Shares of Amazon (NASDAQ: AMZN) hit an all-time excessive this week after rising 53% during the last 12 months. The corporate has rallied Wall Road with a number of quarters of stellar monetary development and an increasing function in synthetic intelligence (AI).

Amazon Net Providers’ (AWS) dominance within the cloud business grants the corporate a promising place in AI, as increasingly more companies flip to such platforms for his or her AI wants. In the meantime, the corporate has introduced a enterprise into chip design. Amazon has an thrilling outlook in AI and would probably make an asset to any portfolio over the long run. Nevertheless, its inventory development during the last yr hasn’t precisely matched its earnings development, which means its shares are barely overpriced for now.

This desk exhibits Amazon has the best price-to-earnings (P/E) and price-to-free money movement ratios out of among the most distinguished names in AI software program. The figures recommend Amazon is presently one of many worst-valued shares amongst its friends.

Nevertheless, two firms stand out as cut price buys within the area, indicating they could possibly be value contemplating over Amazon: Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) and Apple (NASDAQ: AAPL). These tech giants are investing closely in AI and will see important beneficial properties because the business develops.

So, neglect Amazon and take into account shopping for these two synthetic intelligence shares now.

1. Alphabet

Alphabet is a no brainer at its present value level. The corporate has delivered important earnings and inventory development during the last yr, but is buying and selling at a cut price value in comparison with its friends. In the meantime, Alphabet has the model energy, tech, and money reserves to go far in AI.

The corporate’s Google Cloud platform holds an 11% market share in cloud computing, in comparison with AWS’ 31%. It is the third-largest cloud firm after Amazon and Microsoft. Nevertheless, it is outpacing each in development.

Within the first quarter of 2024, Google Cloud income jumped 28% yr over yr. Comparatively, the identical interval noticed AWS gross sales rise by 17% and Microsoft Azure’s income improve by 21%.

Alphabet is investing billions in AI and is in a stable place to construct a profitable AI ecosystem round its merchandise. As the house of potent manufacturers like Android, YouTube, and the various companies beneath Google, Alphabet has numerous alternatives to spice up its enterprise with AI. The corporate has the potential to supply extra environment friendly digital promoting, add generative options to its smartphone working system, higher observe viewing developments on YouTube, and create a Google Search expertise nearer to OpenAI’s ChatGPT.

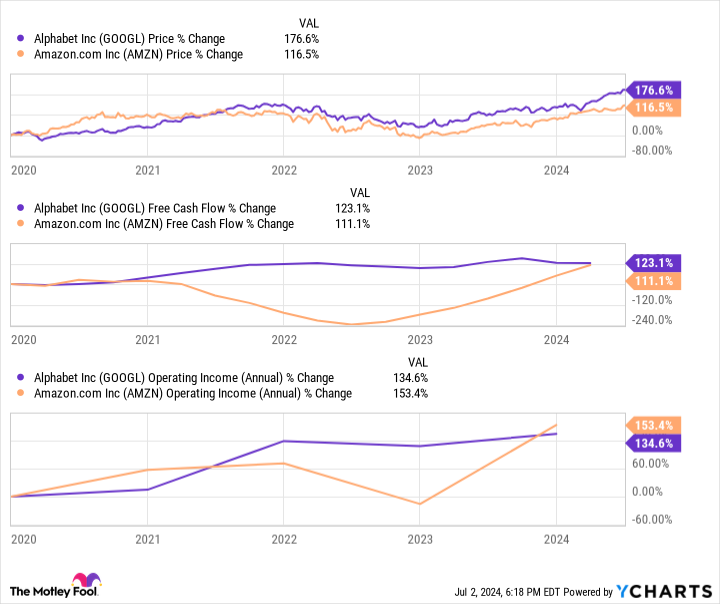

Furthermore, this chart exhibits Alphabet is a completely dependable inventory. During the last 5 years, it has overwhelmed Amazon in inventory and free money movement development. In the meantime, it has delivered an identical rise in working earnings. Along with its far better-valued share value, Alphabet is a screaming purchase proper now and a greater AI inventory than Amazon.

2. Apple

Apple’s inventory has risen 14% since Jan. 1. The determine is significantly decrease than its friends, with Amazon’s and Alphabet’s shares rising greater than 30% throughout that point. Apple missed out on the preliminary increase in AI, preferring to take a extra gradual method to the market. Nevertheless, latest developments recommend it might come again sturdy within the coming years.

Bloomberg reported on Jul. 2 that Apple is poised to get an observer function on ChatGPT developer OpenAI’s board. The transfer follows an announcement at Apple’s Worldwide Developer Convention in June that exposed its sensible assistant Siri will obtain a significant AI overhaul, making it extra intuitive and capable of reply lots of of recent questions. Siri will now cross off sure inquiries to ChatGPT as a part of the replace, making the OpenAI platform accessible to customers by means of its iPhones, iPads, or Macs.

In response to Bloomberg, “The board observer function will put Apple on par with Microsoft Corp., OpenAI’s greatest backer, and its essential AI know-how supplier.” Apple has been in steep competitors with Microsoft for years, with each leaders in shopper tech and accountable for the 2 most used laptop working programs. In consequence, Apple’s seat at OpenAI’s desk might deliver its AI know-how extra consistent with its rival and increase its total place within the business.

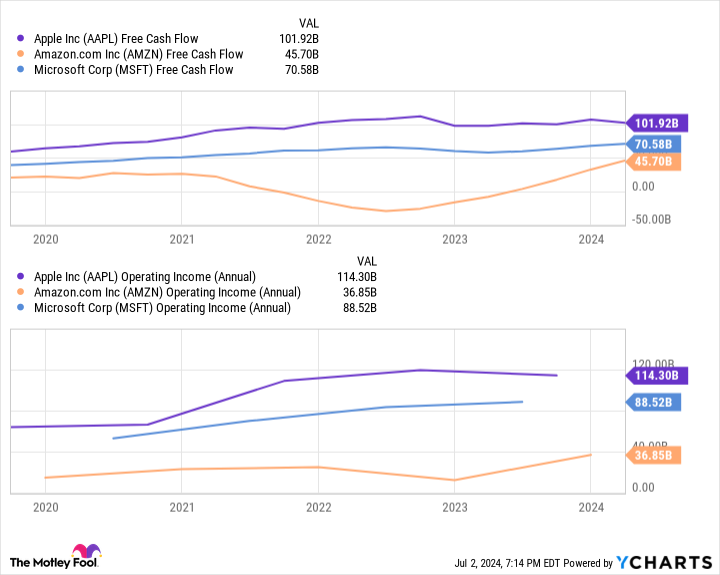

This desk exhibits that Apple is probably higher financially geared up than Amazon or Microsoft to increase in AI. The corporate is a money cow, with much more free money movement and working earnings during the last 5 years. So, regardless of its slower method to AI, I would not be towards it carving out a profitable place within the sector over the long run.

Alongside its better-valued inventory value, Apple is value contemplating over Amazon inventory this July.

Must you make investments $1,000 in Alphabet proper now?

Before you purchase inventory in Alphabet, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Alphabet wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $771,034!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 2, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Dani Cook dinner has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, and Microsoft. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Overlook Amazon: 2 Synthetic Intelligence (AI) Shares to Purchase Now was initially printed by The Motley Idiot