(Bloomberg) — The Federal Reserve’s first-line inflation gauge is about to indicate some modest reduction from cussed worth pressures, corroborating central bankers’ prudence in regards to the timing of interest-rate cuts.

Most Learn from Bloomberg

Economists anticipate the non-public consumption expenditures worth index minus meals and vitality — due on Friday — to rise 0.2% in April. That might mark the smallest advance to date this yr for the measure, which gives a greater snapshot of underlying inflation.

The general PCE worth index most likely climbed 0.3% for a 3rd month, in accordance with median projection in a Bloomberg survey. Will increase this yr stand in distinction to comparatively flat readings within the ultimate three months of 2023, underscoring uneven progress for the Fed in its inflation combat.

Fed Chair Jerome Powell and his colleagues have burdened the necessity for extra proof that inflation is on a sustained path to their 2% aim earlier than slicing the benchmark rate of interest, which has been at a two-decade excessive since July.

The PCE worth measure is seen rising 2.7% on an annual foundation, whereas the core metric is anticipated at 2.8% — each matching the prior month’s ranges.

Officers earlier this month coalesced round a need to carry rates of interest larger for longer and “many” questioned whether or not coverage was restrictive sufficient to convey inflation right down to their goal, in accordance with minutes of their final assembly.

Learn extra: Minutes Present Officers Rallying Round Increased-for-Longer Charges

The most recent inflation numbers will probably be accompanied by private spending and earnings figures. Whereas demand grew at a strong tempo within the first quarter, the information will inform on providers spending after flat retail gross sales in April beforehand reported.

What Bloomberg Economics Says:

“The report will possible present some encouraging indicators that the disinflation course of hasn’t utterly stalled. With earnings development slowing in a cooling labor market, customers are progressively cracking, which ought to present a continued disinflationary impulse in the remainder of the yr. But, with catch-up worth pressures nonetheless within the pipeline, inflation will possible reasonable solely very progressively this yr.”

—Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou, economists. For full evaluation, click on right here

Different information for the week embrace revised first-quarter gross home product on Thursday. Economists forecast development most likely cooled from the federal government’s preliminary estimate. The Ate up Wednesday will subject its Beige Guide abstract of financial situations across the nation.

Among the many US central bankers talking throughout the holiday-shortened week are John Williams, Lisa Cook dinner, Neel Kashkari and Lorie Logan.

Wanting north, Canada will launch gross home product information for the primary quarter. Waning month-to-month momentum in March and weak home demand would possible maintain a June fee lower in play for the central financial institution.

Elsewhere, a probable pickup in euro-zone inflation, Chinese language industrial information and PMI numbers, and worth studies from Brazil will probably be among the many highlights.

Click on right here for what occurred up to now week and beneath is our wrap of what’s arising within the world financial system.

Asia

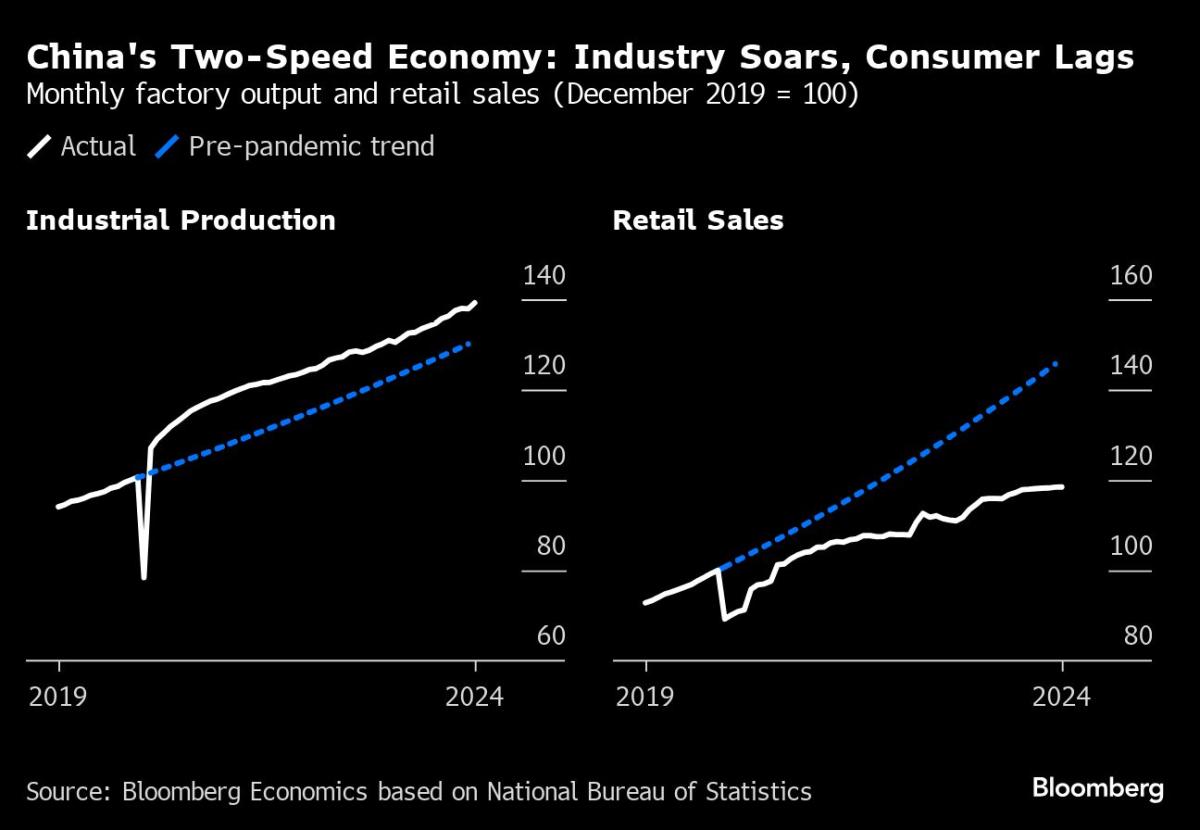

China’s manufacturing sector is within the highlight within the coming week. Industrial information Monday will present whether or not earnings bounced again in April after a pointy retreat in March dragged the tempo of positive factors for the primary three months to 4.3%.

Persistent deflation in producer-gate costs and comfortable home demand might maintain profitability underneath stress. China will get its official manufacturing PMI information on Friday, with the give attention to whether or not the gauge stays above the 50 threshold that separates contraction from enlargement for a 3rd month in Could.

Additionally on Friday, Japan’s industrial output development is seen slowing whereas retail gross sales chug alongside in April.

Shopper inflation in Tokyo might choose up a bit in Could, foreshadowing positive factors for the nationwide figures.

Australia’s client worth development is forecast to sluggish to three.3%, nonetheless sizzling sufficient to maintain the Reserve Financial institution of Australia on maintain.

Vietnam additionally studies CPI information, together with industrial output, retail gross sales and commerce throughout the week.

In central banking, Kazakhstan units its benchmark coverage fee on Friday.

Europe, Center East, Africa

Within the euro zone, inflation most likely accelerated in Could to 2.5%, in accordance with economists’ forecasts. An underlying gauge is anticipated to have stopped weakening for the primary time since July, holding at 2.7%.

In tune with the broader euro-zone information, nationwide releases that begin with Germany’s on Wednesday are anticipated to have gone the fallacious method in three of the area’s 4 greatest economies. Solely Italy is seen to be experiencing slower worth development.

Such outcomes impede progress towards the ECB’s 2% goal, however officers’ constant alerts for a quarter-point fee discount on June 6 make it unlikely that one month of knowledge will derail them. Even so, some policymakers are arguing in opposition to any rush to ease additional.

“The likelihood is rising that in 13 days we are going to see the primary fee lower,” Bundesbank President Joachim Nagel, a coverage hawk, mentioned in an interview on Friday. “If there’s a fee lower in June, we’ve got to attend, and I consider we’ve got to attend until possibly September.”

Different studies within the euro-zone embrace Germany’s Ifo enterprise confidence index on Monday, the ECB’s survey of inflation expectations on Tuesday, and financial confidence on Thursday.

ECB officers scheduled to talk within the coming week embrace chief economist Philip Lane and the Dutch, French and Italian governors. A pre-decision blackout interval kicks in on Thursday.

The Financial institution of England has already gone silent, cancelling all speeches and public statements by policymakers throughout the marketing campaign earlier than the UK basic election on July 4.

Amongst different European central banks, a monetary stability report from Sweden’s Riksbank on Wednesday, and a speech in Seoul by Swiss Nationwide Financial institution President Thomas Jordan will probably be among the many highlights.

A number of financial selections are scheduled within the wider area:

-

Israel’s central financial institution is anticipated to maintain its base fee regular at 4.5% on Monday, largely to maintain war-related inflationary pressures in test and supply help to the shekel. Governor Amir Yaron is cautious of easing financial coverage and additional widening the hole between borrowing prices in Israel and the US.

-

Ghana’s financial authority is about to go away its key fee at 29% on Monday to conquer sticky inflation and help its floundering forex.

-

On Wednesday, Mozambique’s policymakers are poised to chop borrowing prices, with consumer-price development anticipated to stay within the single digits for the remainder of the yr.

-

And on Thursday — a day after elections the place the ruling African Nationwide Congress dangers shedding its majority — South African financial officers are predicted to take care of their key fee at 8.25%, with inflation but to return to the 4.5% midpoint of their goal vary.

Latin America

Brazil within the coming week studies the mid-month studying of its benchmark client worth index together with the Could studying of its broadest measure of inflation.

The mix of Brazil’s tight labor market and weaker forex possible restrict the scope for additional disinflation from present ranges, with inflation already operating close to consensus year-end forecasts.

The IPCA-15 worth index fell again beneath 4% final month after leaping over 5% in September — which got here simply two months after hitting 3.19%, beneath the central financial institution’s 2023 goal.

Additionally in Brazil, the central financial institution on Monday posts its weekly survey of economists, whose inflation expectations and rate of interest forecasts are rising once more, together with nationwide unemployment, complete excellent loans, and funds balances.

Chile posts six separate indicators for April, with the highlights being joblessness, retail gross sales, industrial manufacturing and copper output.

Mexico’s mild schedule will probably be dominated by the central financial institution’s publication of it quarterly inflation report, adopted by a press convention hosted by Governor Victoria Rodriguez.

Banxico earlier this month marked up its inflation forecasts via the third quarter of 2025, whereas Wednesday’s report will reveal the financial institution’s revised GDP forecasts.

On Thursday, Mexico’s April labor market information are due. The early consensus sees the unemployment fee rising from the file low of two.28% posted in March.

–With help from Robert Jameson, Piotr Skolimowski, Monique Vanek and Laura Dhillon Kane.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.