Nvidia (NASDAQ: NVDA) has been one of many hottest shares in the marketplace because the starting of 2023, clocking beautiful beneficial properties of 799% and outpacing the S&P 500 index’s 45% soar by an enormous margin. This was as a result of spectacular development within the firm’s income and earnings as a result of wholesome demand for its synthetic intelligence (AI) chips.

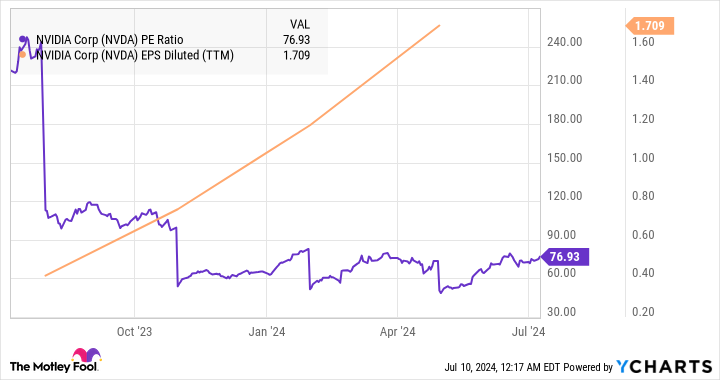

This phenomenal surge is why Nvidia is now buying and selling at a wealthy valuation. Its price-to-earnings (P/E) ratio of 77 is nicely above the Nasdaq 100 index’s a number of of 32 (utilizing the index as a proxy for tech shares). For this reason some Wall Avenue analysts are actually involved concerning the firm’s skill to maintain its red-hot rally.

New Avenue Analysis lately downgraded Nvidia from purchase to impartial, citing the inventory’s valuation. Analyst Pierre Ferragu has a one-year worth goal of $135 on the inventory, which factors towards a really restricted upside from present ranges. In the meantime, the inventory’s median one-year worth goal of $130, as per 62 analysts masking the inventory, additionally signifies that it is unlikely to ship extra beneficial properties.

Does this imply it is now time for traders to e-book their income and promote Nvidia inventory?

Can Nvidia proceed to outperform the market’s expectations?

New Avenue Analysis believes that Nvidia inventory may ship extra beneficial properties provided that there is a sizable enhance in its outlook past 2025. It is analysts aren’t satisfied that this situation goes to materialize simply but. The mixture of Nvidia’s wealthy valuation and issues about sustaining its terrific development subsequent 12 months appears to have dented confidence within the firm.

However a better take a look at the potential development of the AI chip market, which Nvidia dominates, and the corporate’s sturdy pricing energy counsel it may certainly maintain wholesome development in 2025 and past. Market analysis agency TechNavio is forecasting the AI chip market will see an unbelievable annual development fee of 68% by way of 2028, including $390 billion in incremental income.

With an estimated 94% share of this market, Nvidia stays in a terrific place to capitalize on this chance. In fact, there’s competitors from the likes of AMD and Intel within the AI chip market, however Nvidia is anticipated to stay the dominant participant. For instance, Citigroup expects Nvidia to regulate between 90% and 95% of the AI chip market in 2024 and 2025.

One cause that could be the case is due to the Nvidia’s skill to command a know-how lead over rivals. Its next-generation Blackwell AI chips are already in full manufacturing, as administration mentioned on the newest earnings convention name. It additionally identified that the demand for Blackwell is “nicely forward of provide, and we count on demand might exceed provide nicely into subsequent 12 months.”

It is value noting that Nvidia’s Blackwell chips are manufactured on a 4-nanometer (nm) node. For comparability, AMD’s flagship MI300X AI accelerator is reportedly manufactured on a 5nm and 6nm course of. The smaller course of node permits Nvidia to pack in additional transistors, making its chips extra highly effective and vitality environment friendly.

Extra particularly, the Blackwell chips pack 208 billion transistors, as in comparison with 153 billion transistors on the MI300X. This explains why the demand for Nvidia’s new processors exceeds provide. Furthermore, even when Nvidia had been to lose floor within the AI chip market sooner or later, its knowledge middle income is anticipated to multiply considerably, due to the huge addressable alternative current on this area.

All this explains why Nvidia’s income estimates have been heading larger constantly of late.

Furthermore, analysts are estimating Nvidia’s earnings to extend at an annual fee of 43% for the following 5 years. Based mostly on its earnings of $1.19 per share in fiscal 2024, the corporate’s backside line may soar to $7.11 after 5 years. Multiply that with the Nasdaq 100’s ahead earnings a number of of 29.5 and Nvidia’s inventory worth may enhance to $210, implying a 60% upside from present ranges.

It might not be a good suggestion to promote shares of Nvidia proper now, and a better take a look at the corporate’s valuation signifies it is not actually costly when contemplating the expansion that the inventory is anticipated to ship.

The chipmaker’s valuation is justified

Whereas it is true that Nvidia inventory is pricey proper now when in comparison with the broader index, it might be fallacious to check out its valuation in isolation. The corporate delivered a 262% year-over-year enhance in income in fiscal Q1 to a file $26 billion, together with a 461% enhance in adjusted earnings. For comparability, the S&P 500 index’s earnings grew an estimated 7.1% within the first quarter of the calendar 12 months.

Because it seems, Nvidia’s fast earnings development is why its P/E has dropped previously 12 months, signifying that it has been capable of justify the premium valuation.

The corporate’s ahead P/E ratio of 48 is not very costly contemplating that the U.S. know-how sector has an identical earnings a number of. So promoting Nvidia inventory based mostly on its valuation would not appear to be a good suggestion. The terrific development that it has been delivering and its skill to maintain it may lead to extra upside in the long term.

Don’t miss this second likelihood at a doubtlessly profitable alternative

Ever really feel such as you missed the boat in shopping for essentially the most profitable shares? Then you definately’ll need to hear this.

On uncommon events, our professional group of analysts points a “Double Down” inventory suggestion for firms that they assume are about to pop. In the event you’re frightened you’ve already missed your likelihood to speculate, now could be the most effective time to purchase earlier than it’s too late. And the numbers converse for themselves:

-

Amazon: if you happen to invested $1,000 after we doubled down in 2010, you’d have $21,968!*

-

Apple: if you happen to invested $1,000 after we doubled down in 2008, you’d have $43,001!*

-

Netflix: if you happen to invested $1,000 after we doubled down in 2004, you’d have $352,022!*

Proper now, we’re issuing “Double Down” alerts for 3 unbelievable firms, and there might not be one other likelihood like this anytime quickly.

*Inventory Advisor returns as of July 8, 2024

Citigroup is an promoting accomplice of The Ascent, a Motley Idiot firm. Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units and Nvidia. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and quick August 2024 $35 calls on Intel. The Motley Idiot has a disclosure coverage.

Is It Lastly Time to Promote Nvidia Inventory? was initially printed by The Motley Idiot