Over the past couple of years, the know-how trade has develop into overwhelmingly enamored with synthetic intelligence (AI). Specifically, semiconductor shares have witnessed newfound development and traders can not seem to get sufficient. Whereas Nvidia is the largest icon within the chip house proper now, I see one other firm rising as a superior funding over the subsequent a number of years.

Let’s discover why Taiwan Semiconductor Manufacturing (NYSE: TSM) — generally referred to as TSMC — may be probably the most profitable alternative of all on the intersection of AI and chipmaking.

Nvidia is within the driver’s seat, however…

Nvidia specializes within the growth of superior semiconductor chips referred to as graphics processing items (GPUs). GPUs are a core part throughout many generative AI purposes comparable to coaching giant language fashions (LLMs).

Proper now, Nvidia’s A100, H100, and new Blackwell GPUs are extensively perceived as one of the best chips available on the market. It is no shock to study that Nvidia has an estimated 80% market share within the AI-powered chip house.

Given the outsize demand for Nvidia’s chips, the corporate has amassed vital pricing energy over the competitors. This dynamic has performed a giant function in Nvidia’s present development, as seen within the chart under.

Nvidia inventory is up a staggering 157% over the past yr. Whereas there may be probably nonetheless cash to be made proudly owning the inventory, traders ought to all the time be fascinated by the long term.

Taiwan Semiconductor is the engine powering the automobile

Contemplating the extent of development throughout Nvidia’s whole enterprise, I feel it is protected to say that the corporate is the principle driver within the chip race.

Nonetheless, Taiwan Semiconductor is quietly taking part in an infinite function within the background, fueling the automobile. Whereas Nvidia designs among the world’s main GPU processors, the corporate doesn’t focus on manufacturing. Quite, Nvidia outsources a lot of its manufacturing course of to Taiwan Semiconductor.

TSMC operates superior fabrication amenities the place these chips are literally made. Furthermore, Nvidia is only one of many main semiconductor firms that depend on Taiwan Semiconductor. Apart from Nvidia, TSMC additionally makes chips for Superior Micro Units, Broadcom, Intel, Sony, Qualcomm, NXP Semiconductors, and Amazon.

Is Taiwan Semiconductor inventory a great purchase proper now?

The plain takeaway from among the themes explored above is that Taiwan Semiconductor’s companies are in excessive demand. However the extra delicate alternative that I see is that the corporate’s development is basically simply starting.

Nvidia faces stiff competitors within the GPU and information middle house, and I believe the corporate’s present degree of momentum will ultimately start to gradual. As such, I would not be stunned to see Nvidia’s income and revenue acceleration begin to dip over the subsequent a number of years.

Conversely, Taiwan Semiconductor works with a wide range of firms throughout the broader chip trade. Given the breadth of TSMC’s buyer base, I see the corporate because the engine powering many of those chip companies. Subsequently, I feel demand for Taiwan Semiconductor’s manufacturing capabilities will proceed to thrive for years to come back.

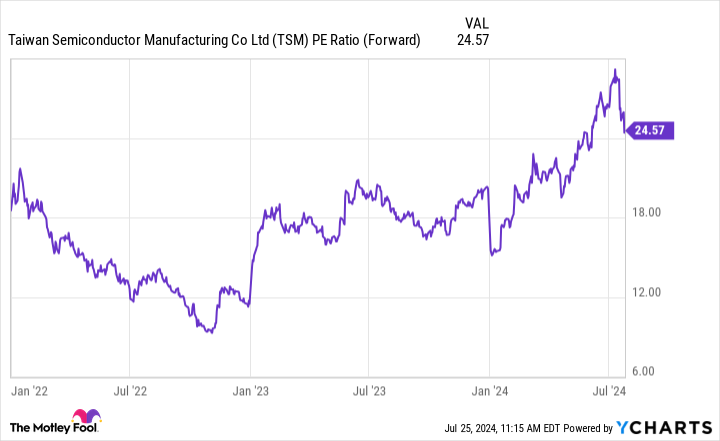

The one space to keep watch over with Taiwan Semiconductor inventory is its valuation. The corporate at the moment trades at a ahead price-to-earnings (P/E) ratio of 24.6 — and per the chart above, there’s been some clear valuation growth all through a lot of 2024.

Whereas this might counsel that some future development is already baked into the inventory, I would not get too caught up in attempting to time the proper second to scoop up some shares.

As a substitute, I feel utilizing a dollar-cost averaging technique over a long-term horizon is the optimum option to begin constructing a place. To me, TSMC has huge potential for the lengthy haul and I do not see the corporate dropping momentum anytime quickly. Traders who’re in search of publicity to AI and the chip house might wish to take into account a place in Taiwan Semiconductor and put together to carry for the long term.

Must you make investments $1,000 in Taiwan Semiconductor Manufacturing proper now?

Before you purchase inventory in Taiwan Semiconductor Manufacturing, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Taiwan Semiconductor Manufacturing wasn’t one in every of them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $692,784!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 29, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Amazon and Nvidia. The Motley Idiot has positions in and recommends Superior Micro Units, Amazon, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Broadcom, Intel, and NXP Semiconductors and recommends the next choices: lengthy January 2025 $45 calls on Intel and brief August 2024 $35 calls on Intel. The Motley Idiot has a disclosure coverage.

Prediction: This Synthetic Intelligence (AI) Semiconductor Inventory Will Be the Finest Chip Firm to Personal Over the Subsequent Decade (Trace: Not Nvidia) was initially printed by The Motley Idiot