Nvidia (NASDAQ: NVDA) is a good synthetic intelligence (AI) inventory. Nevertheless, it has gotten a bit costly from a valuation standpoint, which has some buyers trying elsewhere for AI investments. I am in that camp, however luckily, loads of AI firms are value shopping for proper now.

Two that come to thoughts are Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) and Adobe (NASDAQ: ADBE). Each firms’ shares are buying and selling at cheap valuations, and each are at all times improbable companies.

Generative AI has been an enormous know-how shift for each firms

Alphabet is best recognized by its former title, Google. For a few years, it has been investing in its AI capabilities, and that’s beginning to repay. Probably the most noteworthy space is its generative AI platform, Gemini. Gemini is already getting used for a number of functions, together with creating advertisements for purchasers, summarizing search outcomes, and aiding builders in writing code.

The tech large can be seeing sturdy demand in its cloud computing wing: Google Cloud. Whereas many firms wish to make the most of AI, few have the computing energy to create a mannequin tailor-made to their enterprise. Moreover, shopping for a supercomputer to create one can be overkill, so that they lease computing energy from a supplier like Google Cloud. Many generative AI start-ups have finished this, as it’s a extra environment friendly use of capital. Amongst its shopper base are a number of the hottest start-ups, together with 60% of funded generative AI start-ups and 90% of generative AI unicorns (personal firms with valuations above $1 billion).

By creating an ecosystem full of AI instruments, Alphabet has created a improbable providing for anybody seeking to develop and implement AI right into a enterprise.

Adobe is one other avid supplier of AI instruments, though it is tackling the digital media market. Its generative AI instruments have reduce down on the time wanted to create media property, and permit customers to create photographs tailor-made to the viewer. Adobe can be innovating within the doc area, the place its conversational AI can learn paperwork and reply questions associated to their contents.

Whereas there have been questions on whether or not Adobe could be out of contact in right now’s day of AI, its sturdy leads to its fiscal 2024 second quarter, which ended Might 31, eliminated these considerations. Adobe exceeded its steerage on each income and earnings per share, and raised its income steerage for the 12 months.

Adobe is benefiting from the brand new demand wave that AI is bringing, and it can be bought at a steep low cost to its common historic valuation.

Each shares are moderately priced for his or her development

Each shares are buying and selling at way more cheap costs than Nvidia. As a result of there may be a lot change happening with each firms, I am going to use the ahead price-to-earnings ratio to gauge their valuations.

Though Adobe popped after its newest earnings report, the inventory continues to be valued beneath the place it has traded over the previous 12 months.

Though some might take into account a valuation of 29 occasions ahead earnings dear, Adobe has persistently been one of many high performers out there and has earned its premium.

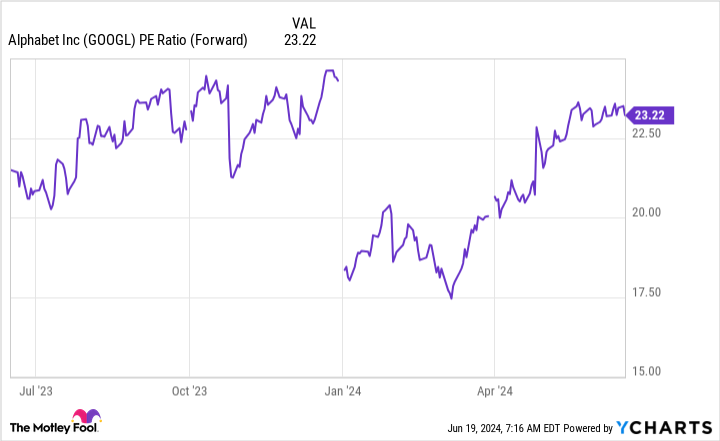

Alphabet, in the meantime, is even cheaper.

Though 23 occasions ahead earnings is close to the highest of the place Alphabet has traded this previous 12 months, it is nonetheless low-cost from a broader market perspective. The S&P 500 presently trades at 22.1 occasions ahead earnings, which suggests Alphabet barely carries any premium to the broader market.

Contemplating Alphabet’s success and monitor report, it is nonetheless an outstanding purchase at these costs.

Do you have to make investments $1,000 in Adobe proper now?

Before you purchase inventory in Adobe, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Adobe wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $801,365!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Keithen Drury has positions in Adobe and Alphabet. The Motley Idiot has positions in and recommends Adobe, Alphabet, and Nvidia. The Motley Idiot has a disclosure coverage.

2 Synthetic Intelligence (AI) Shares I would Purchase Over Nvidia Proper Now was initially revealed by The Motley Idiot