Even in a world the place rates of interest are increased than they had been just a few years in the past, a yield of over 20% nonetheless stands out it doesn’t matter what kind of setting we’re in, and that’s precisely what the REX FANG & Innovation Fairness Premium Earnings ETF (NASDAQ:FEPI) affords traders.

I’m bullish on this newer, nonetheless under-the-radar dividend ETF from REX Shares primarily based on its gargantuan yield, engaging month-to-month payout schedule, and portfolio of highly-rated tech shares.

What Is the FEPI ETF’s Technique?

FEPI’s technique is to personal large-cap tech shares (the 15 shares within the Solactive FANG Innovation Index) and write coated calls in opposition to these holdings with a purpose to create enhanced earnings potential.

It’s a method that has grown in recognition lately, as related funds just like the JPMorgan Fairness Premium Earnings ETF (NYSEARCA:JEPI) and the JPMorgan Nasdaq Fairness Premium Earnings ETF (NASDAQ:JEPQ) have grown into among the market’s hottest ETFs.

Primarily, FEPI sells coated calls in opposition to its holdings and makes use of the choices premiums it receives from promoting these calls with a purpose to pay its holders a month-to-month distribution. This generally is a nice technique for producing regular and above-average earnings, as evidenced by FEPI’s frequent payouts and huge yield. These large-cap tech shares drive appreciable investor curiosity and have loads of volatility, so they’re significantly well-suited for producing engaging choices premiums.

The draw back of this technique is that FEPI holders probably sacrifice upside from capital appreciation as a result of if its holdings climb above the strike value for the calls it’s promoting, FEPI holders miss out on this extra upside.

For instance, FEPI’s high holding is Nvidia (NASDAQ:NVDA). It is a theoretical instance, however let’s say FEPI sells one contract of June 21 Nvidia calls with a strike value of $130 for a $120 premium. On this hypothetical instance, the fund advantages by receiving a premium of ~$120 from the client of the choices for promoting these calls, which it may distribute to its holders.

Nonetheless, if the shares of Nvidia rise above $130 on the time limit, to $150 for instance, the fund is contractually obligated to promote these shares to the client of the decision for the contracted value of $130, which means that it didn’t profit from any of the appreciation of $20 per share previous the strike value.

Nonetheless, if the shares of Nvidia keep under the strike value, the fund managers can promote new calls in opposition to them and repeat the method once more to repeatedly generate constant earnings.

So long as traders perceive these potential tradeoffs and settle for the truth that they’ll seemingly miss out on some upside from value appreciation infrequently, this may be a beautiful and efficient technique for producing appreciable earnings on a month-to-month foundation.

Large Yield

It’s essential to notice that the extent of FEPI’s month-to-month payout shouldn’t be set in stone, and the fund doesn’t assure that it’ll make a month-to-month payout.

That being stated, since launching in October 2023, the fund has been remarkably constant thus far, making a payout every month — the smallest of those was $1.09 in April. We coated FEPI shortly after it launched final yr, writing that it had the potential for important payouts, and this has largely performed out.

Many web sites will checklist FEPI’s yield as 14.9% — which remains to be extremely engaging — however that doesn’t inform the entire story. That is its yield on a trailing 12-month foundation, and the fund solely launched late final yr, so it has solely made seven months of funds up to now.

Wanting on the yield on a ahead foundation paints a clearer, although imperfect, image. Utilizing the fund’s most up-to-date payout of $1.16 in Might because the month-to-month payout going ahead, the fund boasts an enormous distribution yield of 25.2%. Even when payouts lower barely from Might’s degree and fluctuate, this yield will nonetheless be very excessive.

It’s exhausting to understate simply how outsized this yield is. The S&P 500 (SPX) yields only a meager 1.4%, whereas 10-year treasury bonds yield a risk-free 4.4%. Even FEPI’s aforementioned friends, like JEPI and JEPQ, yield 7.7% and 9.8%, respectively, on a ahead foundation (utilizing the identical methodology as above).

Concentrated Holdings

FEPI owns 15 shares, and its high 10 holdings account for 67.8% of its portfolio. FEPI shouldn’t be very diversified and is extremely concentrated, however diversification shouldn’t be the fund’s purpose.

Under, you’ll discover an outline of FEPI’s high 10 holdings utilizing TipRanks’ holdings device.

As you possibly can see, FEPI’s portfolio consists largely of the highly-rated large-cap expertise shares which have powered the market increased lately, reminiscent of Nvidia and its fellow magnificent-seven shares, fellow chipmakers Micron (NASDAQ:MU) and Broadcom (NASDAQ:AVGO), and a handful of different tech names.

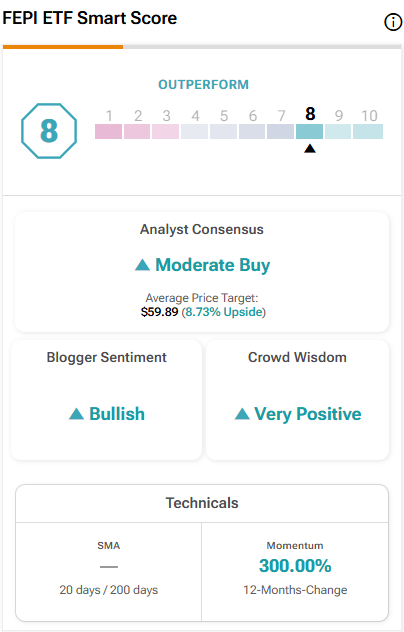

These holdings are extremely rated by TipRanks’ proprietary Sensible Rating system. The Sensible Rating is a proprietary quantitative inventory scoring system created by TipRanks. It offers shares a rating from 1 to 10 primarily based on eight market key components. A rating of 8 or above is equal to an Outperform score. Eight of FEPI’s high 10 holdings function Outperform-equivalent Sensible Scores, and three, Broadcom, Amazon (NASDAQ:AMZN), and Alphabet (NASDAQ:GOOGL), function “Excellent 10” Sensible Scores.

FEPI boasts an Outperform-equivalent ETF Sensible Rating of 8.

How A lot Does FEPI Cost?

One draw back of FEPI is that its expense ratio of 0.65% is pretty expensive. An investor placing $10,000 into the fund can pay $65 in charges yearly. Nonetheless, that is an actively managed fund with a reasonably advanced technique, so the upper expense ratio shouldn’t be essentially shocking. If the fund can proceed to ship month-to-month funds to holders and keep such a excessive yield, then few traders will complain in regards to the expense ratio. Nonetheless, if FEPI falters, then extra traders will start to query its expense ratio.

Not With out Dangers

As mentioned above, traders within the fund are probably forgoing some upside from value appreciation in alternate for this huge yield.

Past that, this can be a pretty new fund and technique, so it stays to be seen if its technique will pan out over time or if it is going to be in a position to proceed paying out this a lot over the long run.

Lastly, the truth that the fund is extremely concentrated and closely uncovered to only one a part of the market, large-cap tech, exposes traders to appreciable danger if this section of the market suffers.

Is FEPI Inventory a Purchase, Based on Analysts?

Turning to Wall Avenue, FEPI earns a Average Purchase consensus score primarily based on 13 Buys, 4 Holds, and 0 Promote rankings assigned previously three months. The common analyst FEPI inventory value goal of $59.89 implies 8.7% upside potential from present ranges.

The Takeaway: A Standout Funding for Earnings Buyers

Even in a world of upper yields, FEPI’s yield of over 20% stands out. I’m bullish on the ETF primarily based on this huge yield and its month-to-month payout schedule, in addition to its highly-rated portfolio.

So long as traders perceive and are comfy with the truth that this big-time yield comes with the tradeoff of probably leaving a portion of potential upside from capital appreciation on the desk, then FEPI generally is a good possibility for producing month-to-month earnings. For that reason, I wouldn’t essentially allocate my complete portfolio towards FEPI, however I imagine it may be a great tool for producing earnings inside a diversified portfolio.