Six American firms have a valuation of no less than $1 trillion, and all of them function within the know-how {industry}. Thus far, 5 of them have graduated into the $2 trillion membership or increased:

-

Microsoft is valued at $3.3 trillion.

-

Apple is valued at $3.2 trillion.

-

Nvidia is valued at $3 trillion.

-

Alphabet is valued at $2.3 trillion.

-

Amazon (NASDAQ: AMZN) is valued at $2 trillion.

Amazon is the latest member, having crossed the $2 trillion threshold final week for the primary time. The corporate generates extra income than all of its friends on the above listing, however that hasn’t translated into the next valuation due to its comparatively modest profitability. Amazon’s e-commerce enterprise, for instance, operates on razor-thin margins.

However the firm is making modifications which might be driving substantial progress on the backside line. Mixed with its rising presence in synthetic intelligence (AI), buyers are clearly paying consideration. Here is why $2 trillion most likely will not be a stopping level for Amazon.

Amazon is in its AI period

Amazon was based as an e-commerce firm, and on-line gross sales are nonetheless its largest income. Nonetheless, buyers are keenly centered on its different companies like streaming, digital promoting, and particularly cloud computing. Amazon Net Providers (AWS) is the world’s largest cloud platform, and it is making ready to dominate the three core layers of AI.

On the backside layer, AWS designed its personal chips for each coaching and inferencing AI fashions, and they’re rising in reputation as a result of they are often as much as 50% cheaper to make use of than a few of its different infrastructure, which is powered by Nvidia’s industry-leading {hardware}. Plus, they assist AWS ease provide constraints different information heart operators like Oracle (NYSE: ORCL) are grappling with.

Giant language fashions (LLMs) make up the second layer. The AWS Bedrock platform affords builders a complete portfolio of ready-made LLMs they’ll use to speed up the buildout of customer-facing functions like chatbots and digital assistants. That portfolio features a household of LLMs designed by Amazon itself, known as Titan, along with LLMs from main AI start-ups like Anthropic.

The appliance layer is third, and it contains accomplished AI software program that’s prepared for integration into virtually any enterprise. The brand new Amazon Q digital assistant is an efficient instance, as a result of it will probably analyze excessive volumes of information to determine potential income alternatives, and it will probably additionally analyze, debug, and write laptop code to speed up software program improvement.

However Amazon’s use of AI additionally extends to its legacy e-commerce enterprise. It powers the advice engine on amazon.com to point out prospects merchandise they’re doubtless to purchase, and the corporate additionally developed a set of AI instruments to assist sellers craft extra partaking product pages to spice up gross sales.

Amazon generates extra income than every of its friends

Amazon has generated $590 billion in trailing-12-month income, which is excess of any of its friends within the $2 trillion membership:

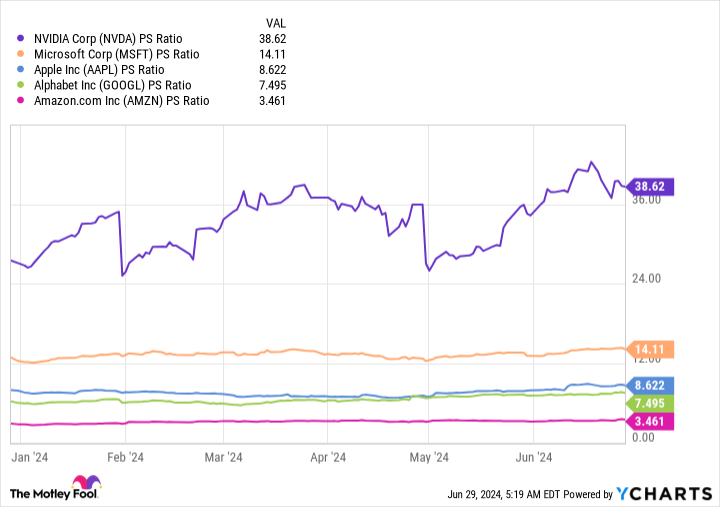

Nonetheless, Amazon’s price-to-sales (P/S) ratio — which is calculated by dividing its valuation by its income — is the most affordable of the bunch:

Merely put, buyers have not given Amazon full credit score for each side of its enterprise. Within the current first quarter of 2024 (ended March 31), the AWS cloud platform contributed 61.5% of the corporate’s whole working revenue regardless of accounting for simply 17.5% of its whole income.

Its e-commerce phase, then again, has inflated income however typically generates working losses as a result of Amazon costs low costs to be able to promote a excessive quantity of merchandise. However the firm is making efforts to enhance profitability in that phase. Final yr, it break up its U.S. nationwide achievement community into eight areas, so sure geographic places can inventory increased ranges of stock for the most well-liked merchandise. This implies merchandise journey a shorter distance to succeed in prospects, which reduces logistics prices.

By the tip of 2023, Amazon’s value to serve (the price of fulfilling orders) on a per-unit foundation shrank globally for the primary time since 2018. Plus, throughout Q1 this yr, virtually 60% of Prime members in Amazon’s high 60 largest metro areas acquired their orders on the identical day or the following day. Amazon CEO Andy Jassy says quicker deliveries are prompting prospects to order extra regularly and spend more cash, which is nice for each income and profitability.

Sturdy contributions from each AWS and the e-commerce enterprise despatched Amazon’s web revenue hovering to $10.4 billion in Q1 2024, a rise of 225% from the year-ago interval. That is a key motive buyers have piled into its inventory these days.

$2 trillion most likely will not be a stopping level for Amazon

Based mostly on Amazon’s trailing-12-month earnings per share of $3.57, its inventory trades at a price-to-earnings (P/E) ratio of 54.1. The typical P/E ratio of the opposite 4 shares within the $2 trillion membership is 42.9, which is why Amazon was so late to earn its membership regardless of its towering income (it seems costly by comparability).

Nonetheless, bettering profitability will clear the best way for Amazon inventory to maneuver increased. Wall Road expects the corporate to ship $5.41 per share in earnings throughout 2025, which locations its inventory at a ahead P/E ratio of 35.7. In different phrases, its inventory must rise 20% by the tip of subsequent yr simply to commerce consistent with the present common P/E ratio of the remainder of the $2 trillion membership.

AI may add additional gas to Amazon’s outcomes. The corporate not too long ago invested $4 billion in Anthropic, and as a part of the deal, the start-up is making AWS its main cloud supplier. It additionally dedicated to utilizing Amazon’s chips to coach its future fashions, which may entice different main builders to strive them. Lastly, it should make these fashions obtainable on AWS for purchasers to make use of, which may assist the cloud platform win prospects who might need chosen opponents like Microsoft Azure as an alternative.

In abstract, buyers with a time horizon of no less than two years are getting an incredible deal on Amazon inventory at present, despite the fact that it not too long ago set a brand new report excessive. However buyers who set their sights on the long term may earn larger rewards as AI unlocks extra alternatives for the corporate.

Do you have to make investments $1,000 in Amazon proper now?

Before you purchase inventory in Amazon, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Amazon wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $757,001!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 24, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Anthony Di Pizio has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Microsoft, Nvidia, and Oracle. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Meet the Unstoppable Inventory That Simply Joined Nvidia, Microsoft, Apple, and Alphabet by Topping $2 Trillion in Market Cap was initially revealed by The Motley Idiot