Market sentiment has gotten rather more bullish since once I wrote No Collapse is the Actual Dystopia in June. This summer season noticed a serious bull market, or reasonably bear market rally, with the Dow reaching its longest successful streak for the reason that Eighties. The “high economists” did a complete U-turn and not anticipate a recession this or subsequent 12 months. The current bullish sentiment feels much like 2021, when covid was easing and there was a surge in stimulus. This wave of bullishness continues, regardless of shares dipping after Fitch downgraded the US credit standing.

The present bullish propaganda is an identical to that earlier than the 2008 crash. As an example, Tyler Cowen’s current Bloomberg op-ed, The US Economic system Is Nice. Cease Worrying About It, is very like Brian Wesbury’s 2008 WSJ op-ed, “The Economic system is Advantageous (Actually) . A current CNN Enterprise article, the case for a gentle touchdown, is very like a CNN Cash article, making the sturdy case for market optimism in 2008. In January of 2008, Fed chair, Bernanke, proclaimed that the Fed will not be forecasting a recession. The primary arguments that bulls make for his or her gentle touchdown thesis are that unemployment remains to be low, inflation has gone down, GDP progress, and excessive inventory costs, regardless of numerous indicators of financial peril.

Whereas silly financial optimism is predicted from clowns like CNBC’s, Jim Cramer, who was infamous for saying don’t be foolish on Bear Stearns earlier than the crash of 08, even revered monetary figures who’re extra bearish, like Mohamed El-Erian, have been lately shilling a powerful financial restoration. An instance of blatant propaganda from bulls, is a Bloomberg interview with Blackrock’s Rick Rieder, by which Rieder dismissed that the Yield Curve has been unsuitable at flagging many recessions, agreeing with “Economist” Ed Yardini, who mentioned that “the yield curve is completely different this time as a result of now we have a “Nirvana Situation.” That is blatantly false, because the Yield Curve has precisely predicted each single recession, and was solely barely off as soon as within the 60s. It’s notable that Yardini was saying the identical in regards to the Yield Curve again in April of 2008. The Yield Curve has inverted probably the most for the reason that early 80s recession.

1 12 months Treasury Yield

Supply: Northman Dealer through @StockCharts.com

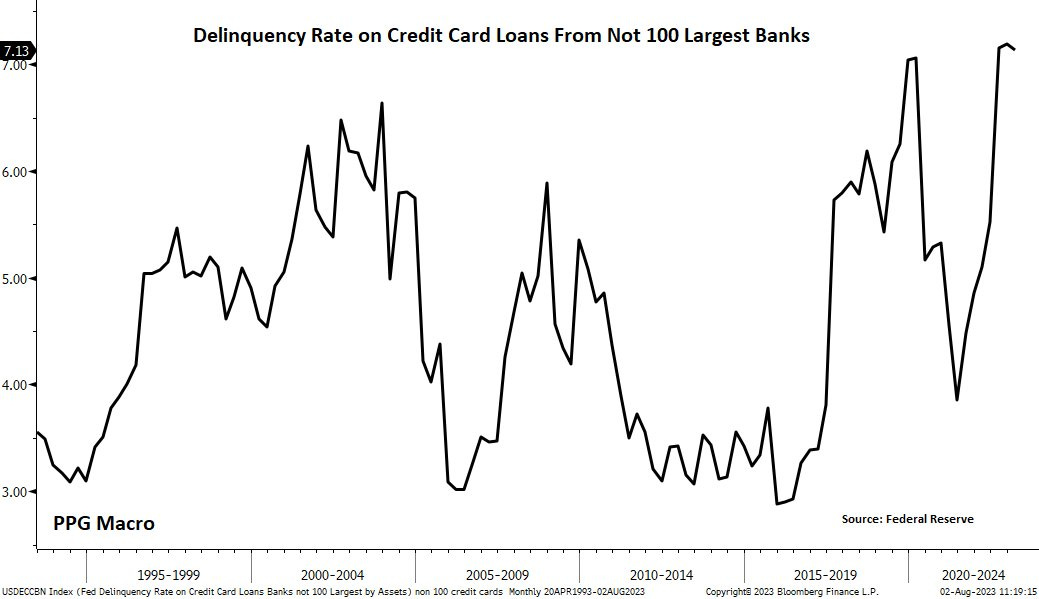

Blackrock’s Rieder additionally dismissed that rising rates of interest may have a serious adverse affect on the financial system, solely specializing in these with mounted mortgage charges whereas ignoring that medium home cost are up 19% from 2022, the most costly ever, and 30 12 months mortgages are on the highest charges since 2000. Rising rates of interest, that are on the highest stage in 22 years, coincide unprecedented ranges of debt, with bank card balances at 20 12 months highs and US adults having extra bank card debt than complete financial savings. Additionally delinquency charges on bank card loans from small lenders are at a excessive of seven.1%, above the final peak of 6.0% in 2008, a speedy rise from 3.8% in 2020. When rates of interest have been close to 0, companies took on a great deal of debt, that they are going to face a looking on when they’re compelled to refinance at larger charges. Complete US debt, together with authorities, enterprise, and private debt has reached a whopping $100 trillion.

Supply: Kobeissi Letter through Federal Reserve

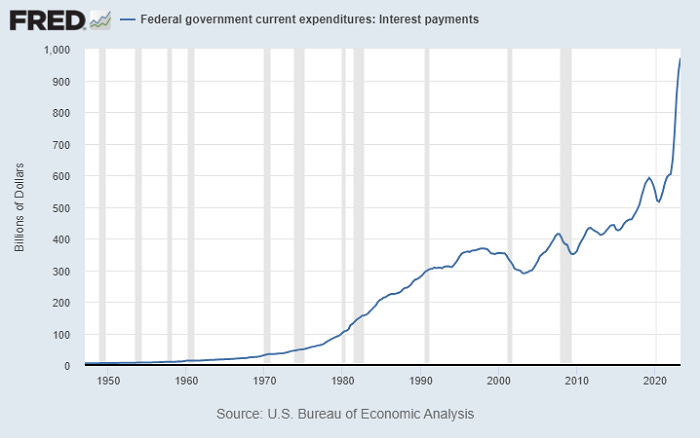

Curiosity expense on the nationwide debt reached 1 trillion for the primary time, surging 50% in simply the previous 12 months, and curiosity bills will quickly account for over 20% of all authorities expenditures, which is larger than nationwide protection spending. It will solely speed up as charges rise or at the least should be sustained, and over the subsequent 10 years, the Congressional Finances Workplace tasks curiosity prices to hit $10.6 trillion.

Supply: Kobeissi Letter through US. Bureau of Financial Evaluation

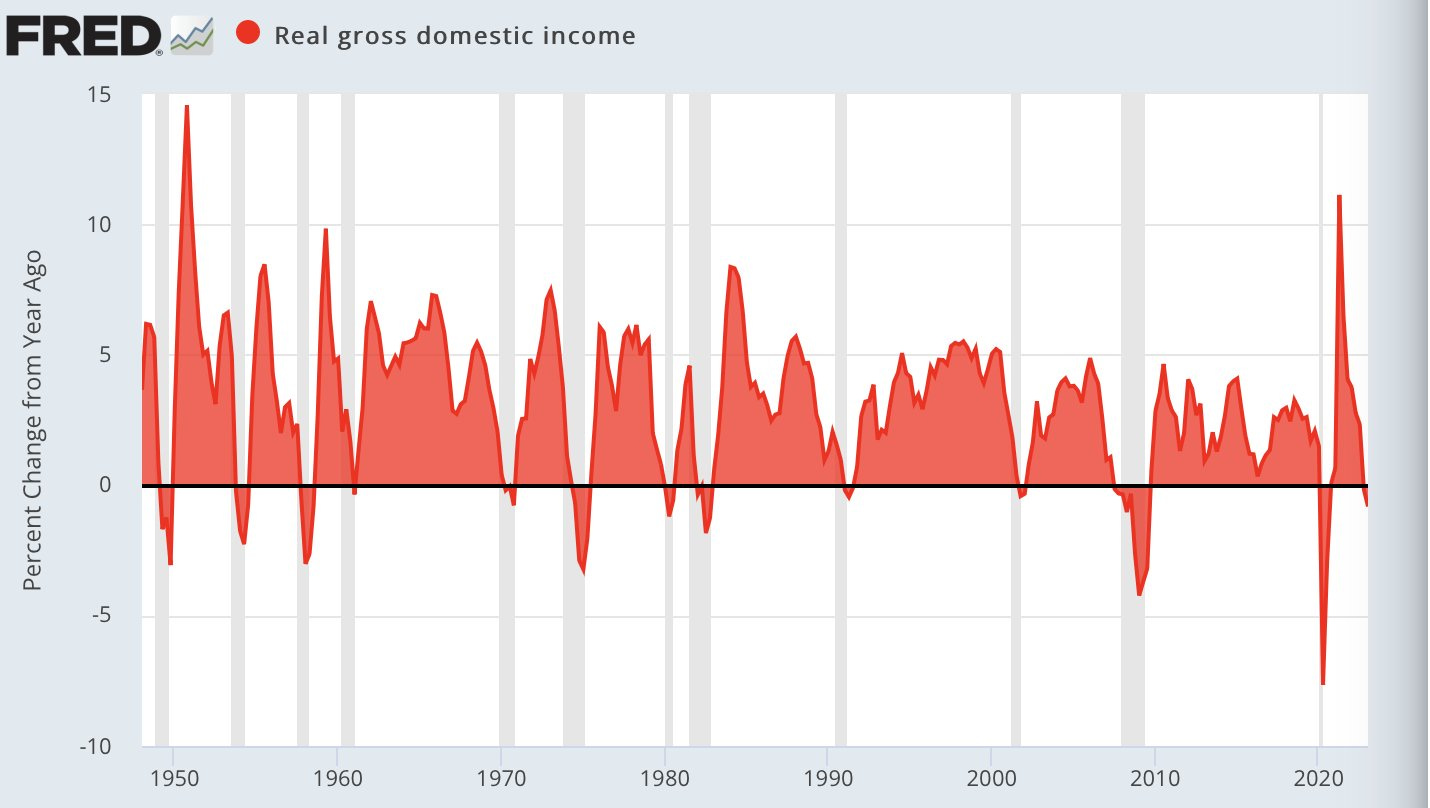

In distinction with sturdy GDP progress, GDI (Gross Home Earnings) has turned adverse and declined during the last two quarters. The Fed’s Actual Gross Home Earnings chart exhibits a serious dip from covid, after which huge progress because of stimulus, earlier than dipping adverse once more. The huge divergence between GDP and GDI is defined by huge authorities spending, as GDI is derived from earnings reasonably than expenditure knowledge. One other issue for this divergence is the current surge in migration, with even the New York Occasions, mainly admitting that Bidenomics hinges upon mass migration. It’s because migration grows the GDP whereas lowering labor inflation by undercutting wages.

Supply: Northman Dealer through Federal Reserve Financial Knowledge

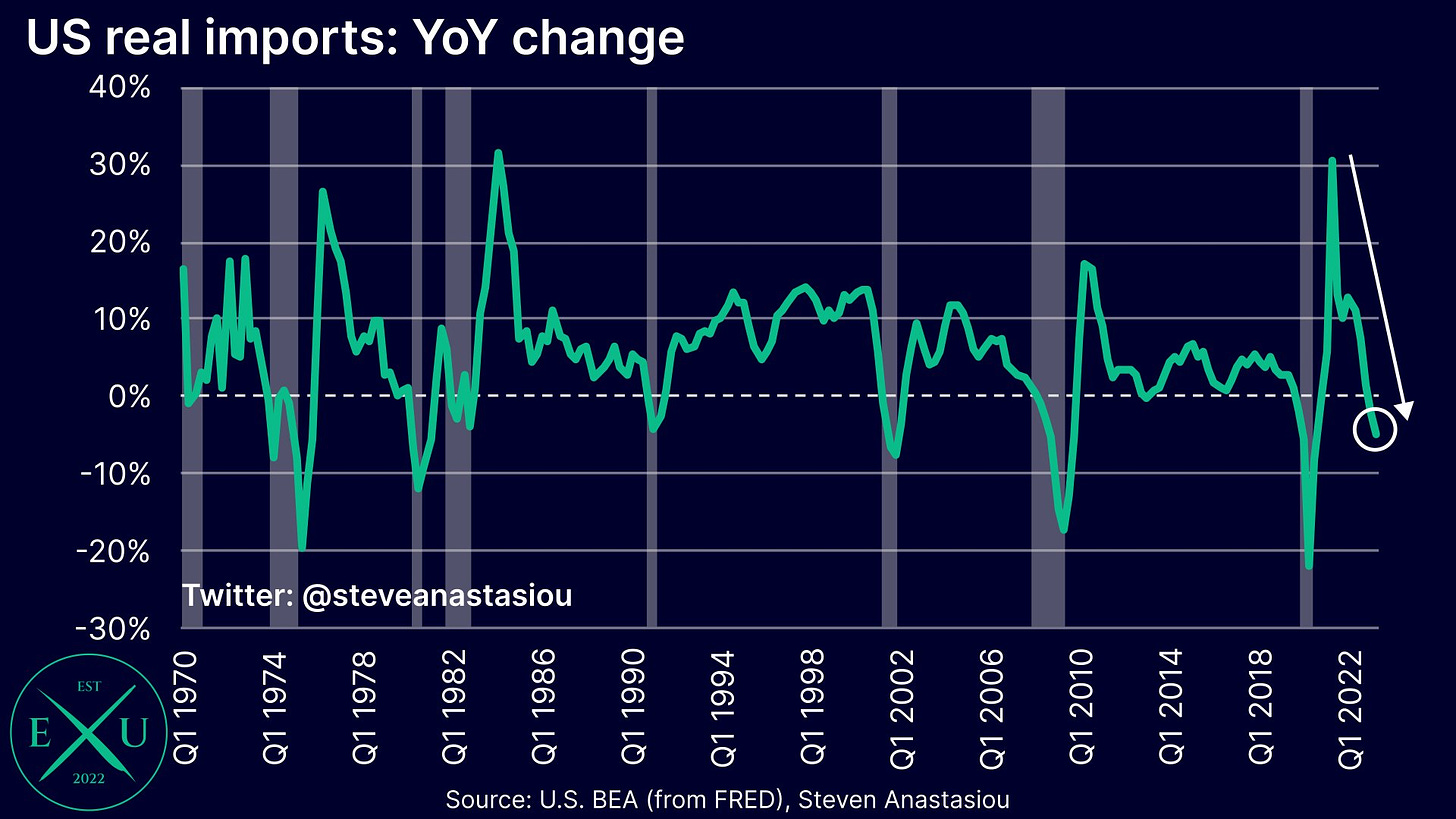

One other bearish metric is the US Main Financial Indicators, which have been minus .7% for June, and adverse for the fifteenth consecutive month. That is the longest adverse streak since 2007/08 earlier than the International Monetary Disaster. Different bearish indicators embrace the Philly Fed’s Manufacturing Survey, signaling 10 straight months of contraction, and Chapter 11 “reorganization” bankruptcies surging 68% for the primary half of 2023, with filings for small companies climbing by 55%, and 340 U.S. companies submitting for chapter within the first half of 2023, a brand new 13-year excessive. The US trucking agency, Yellow, simply declared chapter, which had about 30k staff. Additionally US imports have plunged to an annualized fee of -7.8 for Q2 of this 12 months, which is the worst decline since 1970.

Supply: @steveanastasiou through Federal Reserve Financial Knowledge

The US added 187k jobs in July, which is beneath expectations of 200k, whereas the unemployment fee fell from 3.6% to three.5%. In response to current US Manufacturing Survey knowledge employment is the weakest for the reason that covid lockdowns, and Vanguard’s high economist proclaimed that People are about to begin dropping their jobs — and that may spoil the Fed’s dream no-recession situation. To not point out that the Authorities simply admitted that thousands and thousands of unemployed folks weren’t counted. Whereas there was a slowdown in layoffs, there’s additionally a slowdown in new hiring, which indicators both stagnation (stagflation) or a transition interval from growth to bust.

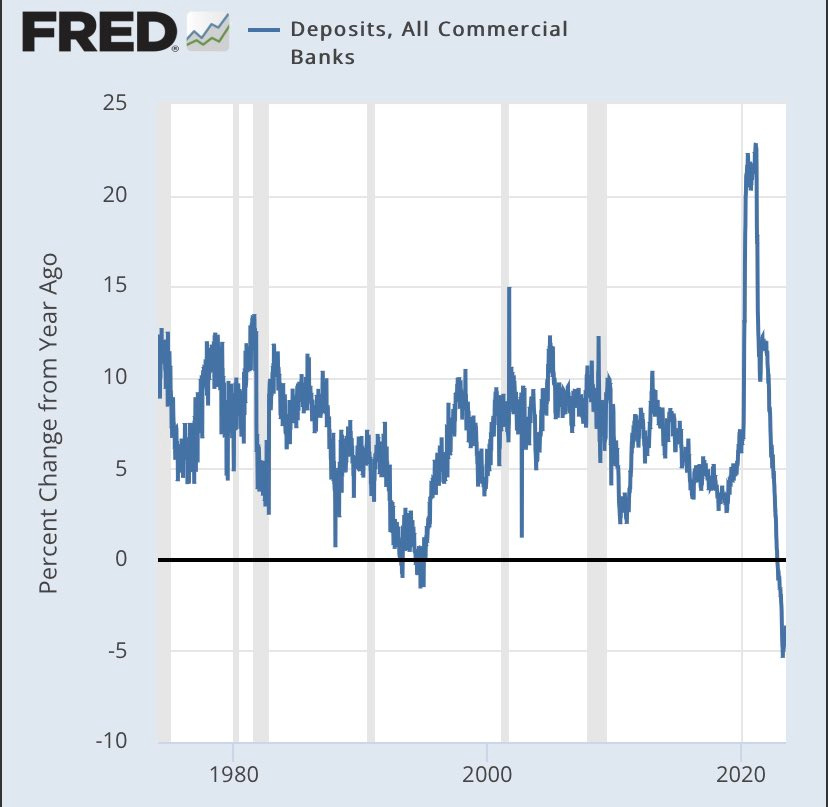

This spring’s banking disaster is way from being resolved, with the Heartland Tri-State Financial institution in Kansas turning into the fifth US financial institution to fail this 12 months, and now Moody’s is chopping the scores of 10 main banks, together with some massive names. Banks are hyper-sensitive to larger rates of interest, which signifies that larger debt repayments are stifling mortgage creation. Financial institution deposit progress continues to plunge adverse at an unprecedented fee, and it has been uncovered that banks have been deliberately under-stating their uninsured deposits. No to say {that a} doubtless business actual property crash will take down many extra regional banks.

supply through US. Bureau of Financial Evaluation

The bond market is on the verge of a serious breakdown with the yield on the 10-year Treasury reaching over 4.1% for the primary time since November of 2022. Additionally Hedge Funds are shorting treasury bonds at historic ranges. Nevertheless, Friday the bond market recouped a number of the loses from final week’s carnage, largely as a result of lower than stellar employment knowledge, signaling hope for a Fed pivot on fee hikes. Regardless, the price of financing the $32.7 trillion Nationwide Debt goes to crash the bond markets. There may be additionally hazard that Japan, because the primary holder of US treasury bonds, will dump US bonds to pay down their money owed and save the Yen, simply because the Fed is promoting off treasuries. This alone might crash the US financial system and set off a worldwide monetary crash. Simply contrasting the disconnect between shares and the bond market exhibits that this hole will shut violently for the markets.

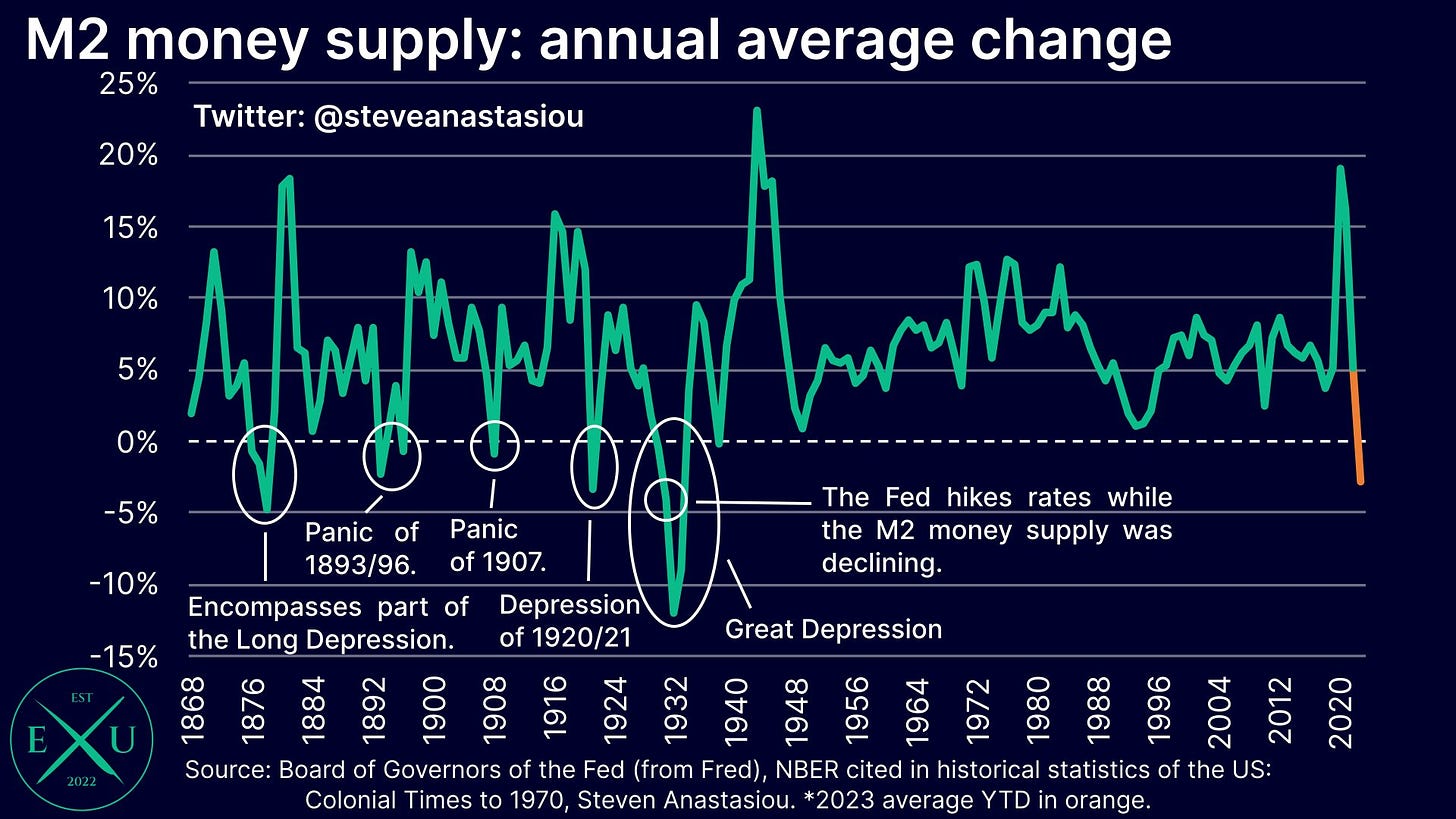

Supply: Sport of Trades

Whereas the Fed lowered its stability sheet by 8% since its peak, the cash provide remains to be twice the scale that it was pre-covid, making an allowance for that about 40% of all cash in circulation was printed in simply 1.5 years. The US remains to be spending 44% of GDP per 12 months, which has similarities to World Warfare 2 ranges. The M2 Cash Provide’s progress fee has gone adverse this 12 months, contracting on the quickest fee for the reason that Nice Melancholy, although the Cash Provide expanded once more lately after contracting. The M2 Cash Provide has elevated whereas the Fed’s stability sheet decreased, which could be defined by the Fed shrinking its belongings and promoting off bonds (quantitative tightening), whereas additionally focused bailouts of banks, and buying bonds from companies resembling Apple and Disney, which props up the inventory market. To not point out the general excessive ranges of spending. This mixture of increasing the cash provide after which contracting sharply is extraordinarily unstable.

Supply: @steveanastasiou through the Board of Governors of the Fed

Whereas inflation declined considerably from final 12 months’s peak, there are worrying indicators that inflation might resurge once more, very like through the 70s. A lot of the discount in inflation was because of provide chain points getting resolved, in addition to the strengthening of the greenback. The ten 12 months word yield was buying and selling like inflation is again on the rise, and surging oil costs and collapsing bond costs, in addition to the greenback and bond yields taking place whereas shares are up are main inflationary indicators.

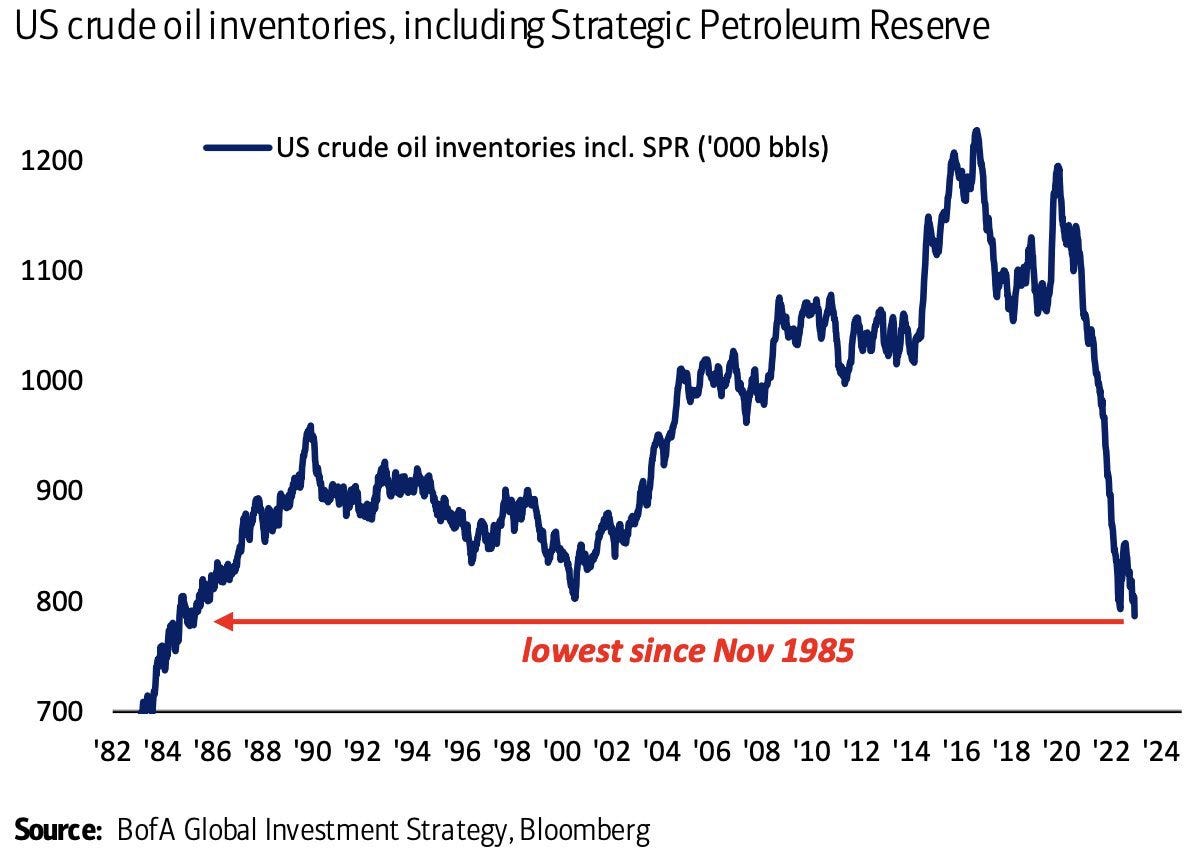

Supply: Kobeissi Letter through BofA International Funding Technique, Bloomberg

Moreover core or financial inflation, commodity costs are set to spike. The value of oil is as much as $82 a barrel, the very best since April, a rise of 30% over the previous three months. That is due to OPEC manufacturing cuts whereas Biden has didn’t refill the Strategic Petroleum Reserve, after depleting reserves to maintain costs down final 12 months. Now US oil reserves are on the lowest ranges since 1985. Additionally Ukrainian drones are beginning to strike Russian oil tankers within the Black Sea which can additional restrict provide. Agricultural commodities are up and simply 3% away from reaching the highs from the start of the Ukraine Warfare, as a result of finish of the grain deal between Russia and Ukraine, in addition to India limiting rice exports. Total commodities have been up considerably for July.

Commodities Worth Index

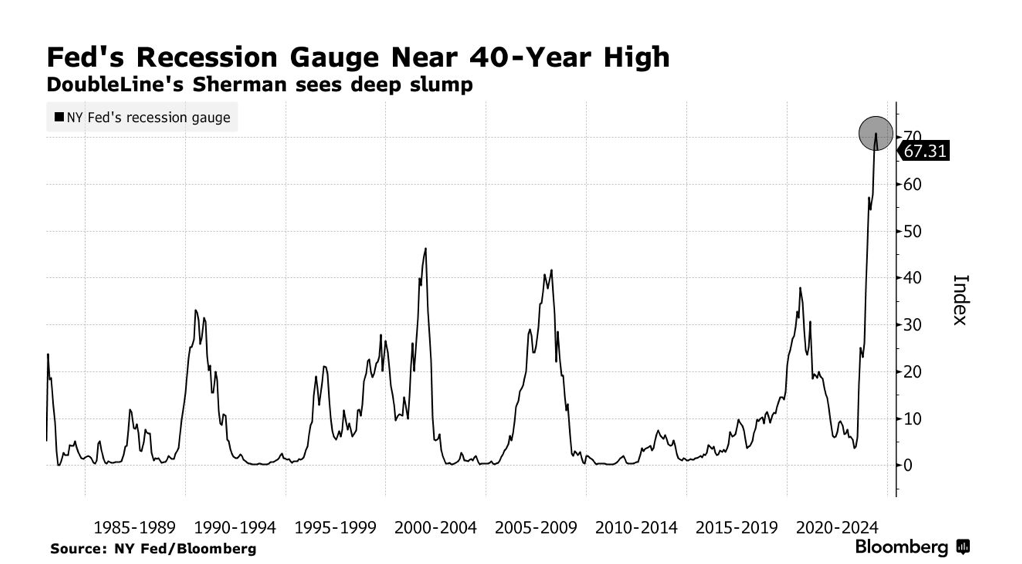

On the onset of the pandemic, the Fed dismissed issues about inflation. Then in January of 2021, the Fed claimed that inflation would simply be “transitory,” and by September of 21’, the Fed completely dismissed the necessity to increase rates of interest to quell rising inflation. Nevertheless, the Fed modified course by January of twenty-two’, when Powell known as for mountaineering charges to trigger a recession, as the one strategy to finish inflation. By December of twenty-two’, the Fed proclaimed that inflation had been defeated, and by February of 23’, {that a} “gentle touchdown” was doable. Then the Fed downplayed the severity of the banking disaster in March, claiming that the monetary system was secure. Now the Fed is not anticipating a recession, regardless of being confirmed unsuitable each single time. This can be a complete contradiction of Powell lately stating that “the total results of tightening are but to be felt,” and the Fed’s recession gauge predicting a a lot worse recession than it did earlier than 08.

Supply: Northman Dealer through NY Fed/Bloomberg

Bloomberg Information admitted that an financial gentle touchdown hinges upon the Fed’s tolerance of inflation, and the Fed pursuing this fantasy of defeating inflation with out inflicting a recession will trigger the 2nd wave of inflation adopted by a extreme recession. Powell nonetheless insists upon a 2% goal, which is unrealistic with no deflationary crash. Shares rallied over hints that the Fed will pause this 12 months and lower charges subsequent 12 months, however mockingly the inventory rally gave the Fed a cushion to lift charges in July. The truth that a recession has not materialized signifies that the Fed should hold charges excessive longer. So good financial information is unhealthy information and there isn’t any escaping the entice, that fee hikes will trigger a crash whereas a pivot will trigger inflation to resurge. The gentle touchdown thesis hinges upon a hope of sustaining this goldilocks zone the place inflation declines with none rise in unemployment, after which the Fed cuts charges, which is completely delusional.

The Fed’s plan appears to be to step by step proceed tightening or hold charges the identical, after which use that cushion to chop charges or simulate if a serious crash happens. That is all on the expense of letting small companies and regional banks crash from a scarcity of liquidity, with larger charges resulting in larger financial consolidation. Principally a managed demolition of the financial system and wealth switch from the center class to the 1% and huge establishments. Debt is what will take down the financial system, and there’s a excessive chance that the Fed will simply inflate the debt away by devaluing the forex.

supply: Cross Border Capital