Costco Wholesale (NASDAQ: COST) and Amazon (NASDAQ: AMZN) are each categorized as retail shares, however their diverse enterprise fashions make for some difficult comparisons when making an attempt to find out which is the higher funding.

One commonality is that each firms are leaders of their respective areas of retail (Costco leads the wholesale brick-and-mortar sector and Amazon is the king of e-commerce). Costco has vastly expanded its on-line presence lately so some comparisons are getting simpler. Likewise, Amazon is constructing a place in grocery shops with its subsidiary Complete Meals.

One vital commonality is that they each use a subscription-based mannequin to extend gross sales and encourage model loyalty. Costco has discovered appreciable success in providing an annual membership for entry to its tremendous aggressive product pricing. Amazon’s Prime membership offers members entry to cheaper and extra environment friendly transport (in addition to different perks). Each firms boast a formidable renewal price on these memberships. These subscription fashions pave the way in which for dependable development over the long run, serving to each firms fear much less about product gross sales and extra about membership development.

On the investor facet, that regular earnings is engaging and it has helped each Costco and Amazon shares ship market-beating positive factors over the previous a number of years (see chart above). Even higher, each shares are anticipated to proceed this above-average efficiency, providing new traders an opportunity to get in on the continued development.

However for those who solely had room so as to add considered one of these retail shares to your portfolio, which do you have to select? Which one has a greater likelihood to revenue from the retail sector’s continued development over the subsequent decade?

The case for Costco

As measured by market cap, Costco (at $390 billion) is the world’s third-largest retailer (trailing solely Amazon and Walmart). The corporate has come a good distance in the course of the almost 50 years it is existed. Costco now operates 879 warehouses throughout 14 nations. But it has barely scratched the floor of its growth potential.

Costco’s comparatively distinctive enterprise mannequin provides paying membership members entry to wholesale costs on hundreds of merchandise throughout a number of classes. The corporate’s priorities emphasize high quality merchandise and low-margin costs catered to the numerous cultures of the nations it operates in. Its earnings proceed to rise regardless of its low margins and investments in worldwide growth because of environment friendly operations, loyal prospects, and regular membership charges.

Over the previous 5 years, Costco’s annual income and working earnings have jumped 59% and 71%, whereas free money stream has soared by 121%. For reference, Walmart’s free money stream fell 14% throughout the identical interval.

And regardless of its regular development (together with reaching 714 areas in North America), the retail large nonetheless has loads of room so as to add extra shops and develop its footprint. Costco has seven or fewer shops in six of the 14 nations it operates in, suggesting it is solely simply getting began in these markets. Its growth will solely be helped by the 91% membership renewal price the corporate has worldwide, which noticed it hit 128 million members in 2023.

Furthermore, e-commerce has turn into a significant development catalyst for Costco lately. Within the third quarter of 2024, e-commerce gross sales rose 21% yr over yr, greater than double the expansion from some other section and even outperforming Amazon’s retail development in the identical quarter.

As already famous, traders are interested in Costco’s enterprise mannequin. In consequence, shares in Costco have delivered triple-digit development during the last 5 years. That elevated share value efficiency has additionally elevated the inventory’s valuation effectively above its 10-year common. That elevated valuation is cheap, although, given its development potential.

The case for Amazon

Like Costco, Amazon has amassed a substantial consumer base. Its subscription-based mannequin has seen Amazon Prime achieve over 200 million subscribers worldwide, boasting a 99% 2-year renewal price within the U.S. Prime has turn into so ubiquitous that roughly 71% of all U.S. Amazon consumers are members.

Amazon’s annual income and working earnings have risen by 105% and 153%, respectively, during the last 5 years, and its free money stream is up 111%. That development has come regardless of the financial turbulence of 2021 and 2022, proving the resiliency of Amazon’s enterprise.

Nonetheless, Amazon’s overwhelming presence in on-line retail has brought on e-commerce development to sluggish, with gross sales in Q1 2024 up 5% in comparison with complete income development of 13% yr over yr. In consequence, the corporate has steadily reinvested its positive factors into diversifying its income streams, turning into one of the vital outstanding names in tech. The corporate is dwelling to the world’s largest cloud platform, Amazon Internet Companies (AWS), and is liable for a number one 22% market share in video steaming because of the success of Prime Video.

Whereas retail continues to ship gross sales development, the corporate’s positions in cloud computing and streaming are boosting earnings much more. Within the first quarter, AWS income spiked by 17% yr over yr, whereas working earnings almost doubled. In the meantime, promoting providers gross sales jumped 24% yr over yr after Amazon launched advertisements on Prime Video.

Amazon has constructed itself right into a behemoth in retail and tech. The expansion catalysts throughout each industries make its inventory value contemplating. Its valuation is elevated in comparison with a median inventory, however low in comparison with different tech shares and never unhealthy in comparison with its 10-year common. Given its development potential going ahead, its valuation is cheap.

Is Costco or Amazon the most effective inventory to purchase proper now?

As was famous on the prime, evaluating these two shares is not straightforward. They are surely totally different firms with various factors influencing the funding thesis for every. Discovering monetary metrics that enable for honest comparisons is not straightforward both. How do you pretty evaluate what’s finest described as a tech development inventory to what’s finest described as a retail sector dividend inventory?

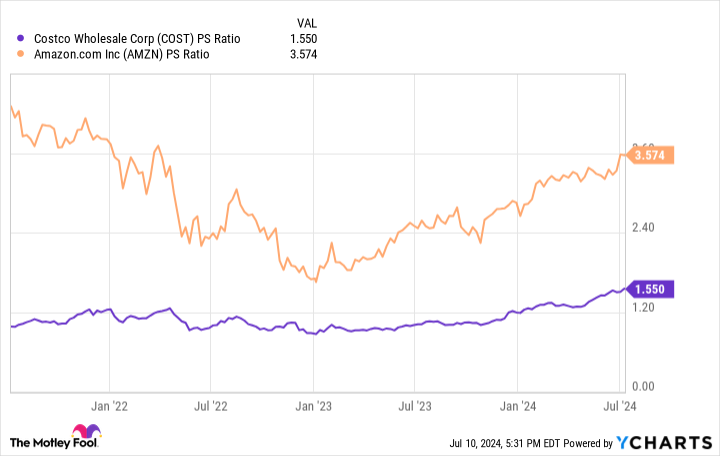

Even a primary metric just like the price-to-sales ratio (P/S) is not excellent. The chart under would appear to point Amazon is the dearer inventory to purchase proper now.

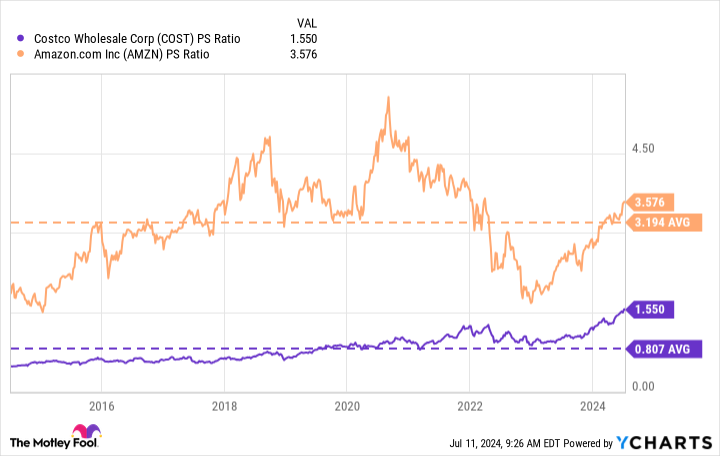

However increase that chart out over a decade and embody 10-year averages, and also you see that the reply is extra difficult. Amazon inventory is definitely buying and selling round its common P/S whereas Costco is buying and selling roughly twice its common P/S over the previous decade. That means Costco is the dearer inventory.

It is honest to say that each Costco and Amazon are killing it of their respective industries, and each firms’ shares are prone to raise any portfolio over the long run. So the selection between these firms actually comes right down to your funding model.

One other take a look at the chart above reveals that Amazon’s P/S has been erratic over the previous decade, whereas Costco’s has remained extra steady. Amazon’s focus and earnings are progressively shifting away from retail and extra into tech, an trade that typically provides vital positive factors over the long run however may endure short-term steep declines once in a while. Costco has supplied extra dependable development.

So, for those who’re prepared to carry throughout potential market downturns so as to achieve publicity to high-growth markets like cloud computing, synthetic intelligence, and digital promoting, Amazon inventory is a superb possibility. In the event you choose a gentle development inventory (additionally providing a dividend) that you may simply purchase and neglect about over the subsequent decade, you is likely to be higher suited to Costco’s inventory.

Given my investing objectives and pursuits, Amazon is the higher purchase than Costco in the intervening time.

Must you make investments $1,000 in Amazon proper now?

Before you purchase inventory in Amazon, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 finest shares for traders to purchase now… and Amazon wasn’t considered one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $791,929!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 8, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Dani Cook dinner has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, Costco Wholesale, and Walmart. The Motley Idiot has a disclosure coverage.

Finest Inventory to Purchase Proper Now: Costco vs. Amazon was initially revealed by The Motley Idiot