Amazon (NASDAQ: AMZN) joined the Dow Jones Industrial Common in late February — giving the historically stodgy, income-oriented index extra publicity to progress.

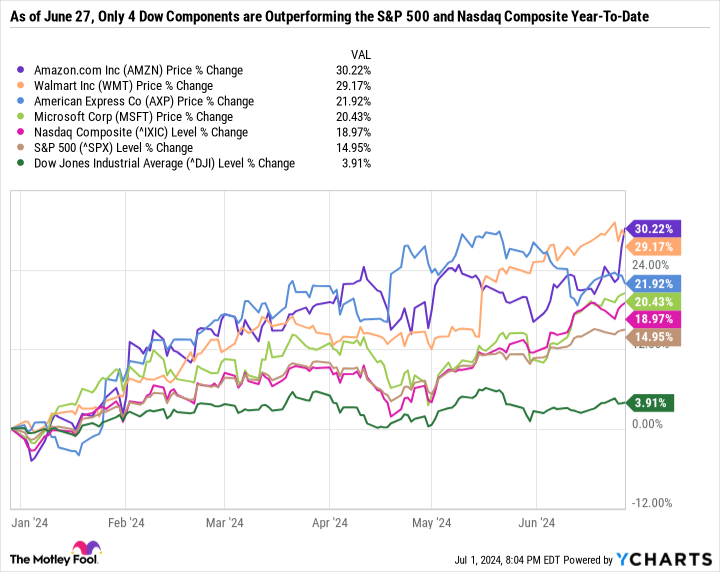

Amazon has continued its torrid run since 2023. As of June 27, it’s the best-performing inventory within the index.

This is why Amazon continues to climb larger and whether or not the progress inventory is price shopping for round its all-time excessive.

Amazon is gushing money

Earlier than altering its title to Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG), Google was named after its flagship search engine. However YouTube is arguably Alphabet’s crown jewel. Fb was named after its flagship social media app, however then modified its title to Meta Platforms (NASDAQ: META). Instagram is arguably extra beneficial than Fb at this time. Equally, Amazon is known as after its solely retail outlet, however Amazon Internet Companies (AWS) is the place a lot of the worth lies.

AWS is the undisputed chief in cloud infrastructure. In line with HG Insights 2023 Infrastructure as a Service Market Report, AWS had a 50.1% market share among the many prime 10 cloud suppliers and the best year-over-year buyer rely progress at 31%. AWS has been tapping into start-ups, with 86% of AWS prospects spending lower than $1,000 a month on AWS companies — in accordance with HG Insights.

The influence of AWS on the broader enterprise is plain. This is a take a look at Amazon’s trailing-12-month (TTM) outcomes as of the primary quarter of 2024 in comparison with the identical durations over the past 5 years.

|

Metric |

Q1 2020 TTM |

Q1 2021 TTM |

Q1 2022 TTM |

Q1 2023 TTM |

Q1 2024 TTM |

|---|---|---|---|---|---|

|

North America income |

$181.09 billion |

$254.52 billion |

$284.71 billion |

$323.52 billion |

$362.29 billion |

|

North America working earnings |

$6.06 billion |

$10.79 billion |

$2.25 billion |

($381 million) |

$18.96 billion |

|

Worldwide income |

$77.64 billion |

$115.96 billion |

$125.9 billion |

$118.37 billion |

$134.01 billion |

|

Worldwide working earnings |

($2 billion) |

$2.37 billion |

($3.46 billion) |

($7.71 billion) |

$903 million |

|

AWS income |

$37.55 billion |

$48.65 billion |

$67.14 billion |

$83 billion |

$94.44 billion |

|

AWS working earnings |

$10.05 billion |

$14.62 billion |

$20.89 billion |

$21.45 billion |

$28.93 billion |

Knowledge supply: Amazon.

Discover the inconsistent working earnings from Amazon’s North America and worldwide segments, in addition to the considerably sluggish top-line progress. In the meantime, AWS has been a juggernaut, with TTM working earnings rising practically threefold in simply 5 years.

Probably the most spectacular metric on this desk is that AWS working earnings has grown sooner than AWS income, suggesting that margins are bettering. Not way back, one of many largest crimson flags for Amazon’s funding thesis was that AWS could not sustain its margins within the face of mounting competitors. However the outcomes inform a special story and are probably a motive why the inventory has been crushing the market as of late.

A better-quality enterprise

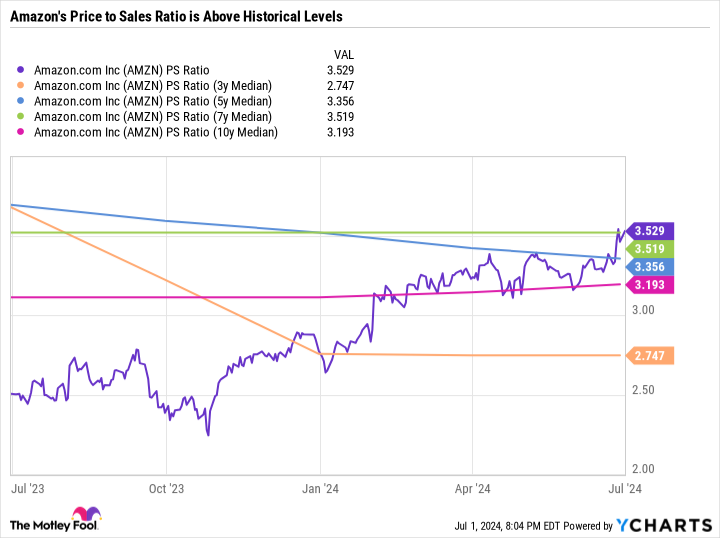

Amazon is infamous for reinvesting income again into the corporate. So utilizing internet income-based metrics just like the price-to-earnings ratio may be unhelpful. Historically, Amazon’s go-to metric was its price-to-sales ratio, which is the worth of an organization in comparison with its income. Within the following chart, you may discover that Amazon’s P/S ratio is larger than historic ranges — suggesting the inventory is dearer.

The P/S ratio may be helpful when coping with a constant enterprise over a time frame. However the situation with utilizing it to judge Amazon is that the corporate is essentially completely different at this time than it was even two to 3 years in the past due to the expansion of AWS. That is why I believe one of the simplest ways to worth Amazon is by taking a look at its P/S ratio inside the context of its working earnings and working margin.

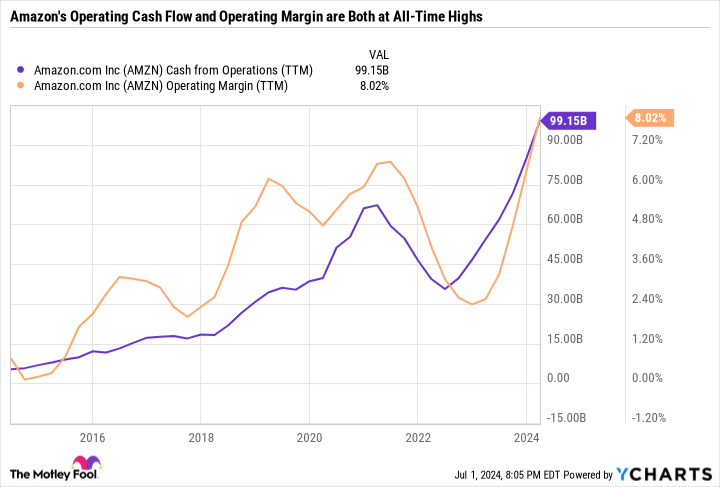

This chart is maybe the only option to visualize Amazon’s success. Amazon’s TTM working earnings is sort of $100 billion, and its working margin is at a 10-year excessive because of AWS and a rebound in its North America and worldwide segments.

Paying a 3.53 P/S ratio for a high-growth, low-margin enterprise is one factor. However that very same ratio for a corporation rising its prime line and increasing margins is fully completely different.

The largest bull case for Amazon is that it’s inside hanging distance of its historic P/S ratio, however the high quality of the enterprise is vastly improved, and it’s on a path towards constant profitability. In spite of everything, analyst consensus estimates name for $4.55 in 2024 earnings per share (EPS) and $5.78 in 2025 EPS — giving Amazon a 34.1 P/E based mostly on 2025 estimated earnings. That is not a sky-high valuation — particularly when contemplating the inventory is up 130% in 18 months.

Amazon is stretched skinny however continues to be an excellent purchase

Amazon is on the prime of its recreation, however its inventory chart displays that. Warren Buffett as soon as stated, “You pay a really excessive worth within the inventory marketplace for a cheery consensus.” In different phrases, consensus positivity towards an organization normally ends in an costly inventory worth, simply as an out-of-favor inventory may be fairly low cost.

Lower than two years in the past, Amazon was underneath immense stress on account of slowing progress and recession fears. It was the other of a cheery consensus. Immediately, Amazon is, as soon as once more, a darling. However the long-term funding thesis has additionally gotten stronger as AWS continues to be a high-margin progress engine that may gas the corporate’s different exploits.

All advised, Amazon is a good purchase, however it’s now not the no-brainer purchase it was earlier than. It nonetheless should develop into its valuation and show its larger margins aren’t a one-off. If progress slows, count on Amazon to be underneath stress.

The upper a inventory runs up within the quick time period, the extra its valuation will get stretched. However over the long run, Amazon actually has the trajectory wanted to compound earnings and profit affected person traders.

Do you have to make investments $1,000 in Amazon proper now?

Before you purchase inventory in Amazon, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Amazon wasn’t one in every of them. The ten shares that made the minimize may produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $786,046!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 2, 2024

Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. American Categorical is an promoting accomplice of The Ascent, a Motley Idiot firm. Daniel Foelber has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Walmart. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Amazon Is Now the Finest-Performing Inventory within the Dow Jones Industrial Common In 2024. Is It a Purchase Round Its All-Time Excessive? was initially printed by The Motley Idiot