-

Blue Hen Corp. is one of the best performing EV inventory to date this yr.

-

The bus producer has seen a growth in its EV bus enterprise due to a $5 billion authorities program.

-

Electrical college buses can value greater than $300,000 in comparison with $100,000 for conventional buses.

The perfect-performing electrical automobile inventory is a little-known college bus maker.

Blue Hen Corp., which has a market cap of about $2 billion, has began to diversify from its diesel and gas-power buses to electrical, boosted by authorities funding.

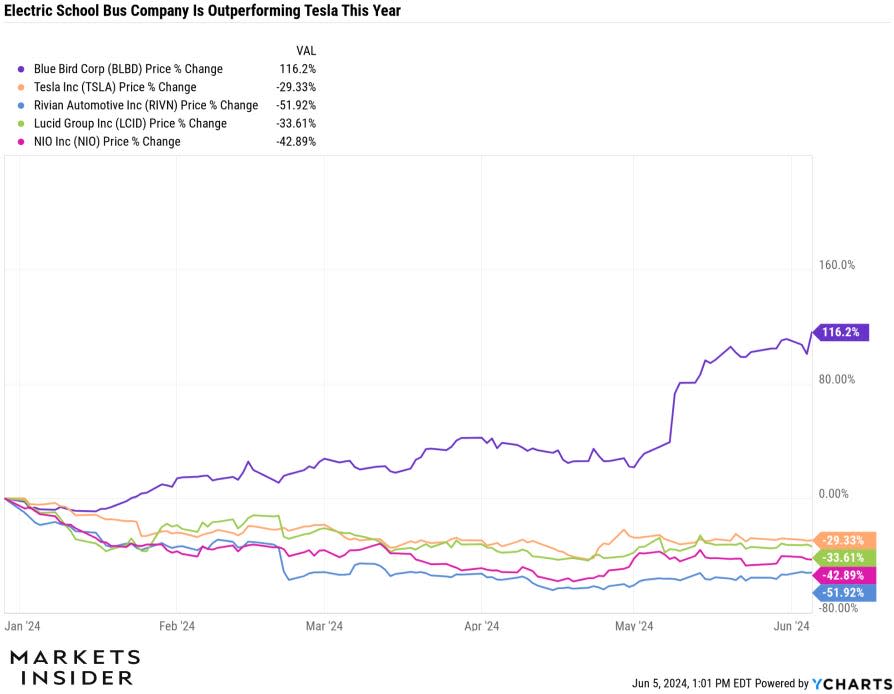

Shares of Blue Hen have surged 116% year-to-date, far outpacing different EV shares, that are largely down this yr, together with Tesla, Rivian, Lucid, and a slew of Chinese language EV corporations.

In its fiscal second-quarter earnings report launched final month, Blue Hen stated its income grew 15% year-over-year to $346 million, outpacing analysts’ estimates by almost $50 million, whereas its earnings greater than tripled to $0.89 per share.

The college bus producer offered a report 210 electrical college buses within the quarter and stated it had an order backlog of about 500 electrical buses, with bookings hovering 56% from the year-ago interval.

Serving to gas Blue Hen’s EV college bus enterprise is the US Environmental Safety Company’s Clear College Bus Program, which was established in the 2021 Bipartisan Infrastructure Legislation and supplies $5 billion in funding to switch diesel college buses with electrified buses.

Electrical college buses now make up 9% of Blue Hen’s income, up from 6% final yr, and is ready to rise as funding from the EPA’s EV college bus program continues to circulation to districts trying to improve their fleet.

An enormous profit to Blue Hen is that electrical college buses will considerably improve its common promoting worth and revenue margins on the autos it produces.

In line with analysis from Barclays, an electrical college bus can promote for greater than $300,000 in comparison with simply $100,000 for conventional college buses.

“That is a wholly completely different Blue Hen bus income and gross margin construction in contrast with only a yr in the past with bus costs up considerably,” Blue Hen CEO Phil Horlock stated on the corporate’s most up-to-date earnings name.

Needham stated in a word final month that it expects the expansion of Blue Hen’s EV enterprise to proceed.

“EV college bus progress is within the early innings. We anticipate continued robust demand as college districts compete for primarily free buses, with increased, recognized ASPs over a multiyear interval permitting BLBD and business friends time to drive prices decrease earlier than market costs take over,” Needham analyst Chris Pierce stated.

Needham charges Blue Hen at “Purchase” with a $52 worth goal.

Learn the unique article on Enterprise Insider