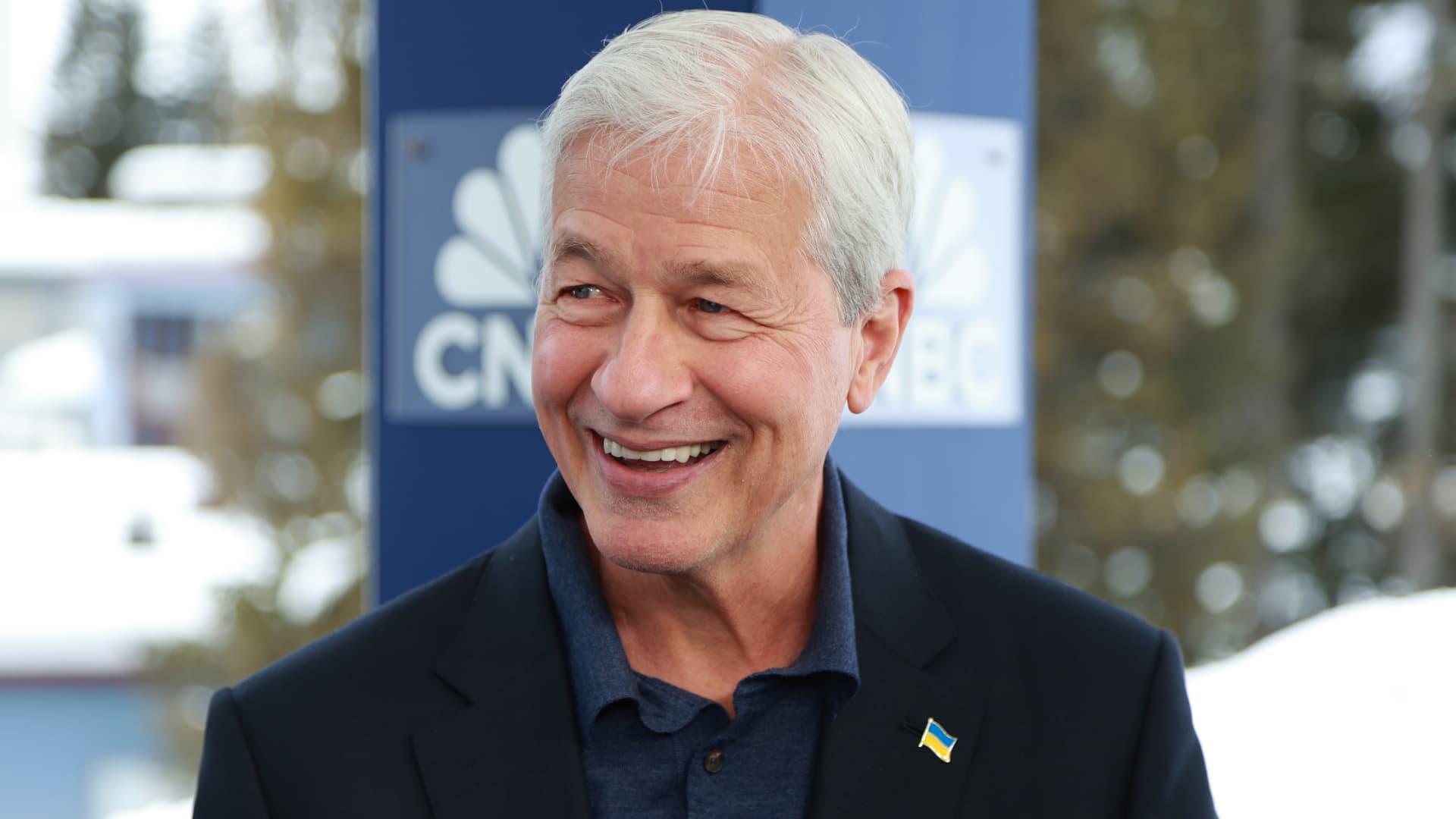

Jamie Dimon, President and CEO of JPMorgan Chase, talking on CNBC’s “Squawk Field” on the World Financial Discussion board Annual Assembly in Davos, Switzerland, on Jan. 17, 2024.

Adam Galici | CNBC

JPMorgan Chase is scheduled to report first-quarter earnings earlier than the opening bell Friday.

This is what Wall Avenue expects:

- Earnings: $4.11 a share, in response to LSEG

- Income: $41.85 billion, in response to LSEG

- Web curiosity revenue: $23.18 billion, in response to StreetAccount

- Buying and selling Income: Mounted revenue of $5.19 billion and equities of $2.57 billion, in response to StreetAccount

JPMorgan will probably be watched intently for clues on how banks fared at the beginning of the yr.

Whereas the largest U.S. financial institution by belongings has navigated the speed setting nicely because the Federal Reserve started elevating charges two years in the past, smaller friends have seen their earnings squeezed.

The trade has been pressured to pay up for deposits as clients shift money into higher-yielding devices, squeezing margins. Concern can be mounting over rising losses from business loans, particularly on workplace buildings and multifamily dwellings, and better defaults on bank cards.

Nonetheless, giant banks are anticipated to outperform smaller ones this quarter, and expectations for JPMorgan are excessive. Analysts consider the financial institution can increase steerage for 2024 web curiosity revenue because the Federal Reserve is pressured to keep up rate of interest ranges amid cussed inflation knowledge.

Analysts can even wish to hear what CEO Jamie Dimon has to say concerning the economic system and the trade’s efforts to push again towards efforts to cap bank card and overdraft charges.

Wall Avenue could present some assist this quarter, with funding banking charges for the trade up 11% from a yr earlier, in response to Dealogic.

Shares of JPMorgan have jumped 15% this yr, outperforming the three.9% acquire of the KBW Financial institution Index.

Wells Fargo and Citigroup are scheduled to launch outcomes later Friday, whereas Goldman Sachs, Financial institution of America and Morgan Stanley report subsequent week.

This story is creating. Please test again for updates.