-

Berkshire Hathaway is sitting on a document pile of money at $189 billion.

-

That is no motive to fret about an imminent inventory market crash, in keeping with one fund supervisor.

-

“Everyone will get exercised, they go hyperbolic about it, nevertheless it’s not that huge of a quantity,” Chris Bloomstran mentioned.

Berkshire Hathaway just lately reported its first-quarter outcomes, and like clockwork, a swarm of bearish buyers identified that Warren Buffett is sitting on a document money pile of $189 billion.

The implication, in keeping with these commentators, is that the inventory market is prone to quickly endure a large decline as a result of Buffett does not see any worth in investing his agency’s huge money pile on the present sky-high valuations.

Actually, that could not be farther from the reality, in keeping with Chris Bloomstran, fund supervisor of Semper Augustus, which manages about $550 million in belongings and counts Berkshire Hathaway as its largest place.

In a latest interview with Enterprise Insider, Bloomstran defined that there is much more nuance to Berkshire Hathaway’s mountain of money, and it does not replicate the concept that Buffett is bearish on the inventory market or {that a} inventory market crash is imminent.

“Everyone will get excited, they go hyperbolic about it, nevertheless it’s not that huge of a quantity,” Bloomstran mentioned.

Placing Berkshire’s money pile into perspective

As an alternative of measuring Berkshire Hathaway’s money place on an absolute foundation, buyers are higher off measuring the money pile as a proportion of Berkshire’s whole belongings, in keeping with Bloomstran.

And at 17.5%, Berkshire Hathaway’s present money place is about in-line with its long-term common when measured in opposition to the agency’s whole belongings. Berkshire Hathaway has stored money on its stability sheet at a mean of 13% of belongings since 1997, in keeping with Bloomstran.

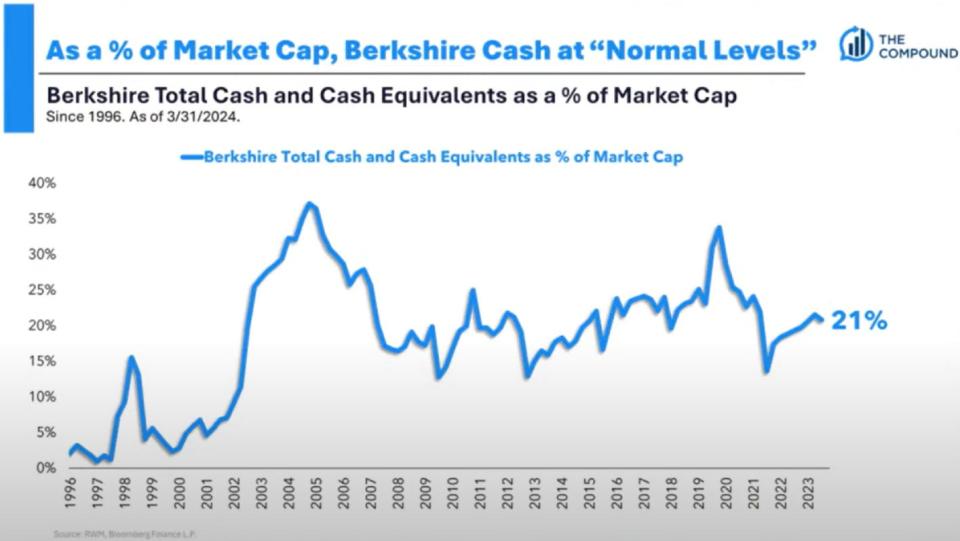

One other approach to have a look at Berkshire Hathaway’s money place is to measure it in opposition to the agency’s market valuation, which paints the same image. Berkshire Hathaway’s $189 billion money is definitely at a fairly normalized stage, and nicely under its peak of practically 40% in 2004.

Berkshire Hathaway is required to carry onto money

Simply because Berkshire Hathaway holds practically $200 billion in money does not imply they’ll make investments all of that money in the event that they discover a sufficiently big goal.

“I consider the money, roughly half of it’s legitimately deployable,” Bloomstran mentioned.

That is as a result of Berkshire Hathaway’s huge insurance coverage operations require the corporate to have an ample money reserve to fund potential insurance coverage payouts.

Whereas Buffett has acknowledged that Berkshire Hathaway will preserve a everlasting money reserve of about $30 billion to fund potential insurance coverage payouts, Bloomstran takes a extra conservative strategy and provides about $50 billion to that reserve stage to account for a full 12 months’s price of potential insurance coverage losses.

“We’re thus calling $82 billion a roughly everlasting money reserve,” Bloomstran mentioned in his annual investor letter, leaving about $110 billion accessible for Berkshire Hathaway to take a position.

Berkshire Hathaway’s investable universe is slim

Due to the large dimension of Berkshire Hathaway, there’s solely a small group of firms it might spend money on that may actually transfer the needle for the conglomerate.

If you mix that with the truth that cash-equivalents like short-term Treasurys are yielding greater than 5%, Buffett and and his firm are taking their time to search out the best funding on the proper value — and that funding might come at any time, similar to it did within the first quarter of 2016 when Berkshire first invested in Apple.

On the time, the S&P 500 was buying and selling close to document highs, Apple was the largest firm on this planet, and Berkshire Hathaway’s absolute money pile was at a document. None of these elements — all of that are current immediately — stopped Buffett from making the most effective investments in Berkshire Hathaway’s historical past.

“He is restricted to possibly the 100 largest firms within the S&P 500 and possibly a handful of worldwide companies to have the ability to spend money on. So, his alternative set is pricey, however he does not thoughts incomes 5.3% within the interim, nevertheless it doesn’t imply in any approach, form, or kind {that a} inventory market crash is imminent. He is simply looking for nice costs steady sufficient to place cash to work. His universe is proscribed,” Bloomstran mentioned.

Put collectively, buyers should not have a bearish view on the inventory market simply because Berkshire Hathaway is sitting on a document pile of money.

Take it from Buffett himself.

When requested “what’s Buffett ready for?” almost about Berkshire’s money pile at this 12 months’s annual shareholder assembly, the legendary investor responded:

“We solely swing at pitches we like.”

Learn the unique article on Enterprise Insider