The S&P 500 Index (SPX) gained about 14.5% within the first half of 2024. Double-digit returns within the first half have gotten widespread; in reality, its the third time in 4 years (and 4 of six) that the S&P 500 gained not less than 10% by way of June. The final time we noticed this was the late 1990’s, when the index gained double digits three years in a row (1997 – 1999). That was proper earlier than the tech bust, so hopefully, that’s not foreshadowing .

This week, I’m taking a look at what we will count on for the second half of 2024 primarily based on the robust first half. I’ll break down the numbers in just a few methods to swimsuit the present surroundings to previous years.

The Inventory Market Candy Spot

Since 1950, the second half of the yr has averaged a return of just below 5%. Based mostly on the desk under, it appears the higher the primary half, the higher the second half. When the S&P 500 gained 10% or extra within the first half of the yr, the second half averaged a return of seven.7% with 83% of the returns optimistic. These numbers are higher than different years. Whenever you slender down the returns to these inside +/- 5% of the 2024 returns, the outcomes have been even higher. Within the 20 cases during which the index gained between 9.5% and 19.5%, it averaged a second-half return of 10% with a formidable 19 of 20 returns optimistic. Seems like we’ve landed proper within the candy spot of first-half returns.

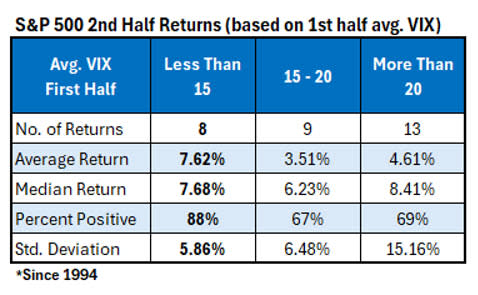

Right here’s one other desk suggesting a robust second half. This information goes again to 1994, the primary full yr of Cboe Volatility Index (VIX) information we’ve got in our database. The common VIX shut within the first half of 2024 was 13.9, which is on the low finish. When the VIX common within the first half was lower than 15, the S&P 500 averaged a return of seven.6% within the second half with seven of eight returns optimistic. These numbers are simply higher than when the VIX averaged a better closing stage.

25 Second-Half Shares to Watch

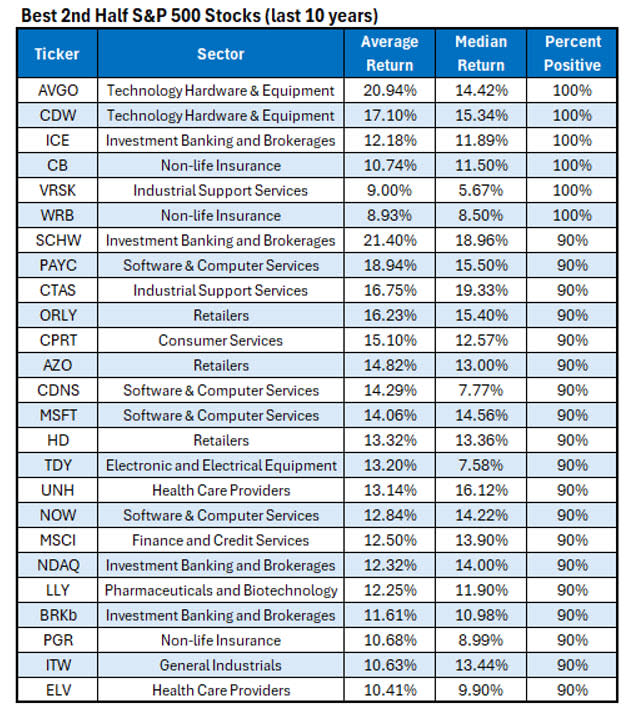

On this part, I’m itemizing shares which have tended to carry out exceptionally properly and shares which have disenchanted within the second half of the yr. This primary desk reveals the most effective S&P 500 shares within the second half of the yr over the previous 10 years. Six shares have been optimistic each single time over this time-frame. Microsoft (MSFT) is the most important identify on the record which accommodates a great variety of expertise shares and finance associated shares.

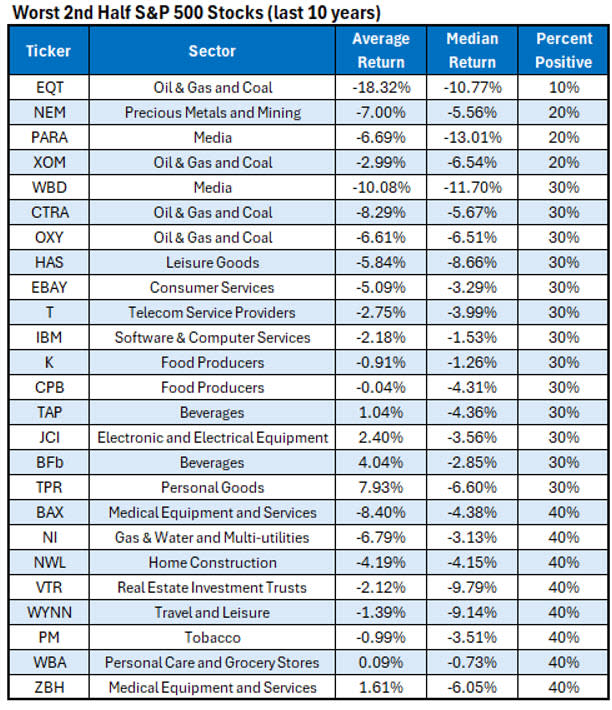

This final desk reveals shares which have performed poorly within the second half of the yr over the previous 10 years. Oil shares are outstanding on the high of this desk.