Down between 19% and 28% from their all-time highs, dividend development shares Unilever (NYSE: UL), The Hershey Firm (NYSE: HSY), and Lamb Weston (NYSE: LW) at present commerce close to once-in-a-decade valuations.

These magnificent shares have five-year betas properly beneath 1, making these discounted costs much more alluring for buyers. Betas measure an organization’s share worth volatility in comparison with the broader market. Low betas of lower than 1 usually belong to dependable, steady-Eddie operators match to anchor any investor’s portfolio.

This mix of low share worth volatility and regular dividend development at a decade-low valuation makes these three shares promising once-in-a-decade alternatives. This is how they might reward buyers handsomely over the approaching years.

1. Unilever

Shopper items juggernaut Unilever owns greater than 400 manufacturers bought in additional than 190 international locations. Because of highly effective labels akin to Dove cleaning soap, Axe physique spray, Tresemme shampoo and conditioner, Vaseline, and Ben & Jerry’s, roughly 3.4 billion individuals use its merchandise day by day.

Regardless of this international attain and widespread buyer adoption, there are two crucial causes for buyers to stay excited in regards to the firm’s long-term prospects — particularly with the behemoth buying and selling practically 20% beneath its all-time excessive share worth.

First, Unilever generates 59% of its gross sales from rising markets. Because it’s increasing its presence in high-growth-potential international locations like India, Brazil, China, and Indonesia, the corporate’s development story ought to have loads of chapters left. It elevated 2023 gross sales by 15% in Latin America and seven% in Asia Pacific and Africa. Unilever is well-positioned to see robust development as the center class continues increasing globally.

Second, the corporate not too long ago introduced the upcoming separation of the smallest and least worthwhile unit, its ice cream operations. The ice cream unit weighs on the corporate’s cash-generating potential, because the chilly storage provide chain infrastructure wanted is capital-intensive and dissimilar from the remainder of Unilever’s operations.

Greatest but for buyers, even after the corporate’s share worth rose 8% following its first-quarter ends in April, its price-to-earnings (P/E) ratio of 19 and dividend yield of three.6% stay extra enticing than the S&P 500 index’s 25 and 1.4% averages.

2. The Hershey Firm

With its share worth down 29% during the last 12 months, confectioner Hershey continues to battle in opposition to an array of points, akin to:

-

Cocoa costs greater than tripling since 2023.

-

Capital expenditures (capex) hovering to all-time highs as the corporate implements a brand new enterprise useful resource planning (ERP) system.

-

The specter of GLP-1 weight problems medication and their impact on snacking.

-

YouTuber Jimmy Donaldson’s (Mr. Beast) entrance into the business with shortly rising Feastables candies.

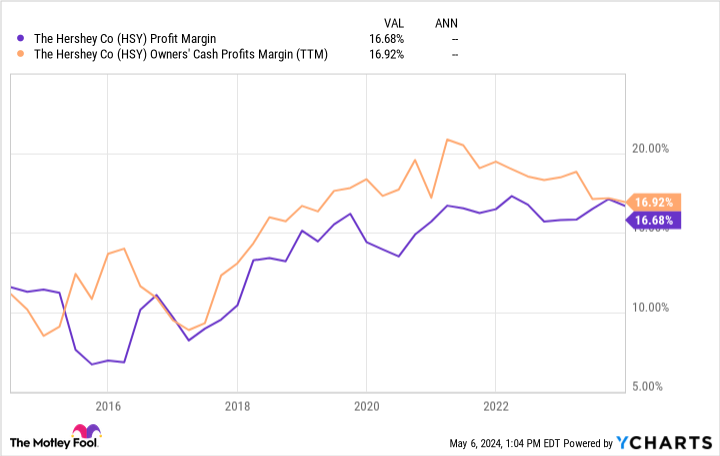

Regardless of these probably crippling circumstances, Hershey has maintained a sturdy 17% internet revenue and free money move (FCF) margin.

Moreover, the corporate’s KitKat, Hershey’s, and Reese’s manufacturers ranked first amongst Gen Z snackers, in accordance with a examine from Segmanta, highlighting sustained recognition throughout generations.

With this unwavering recognition and profitability — whereas working in a recession-resilient business — Hershey makes for an intriguing turnaround candidate as cocoa costs and the corporate’s capex revert to “regular” ranges.

Greatest but, buying and selling at simply 21 instances earnings and with a 2.5% dividend yield, Hershey trades at a reduction to the broader market and its personal 10-year averages. Because of this low cost, Hershey’s model energy, and its longer-term rebound potential, the corporate seems like a wonderful holding, which is why I am excited so as to add it to my daughter’s portfolio.

3. Lamb Weston

Whereas the frozen potato business might not elicit ideas of turmoil, Lamb Weston’s share worth drop of 21% 12 months thus far reveals in any other case. Like our different steady-Eddie funding concept, Hershey, Lamb Weston has launched into a mission to deploy a brand new ERP system.

Nevertheless, this has not been a easy course of for the frozen potato juggernaut. Through the firm’s third-quarter earnings name, administration estimated that the ERP transition brought on gross sales quantity to say no by 8% as a consequence of damaging impacts on order achievement charges.

Making issues worse, elevated capex used to spice up manufacturing capability within the Netherlands, Argentina, and China has quickly brought on Lamb Weston’s free money move (FCF) to show damaging. Whereas this short-term ache is hard to abdomen, administration estimates it is going to be in a position to develop worldwide gross sales from 15% of gross sales in 2022 to 34% in 2024 — all whereas giving it invaluable publicity to higher-growth markets.

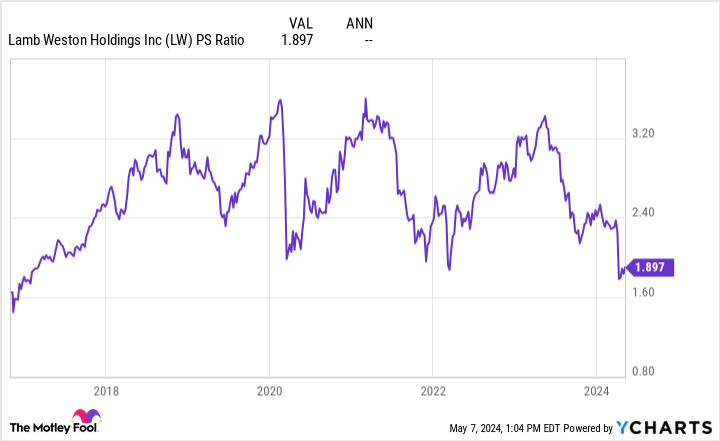

With a decade-low price-to-sales (P/S) ratio of 1.9, Lamb Weston could possibly be a steal at at the moment’s low cost as soon as capex normalizes and its development investments begin to pay dividends.

If the corporate can return to the typical FCF margin of 11% it noticed between 2016 and 2022, it might commerce at simply 17 instances FCF.

Should you plug this right into a reverse discounted money move mannequin, Lamb Weston would solely must ship 5% development to match the market’s common efficiency of 10% yearly. With international potato demand anticipated to develop by 3% yearly over the long run and Lamb Weston poised for worldwide development, I believe it may simply exceed this 5% development price and beat the market.

This outperformance potential, paired with the corporate’s rising dividend that yields 1.5% and solely makes use of 15% of internet earnings, makes for a wonderful once-in-a-decade alternative.

Must you make investments $1,000 in Unilever proper now?

Before you purchase inventory in Unilever, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Unilever wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $550,688!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Might 6, 2024

Josh Kohn-Lindquist has positions in Hershey. The Motley Idiot recommends Hershey and Unilever Plc. The Motley Idiot has a disclosure coverage.

A As soon as-in-a-Decade Alternative: 3 Magnificent Dividend Shares Down Between 19% and 28% to Purchase Now and Maintain Without end was initially printed by The Motley Idiot