It is a uncommon time to be an investor on Wall Avenue. Whereas it is completely regular for a next-big-thing innovation, know-how, or development to be charming buyers’ consideration, having two tendencies vying for curiosity on the identical time does not occur typically.

Though synthetic intelligence (AI) is the core catalyst that is despatched the enduring Dow Jones Industrial Common, broad-based S&P 500, and growth-focused Nasdaq Composite to record-closing highs in 2024, stock-split euphoria has performed a key position, too.

A inventory cut up is an occasion that enables a publicly traded firm the chance to change its share value and excellent share rely. What’s noteworthy about splits is that they are completely beauty, with an organization’s market cap and working efficiency being unaffected.

Inventory splits are available two varieties, ahead and reverse, with buyers undeniably favoring the previous. With a forward-stock cut up, an organization is purposely decreasing its share value to make it extra nominally inexpensive for retail buyers and/or its workers. Comparatively, the objective of a reverse-stock cut up is to extend a publicly traded firm’s share value, typically to make sure that it meets the minimal continued itemizing requirements of a significant inventory change.

The rationale buyers favor ahead splits is as a result of they’re undertaken by extremely progressive firms that persistently out-execute their friends.

Since 2024 started, round a dozen high-profile companies have introduced a inventory cut up. Nonetheless, none had been extra anticipated than that of AI titans Nvidia (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO).

Synthetic intelligence leaders Nvidia and Broadcom turned Wall Avenue’s latest stock-split shares

Nvidia’s board kicked issues off on Might 22, with the corporate saying a 10-for-1 ahead cut up, which turned efficient after the closing bell on June 7. This marked the sixth inventory cut up for Nvidia since going public in January 1999.

Not lengthy after, on June 12, Broadcom’s board made historical past by saying its first-ever inventory cut up, which coincidentally was additionally of the 10-for-1 selection. Broadcom’s cut up went into impact after the shut of buying and selling on Friday, July 12, with shares buying and selling at their split-adjusted value as of right now, July 15.

Whereas there’s pure pleasure about an organization’s inventory being extra nominally inexpensive for on a regular basis buyers, synthetic intelligence has been the driving pressure for each firms.

Nvidia’s declare to fame is its first-mover benefits with AI-graphics processing models (GPUs). In 2023, 98% of the three.85 million AI-GPUs that had been shipped got here from Nvidia, based on semiconductor evaluation agency TechInsights. The corporate’s H100 GPU has grow to be the go-to chip desired by companies wanting to coach massive language fashions and run generative AI options.

What’s extra, buyers are enthusiastic about the way forward for Nvidia’s AI-GPU structure. The corporate’s Blackwell platform, which affords accelerated computing enhancements in various areas, together with quantum computing and generative AI, is about to start delivery to prospects later this 12 months. In the meantime, in June, CEO Jensen Huang teased the discharge of the Rubin platform by 2026.

As for Broadcom, it is shortly grow to be the premier identify in AI-driven networking options. It capitalized on the bogus intelligence hype final 12 months by introducing its Jericho3-AI cloth in April 2023, which is ready to join as much as 32,000 GPUs in AI-accelerated information facilities. Jericho3 is an answer that is designed to maximise the compute capability of GPUs — one thing needed for the split-second decision-making required of AI software program and programs — in addition to cut back tail latency.

Broadcom has additionally been a preferred associate for a number of the largest and most-influential tech firms, together with infrastructure big Dell Applied sciences and Alphabet, the mother or father firm of web search engine Google and cloud infrastructure service platform Google Cloud.

Broadcom can run circles round Nvidia over the following 5 years

Primarily based on historic information from Financial institution of America International Analysis that dates again to 1980, firms conducting forward-stock splits have averaged a 25.4% return within the 12 months following their announcement. That is greater than double the typical annual return of 11.9% for the benchmark S&P 500 over the comparable interval. Statistically talking, Nvidia and Broadcom would seem like poised for extra upside.

However dig beneath the floor and you will find various clear-cut explanation why Broadcom has the instruments and intangibles to handily outperform Nvidia’s inventory over the approaching 5 years.

If there is a prevailing theme that makes Broadcom the far more-favorable inventory to personal within the coming years, it is historical past. Because the proliferation of the web three many years in the past, no next-big-thing innovation, know-how, or development has averted a bubble-bursting occasion early in its existence. This can be a roundabout approach of claiming that buyers persistently overestimate the utility and/or adoption of recent improvements and applied sciences, and synthetic intelligence is unlikely to be the exception to this unwritten rule.

The whole thing of Nvidia’s almost $3 trillion improve in market worth for the reason that begin of 2023 has come on the heels of its AI-GPUs and CUDA platform, which is a toolkit that helps builders construct massive language fashions. If the AI bubble had been to burst in some unspecified time in the future sooner or later, Nvidia’s inventory would most likely be clobbered greater than every other AI firm.

Though Broadcom has additionally loved a large increase from AI, it is a significantly more-diversified firm that may fare higher if historical past had been to rhyme. For instance, Broadcom generates a notable proportion of its gross sales from wi-fi chips and equipment utilized in next-generation smartphones. It additionally makes optical elements utilized in industrial tools, networking options for newer vehicles, and cybersecurity options, to call a small variety of its different ventures and gross sales channels. Whereas the bursting of the AI bubble can be damning for Nvidia, it would not be an end-all for Broadcom.

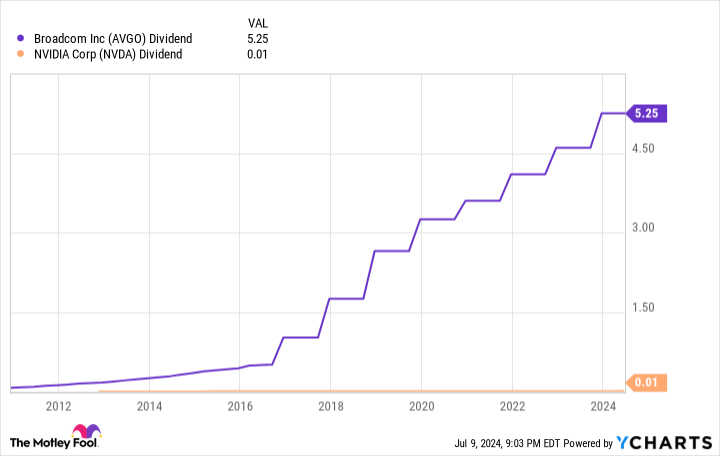

One thing else to contemplate is that Broadcom’s quickly rising dividend supplies a safer basis and, arguably, extra mature investor base than Nvidia. Even with Nvidia just lately rising its quarterly payout by 150% to $0.01 per share on a post-split foundation, the corporate’s token yield is just 0.03%.

Comparatively, Broadcom’s quarterly payout has catapulted larger by 7,400% since late 2010. Whereas the corporate had beforehand been pacing a $0.28 base annual payout, Broadcom is now on observe to dole out a cumulative $21/share yearly to its buyers. That is adequate for a 1.2% yield, and it demonstrates how constant Broadcom’s development in working money circulation has been for the reason that finish of the Nice Recession.

The ultimate cause Broadcom can handily outperform Nvidia within the return column over the following 5 years is their respective valuations. Nvidia’s trailing-12-month (TTM) value to gross sales (P/S) ratio just lately topped 40. This successfully matches the TTM P/S peaks witnessed previous to the dot-com bubble bursting from the likes of Amazon and Cisco Methods.

Though Broadcom’s TTM P/S ratio of 19 is significantly larger than its common of 5 to 7 occasions gross sales over a lot of the final decade, it’s going to have a a lot simpler time rising into its present valuation than Nvidia.

Between Wall Avenue’s two premier stock-split shares, Broadcom seems to be a better long-term funding than Nvidia.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $791,929!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 8, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Financial institution of America is an promoting associate of The Ascent, a Motley Idiot firm. Sean Williams has positions in Alphabet, Amazon, and Financial institution of America. The Motley Idiot has positions in and recommends Alphabet, Amazon, Financial institution of America, Cisco Methods, and Nvidia. The Motley Idiot recommends Broadcom. The Motley Idiot has a disclosure coverage.

Nvidia and Broadcom Have Accomplished Their 10-for-1 Inventory Splits, however Their Outlooks Differ Dramatically Over the Subsequent 5 Years was initially revealed by The Motley Idiot