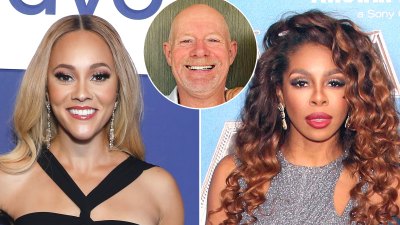

Vicki Gunvalson Wealthy Polk/Bravo

Vicki Gunvalson is being sued by a former consumer of her insurance coverage firm for monetary elder abuse, negligence and fraud, amongst different allegations.

Diane Discipline, who’s 74 years previous, filed her lawsuit in opposition to Gunvalson and enterprise companion Ali Hashemian on the Superior Court docket of California in Orange County in late Might, in keeping with courtroom paperwork obtained by Us Weekly on Wednesday, July 31.

Discipline acknowledged that she and her late husband, George, had a mixed web price of $6 million, and that she managed their funds after he was “significantly injured in a bicycle accident” in 2002. That very same yr, Discipline’s mom died and left an inheritance. Discipline transferred the funds into an Allianz 222 annuity, a financial savings plan that helps lower an individual’s taxes. “Diane has at all times left the cash on this account (by no means been touched) for the only real goal of rising it for her daughter,” she claimed in her submitting.

Discipline recalled assembly Gunvalson, 62, in 2019, when she attended a dinner hosted by The Actual Housewives of Orange County alum and her firm, Coto Insurance coverage & Monetary Companies. In line with Discipline, Gunvalson instructed her on the time “that she may assist her handle her funds.” Discipline claimed she later met with Gunvalson and Hashemian, who promised her that “if she invested her cash with them, she would have decrease earnings taxes and elevated future/potential monetary capital for her kids.”

When George’s well being took a flip for the more serious, Diane employed a live-in caregiver. “Trying again, [she] thinks the anguish and trauma she was enduring presently contributed to her letting herself put her belief in Gunvalson and Hashemian as they appeared so honest and gave the impression to be working for Diane’s greatest pursuits,” the submitting acknowledged.

Discipline alleged that the pair pushed her to spend money on a life insurance coverage coverage with out explaining “how a lot it might value.” Hashemian, she claimed, had mentioned that she wanted to solely make a “one and finished” cost of $300,000 to cowl the $6 million that might be paid to her household after her dying.

In hindsight, “Diane realizes this was an intentional, deceptive, and false misrepresentation. As a substitute, it was the proper time for Hashemian to inform her that she would want to pay $300,000 yearly for this coverage, which he by no means instructed Diane,” the go well with claimed.

Discipline inked a contract in December 2019 in “reliance on Gunvalson’s “fraudulent gross sales techniques” and whereas feeling “despair” over George’s bodily decline. In 2020, she was identified with lung most cancers and had surgical procedure to deal with it. A number of weeks after her operation, she paid one other $300,000 towards her life insurance coverage.

“Though she thought she solely needed to make this $300,000 cost as soon as when she opened the coverage based mostly on what Hashemian had promised her, her arms have been tied up, and he or she paid it once more as a result of she felt like she had no different selection,” the authorized docs claimed.

George died in October 2021, and Discipline claimed that afterward, Gunvalson and Hashemian persuaded her to place George’s funds right into a standalone annuity account. The next yr, “she began to query why she was paying this $300,000 premium but once more, as this was not what Hashemian had promised her, however she went forward and did it anyway, as her husband had just lately handed away and he or she was nonetheless mourning his loss (and he or she was recovering from her personal hip surgical procedure).”

In December 2022, Discipline claimed that she emailed Gunvalson and Hashemian, writing that “she felt uninformed by them and that the annuities and life insurance coverage coverage they satisfied her to open didn’t appear to be one of the best investments for her, as they tie up massive sums of cash for a very long time that she might by no means be capable of use, for possibly longer than she is going to stay or can be too previous to take pleasure in.”

In March 2023, Gunvalson provided Discipline the choice to decrease her life-insurance premium to $100,000 yearly, and Discipline took the deal and “bought a few of her inventory” to make that first $100K cost. In the meantime, her dying profit had been diminished to $3.5 million.

When Discipline was purported to pay the subsequent $100K within the spring of 2024, Gunvalson “repeatedly contacted Diane to remind her.” As a substitute, Discipline bypassed Gunvalson and “reached out to Allianz straight in April 2024 to see what the due date was, and a consultant at Allianz instructed Diane that she had over $600,000 in her account since she was beforehand paying $300,000 a yr in premiums. Diane was instructed that she doesn’t should ship any cost in any respect due to this extra in her account.”

In conclusion, Discipline’s go well with declared, “Defendants deliberate and engaged of their sample of elder monetary abuse with malice, oppression, and fraud.”

Us Weekly has reached out to Gunvalson, Hashemian and Coto Insurance coverage for remark.

This wasn’t the primary time one among Gunvalson’s former purchasers has sued her. Joan Lile, then 82, accused the fact star in 2019 of elevating premium prices. That lawsuit was dismissed with prejudice.

Gunvalson’s former costar, Teddi Mellencamp, seemingly reacted to the lawsuit on Tuesday, July 30, writing on X, “I HAVE NEVER ABUSED MULTIPLE ELDERS IN MY LIFE.” RHOC followers will know that Mellencamp, 43, was riffing on an iconic Gunvalson line from season 8 of the collection. That line: “I’ve by no means been with a number of companions in my life!”