(Bloomberg) — When China deserted pandemic restrictions after three years of stringent controls, Nie Xingquan was anticipating booming gross sales for his hand-made leather-based footwear. As a substitute, demand has been so poor that he’s needed to lower costs 3% from a 12 months in the past and scale back his income.

Most Learn from Bloomberg

It’s an ominous signal of the deflationary strain that’s hitting Chinese language companies because the financial system weakens, and threatening to undermine Beijing’s stimulus plans if customers decide to defer spending.

Nie mentioned his Italy Elsina Group Co., which relies in japanese China’s Wenzhou metropolis and caters to home retailers and customers, has seen enterprise tail off since February. Lots of his shoppers are nonetheless scarred from the harm Covid did to their money circulate and income. Some retailers, somewhat than placing in new orders, try to promote all of the inventory they collected whereas anticipating gross sales to surge.

“Everyone seems to be simply hanging in there and doing their finest to squeeze income as a lot as doable in order that they will nonetheless survive” and stay aggressive, mentioned Nie.

As a substitute of speedy value features predicted by some economists firstly of the 12 months, China is experiencing a uncommon interval of falling costs. That’s a transparent distinction to the rocketing inflation that adopted the reopening of the US and different main economies, and is seen each on the manufacturing unit gate and retail facet.

Producer costs have been contracting on a year-on-year foundation since October 2022, largely as a result of falling costs for commodities like coal and crude oil. Knowledge on Wednesday will possible present shopper costs declined in July, which might be the primary time since late 2020 that each shopper and producer costs register contractions.

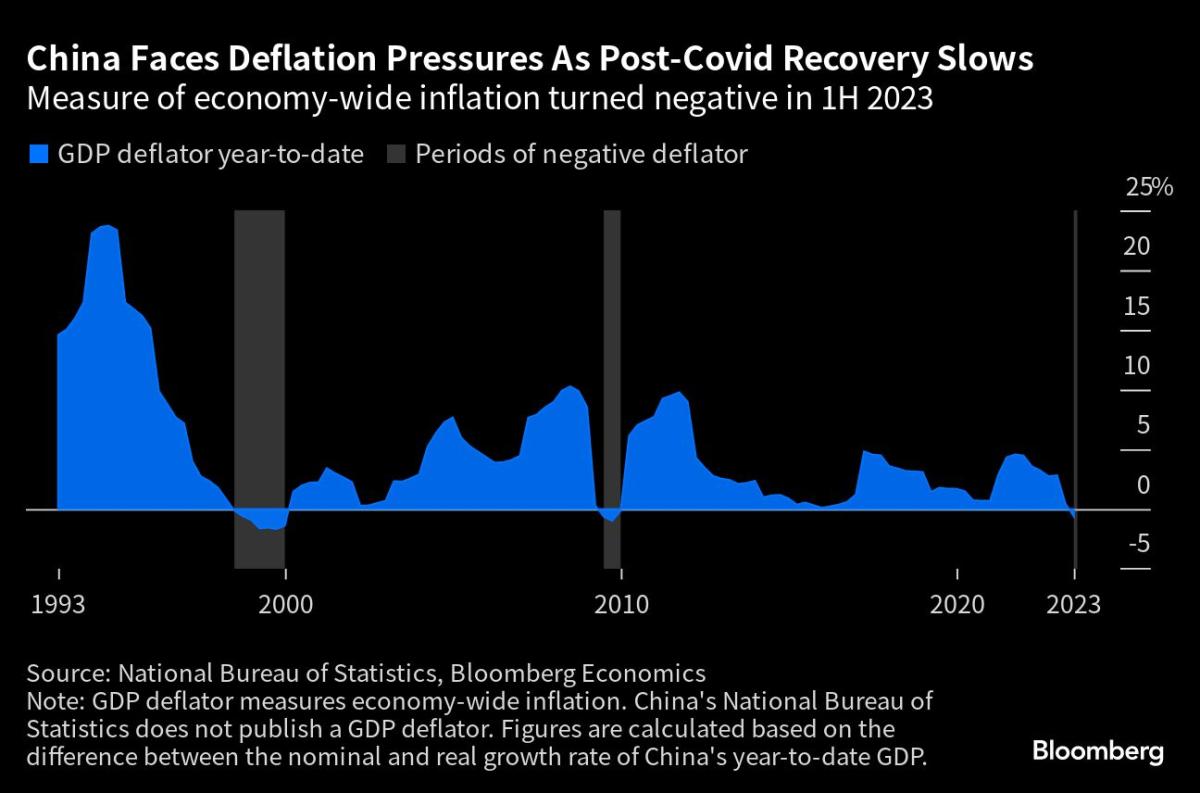

Utilizing the gross home product deflator — a measure of economy-wide costs — China is already in deflation. The Worldwide Financial Fund defines deflation as “a sustained decline in an mixture measure of costs,” reminiscent of the patron value index or the GDP deflator.

Chinese language shares led losses in Asia on Tuesday, with the MSCI China Index sliding as a lot as 1.9%. Marvin Chen, an fairness strategist at Bloomberg Intelligence, mentioned deflation is a big danger that might influence company earnings in China. Falling producer costs have already been hitting industrial and upstream sector income, he mentioned, and declining shopper costs will now squeeze downstream sectors as nicely.

Not like the momentary decline in late 2020 and early 2021, the drop in shopper costs this time round is extra trigger for concern. Again then, falling pork costs had been the primary purpose. Now, exports have plunged as customers in a few of China’s greatest markets, together with the US and Europe, pull again on spending. A chronic downturn in China’s property sector has lower costs for hire, furnishings and residential home equipment.

Additionally, a value conflict amongst carmakers triggered by Tesla Inc.’s reductions led different main manufacturers to affix in with steep reductions earlier this 12 months.

If costs preserve dropping throughout a broad vary of products for an prolonged interval, customers might delay their purchases, curbing financial exercise additional and forcing companies to maintain lowering costs. That, in flip, would lower into income and income, prompting companies to curb funding and jobs — ensuing within the sort of financial stagnation that Japan suffered for many years.

To make sure, China isn’t in the identical boat. Not all costs are falling, with shopper spending on providers remaining pretty robust. Tourism costs surged 7.1% within the first six months from a 12 months in the past, as inns charges surged. Prices for providers reminiscent of recreation and schooling, and medical care, are additionally nonetheless rising.

The issue of low or falling costs is most acute within the consumer-goods industries.

“It seems like persons are now not spending a lot on clothes like they used to,” mentioned Chen Yubing, supervisor of the Jiayao Textile Co. Ltd., a maker of polyester and nylon cloth based mostly within the japanese province of Zhejiang.

“Competitors has turn out to be fiercer and plenty of factories are slashing their costs with a purpose to promote, which led to a vicious cycle,” mentioned Chen, whose manufacturing unit lowered costs by 5% this 12 months although prices have risen by simply as a lot.

The federal government has been downplaying considerations about deflation, with officers from the Individuals’s Financial institution of China, Nationwide Bureau of Statistics and different companies repeatedly saying there’s no basis for long-term value declines.

Speaking about deflation publicly can also be off-bounds for a lot of Chinese language analysts. One economist at a neighborhood brokerage mentioned he was instructed by regulators to not focus on deflation. He was informed to advertise the narrative that China’s financial system is steadily enhancing, he mentioned, declining to be recognized with a purpose to focus on personal data. One other China-based economist mentioned they obtained steerage from regulators and their firm’s public relations division to not focus on deflation publicly.

An enormous driver of low costs this 12 months is the build-up of inventories over the pandemic, and within the first quarter, throughout a burst of optimism following the top of Covid restrictions. That has since reversed, with companies reducing costs to scale back their inventory.

Vivian Feng is a Shanghai resident who purchases discounted items, from farm merchandise to Nike Inc.’s t-shirts, and sells them to neighbors in her residential group. She mentioned her suppliers have lower costs considerably this 12 months as a result of excessive inventories and tender demand.

“Some well-established attire manufacturers used to supply merchandise for the group-buy channel at round 40% of the unique costs in 2021, and so they’re now promoting at simply 10% and even much less,” mentioned Feng.

Some economists anticipate shopper inflation to pattern decrease for a number of extra months earlier than choosing up towards the top of the 12 months as the upper base of comparability with final 12 months fades and home demand picks up. Economists surveyed by Bloomberg anticipate full-year inflation to succeed in simply 0.8% in 2023, the slowest tempo since 2009.

Low inflation is driving up actual, or inflation-adjusted, rates of interest within the financial system, pushing up companies’ debt-servicing prices and undermining the central financial institution’s pledge to spur lending.

Whereas that will increase the case for the PBOC so as to add stimulus to the financial system, the central financial institution is dealing with a number of constraints that’s making it cautious, together with a weaker yuan and elevated debt ranges within the financial system.

Central financial institution officers have hinted at some easing measures, reminiscent of lowering the amount of money that banks should maintain in reserves. Economists additionally predict a ten basis-point coverage price lower within the third quarter.

“The continuing weak spot in China information will proceed to dampen consumption, as households will stay cautious about making purchases of big-ticket objects given the potential dangers of job losses and wage lower,” mentioned Ken Cheung, chief FX strategist at Mizuho Financial institution Ltd. “The uncertainties surrounding deflation could immediate the PBOC to implement extra financial easing measures.”

–With help from Daniela Wei, Tom Hancock, Lucille Liu and Zhu Lin.

(Updates with market considerations.)

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.