The expertise sector is at present experiencing one thing of a renaissance as breakthroughs in synthetic intelligence (AI) have ignited newfound curiosity from buyers.

Among the many high AI alternatives are a small cohort of megacap tech corporations collectively known as the “Magnificent Seven.” Over the past yr and a half, semiconductor firm Nvidia (NASDAQ: NVDA) has returned 628% — greater than some other member of the Magnificent Seven.

Nvidia is undoubtedly taking part in a giant function within the AI revolution, and its near-term prospects look very sturdy. However what about the long run?

Amongst its Magnificent Seven friends, I see Amazon (NASDAQ: AMZN) because the superior funding alternative. Let’s discover why Nvidia is at present on a roll, and assess the long-term prospects of the chipmaker versus Amazon.

Nvidia is supercharged, however competitors lingers

Generative AI functions, akin to coaching giant language fashions, machine studying, and accelerated computing, depend on a few key elements. Particularly, subtle semiconductor chips generally known as graphics processing items (GPUs), in addition to information middle community companies, are integral for AI use circumstances.

Proper now, Nvidia sits conveniently on the intersection of GPUs and information middle operations. At present, the corporate is estimated to have 80% of the addressable marketplace for AI chips.

This commanding lead has translated into document income, margins, and money circulation.

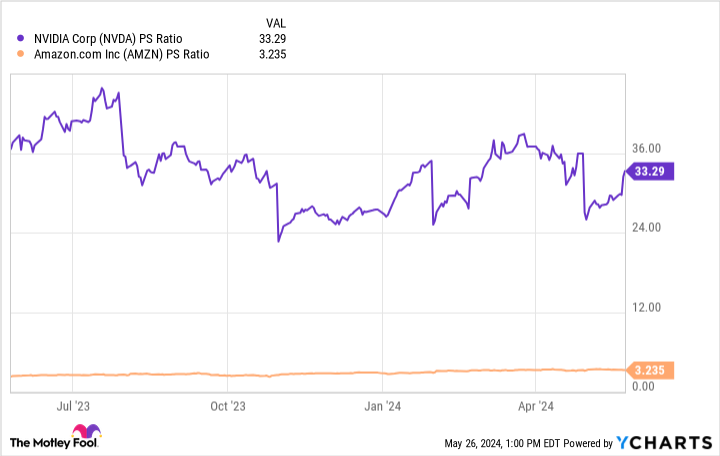

The slope of the strains within the chart above underscores Nvidia’s dominance. Demand for the corporate’s chips and information middle companies is powerful, and has offered Nvidia with a profitable supply of pricing energy. Nevertheless, Superior Micro Gadgets and Intel are creating a set of different GPUs.

Though neither firm has wherever close to the market share of Nvidia at this time, the longer-term secular tailwinds fueling AI counsel that there could possibly be a chance to make up floor as Nvidia faces the problem of matching buyer demand tendencies with provide output.

Moreover, Nvidia isn’t solely dealing with competitors from different chip companies. Meta Platforms and Amazon are each engaged on their very own internally developed chips in an effort to maneuver away from their reliance on Nvidia.

Though I do not see both firm migrating from Nvidia anytime quickly, the longer-term image means that a few of Nvidia’s main prospects could possibly be a much less important supply of development a number of years from now.

Why I see Amazon as the higher funding

At the moment, Amazon is greatest recognized for its e-commerce market and cloud computing infrastructure — Amazon Internet Companies (AWS). Nevertheless, Amazon has quite a few different alternatives in its ecosystem, together with streaming, grocery supply, and promoting.

This diversified enterprise is what has me most bullish on Amazon’s long-term prospects, as a result of the corporate has a singular alternative to amplify its attain by integrating AI throughout its complete operation.

One of the vital profitable strikes Amazon has already made is its $4 billion funding into AI start-up Anthropic. Anthropic makes use of AWS as its main cloud supplier, and is coaching its generative AI fashions on Amazon’s homegrown chips.

Furthermore, Amazon additionally just lately dedicated $11 billion to construct out information facilities — a transfer I see as a serious validation that the corporate is critical about shifting away from Nvidia in the long term.

Whereas the long-term beneficial properties from these initiatives are possible years sooner or later, I am optimistic that Amazon is laying the groundwork for sustained development. Checked out a unique approach, whereas Nvidia is at present having fun with triple-digit income and revenue development, I am skeptical that the corporate can sustain such momentum. However, I feel Amazon is simply scratching the service of a brand new wave fueled by aggressive ambitions that includes AI.

The underside line

In the case of selecting between Nvidia and Amazon, I do not suppose you possibly can go incorrect. Each corporations are working from positions of energy, and every represents compelling funding prospects.

With that mentioned, Nvidia’s inventory worth has risen sharply over the past couple of years. Provided that competitors lingers throughout each information middle companies and AI-powered chips, I do not see Nvidia sustaining its lead. Ultimately, I feel prospects will broaden their AI infrastructure and complement present Nvidia companies with these from different distributors.

In flip, this dynamic would end in decelerating income and profitability for Nvidia within the coming years. In contrast, Amazon already boasts over $50 billion in free money circulation and $84 billion of money and equivalents on its stability sheet.

Amazon is in a very great spot, financially talking, and has the pliability to proceed doubling down on its AI efforts. In consequence, I feel Amazon will finally surpass Nvidia when it comes to worth because it grows right into a extra subtle enterprise.

Contemplating the disparity between valuation multiples, I would scoop up shares of Amazon and plan to carry them for the long term. Nvidia is buying and selling at a noticeable premium, thereby suggesting some future development could also be priced into the inventory. To me, Amazon’s place within the AI realm is underappreciated, and the inventory seems to be dust low-cost proper now. I would encourage buyers to make the most of this low cost and proceed monitoring the corporate’s progress.

Must you make investments $1,000 in Amazon proper now?

Before you purchase inventory in Amazon, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Amazon wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our advice, you’d have $671,728!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Might 28, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Amazon, Meta Platforms, and Nvidia. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Amazon, Meta Platforms, and Nvidia. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and brief Might 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.

Prediction: This “Magnificent Seven” Synthetic Intelligence (AI) Inventory May Be a Higher Funding Than Nvidia Over the Subsequent 5 Years was initially revealed by The Motley Idiot