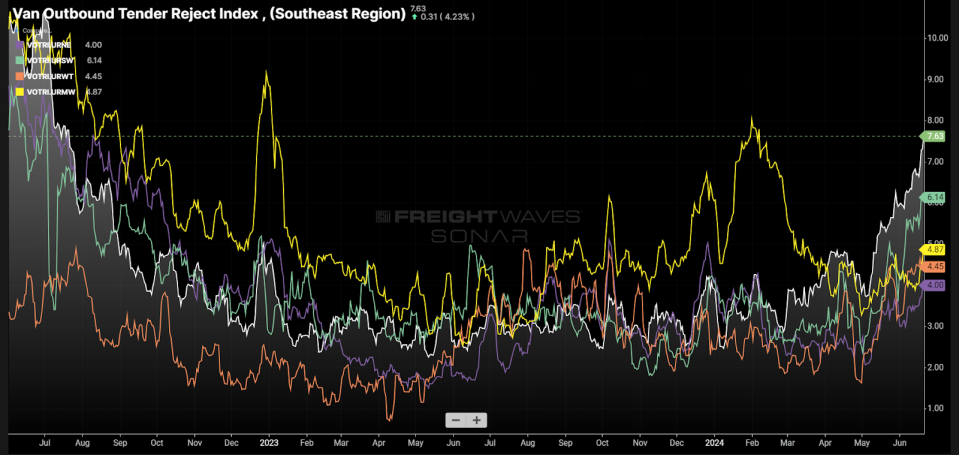

Chart of the Week: Inbound Ocean TEUs Index – USA SONAR: VOTRI.URSE, VOTRI.URNE, VOTRI.URSW, VOTRI.URWT, VOTRI.URMW

Southeastern dry van regional rejection charges — the speed at which truckload carriers flip down hundreds from contracted shippers — have surged previous all different areas this summer time, hitting their highest degree since July 2022. This breaks a development of practically two years of low volatility for the area.

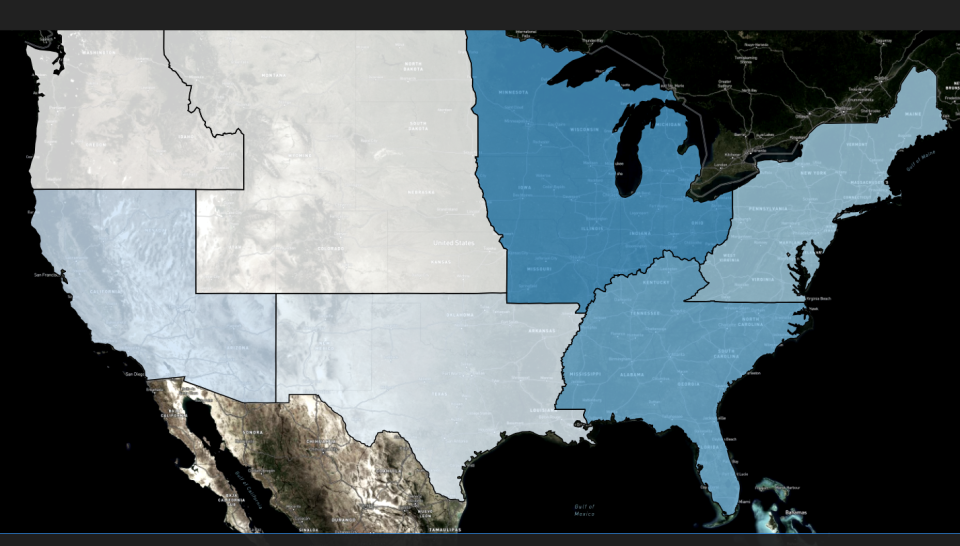

The Southeastern area is the second-largest outbound area for freight within the U.S., behind the Midwest. It consists of states east of the Mississippi and south of Indiana and Virginia. The biggest outbound market is Atlanta. It is usually the place many carriers are based mostly and plenty of drivers reside.

The importance of this area’s having probably the most elevated rejection charges is solely that it’s breaking a multiyear sample of comparatively free capability situations and minimal volatility.

Final summer time the Southeast peaked at a 3.52% rejection charge for dry van hundreds heading into the July Fourth vacation. The extra telling factor is that rejection charges moved between a band of two.5% and three.5% all year long.

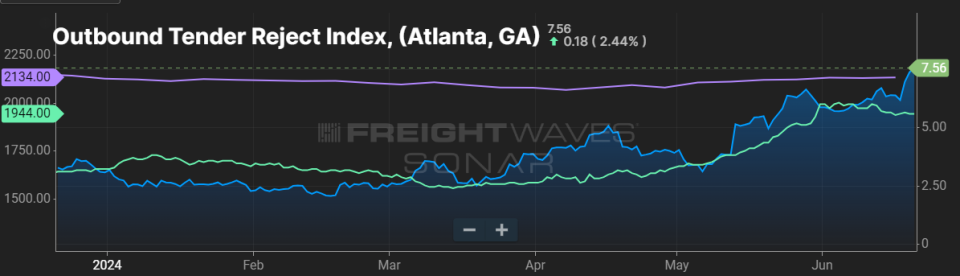

This 12 months, rejection charges have exceeded 3.5% because the begin of March and have now topped 7.5% for the primary time in 23 months.

Atlanta, the regional hub, has been the nation’s second-largest outbound market in 2024, accounting for roughly 3.4% of the entire outbound tenders in SONAR’s tender knowledge. Ontario, California, has the highest spot at 3.6% because the begin of the 12 months. Dallas is third however rising at 3.3%.

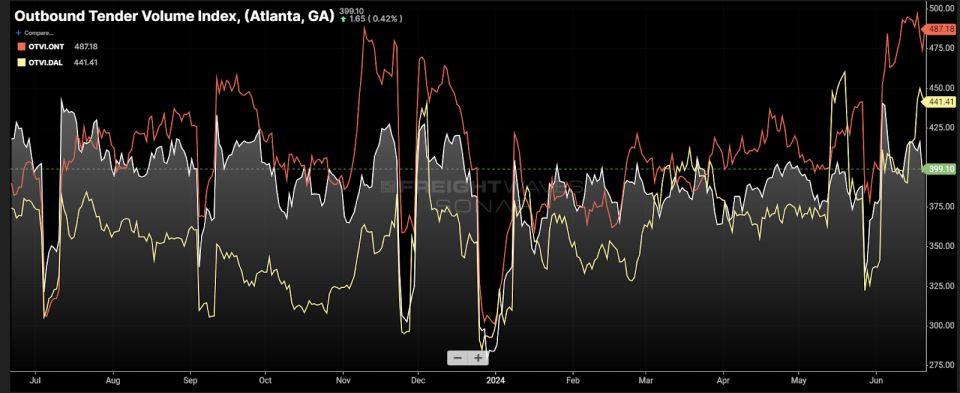

Atlanta’s outbound rejection charge has doubled since final summer time and has risen sooner than each the Ontario and Dallas markets this 12 months. Apparently, rising demand doesn’t seem like a driving power behind the deterioration in service compliance, at the least on a market degree.

Tender volumes are comparatively flat in June in comparison with the place they’ve been by means of many of the 12 months, exterior of a post-Memorial Day blip. The reason could also be within the substantial improve within the Ontario market demand degree since early Might. Ontario’s OTVI has risen 20% since Might 1 and seems to nonetheless be rising.

Whereas capability stays considerable within the home freight market, the stream of freight isn’t balanced. Carriers are consistently having to rebalance their networks to account for demand shifts. Masking Southern California requires a major quantity of capability because of the lack of inbound freight relative to the remainder of the nation. Hundreds originating from the Los Angeles space common the longest within the U.S. attributable to affect from the nation’s largest port advanced.

Carriers are inclined to prioritize protecting hundreds originating in Southern California as a result of they’re probably the most disruptive and supply probably the most income.

On the flipside, the Midwest could also be a beneficiary of the West Coast regional freight demand growth. Most of the hundreds leaving Los Angeles find yourself within the Midwest and Northeast. Subsequently rejection charges are comparatively subdued in each areas.

Spot charges from Atlanta to Harrisburg, Pennsylvania, are up 16% since early Might, in response to FreightWaves TRAC knowledge, nearing the typical contract charge. If spot charges exceed contract charges, rejection charges might spike, resulting in vital deterioration in service, and power shippers as soon as once more to bid towards each other for capability.

There nonetheless seems to be loads of capability obtainable available in the market, simply not in the best locations. This regional shortfall of capability could also be momentary, as we’re approaching the seasonal peak of summer time transport across the Fourth of July, however it is only one extra instance displaying the home truckload market is changing into more and more susceptible to disruptions.

In regards to the Chart of the Week

The FreightWaves Chart of the Week is a chart choice from SONAR that gives an fascinating knowledge level to explain the state of the freight markets. A chart is chosen from hundreds of potential charts on SONAR to assist individuals visualize the freight market in actual time. Every week a Market Professional will put up a chart, together with commentary, reside on the entrance web page. After that, the Chart of the Week might be archived on FreightWaves.com for future reference.

SONAR aggregates knowledge from tons of of sources, presenting the info in charts and maps and offering commentary on what freight market specialists need to know in regards to the trade in actual time.

The FreightWaves knowledge science and product groups are releasing new datasets every week and enhancing the shopper expertise.

To request a SONAR demo, click on right here.

The put up Cracks in trucking capability present up within the South appeared first on FreightWaves.