Cloud shares slipped on Tuesday, after one of many extra outstanding ones, Datadog, lowered its full-year income steerage as organizations stay engaged in cost-saving workouts.

One cloud-oriented exchange-traded fund, the WisdomTree Cloud Computing Fund, tumbled 3% for the day, marking its fifth day of declines up to now six buying and selling classes.

Many cloud-computing firms loved increased demand after Covid prompted firms, governments and colleges to change on extra cloud providers as workers labored from dwelling. Then inflation hit, central bankers raised rates of interest and traders started promoting holdings in fast-growing cloud shares and rotating into safer investments that might extra constantly provide returns.

Plus, some elements of the financial system, reminiscent of actual property, have began to flag due to increased charges, main administration groups to search for locations to save cash on cloud infrastructure and different expertise.

Executives at many cloud firms responded by decreasing overhead, generally within the type of layoffs. Previously a number of months, the rise of generative synthetic intelligence providers reminiscent of startup OpenAI’s ChatGPT chatbot have made traders extra enthusiastic about adopting comparable applied sciences and extra instruments to assist with the shift. Cloud shares started to rebound, however many, together with Datadog, have but to commerce above their document highs from 2021.

Now among the fastest-growing firms are now not trying so scorching.

Datadog’s income grew virtually 83% 12 months over 12 months within the first quarter of 2022. Early on Tuesday Datadog, which gives cloud-based infrastructure monitoring, mentioned it expects full-year income to come back in between $2.05 billion and $2.06 billion, down from the vary of $2.08 billion to $2.10 billion that it supplied in Could. That suggests Datadog sees fourth-quarter income rising simply 15%, in contrast with an earlier forecast of just about 23%. Analysts polled by Refinitiv had anticipated $2.081 billion in income for the total 12 months.

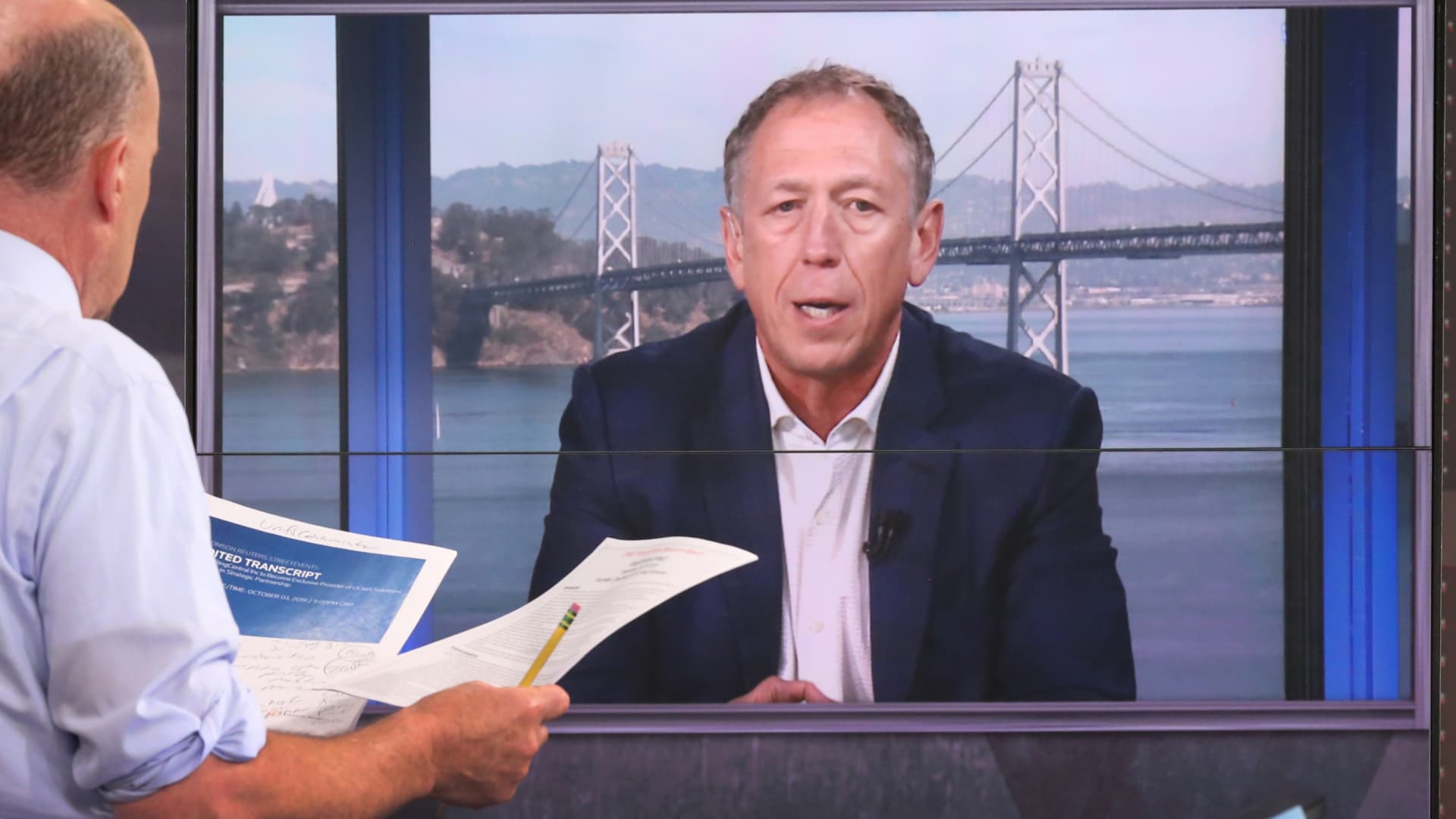

“We noticed utilization progress for present prospects that was a bit decrease than it had been in earlier quarters,” Olivier Pomel, Datadog’s co-founder and CEO, mentioned on a convention name with analysts. “We proceed to see prospects bigger spending prospects scrutinize prices.”

Datadog’s steerage of $521 million to $525 million in income for the third quarter underwhelmed analysts. They’d anticipated $533 million, in response to Refinitiv. Then once more, Pomel mentioned throughout the name that he and his colleagues have integrated conservatism into their outlook.

“For an organization the place progress has been one side making it so enticing, it’s most likely not stunning that the inventory is down sharply within the pre-market,” Bernstein Analysis analysts led by Peter Weed, with the equal of a purchase score on Datadog inventory, wrote in a word distributed to purchasers. They have not soured on the inventory altogether, although. They analysts wrote that they count on progress to return as enterprise-spending budgets get better and enterprise capitalists begin pouring giant swimming pools of cash into startups once more.

Datadog shares, which debuted on the Nasdaq in 2019, fell 17%, their sharpest single-day pullback since March 2020 when Covid first emerged within the U.S.

Most shares in WisdomTree’s cloud fund have been down on Tuesday. But it surely wasn’t all Datadog’s fault.

Late on Monday, cloud-communications software program maker RingCentral mentioned Hewlett Packard Enterprise’s finance chief, Tarek Robbiati, will substitute co-founder Vlad Shmunis as CEO later this month. Shares of RingCentral ended Tuesday’s buying and selling session down 18%. Shmunis will stay on RingCentral’s board and can take the title of government chairman.

“Gross sales cycles stay elevated versus final 12 months, and customer-buying selections proceed to undergo further layers of approval,” RingCentral’s chief monetary officer, Sonalee Parekh, mentioned on a convention name with analysts. “We’re additionally seeing much less upsell inside our present base as prospects have slowed hiring and rationalized their worker counts.”

Like Datadog, Everbridge, whose software program helps firms reply to emergencies, lowered its progress expectations for the total 12 months on Tuesday. It now sees a bigger loss than it had referred to as for 3 months in the past.

A weaker financial system has led to “slower gross sales of huge offers,” finance chief Patrick Brickley mentioned on a convention name with analysts. Shares slid virtually 22%.