “Core” funds goal the bottom return with the bottom danger, “value-add” carries the promise of larger return with larger danger, whereas “opportunistic” is the riskiest of all, a raffle with hopes that it might be rewarded with the very best payout.

There aren’t any definitive guidelines about what every technique entails. However when shopping for current flats, funding specialists mentioned, core funds sometimes purchase top-performing properties and will not elevate rents any greater than earlier homeowners.

Worth-add and opportunistic funds — these The Instances included in its evaluation — “are slightly extra mercenary,” mentioned Jeffrey Hooke, a senior lecturer at Johns Hopkins College and former personal fairness govt. “They’d be extra open to kicking out poor individuals and jacking up rents.”

John Drachman, co-founder of Waterford Property Co. in Newport Seaside, beforehand executed value-add residence methods on behalf of traders. He mentioned he stopped as a result of not solely is such funding too dangerous, nevertheless it typically negatively impacts lower- and middle-class tenants.

To earn the excessive returns opportunistic and value-add funds goal, it’s usually crucial to extend hire extra aggressively than is typical throughout {the marketplace}, Drachman mentioned.

Actual property govt John Drachman mentioned worth add and opportunistic methods typically have a detrimental impression on low-and middle-income tenants.

(Mel Melcon / Los Angeles Instances)

“You cannot lower bills sufficient to justify that degree of return,” mentioned Drachman, who additionally teaches actual property entrepreneurship at USC.

To realize wanted rents, specialists mentioned, these riskier funds typically take dated buildings with comparatively low rents and transform widespread areas and vacant flats to draw new tenants who pays extra, with the renovations starting from superficial to intensive.

Adjustments don’t cease there. Drachman mentioned fund managers need to aggressively push rents larger on current tenants too. If tenants settle for the hikes and keep, homeowners herald extra cash than they have been with out spending cash on new flooring and home equipment. In the event that they transfer out, homeowners can renovate and cost much more.

As flats develop into pricier, the additional hire not solely brings in additional income, nevertheless it raises the worth of the property, which is meant to generate outsize returns when funding managers promote it, typically after a number of years.

“That is very clearly decreasing the availability of housing at a selected affordability degree,” mentioned Amy Schur, marketing campaign director for Alliance of Californians for Group Empowerment, which helps to prepare Blackstone tenants. “When pension funds put money into excessive danger portfolios of Blackstone and others like them, what they’re … doing is fueling gentrification.”

Within the case of the Shady Lane Residences, CoStar information present an opportunistic fund from Blackstone bought the complicated and greater than 5,500 different models throughout San Diego County from the Conrad Prebys Basis, a longstanding nonprofit group. Greater than 20% of commitments to the fund got here from public pensions, in keeping with a Instances evaluate.

For the reason that acquisition in 2021, Blackstone has rebranded lots of the communities and, in keeping with interviews with current tenants, renovated models after they turned vacant.

On the newly branded Terre at Madison, previously Shady Lane, a property web site exhibits photographs of reworked flats with new flooring and spotless white partitions, whereas boasting of “thoughtfully designed” dwelling areas which can be “stylishly appointed with the sort of premium supplies and finishes you gained’t discover in another flats for hire in El Cajon.”

A number of checks of the web site this yr confirmed the most affordable accessible two-bedroom flats ranged from $110 to $506 dearer than what Flournoy presently pays for a similar dimension unit.

Rubin Flournoy, 48, in his two-bedroom residence in El Cajon earlier than it was renovated earlier this yr.

(Gina Ferazzi / Los Angeles Instances)

It took the brand new homeowners over two years to interchange the tattered brown carpet, rusty fridge, range and getting older counter tops in his residence, he mentioned. Whereas he waited for these enhancements, his hire climbed a number of hundred {dollars}.

Final week, he signed a lease renewal that may elevate his hire one other $174 a month come September, a bump of 8.6%.

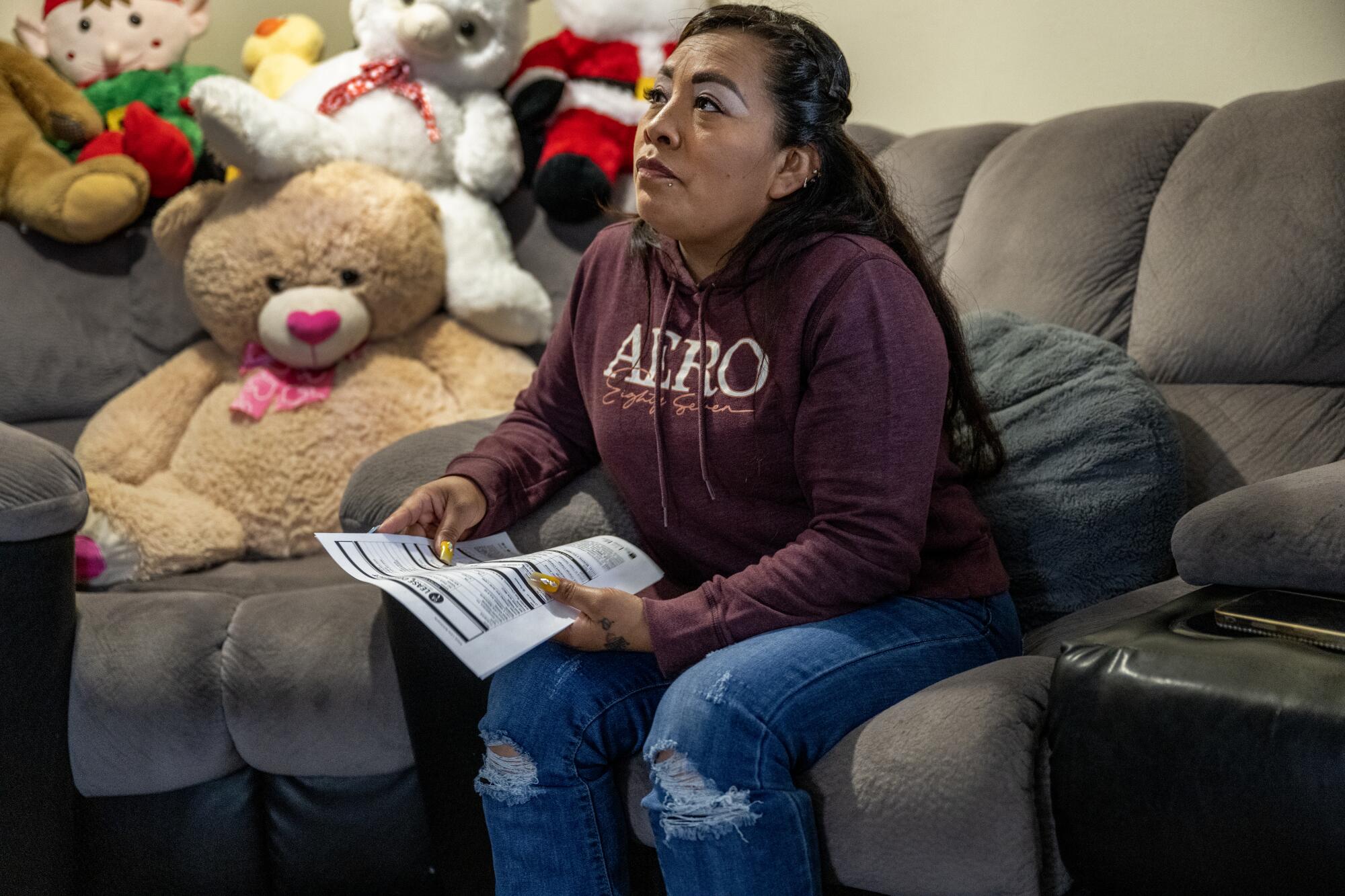

Upstairs, Iraides Gonzalez mentioned the three-bedroom residence she lives in along with her three youngsters and two roommates has not been renovated. Final yr, her hire elevated by $218 a month, in keeping with lease paperwork she shared, double what she mentioned was regular underneath the previous homeowners.

“It’s unjust,” the 37-year-old restaurant employee mentioned.

To afford the additional hire, the one mom mentioned, she beginning working six days per week and reduce on spending, together with laying aside journeys to the seaside along with her youngsters and visits to the orthodontist for her teenage daughter, Brianna.

Previous to Brianna’s fifteenth birthday final yr, her mom mentioned, her daughter requested her to not spend cash throwing her a quinceañera. What she actually wished was one thing Gonzalez needed to inform her wasn’t doable: a room of her personal.

“I want to inform her sure,” Gonzalez mentioned in Spanish final yr. “However sadly it’s not inside my attain.”

Iraides Gonzalez lives in a three-bedroom residence along with her three youngsters and two roommates. She has struggled to afford hire will increase underneath Blackstone.

(Gina Ferazzi / Los Angeles Instances)

In written responses to detailed questions, Blackstone mentioned an absence of housing development, coupled with excessive demand, is the driving issue pushing rents larger, not its investments, which presently account for lower than 1% of all rental housing within the U.S.

On the San Diego properties, Blackstone mentioned nearly all of models stay “reasonably priced for these incomes the world median revenue” and that since buying the properties it has invested about $100 million to “make them higher locations to reside,” finishing greater than 41,000 repairs.

Blackstone mentioned that regardless of hire will increase, Gonzalez and different tenants interviewed pay “considerably under market.”

“We goal to supply the perfect expertise doable for our residents,” the corporate assertion learn. “It advantages our traders to have happier residents that keep of their properties.”

In response to The Instances’ findings, Blackstone officers mentioned in an announcement that the paper’s evaluation was flawed and relied on “incomplete, cherry picked information that considerably overstates precise hire will increase” for Terre at Madison and one other property in its portfolio. Blackstone declined to elaborate.

CoStar wasn’t the one information supplier that confirmed related tendencies. Moody’s Corp. additionally mentioned hire on the two Blackstone properties in query climbed greater than the submarket.

Whereas The Instances’ evaluation targeted on California properties and California pension funds, value-add and opportunistic funds obtain cash from retirement programs throughout the nation and purchase properties outdoors California as effectively.

A fund managed by actual property agency Waterton bought the Vue residence tower in 2021, in keeping with CoStar.

(Allen J. Schaben / Los Angeles Instances)

Waterton, primarily based in Chicago, has a portfolio from coast to coast. In a 2020 presentation to a Connecticut funding council, the corporate inspired the state’s pension system to put money into the value-add fund that will later buy the Vue in San Pedro, in keeping with CoStar.

Within the pitch, Waterton mentioned it seeks to hold out “cost-efficient renovations to enhance property efficiency and drive funding returns” and famous it used “hire optimization software program” to “maximize rents and occupancy.”

In an announcement, Chief Govt David Schwartz mentioned Waterton’s value-add investments are useful. The corporate improves widespread areas, fixes plumbing, roof and different constructing deficiencies and renovates flats when individuals transfer out.

“With out this funding technique, a lot of the present housing inventory throughout the nation would go into disrepair, develop into obsolescent, and in some circumstances develop into unlivable,” Schwartz mentioned.

Such funding is supported by growing rents. Whereas hire development varies by group, at Waterton’s California properties it has been “in line” with the overall market, in keeping with Schwartz.

Waterton declined to share the information.

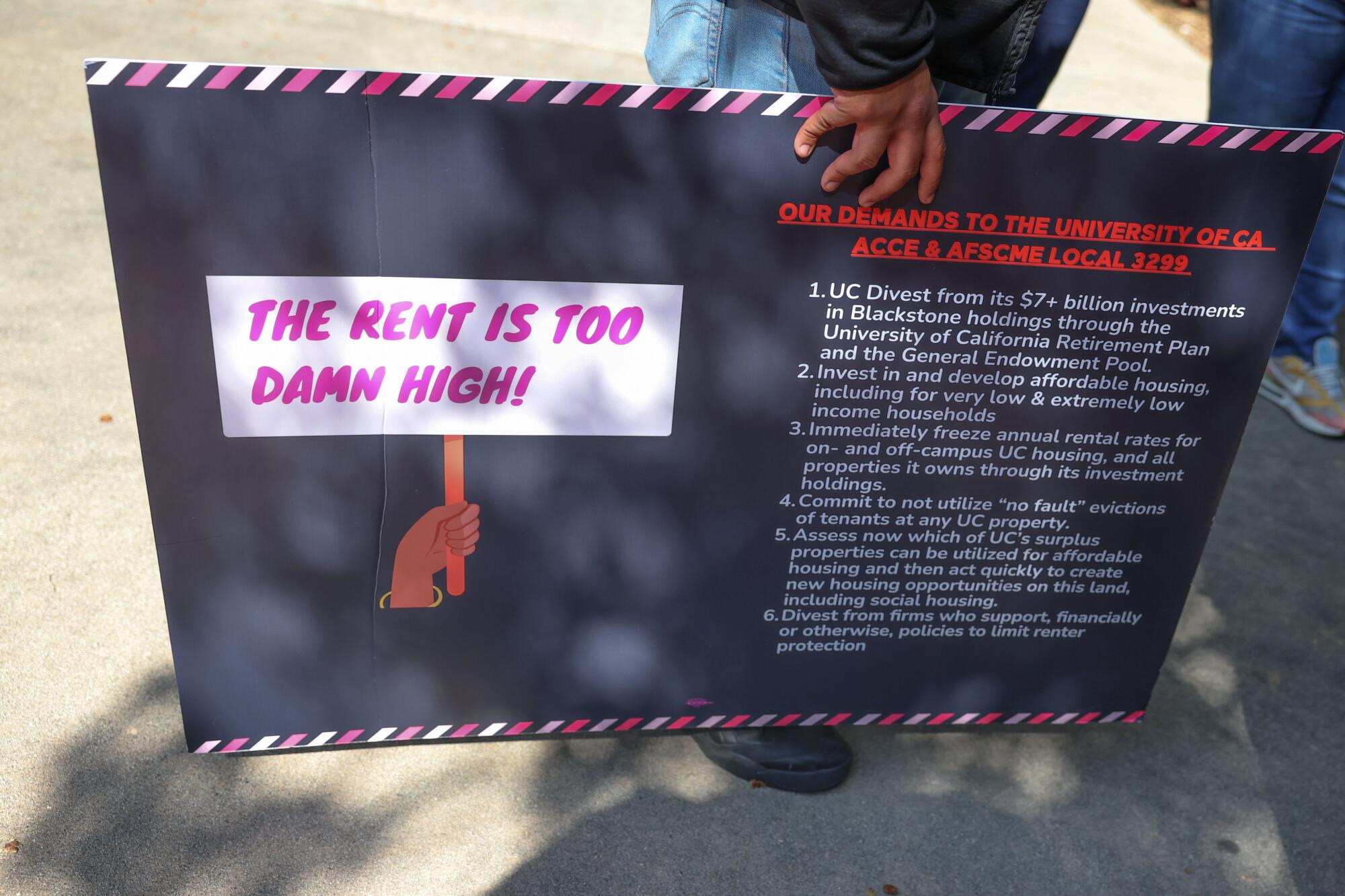

An indication saying “The Lease is Too Rattling Excessive,” is held by Estuardo Mazariegos throughout a protest at UCLA in February calling for the UC Retirement Plan to divest from Blackstone.

(Michael Blackshire / Los Angeles Instances)

With regards to excessive housing prices, many economists agree the driving force is a lack of provide that permits each dwelling sellers and traders to demand larger gross sales costs and rents. In truth, Waterton and Blackstone have cited housing shortages as causes establishments ought to put money into their value-add and opportunistic funds.

Richard Inexperienced, director of the USC Lusk Heart for Actual Property, mentioned there sometimes is a trade-off for such investments. “The upside is it’s a greater constructing and the draw back is it’s much less attainable,” he mentioned. “Higher high quality housing is dearer.”

Shift towards actual property

Public pensions accumulate contributions from staff, native authorities employers and typically the state, and make investments the cash with the hope of incomes sufficient to pay staff once they retire.

If returns aren’t sufficient, governments may very well be compelled to step in and assist cowl the distinction.

Previous to the Eighties, public pensions targeted the overwhelming majority of their funds on conservative investments equivalent to authorities bonds, in keeping with analysis from the Pew Charitable Trusts. In current many years, they’ve dramatically elevated actual property funding.

As funding idea more and more emphasised diversification, actual property turned an possibility that might defend in opposition to inflation, pose much less danger than shares and wouldn’t rise and fall with different investments. It additionally offered robust returns as different choices like bonds struggled within the low-interest fee setting of the previous twenty years.

Residences have proved significantly engaging partly as a result of a provide scarcity helped drive rents up sharply after the Nice Recession and offered pensions a possibility to seize the winnings.

From 2011 by means of final yr, public pensions dedicated a complete of $52.8 billion to privately managed funds devoted particularly to multifamily housing — practically 39% of which was in riskier value-add and opportunistic methods, in keeping with information from Ferguson Companions.

Funding peaked in 2022 and fell again final yr as rising rates of interest chilled the true property market. Even so, pension commitments to value-add and opportunistic multifamily funds final yr have been $2.3 billion, practically seven instances larger than 2011, the information present.

The multifamily figures don’t embody massive, diversified actual property funds that buy flats together with different property sorts equivalent to warehouses and malls.

A kind of is the opportunistic fund that, in keeping with CoStar, acquired the San Diego properties: Blackstone Actual Property Companions IX. At $20.5 billion, the corporate described it because the “the biggest actual property fund ever raised” on the time fundraising wrapped in 2019.

In line with analysis from Reher, the united states professor, from 2009 to 2016, public pensions accounted for 33% of traders in value-add and opportunistic funds that solicited cash from a number of sources and invested it for a restricted time interval, which is the kind of fund within the L.A. Instances evaluation.

Ideally, pensions would make investments solely in safer, long-term actual property methods that aren’t depending on quickly growing rents and getting out comparatively rapidly, mentioned Anthony Randazzo, govt director of the Equable Institute, a nonprofit that seeks to enhance the monetary well being of public retirement programs.

Iraides Gonzalez’ 8-year-old daughter Britany enters the household’s residence in El Cajon to seize a glass of water whereas taking part in along with her associates.

(Gina Ferazzi / Los Angeles Instances)

However many pensions are critically underfunded, an issue that emerged within the 2000s when, following years of expanded advantages, the dot-com bust after which the Nice Recession hammered the worth of pension property.

Randazzo mentioned safer investments alone don’t earn sufficient to backfill underfunded liabilities and will require governments — doubtlessly at their very own monetary danger — to extend contributions to plug the outlet.

“They’re actually, actually hoping that they will … magically make investments their means out of this,” Randazzo mentioned.

In line with The Instances’ evaluation, not all 133 properties reviewed noticed hire climb sooner than surrounding submarkets’.

Rents rose extra slowly than close by flats in practically 35% of the buildings, The Instances discovered.

Funding specialists mentioned that will have occurred for a number of causes. House owners might not have but began renovations or they may have acquired the property at a deep low cost — possibly out of foreclosures — and didn’t want to boost hire as a lot to earn their return.

Hooke, the previous personal fairness govt, had one other idea. In spite of everything, whereas landlords have the facility to boost rents, tenants can go elsewhere.

“It’s not a risk-free proposition doing opportunistic actual property or value-add,” Hooke mentioned. “I believe they screwed up.”

The Los Angeles Metropolis Workers’ Retirement System and the Orange County Workers Retirement System declined to touch upon The Instances’ evaluation, in addition to their investing in value-add and opportunistic funds.

UC Investments, which oversees the College of California’s pension plan that invested within the Blackstone opportunistic fund, equally declined to remark.

Jim Baker, govt director of the Personal Fairness Stakeholder Challenge, mentioned pensions have a duty to make use of members’ cash in methods that won’t damage them or different working individuals.

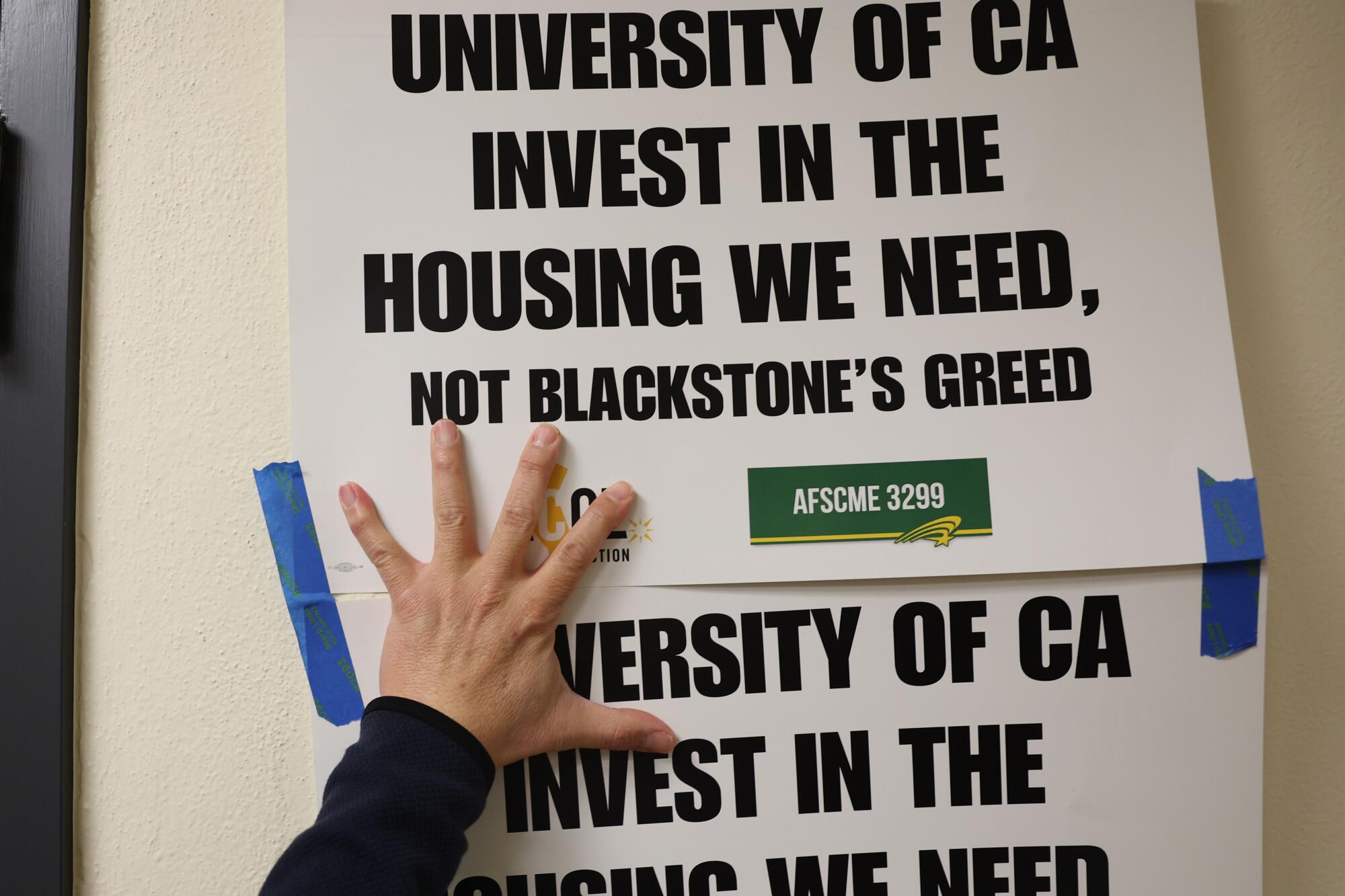

Indicators are positioned within the hallway outdoors the UCLA chancellor’s workplace throughout a protest in February calling for the UC Retirement Plan to divest from Blackstone.

(Michael Blackshire / Los Angeles Instances)

He mentioned The Instances’ findings — in addition to a related evaluation from his group — point out individuals have been negatively impacted and known as on all pensions to undertake particular requirements when making housing investments, together with a 3% hire cap and fast turnarounds for repairs.

Given the dimensions of California public pensions, he argued that in the event that they adopted such insurance policies it might change how personal fairness corporations put money into housing nationwide and thus result in higher outcomes for tenants.

“It’s a large sum of money,” he mentioned. “It might transfer the market.”

The danger

Blackstone is likely one of the largest cash managers within the enterprise.

In its assertion, the corporate mentioned it invests “on behalf of pension funds that present retirement advantages for over 90 million lecturers, firefighters, nurses and others.” Since beginning its opportunistic actual property fund sequence in 1991, Blackstone mentioned it has generated web returns of 15% for “these pensioners and retirees.”

That return degree meets the goal CalSTRS goals for in its opportunistic actual property investments, however such offers don’t at all times prove so rosy.

Timothy Riddiough, a professor on the Wisconsin College of Enterprise, mentioned value-add and opportunistic funds usually goal returns of 13% to twenty%. However in actuality, the funds have achieved solely a ten% return on common, in keeping with his analysis with colleague Da Li that coated funds launched between 1980 and 2014.

Given present turmoil in the true property market, Riddiough mentioned, he expects actual returns to fall additional.

“The personal fairness enterprise — the Blackstones of the world — have been very efficient at promoting to traders that, effectively, each time there’s a downturn, ‘Look, we’ll simply kind a brand new fund,’” Riddiough mentioned. “‘The present funds aren’t doing so nice, however look, we’ll kind a vulture fund and actually make the most of the state of affairs.’”

In April 2023, Blackstone introduced the $30.4-billion Blackstone Actual Property Companions X — practically $10 billion bigger than Blackstone’s earlier fund that acquired the San Diego properties, in keeping with CoStar.

Youngsters play across the pool at Shady Lane Residences, which Blackstone rebranded as Terre at Madison.

(Gina Ferazzi / Los Angeles Instances)

Because the personal fairness agency works to spend these {dollars}, the impacts of earlier offers reverberate.

Again at Blackstone’s Terre at Madison complicated, Iraides Gonzalez acquired a good bigger hire enhance in April — $242 a month — and now pays $2,667, in keeping with lease paperwork. Across the identical time, she mentioned, her boss lowered her hours due to a slowdown at her restaurant.

In a June interview, Gonzalez mentioned she isn’t certain how she’ll pay hire long run. Thus far she’s squeaked by with cash borrowed from her employer.

Instances workers author Paloma Esquivel contributed to this report.