-

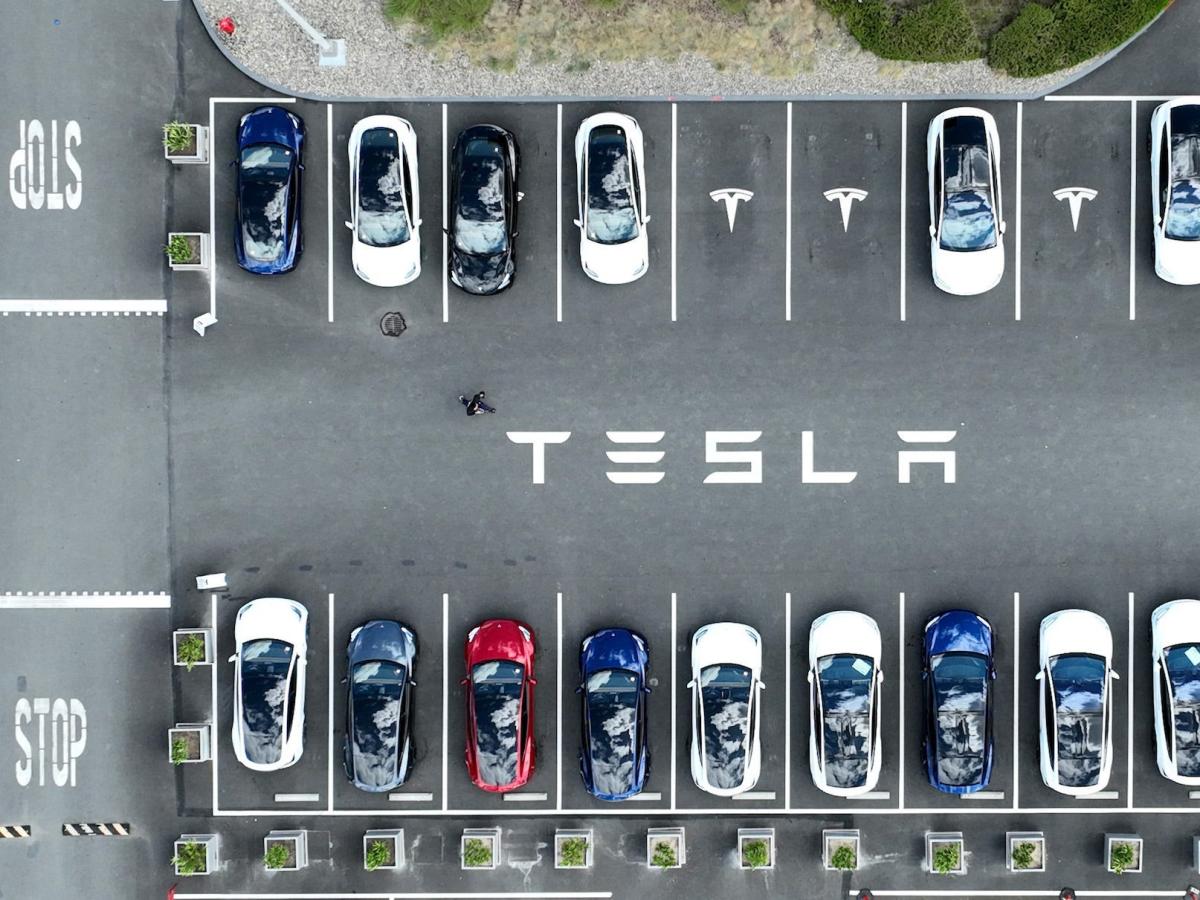

Tesla inventory dropped as a lot as 5% on Tuesday amid experiences of extra layoffs on the firm.

-

Layoffs embody senior executives and their groups overseeing charging infrastructure.

-

The stoop pared some good points from the day before today following optimism round Musk’s shock China go to.

Shares of Tesla dropped as a lot as 5.5% on Tuesday amid experiences that Elon Musk introduced a whole bunch extra layoffs, together with two high-level executives.

Shares of Elon Musk’s firm had been buying and selling 4.7% decrease as of 1:40 p.m. in New York, at round $185 every. The loss eats into a few of Monday’s massive acquire following the Tesla CEO’s journey to China.

The Data reported that the layoffs of a whole bunch of staffers embody Rebecca Tinucci, who supervises the charging infrastructure, and Daniel Ho, an government overseeing car applications and new merchandise.

Round 500 folks from Tinucci’s division are set to be let go, and Tesla’s public coverage staff is being trimmed as nicely, with vice chairman Rohan Patel having left on April 15, in line with Musk’s electronic mail cited by The Data.

The newest cuts add to Musk’s broad efforts to be “completely hardcore” about worker retention and price range discount, as he stated he would ask for give up letters from executives who hold “greater than three individuals who do not clearly cross the superb, obligatory and reliable take a look at.”

Two weeks in the past, Tesla reduce over 10% of the corporate’s workforce globally, citing a “duplication of roles and job features in sure areas.”

Following the stoop in car gross sales within the first quarter, the tech big reported earnings per share that missed consensus forecasts, however delivered the information on a less expensive mannequin that traders had been seeking to hear.

Tesla inventory is down nearly 30% because the starting of this 12 months, whereas its score and value goal had been slashed by a variety of Wall Road analysts.

Musk boosted investor optimism this week when he made an surprising journey to China, the EV producer’s second-largest market. The inventory soared 12% on Monday in response to his go to, which culminated in experiences that the corporate’s full self-driving know-how might quickly debut within the nation.

Learn the unique article on Enterprise Insider