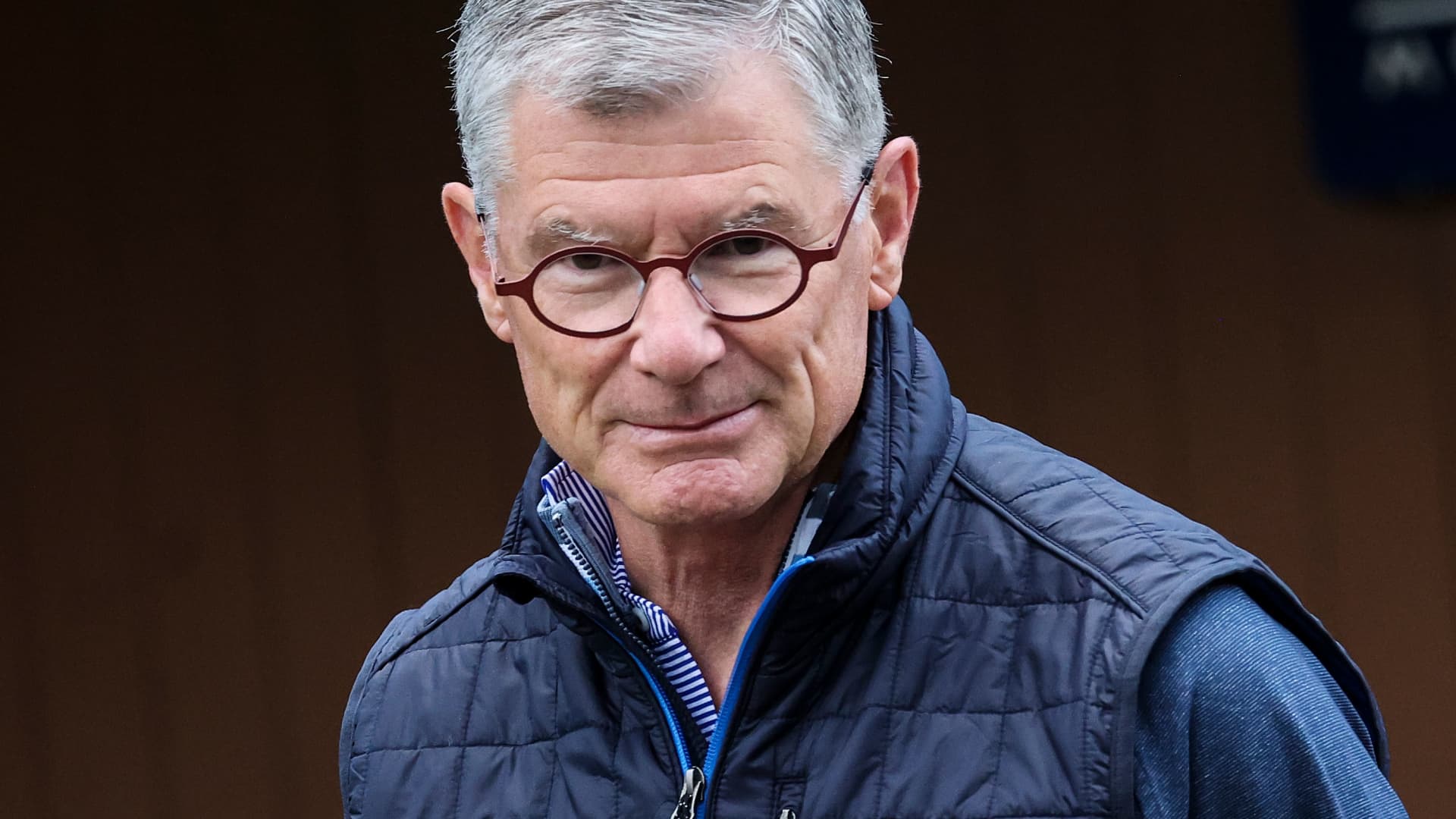

Peloton introduced Thursday that CEO Barry McCarthy shall be stepping down and the corporate will lay off 15% of its workers as a result of it “merely had no different option to convey its spending according to its income.”

McCarthy, a former Spotify and Netflix govt, will develop into a strategic advisor to Peloton via the tip of the yr whereas Karen Boone, the corporate’s chairperson, and director Chris Bruzzo will function interim co-CEOs. Jay Hoag, one other Peloton director, has been named the brand new chairperson of the board. Peloton is in search of a everlasting CEO.

The corporate additionally introduced a broad restructuring plan that may see its world headcount lower by 15%, or about 400 workers. It plans to proceed to shut retail showrooms and make adjustments to its worldwide gross sales plan.

The strikes are designed to realign Peloton’s value construction with the present dimension of its enterprise, it mentioned in a information launch. It is anticipated to cut back annual run-rate bills by greater than $200 million by the tip of fiscal 2025.

“This restructuring will place Peloton for sustained, optimistic free money move, whereas enabling the corporate to proceed to spend money on software program, {hardware} and content material innovation, enhancements to its member help expertise, and optimizations to advertising and marketing efforts to scale the enterprise,” the corporate mentioned.

The corporate’s shares surged greater than 12% in premarket buying and selling.

McCarthy took the helm of Peloton in February 2022 from founder John Foley and has spent the final two years restructuring the enterprise and dealing to get it again to development.

As quickly as he took over, he started implementing mass layoffs to proper dimension Peloton’s value construction, closing the corporate’s splashy showrooms and enacting new methods designed to develop membership. Opposite to Peloton’s founder, McCarthy redirected Peloton’s consideration to its app as a way to seize members who might not be capable of afford the corporate’s dear bikes or treadmills however may very well be fascinated with taking its digital lessons.

In a letter to workers, McCarthy mentioned the corporate wanted to implement layoffs as a result of it would not be capable of generate sustainable free money move with its present value construction. Peloton hasn’t turned a revenue since December 2020 and it could solely burn money for thus lengthy when it has greater than $1 billion in debt on its steadiness sheet.

“Attaining optimistic [free cash flow] makes Peloton a extra enticing borrower, which is essential as the corporate turns its consideration to the required job of efficiently refinancing its debt,” McCarthy mentioned within the memo.

In a letter to shareholders, the corporate mentioned it’s “aware” of the timing of its debt maturities, which embody convertible notes and a time period mortgage. It mentioned it’s working intently with its lenders at JPMorgan and Goldman Sachs on a “refinancing technique.”

“Total, our refinancing objectives are to deleverage and prolong maturities at an affordable blended value of capital,” the corporate mentioned. “We’re inspired by the help and inbound curiosity from our present lenders and traders and we stay up for sharing extra about this matter.”

In a information launch, Boone thanked McCarthy for his contributions.

“Barry joined Peloton throughout an extremely difficult time for the enterprise. Throughout his tenure, he laid the muse for scalable development by steadily rearchitecting the associated fee construction of the enterprise to create stability and to succeed in the essential milestone of reaching optimistic free money move,” Boone mentioned.

“With a robust management workforce in place and the Firm now on stable footing, the Board has determined that now’s an acceptable time to seek for the subsequent CEO of Peloton.”

In a joint assertion, Boone and Bruzzo mentioned they’re wanting ahead to “working in lockstep” with the corporate’s management to make sure it “would not miss a beat whereas the CEO search is underway.”

Additionally on Thursday, Peloton introduced its fiscal third-quarter outcomes and fell in need of Wall Avenue’s expectations on the highest and backside line. Here is how the linked health firm did in contrast with what Wall Avenue was anticipating, primarily based on a survey of analysts by LSEG:

- Loss per share: 45 cents vs. a lack of 37 cents anticipated

- Income: $718 million vs. $723 million anticipated

The corporate’s reported internet loss for the three-month interval that ended March 31 was $167.3 million, or 45 cents per share, in contrast with a lack of $275.9 million, or 79 cents per share, a yr earlier.

Gross sales dropped to $718 million, down about 4% from $748.9 million a yr earlier.

Peloton has tried slightly little bit of every thing to get the corporate again to gross sales development. It eliminated the free membership choice from its health app, expanded its company wellness choices and partnered with mega-brands like Lululemon to develop membership, however not one of the initiatives have been sufficient to develop gross sales.

For the ninth quarter in a row, Peloton’s income fell throughout its fiscal third quarter, when put next with the year-ago interval. It hasn’t seen gross sales develop in contrast with the yr in the past quarter since December 2021, when the corporate’s stationary bikes had been nonetheless in excessive demand and plenty of hadn’t but returned to gyms amid the Covid-19 pandemic.

The enterprise is continuous to bleed cash and hasn’t turned a internet revenue since December 2020.

For its present fiscal yr, Peloton lowered its outlook for paid linked health subscriptions, app subscriptions and income. It diminished its linked health subscription outlook by 30,000 members, or 1%, to 2.97 million because it seems to be towards its present quarter, which is usually its hardest as a result of individuals are inclined to work out indoors much less within the spring and summer time months.

“Our Paid Related Health Subscription steering displays an up to date outlook for {hardware} gross sales primarily based on present demand traits and expectations for seasonally decrease demand,” the corporate mentioned.

Peloton now expects app subscriptions to drop by 150,000, or 19%, to 605,000.

“We’re sustaining our disciplined strategy to App media spend as we consider our App tiers, pricing, and refine the Paid App subscription acquisition funnel,” the corporate mentioned.

On account of anticipated downturns in its subscription gross sales, Peloton now tasks full-year income to return in at $2.69 billion, a discount of about $25 million, or 1%. That is under expectations of $2.71 billion, based on LSEG.

Nevertheless, the corporate raised its full-year outlook for gross margin and adjusted EBITDA. It now expects whole gross margin to develop by 50 foundation factors, to 44.5%, and adjusted EBITDA to develop by $37 million, to detrimental $13 million.

“This improve is basically pushed by outperformance from Q3, mixed with decrease media spend and value reductions from at the moment’s introduced restructuring plan,” the corporate mentioned.

Final February, McCarthy set a aim of returning Peloton to income development inside a yr. When it failed to succeed in that milestone, McCarthy pushed it again and mentioned he now expects the corporate to be again to development in June, on the finish of the present fiscal yr.

McCarthy had additionally anticipated Peloton to succeed in optimistic free money move by June — a aim the corporate mentioned it reached early throughout its third quarter. It is the primary time Peloton has hit that mark in 13 quarters. In a letter to shareholders, Peloton mentioned it generated $8.6 million in free money move however it’s unclear how sustainable that quantity is.

Final month, CNBC reported that Peloton hadn’t been paying its distributors on time, which might quickly pad its steadiness sheet. Information from enterprise intelligence agency Creditsafe confirmed that Peloton’s late funds to distributors spiked in December and once more in February after enhancing in January.

The corporate did not present particular steering on what traders can anticipate with free money move within the quarters forward however mentioned it does anticipate to “ship modest optimistic free money move” in its present quarter.

A part of the explanation why Peloton had failed to succeed in optimistic free money move is as a result of it is merely not promoting sufficient of its {hardware}, which is expensive to make and has develop into much less in style because the Covid-19 pandemic ended and folks returned to gyms.

Shortly after McCarthy succeeded Foley, he carried out quite a few rounds of layoffs that impacted hundreds of workers. The final spherical of cuts, affecting 500 workers, was introduced in October 2022. He later mentioned the corporate’s restructuring was “full” and it was as an alternative pivoting to “development.”

“We’re performed now,” McCarthy had mentioned in November 2022 of the layoffs. “There aren’t any extra heads to be taken out of the enterprise.”