(Bloomberg) — China’s most-promising industries are dealing with a rising risk of commerce restrictions from Western governments, blurring the outlook for shares which have the potential to gasoline the nation’s market development.

Most Learn from Bloomberg

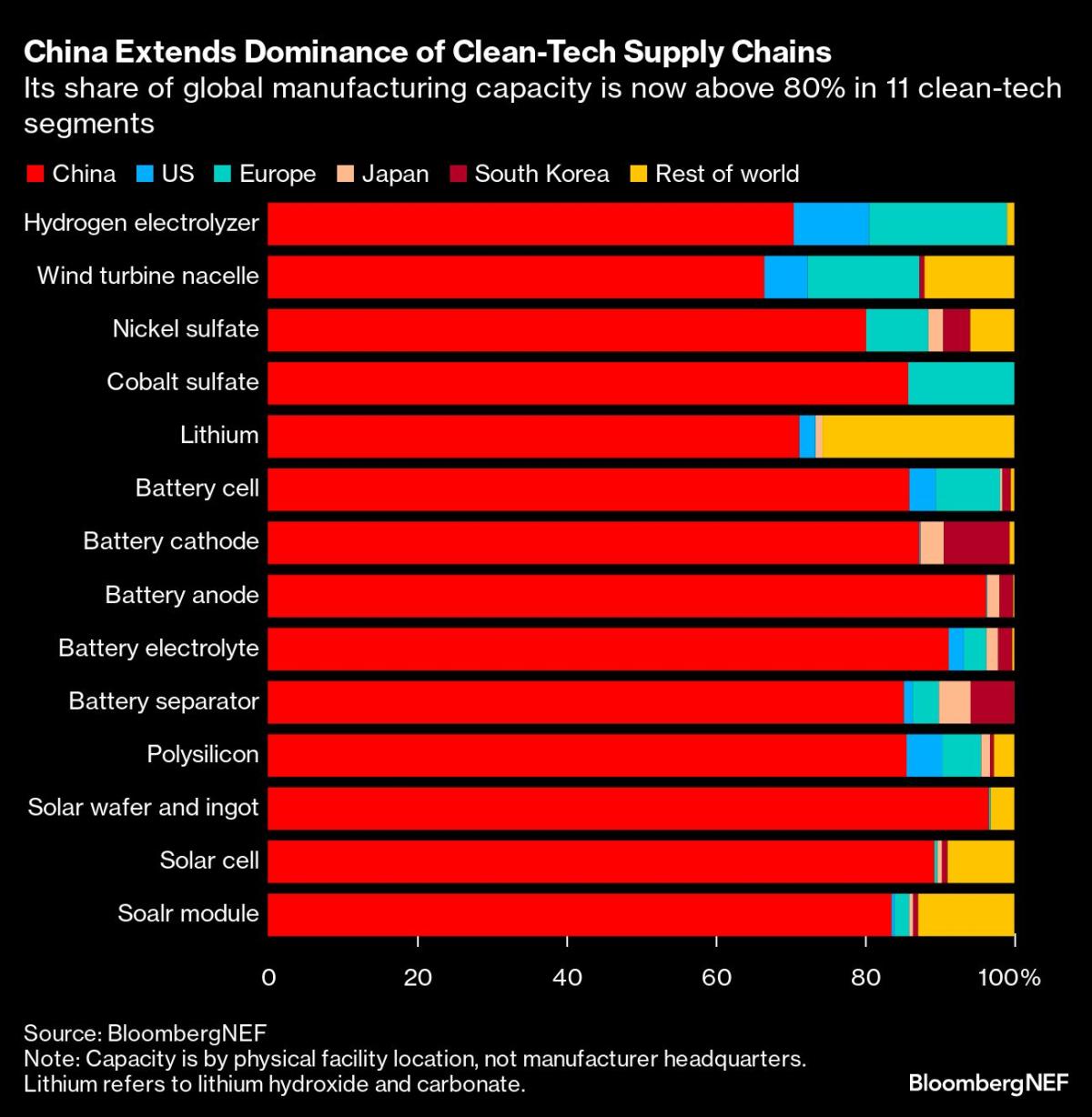

The sectors beneath scrutiny by Europe and the US are as wide-ranging as electrical autos, wind and photo voltaic initiatives, medical gadgets and chips, however have one factor in widespread: they’re of strategic significance to President Xi Jinping’s bid for management within the international race towards inexperienced transition and high-tech improvement.

The rising tensions come at an inopportune time. Shares had been beginning to emerge from a multi-year hunch as buyers purchased into China’s efforts to construct new development engines and obtain self-sufficiency alongside key provide chains. A materialization of these threats can hinder China’s international growth, whereas tit-for-tat responses from Beijing might carry a couple of full-blown commerce battle that may drastically alter the funding panorama.

“Geopolitical pressures will solely rise — any exports will be focused because it’s now not actually about commerce equity,” stated Vey-Sern Ling, managing director at Union Bancaire Privee. “It dampens the export development drivers for China’s economic system.”

China’s CSI 300 Index has climbed about 3% this 12 months, regaining some footing after a third-annual loss. Performances amongst leaders within the inexperienced and high-tech trade have been blended as geopolitical dangers add to considerations over oversupply and worth competitors.

Battery big Up to date Amperex Know-how Co. Ltd has jumped practically 17% onshore this 12 months whereas EV chief BYD Co. has superior 6%. Longi Inexperienced Vitality Know-how Co. and Semiconductor Manufacturing Worldwide Corp. have misplaced about 20% every.

The largest Chinese language corporations that get at the very least a fifth of their income from exports command greater than a 14% weight within the CSI 300, with lots of them together with CATL and BYD buying and selling at the next price-to-earnings ratio than the benchmark, in keeping with information compiled by Bloomberg.

Rising Tensions

Whereas commerce spats have turn out to be a everlasting characteristic in China-Western relations beneath Xi, latest months noticed tensions worsen. The European Union has joined US-styled protectionist strikes as a fancy mixture of nationwide safety considerations, financial and political concerns play out.

President Joe Biden’s name for tariffs as excessive as 25% on some Chinese language metal and aluminum merchandise reveals how China-bashing will ratchet up in a presidential election 12 months. In Europe, policymakers are responding to rising complaints from native producers that China’s industrial overcapacity is crowding them out.

The vary of focused merchandise largely overlap with Xi’s industrial priorities labeled “new productive forces.” Buyers had been looking for inventory winners for the reason that phrase was listed on Beijing’s high agenda in early March, triggering a short rally in shares from robotics corporations to chip makers.

READ: Decoding Xi’s New Catchphrase Aimed toward Reviving China’s Financial system

“Whereas the brand new productive forces might have coverage tailwinds, these could also be considerably offset by rising geopolitical tensions, notably in an election 12 months the place noise will possible enhance,” stated Marvin Chen, a strategist at Bloomberg Intelligence.

New Battleground

The main target is now on which sector will find yourself subsequent within the crosshairs. EVs have to date been a key goal, with Gavekal Analysis pointing to the EU’s worsening commerce stability with China within the trade.

“The cyclical positioning of Europe and China factors to the commerce stability tipping in China’s favor,” Gavekal analysts Cedric Gemehl and Thomas Gatley wrote in a notice dated April 15. European home demand is strengthening, which ought to spur extra purchases of Chinese language items, whereas EU exports to China are more likely to flat-line at finest on weak demand, they stated.

Shen Meng, director at Chanson & Co. in Beijing, expects lithium battery makers to face rising stress. The trade falls beneath the class of unpolluted tech and has been a high driver of China’s export development in previous years, he stated. Key gamers embrace CATL, Eve Vitality Co. and Gotion Excessive-Tech Co.

READ: China’s Dominance of Clear-Tech Provide Chains Grows: BNEF Chart

In some sense, there’s a shiny facet to the tensions as they might help speed up China’s industrial improve. A technical breakthrough by Huawei Applied sciences Co., which isn’t listed and faces US sanctions, has spurred a surge within the shares of its suppliers.

“Whereas fast impacts of such geopolitical tensions may constrain sure sectors quickly, the long-term final result might favor Chinese language corporations that innovate and adapt to altering regulatory and market dynamics,” stated Tareck Horchani, head of prime brokerage dealing at Maybank Securities Pte.

The varied restrictions mulled may even take time to ship. A deliberate probe by Europe into Chinese language medical gadgets procurement has despatched shares like Shenzhen Mindray Bio-Medical Electronics Co. plunging following the report, however most have since partially recovered their losses.

All issues thought-about, the unpredictable nature of geopolitical tensions will increase the chance of investing in Chinese language shares, an asset class that many had been already avoiding as a consequence of regulatory uncertainties and a slowing economic system.

“Any future EU protectionist strikes towards China will additional impede commerce and capital flows into the Chinese language economic system and add to the already heavy downward stress on its inventory market,” stated Han Piow Liew, fund supervisor at Maitri Asset Administration Pte. “What all these means is that investing in Chinese language shares in such an setting is an arduous endeavor requiring razor-like concentrate on shares.”

–With help from Charlotte Yang and Ishika Mookerjee.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.