Shares of Intel (NASDAQ: INTC) rallied as a lot as 8.2% at this time, earlier than settling again right into a 2.4% acquire as of 12:40 p.m. ET.

Whereas that acquire in and of itself wasn’t particularly notable in isolation, it was fairly notable in gentle of the large declines throughout a lot of the remainder of the semiconductor sector. As an illustration, the VanEck Semiconductor ETF (NASDAQ: SMH) was down round 5% on the identical time Intel was up 2.4%.

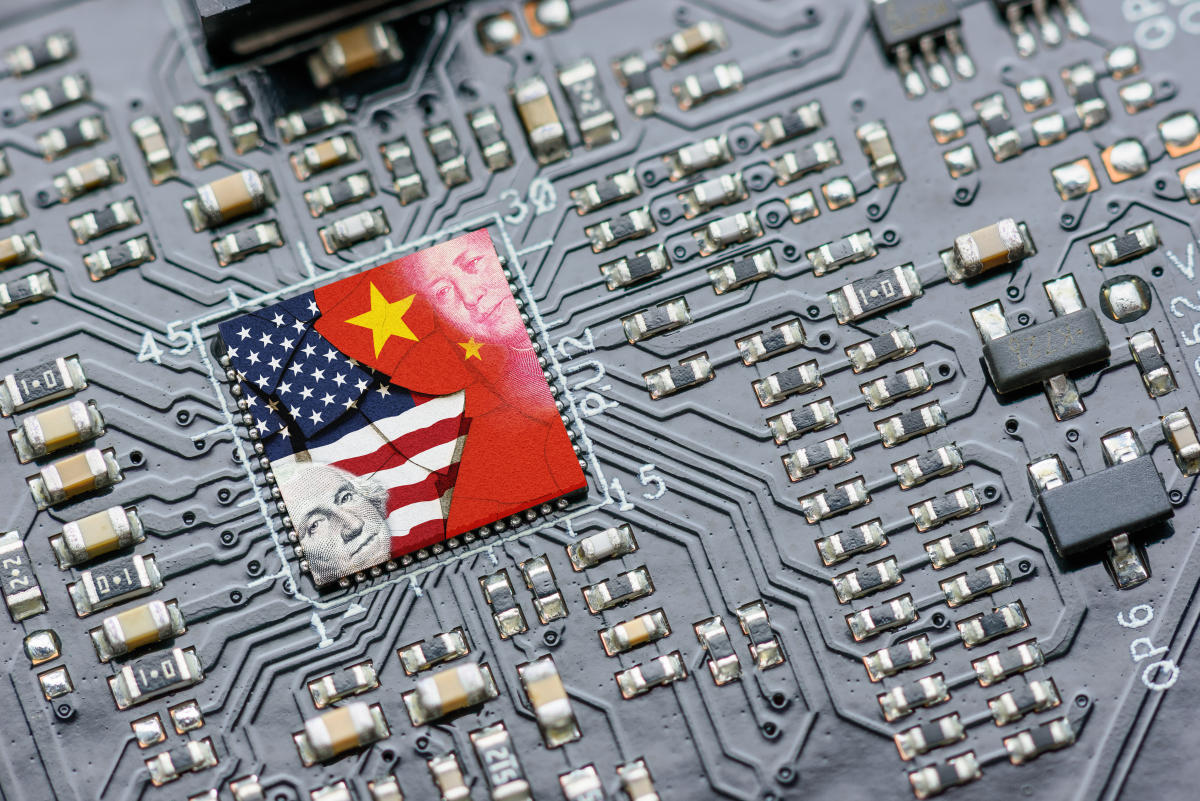

The discrepancy possible needed to do with feedback from former President Donald Trump, which raised questions as as to if the U.S. would defend Taiwan within the occasion of a Chinese language invasion.

Intel is the best way to carry chipmaking again onshore

There was different information at this time in chip world, with ASML Holdings (NASDAQ: ASML) reporting better-than-expected earnings, though with a second-quarter outlook that, whereas calling for quarter-over-quarter development, got here in a bit under what analysts have been anticipating.

One other doable bearish component round chip gear shares at this time was chatter round additional potential curbs on gear gross sales to China. Right now, Bloomberg reported the Biden Administration was “floating” the concept for elevated curbs on gear from Netherlands-based ASML and Japan-based Tokyo Electron (OTC: TOEL.Y), which the administration believes may nonetheless be promoting superior know-how to China, regardless of 2022 curbs on U.S.-based semi-cap gear gross sales to China.

Nonetheless, these two information objects do not clarify why Intel could be up on a day when nearly all different main chipmakers are down. Intel additionally sells some chips into China, and is a purchaser of ASML’s machines.

Thus, the rationale possible must be feedback made by Trump in a Bloomberg Businessweek interview that was printed at this time. In it, when requested about defending Taiwan within the occasion of a Chinese language invasion, the previous president and present Republican presidential candidate mentioned:

They did take about 100% of our chip enterprise. I believe, Taiwan ought to pay us for protection… , we’re no totally different than an insurance coverage firm. Taiwan would not give us something.

It is no surprise that these feedback despatched most chipmakers down considerably at this time. Taiwan is dwelling to Taiwan Semiconductor Manufacturing (NYSE: TSM), which has a present lead in superior chipmaking, and the place nearly all of at this time’s modern chips are produced. So if China have been to invade Taiwan and reduce off chip gross sales to the U.S., it may result in an financial disaster.

Nevertheless, Intel is speeding to place itself as a safe various, as the one chipmaker moreover Korea’s Samsung that also has modern manufacturing fabs. Below CEO Pat Gelsinger, Intel is investing considerably to construct out a modern foundry ecosystem for third events in a bid to compete with TSMC.

Presently, Intel is constructing or increasing its manufacturing in Arizona, Ohio, Oregon, Israel, Eire, and Germany in a bid to grow to be a geopolitically secure dwelling for superior chip designers that wish to transfer some or all of their manufacturing out of Taiwan.

Intel is constructing out this footprint with the assistance of funding from the CHIPS Act, which was handed on a bipartisan foundation in July 2022.

TSMC can also be getting CHIPS Act funding with the intention to construct modern fabs in Arizona as effectively. Nevertheless, TSMC would nonetheless have the overwhelming majority of its most-advanced manufacturing in Taiwan, even after that diversification. With Intel’s footprint 100% outdoors of Taiwan, it will stand to learn considerably ought to Taiwanese chipmaking come into query.

A struggle would nonetheless be disastrous, however considerations over safety may benefit Intel

If Trump wins the election after which China invades Taiwan unopposed by U.S. protection, it will in all probability drag Intel down as effectively, simply because of the vital broad world financial penalties.

Nevertheless, heightened dangers over Taiwan may spur extra chipmakers to maneuver some or all of their manufacturing to Intel’s foundry as a substitute of TSMC’s. Provided that Intel has little or no third-party foundry income at this time, these geopolitical considerations ought to assist it develop that enterprise quicker than analysts count on.

Must you make investments $1,000 in Intel proper now?

Before you purchase inventory in Intel, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Intel wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $774,281!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 15, 2024

Billy Duberstein and/or his purchasers have positions in ASML, Intel, and Taiwan Semiconductor Manufacturing. The Motley Idiot has positions in and recommends ASML and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and brief August 2024 $35 calls on Intel. The Motley Idiot has a disclosure coverage.

Why Intel Shares Rallied Right now on a Dangerous Day for Different Chip Shares was initially printed by The Motley Idiot