Restaurant firm Texas Roadhouse (NASDAQ: TXRH) has been an unlimited winner during the last 10 years. Nevertheless, I reluctantly admit that I missed out on large beneficial properties. And I’ve nobody responsible however myself.

Greater than 10 years in the past, Texas Roadhouse was one of many first shares I ever purchased. I held for a few years and reinvested dividends alongside the way in which, which was an enormous win for my nascent portfolio. Nevertheless, I bought my place through the first yr of the pandemic as a result of I believed the restaurant trade was in for an extended season of restoration.

In the end, I let short-term considering cloud my long-term judgement — it might probably occur to any of us. I’ve consequently missed out on large beneficial properties since I bought, because the chart beneath exhibits.

To be clear, Texas Roadhouse seemingly nonetheless has good days forward, so buyers at present have not “missed out” solely. The corporate’s core restaurant chain is very worthwhile and nonetheless rising. And it is nurturing two small however promising restaurant ideas with Bubba’s 33 and Jagger’s, giving extra alternative for long-term buyers.

That stated, I believe it is truthful to say that progress for Texas Roadhouse over the following 10 years will not be as large because the previous 10 years. However for these in search of a brand new concept, the chance with Chicago’s restaurant firm Portillo’s (NASDAQ: PTLO) is much like investing in Texas Roadhouse 10 years in the past. Here is why.

Why Portillo’s might make an important inventory decide

I wish to set up among the issues which have made Texas Roadhouse a great enterprise to spend money on. First, these eating places are common. In 2013, places made $4.3 million in common gross sales quantity and same-store gross sales have been up 3% for the yr. By ongoing same-store gross sales progress, common unit volumes are actually a whopping $7.8 million — I would say that is fairly common.

Portillo’s can go toe-to-toe with Texas Roadhouse on this regard. As of the primary quarter of 2024, Portillo’s common unit quantity is a whopping $9 million. And whereas first-quarter same-store gross sales have been down a modest 1%, gross sales quantity has persistently elevated because it went public in 2021.

Second, Texas Roadhouse has a great revenue margin on the restaurant stage — a metric that excludes bills that are not core to restaurant operations. Ten years in the past, the corporate already had a restaurant-level revenue margin of 17%. In the latest quarter, it was nonetheless about 17%, which is encouraging.

Portillo’s can maintain its personal right here as effectively, regardless that it measures issues in a different way than Texas Roadhouse. Portillo’s is adjusted earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA). Given how a lot this adjusts for, it should naturally be greater. With all of this stated, Portillo’s restaurant-level adjusted EBITDA margin is about 22% — not too shabby.

The purpose is, Texas Roadhouse had (and has) nice economics — economics which are largely shared by Portillo’s. When a restaurant chain has nice unit economics like this, it may be an important funding because the chain expands. And that is what’s arising for Portillo’s.

The upside potential

Portillo’s has fewer than 90 places at present, comparatively concentrated within the midwest. However sometime, it hopes to have 600 places — that is an enormous soar.

Granted, progress for Portillo’s will occur at a measured tempo. Administration solely expects to develop its restaurant base by 11% this yr, and the expansion fee might be comparable within the coming years. At this tempo, Portillo’s would nonetheless have fewer than 250 places 10 years from now.

Nevertheless, this can be all the expansion that Portillo’s wants for the inventory to carry out effectively. Take into account that Texas Roadhouse had 420 places on the finish of 2013 and had 741 places on the finish of 2023 — solely a 76% improve over 10 years. Portillo’s might feasibly develop greater than this, given its smaller place to begin.

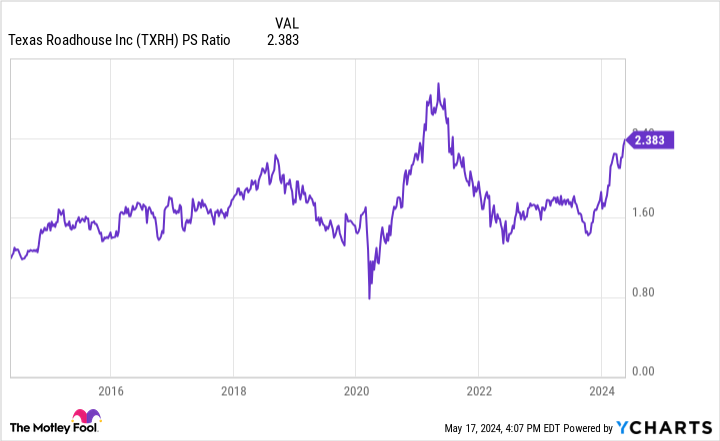

One closing consideration is valuation. Take into account that 10 years in the past, Texas Roadhouse inventory traded at a downright low-cost price-to-sales (P/S) valuation of only one. Right this moment its P/S ratio has doubled to 2.

In line with legendary investor Warren Buffett, a inventory’s valuation can have a big effect on an funding. If a valuation is pricey and comes right down to extra cheap ranges over time, it counteracts the optimistic impression of enterprise progress. With this in thoughts, Texas Roadhouse inventory benefited from an inexpensive beginning place 10 years in the past.

In the identical method, buyers who purchase shares of Portillo’s at present are getting a great deal. The inventory is flirting with all-time lows, and the P/S valuation is a paltry 0.9. That is an important worth to pay for a restaurant firm with nice economics and bold progress plans for the long run.

In conclusion, I imagine shopping for Portillo’s inventory at present is like shopping for Texas Roadhouse inventory 10 years in the past. So, should you missed out on large funding returns from the favored steakhouse, do not miss out on large returns from this Chicago favourite.

Do you have to make investments $1,000 in Portillo’s proper now?

Before you purchase inventory in Portillo’s, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Portillo’s wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $671,728!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Could 28, 2024

Jon Quast has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Texas Roadhouse. The Motley Idiot has a disclosure coverage.

Missed Out on Texas Roadhouse Inventory? Purchase Portillo’s Inventory As an alternative. was initially revealed by The Motley Idiot